Free 600S Georgia Template in PDF

Navigating the complexities of the Georgia Form 600S, as revised on June 20, 2020, is an essential task for S corporations operating within the state. This comprehensive document, issued by the Georgia Department of Revenue, serves as the corporation tax return, encompassing both the income tax and net worth tax return for the relevant fiscal year. The form meticulously outlines the reporting requirements for various components of an S corporation's financial activities. Among these are the initial net worth and any amendments stemming from IRS audits or other changes such as address or name modifications. The form also requires detailed disclosures about nonresident withholding tax payments and elects options for tax responsibility in light of a Georgia audit. Furthermore, it delves into the intricacies of computing Georgia taxable income and net worth, emphasizing the significance of accuracy in reporting assets, income allocation, and apportionment of income. The inclusion of direct deposit options for refunds and the necessity of electronic filing for claiming tax credits further underscore the modernization of the state's tax filing processes. The Georgia Form 600S is more than a mere formality; it is a crucial instrument that facilitates the accurate assessment and fulfillment of tax liabilities by S corporations, ensuring compliance with state tax laws and contributing to the seamless operation of businesses within Georgia.

Form Sample

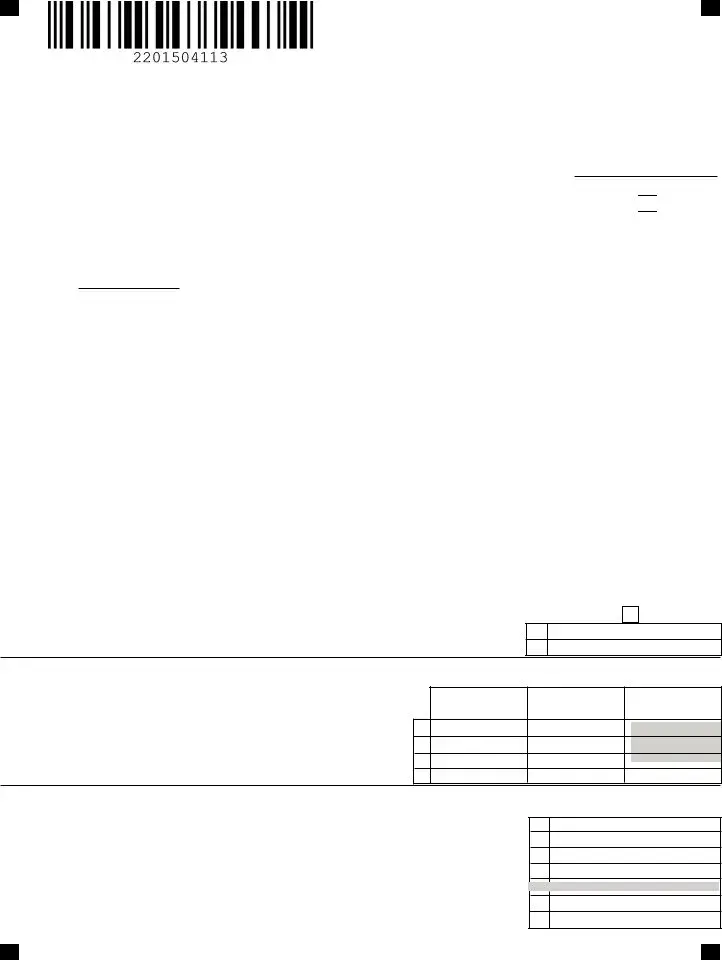

Georgia Form 600S (Rev. 08/02/21) |

PAGE 1 |

|

|

|

|

|||||

Corporation Tax Return |

|

|

|

|

|

|

|

|||

Georgia Department of Revenue (Approved web2 version) |

|

|

|

|

||||||

2021 Income Tax Return |

|

|

|

|

|

|

|

|||

Beginning |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Amount of nonresident withholding tax paid by the S Corporation: |

||||

Ending |

|

|

|

|

|

Original Return |

|

UET Annualization Exception attached |

||

|

|

|||||||||

|

|

|

||||||||

2022 Net Worth Tax Return |

|

|

Amended Return |

|

Initial Net Worth |

|

C Corp Last Year |

|||

|

|

|

|

|||||||

|

|

Amended due to IRS Audit |

|

Address Change |

|

Name Change |

||||

|

|

|

|

|

|

Final Return (Attach explanation) |

|

|

|

|

Beginning |

|

|

|

|

|

|

PL |

|

QSSS Exempt |

|

|

|

|

|

|

|

|

|

|

||

Ending

Extension

Extension

Composite

Composite

Return Filed

A. Federal Employer ID Number |

B. Name (Corporate title) Please give former name if applicable. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. GA Withholding Tax Acct. Number |

D. Business Street Address |

|

|

|

|

|

|||||

Payroll WH Number |

Nonresident WH Number |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. GA Sales Tax Reg. Number |

F. City or Town |

|

|

G. State |

H. ZIP Code |

I. Foreign Country Name |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. NAICS Code |

|

K. Date of Incorporation |

L . Incorporated under laws of what state |

M. Date admitted into GA |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

N. Location of Records for Audit (City & State) |

O. Corporation’s Telephone Number |

P. Type of Business |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Q. Total Shareholders |

R. Total Nonresident |

|

S. Federal Ordinary Income |

T. Latest taxable year |

U. And when reported |

||||||

|

|

Shareholders |

|

|

|

|

adjusted by IRS |

to Georgia |

|||

|

|

|

|

|

|

|

|

|

|

|

|

V. S Corporation Representative |

|

W. S Corporation Representative’s |

X. S Corporation Representative’s |

||||||||

|

|

|

|

|

|

Telephone Number |

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 1 |

|||||||||

By checking the box, the S Corporation elects to pay the tax on behalf of its shareholders due to a Georgia audit.

1. Georgia Taxable Income (see instructions) ..........................................................................................

2. Tax 5.75% x Line 1 ..................................................................................................................

1.

2.

COMPUTATION OF NET WORTH RATIO(to be used by Foreign Corporations only) |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 2 |

1.Total value of property owned (Total assets from Federal balance sheet)

2.Gross receipts from business ....................................................................

3.Totals (Line 1 + 2)........................................................................................

4.Georgia ratio (Divide Line 3A by 3B)........................................................

C. GA (A/B) DO NOT

ROUND COMPUTE TO

A. WITHIN GEORGIA B. TOTAL EVERYWHERE SIX DECIMALS

1.

2.

3.

4.

COMPUTATION OF NET WORTH TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 3 |

1.Total Capital stock issued ......................................................................................................

2.Paid in or Capital surplus .......................................................................................................

3.Total Retained earnings..........................................................................................................

4.Net Worth (Total of Lines 1, 2, and 3) ....................................................................................

5. Ratio (GA and Dom. For. |

5. |

|

|

6.Net Worth Taxable by Georgia (Line 4 x Line 5)

7.Net Worth Tax (from table in instructions)....................................................................................................................................................

1.

2.

3.

4.

6.

7.

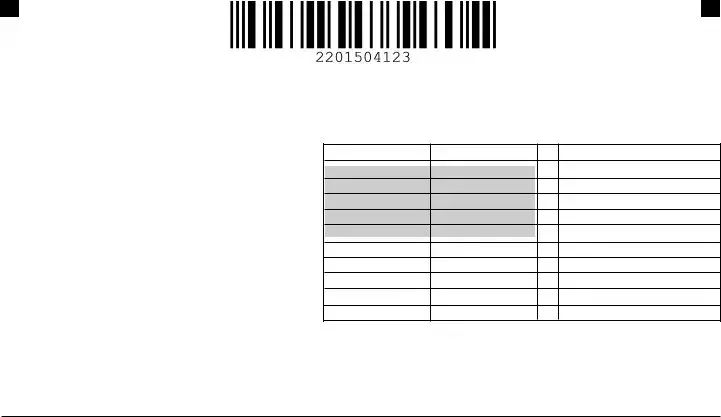

Georgia Form 600S/2021

PAGE 2

(Corporation) Name |

|

|

|

FEIN |

|

|

|

|

|

|

|

||

COMPUTATION OF TAX DUE OR OVERPAYMENT |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 4 |

|

||

1.Total Tax (Schedule 1, Line 2 and Schedule 3, Line 7) ........

2.Credits and payments of estimated tax .................................

3.Credits used from Schedule 10* (must be filed electronically)

4.Withholding Credits

5.Balance of tax due (Line 1, less Lines 2, 3 and 4 ) ................

6.Amount of overpayment (Lines 2, 3 and 4 less Line 1) ........

7.Interest due (See Instructions) .................................................

8.Form 600 UET (Estimated tax penalty) ...................................

9.Other penalty due (See Instructions) .......................................

10.Balance of tax, interest and penalty due with return ................

11.Amount to be credited to 2022 estimated tax (Line 6 less Lines

A. Income Tax |

B. Net Worth Tax |

C. Total |

1.

2.

3.

4.

5.

6.

7.

8. 9.

8. 9.  10.

10.

Refunded 11.

*NOTE: Any tax credits from Schedule 10 may be applied against income tax liability only, not net worth tax liability.

SEE PAGE 3 SIGNATURE SECTION FOR DIRECT DEPOSIT OPTIONS

|

COMPUTATION OF GEORGIA NET INCOME |

(ROUND TO NEAREST DOLLAR) |

|

|

|

|

SCHEDULE 5 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Income for Georgia purposes (Line 11, Schedule 6) |

|

|

|

|

|

1. |

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||||

2. |

Income allocated everywhere (Must Attach Schedule) |

|

|

|

|

2. |

|

|

|

|

|||||

|

3. Business Income subject to apportionment (Line 1 less Line 2) |

|

|

|

|

3. |

|

|

|

|

|||||

4. |

..........................................................Georgia Ratio (Schedule 9, Column C) |

4. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||||||

|

5. Net business income apportioned to Georgia (Line 3 x Line 4) |

|

|

|

|

5. |

|

|

|

|

|||||

|

6. Net income allocated to Georgia (Attach Schedule) |

|

|

|

|

6. |

|

|

|

|

|||||

|

7. Total Georgia net income (Add Line 5 and Line 6) |

|

|

|

|

7. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPUTATION OF TOTAL INCOME FOR GEORGIA PURPOSES |

|

(ROUND TO NEAREST DOLLAR) |

|

|

|

|

SCHEDULE 6 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Ordinary income (loss) per Federal return |

|

|

|

|

1. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2. Net income (loss) from rental real estate activities |

|

|

|

|

2. |

|

|

|

|

|||||

3. |

a. Gross income from other rental activities |

|

3a. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||||

|

|

b. Less: expenses |

|

3b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

..........................................c. Net business income from other rental activities (Line 3a less Line 3b) |

3c. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Portfolio income (loss): |

a. Interest Income |

|

|

|

|

4a. |

|

|

|

|||||

|

|

|

b. Dividend Income |

|

|

|

|

|

4b. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Royalty Income |

|

|

|

|

|

4c. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

d. Net |

4d. |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

e. Net |

4e. |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

f. Other portfolio income (loss) |

|

4f. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Net gain (loss) under section 1231 |

....................................................................................................... |

|

|

|

|

5. |

|

|

|

|

||||

6. |

Other Income (loss) |

|

|

|

|

|

6. |

|

|

|

|

||||

7. |

Total Federal Income (Add Lines 1 through 6) |

|

|

|

|

7. |

|

|

|

|

|||||

8. |

Additions to Federal Income (Schedule 7) |

|

|

|

|

8. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Total (Add Lines 7 & 8) |

|

|

|

|

|

9. |

|

|

|

|

||||

10. |

Subtractions from Federal Income (Schedule 8) |

.................................................... |

|

|

|

10. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

11. |

Total Income for Georgia purposes (Subtract Line 10 from Line 9) |

11. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

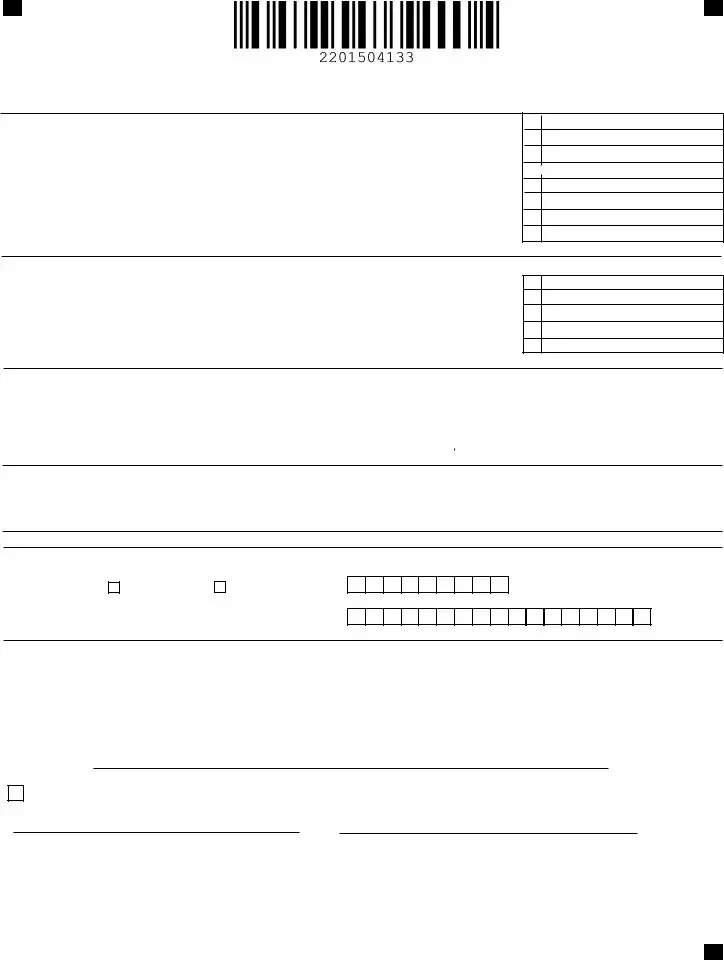

Georgia Form 600S/2021

PAGE 3

(Corporation) Name |

|

|

FEIN |

|

|

|

|

|

|

||

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 7 |

|

||

1.State and municipal bond interest (other than Georgia or political subdivision thereof)

2.Net income or net profits taxes imposed by taxing jurisdictions other than Georgia ................

3.Expense attributable to tax exempt income .................................................................................

4.Reserved......................................................................................................................................

5.Intangible expenses and related interest costs ...........................................................................

6.Captive REIT expenses and costs ...............................................................................................

7.Other Additions (Attach Schedule) .............................................................................................

8.TOTAL - Enter here and on Line 8, Schedule 6 ......................................................................................

1.

2.

3.

4.

5.

6.

7.

8.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 8 |

|

|

|

1. Interest on obligations of United States (must be reduced by direct and indirect interest expense) ..

2. Exception to intangible expenses and related interest costs (Attach

3. Exception to captive REIT expenses and costs (Attach

4. Other Subtractions (Must Attach Schedule) .......................................................................................

5. TOTAL- Enter here and on Line 10, Schedule 6 ...............................................................................

1.

2.

3.

4.

5.

APPORTIONMENT OF INCOME |

|

|

|

|

SCHEDULE 9 |

|

|

|

|

|

|

|

|

A. WITHIN GEORGIA |

B. EVERYWHERE |

C. DO NOT ROUND COL (A)/ COL (B) |

|

|

|

|

|

|

COMPUTE TO SIX DECIMALS |

1. Gross receipts from business |

1. |

|

|

|

|

|

|

|

|

||

|

|

|

|

||

2. Georgia Ratio (Divide Column A by Column B) |

2. |

|

|

|

|

A copy of the Federal Return and supporting schedules must be attached if filing by paper. No extension of time for filing will be allowed unless a copy of the request for a Federal extension or Form

Make check payable to: Georgia Department of Revenue

Mail to: Georgia Department of Revenue, Processing Center, PO Box 740391, Atlanta, Georgia

DIRECT DEPOSIT OPTIONS

A. Direct Deposit (ForU.S.AccountsOnly) See booklet for further instructions. If Direct Deposit is not. selected, a paper check will be issued.

|

|

Routing |

Type: Checking |

Savings |

Number |

|

|

Account |

|

|

Number |

Declaration: I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

By providing my

Check the box to authorize the Georgia Department of Revenue to discuss the contents of this tax return with the named preparer.

SIGNATURE OF OFFICER |

SIGNATURE OF INDIVIDUAL OR FIRM PREPARING THE RETURN |

|||||

|

|

|

|

|

|

|

TITLE |

FIRM PREPARING THE RETURN |

|||||

|

|

|

|

|

|

|

|

|

DATE |

|

IDENTIFICATION OR SOCIAL SECURITY NUMBER |

||

|

|

|

|

|

|

|

Georgia Form 600S/2021

PAGE 4

(Corporation) Name |

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

CREDIT USAGE AND CARRYOVER |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 10 |

|||

|

|

|

|

|

|

|

TO

CLAIM

TAX

CREDITS YOU

MUST FILE

ELECTRONICALLY

Georgia Form 600S/2021

PAGE 5

(Corporation) Name |

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|||

|

CREDIT ALLOCATION TO OWNERS |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 11 |

|

||

TO

CLAIM

TAX

CREDITS YOU

MUST FILE

ELECTRONICALLY

Georgia Form 600S/2021

PAGE 6

(Corporation) Name |

|

|

FEIN |

|

|

|

|

|

|

|

|

||

|

ASSIGNED TAX CREDITS |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 12 |

|

||

|

|

|

|

|

|

|

TO

CLAIM

TAX

CREDITS YOU

MUST FILE

ELECTRONICALLY

File Overview

| Fact Name | Description |

|---|---|

| Form Number and Revision Date | Georgia Form 600S (Rev. 06/20/20) |

| Form Purpose | Corporation Tax Return for the Georgia Department of Revenue for the year 2020 |

| Form Components | Includes sections for Income Tax Return, Net Worth Tax Return, nonresident withholding tax, and various computations related to taxable income and tax credits. |

| Governing Law | Subject to Georgia Public Revenue Code Section 48-2-31, which governs the payment of taxes in lawful money of the United States to the State of Georgia. |

| Tax Credits Electronic Filing Requirement | To claim tax credits on Schedules 10 and 11, filing must be done electronically. |

| Signature Section | Includes a declaration under penalties of perjury, with provisions for both the taxpayer and preparer's signatures, indicating the return's truthfulness and completeness. |

Guide to Using 600S Georgia

Filling out the Georgia Form 600S for S Corporations is an important step in ensuring your business complies with state tax regulations. This process involves declaring income, calculating net worth and taxable income, and detailing shareholders' information. Accuracy in completing this form is crucial as it directly impacts your tax liabilities and potential refunds. Below is a detailed guide on how to complete this form correctly.

- Under "Georgia Department of Revenue 2020 Income Tax Return," mark the applicable boxes for the type of return, any changes, or amendments needed.

- In section A, enter the Federal Employer ID Number.

- For section B, provide the Name (Corporate title) and former name if applicable.

- In section C, fill in the GA Withholding Tax Account Number followed by other required identification numbers and the business address in sections D and E.

- Sections F through J request location information, including city, state, zip code, foreign country name, and NAICS code. Complete each as it applies to your corporation.

- Input the Date of Incorporation and the state under which the corporation is incorporated in sections K and L, respectively. Section M asks for the date admitted into GA.

- Section N requires the Location of Records for Audit while section O asks for the Corporation’s Telephone Number.

- Detail the Type of Business, Total Shareholders, and Total Nonresident Shareholders in sections P, Q, and R.

- For sections S through V, disclose financial details including Federal Ordinary Income, adjustments by the IRS, and the S Corporation Representative’s information.

- Under the "COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX" section, follow the instructions to calculate Georgia taxable income and tax due.

- In the "COMPUTATION OF NET WORTH TAX" section, enter the values for total capital stock, paid in or capital surplus, and total retained earnings to compute the net worth.

- Provide detailed credits and payments information in the "COMPUTATION OF TAX DUE OR OVERPAYMENT" to figure out the balance due or overpayment amounts.

- For SCHEDULE 5 through 11, carefully follow the instructions provided in each section to compute Georgia net income, total income for Georgia purposes, additions and subtractions from federal taxable income, and apportionment of income. Remember, if you are claiming tax credits, electronic filing is mandatory.

- Lastly, ensure the signature of an officer and the preparer (if applicable) are included on PAGE 3, alongside providing an email address for electronic notifications.

After completing the Georgia Form 600S, double-check all entries for accuracy to avoid potential issues. If you're submitting via paper, attach a copy of the Federal Return along with any requested schedules. Mail the completed form and any payment due to the provided address. Keep a copy for your records to ensure compliance and for future reference.

Obtain Clarifications on 600S Georgia

What is Georgia Form 600S used for?

Georgia Form 600S serves as a Corporation Tax Return document for S corporations within the state. These corporations use this form to report their income, calculate their tax due, and disclose shareholders' information. It helps in determining the amount of nonresident withholding tax paid and the net worth tax obligation for the corporation. After the completion and submission of this form to the Georgia Department of Revenue, it ensures compliance with state tax laws, facilitating the proper assessment and collection of taxes from S corporations.

Who needs to file Form 600S in Georgia?

All S corporations incorporated in or doing business in Georgia are required to complete and file Form 600S. This includes entities admitted into Georgia to conduct business, as well as those that have a significant presence in terms of payroll, property, or sales within the state. An S corporation that chooses to pay tax on behalf of its shareholders due to a Georgia audit must also file this form, making it a critical document for maintaining business operations within the state.

How does an S Corporation report its income on the 600S form?

On the Georgia Form 600S, an S Corporation reports its income through several components outlined in the document, including the computation of Georgia taxable income and tax alongside the calculation of net worth tax for foreign corporations. The form requires specific financial details, such as total assets, gross receipts from business, federal ordinary income, and any adjustments due to IRS audits or Georgia-specific adjustments. Additionally, S Corporations electing to pay tax on behalf of their shareholders in case of a Georgia audit need to indicate this choice on the form. The precise income reporting process allows for an accurate tax assessment relevant to the corporation's financial activities.

What are the key sections of Form 600S?

- Identification Information: This section gathers basic details about the corporation, including the federal employer ID number, corporate name and address, incorporation details, and contact information.

- Computation of Georgia Taxable Income and Tax: S corporations calculate their Georgia taxable income and apply the relevant tax rate to determine their tax liability.

- Computation of Net Worth Tax: For foreign corporations, this part requires calculating the net worth ratio and net worth tax payable to Georgia.

- Tax Due or Overpayment: This section summarizes the total taxes due and identifies any overpayments or credits applicable to the corporation.

- Direct Deposit Options: If applicable, corporations can provide banking information for direct deposit of any refunds.

These sections work together to provide a comprehensive overview of the corporation's tax obligations and entitlements in Georgia.

Can amendments be made to Form 600S after it has been filed?

Yes, amendments can be made to Form 600S after its initial filing. If an S corporation needs to correct or update information such as its earnings report, taxpayer information, or address, it can file an Amended Return. This involves indicating the reason for the amendment, such as an IRS audit result, name change, or address update, and providing the revised information. Amendments ensure that the corporation's tax obligations reflect accurate and current information.

Where should Georgia Form 600S be filed and what are the deadlines?

Georgia Form 600S should be filed with the Georgia Department of Revenue, either electronically, which is preferred for its efficiency and environmental benefits, or by mail addressed to the Processing Center in Atlanta, Georgia. The filing deadline typically aligns with the federal deadline for S corporations, which is the 15th day of the third month following the end of their tax year. It is crucial for S corporations to adhere to this timeline to avoid penalties and ensure compliance with Georgia state tax laws.

Common mistakes

Common mistakes made when filling out the Georgia Form 600S include:

- Incorrect calculation of Georgia taxable income and tax due. Calculating taxes requires preciseness. A small mistake in computing the tax rate or taxable income can result in incorrect tax amounts being reported.

- Failure to attach a copy of the Federal Return. The form stipulates that a copy of the Federal Return and supporting schedules must be attached if filing by paper. This oversight can delay processing.

- Incorrectly reporting net worth tax, especially for foreign corporations. The computation of net worth ratio and net worth tax is a unique step that foreign corporations must follow correctly.

- Omitting information on direct deposit options. If the taxpayer expects a refund and prefers direct deposit, failing to select this option and provide account details can lead to receiving a paper check instead.

- Not utilizing the correct schedules for additions and subtractions from Federal taxable income. These adjustments are crucial for accurately determining state tax liability.

- Misunderstanding the election to pay tax on behalf of shareholders due to a Georgia audit. This choice impacts how the tax burden is shared and requires careful consideration.

In addition to these specific mistakes, taxpayers often make several general errors:

- Forgetting to sign and date the return. The declaration section at the end of the form is a critical final step that verifies the accuracy and completion of the form.

- Omitting the Corporation’s telephone number, email address, and representative’s contact information. This information is vital for communication purposes.

- Incorrectly filling out the Schedule of Credits and Payments. Both the computation of tax due or overpayment and the proper allocation and carryover of credits require attention to detail.

- Failing to apply for electronic filing when claiming tax credits. Schedules 10 and 11 emphasize the necessity of electronic filing for credit claims, a step that is commonly overlooked.

- Providing incomplete or incorrect payment information for taxes due. Ensuring that check or electronic payment details are accurate is essential for the timely processing of the tax return.

Documents used along the form

When completing the Georgia Form 600S for S Corporation Tax Return, several other documents often accompany or support the filing process. These documents are crucial for a thorough and compliant submission to the Georgia Department of Revenue.

- Form IT-303: This document is the Application for Extension of Time for Filing State Income Tax Returns. Companies that need additional time to gather necessary information for a complete and accurate return use this form. The filing of this extension form must occur by the tax return's due date to avoid penalties.

- Form G2-A: Known as the Georgia Withholding Tax Withholding Certificate for Distributions, this document pertains to the withholding tax paid or to be paid on behalf of nonresident members. It's essential for S Corporations that distribute income to shareholders residing outside of Georgia, ensuring compliance with state tax withholding requirements.

- Schedule 10: This is the Credit Usage and Carryover Schedule, which must be filed electronically. This form allows the S Corporation to claim certain tax credits, detail the utilization of these credits against the income tax liability, and carry forward any unused amounts. It helps businesses reduce their tax liabilities by applying eligible credits.

- Schedule 11: The Credit Allocation to Owners Schedule is required for S Corporations looking to allocate tax credits among their shareholders. Similar to Schedule 10, this schedule must also be filed electronically. It is essential for transparent and equitable distribution of tax credits within the parameters set by Georgia tax laws.

Each document serves a specific function within the broader context of the S Corporation's tax responsibilities in Georgia. Understanding the purpose and requirements of these forms ensures a comprehensive approach to tax preparation, potentially optimizing the company's tax positions while maintaining full compliance with state tax regulations.

Similar forms

The Georgia Form 600 is the standard Corporation Tax Return form for C corporations. Like the 600S, it's used by businesses to report income, but it applies to corporations that do not elect S corporation status, making it a primary comparison in terms of function and audience. While the 600S is designed for S corporations, both forms serve a similar purpose: to provide detailed financial information to the Georgia Department of Revenue.

The Form IT-303, the Application for Extension of Time for Filing State Income Tax Returns, shares its relevance with the 600S by catering to businesses and individuals needing extra time to file their tax returns. Although it doesn't directly report tax liabilities, it's connected with the 600S through the necessity of attaching a copy if a filing extension has been requested, indicating their procedural interdependence.

Form IT-REIT is involved with Real Estate Investment Trusts (REITs) and their specific financial activities. This form intersects with the 600S through its focused adjustments related to real estate income, revealing a sector-specific counterpart that provides for specialized tax handling in the realm of real estate investments, contrasting the broader scope of the 600S while retaining the essence of tax reporting.

The Form G2-A, used for reporting and remitting withholding taxes from nonresident members by an S corporation, closely ties with the reporting requirements on the 600S. It handles the specifics of nonresident withholding, which is a subset of the 600S's broader responsibilities, thus acting as a document that provides detailed information feeding into the tax calculations and payments detailed in the 600S.

Dos and Don'ts

Filling out Georgia Form 600S, the S Corporation Tax Return, requires careful attention to detail and knowledge of tax law. Here are several do’s and don’ts to guide you through the process.

Do:

Read the instructions carefully. Before starting, review the Department of Revenue's detailed instructions to understand each section of the form and gather all necessary documents.

Use the correct form version. Tax forms are updated regularly. Make sure you're using the form for the correct tax year, noting the revision date (Rev. 06/20/20) for the 2020 tax year.

Provide accurate information. Double-check the Federal Employer ID Number, corporate name, address, and all financial details. Errors can delay processing or result in penalties.

Attach the Federal Return. For paper filings, include a copy of the Federal Return and all relevant schedules. This verifies the income and deductions reported on Form 600S.

Sign and date the form. The form must be signed by an authorized officer of the corporation and, if applicable, the individual or firm preparing the return.

Choose direct deposit for refunds. For faster refund processing, opt for direct deposit by providing your banking information in the designated section.

File electronically if claiming tax credits. To claim tax credits, you must file this form electronically, as indicated in the Credit Usage and Allocation sections (Schedules 10 and 11).

Don't:

Rush through the form. Taking your time to understand each section can prevent errors and ensure your return is processed smoothly.

Forget to calculate the Georgia ratio correctly. For foreign corporations, the computation of the net worth ratio (Schedule 2) must be precise, computed to six decimals, and not rounded.

Omit schedules or supporting documentation. All required schedules and documents must be attached to substantiate the information reported on Form 600S.

Disregard the original documents. If you're amending a return or have special conditions (like an IRS audit), attach the relevant documents or explanations as required.

Miss the filing deadline. Ensure the form is completed and submitted by the specified deadline to avoid penalties. Include a copy of the Federal extension request if applicable.

Ignore the rounding instruction. Follow the form's instructions closely, particularly when it instructs you to round to the nearest dollar.

Send payment without proper identification. If owing tax, make the check payable to the Georgia Department of Revenue and ensure the corporation's name and Federal Employer ID Number are included on the check.

Misconceptions

When it comes to taxes, it's easy for misinformation to spread. This is especially true for specific forms, such as Georgia Form 600S, the S Corporation Tax Return. Let's clear up some common misconceptions:

- Only Georgia-based S corporations need to file Form 600S. In reality, any S corporation with income, losses, or deductions derived from Georgia sources is required to file, regardless of where it is based.

- Form 600S is just for reporting income. This form is multifaceted. It covers income tax, net worth tax for S corporations, and provides for detailed reporting such as nonresident withholding and various tax credits.

- Net worth tax does not apply to S corporations. S corporations do indeed need to calculate and report net worth tax on Form 600S, though there are differences in computation for foreign corporations.

- If you file a federal extension, you automatically receive a state extension for Form 600S. While a federal extension can affect your state filing deadline, you must attach a copy of the federal extension request or Form IT-303 to your Georgia return to validate the extension.

- A paper return is mandatory. Despite the paper form instructions, S corporations are encouraged to file electronically, especially to claim tax credits, which must be done online.

- Amending a return is complicated and uncommon. Adjustments are not unusual and can be made through filing an amended return, which is accommodated through checking the "Amended Return" box and providing updated information.

- S corporations don't pay tax on behalf of shareholders. On the contrary, there’s an option for S corporations to pay Georgia tax on behalf of its shareholders, especially following a state audit, by checking the appropriate box on Schedule 1.

- Direct deposit is not available. Georgians have the option for direct deposit refunds. If selected, providing banking details on Form 600S is necessary, making the refund process faster and more secure.

- All S corporations are treated the same under Form 600S. There are distinctions in how foreign S corporations are treated, particularly in the calculation of the net worth ratio and net worth tax.

- There are no electronic communication options. By providing an email address, filers can authorize the Georgia Department of Revenue to send electronic notifications regarding updates to their account or tax return.

Understanding the specifics of Georgia Form 600S can help S corporations accurately fulfill their tax obligations and potentially avoid common filing errors.

Key takeaways

Filling out the Georgia Form 600S, an essential document for S Corporations, requires careful attention to detail. This guide highlights key takeaways to help you through the process:

- Identify the purpose of your filing: The Form 600S can be used for filing an original return, an amended return due to changes or corrections, reporting an address or name change, opting for composite return, and more. Ensure you check the applicable box at the start of the form to indicate the filing's purpose.

- Understand your tax calculation: The form computes both income tax due based on Georgia taxable income and net worth tax for corporations operating within Georgia. You will need to accurately report your income and calculate your tax using the specified rates.

- Keep track of nonresident withholding: If your S Corporation has paid any nonresident withholding tax, it's necessary to record this amount as it impacts the overall tax liability of the corporation.

- Fulfill net worth tax requirements: Foreign corporations are required to calculate their net worth tax by determining their assets and gross receipts. This calculation is crucial for entities doing business in Georgia but incorporated in another state or country.

- Provide detailed income information: From ordinary income to specific deductions and additions, detailed insight into the corporation’s financial status is necessary. This includes federal taxable income adjustments and allocations specific to Georgia.

- Electronic filing for tax credits: To claim any tax credits on the Form 600S, electronic filing is mandatory. Schedule 10 and Schedule 11 cater to credit usage, carryovers, and allocation to owners, emphasizing the importance of filing electronically to utilize these benefits.

By keeping these key points in mind, you'll ensure a smoother process in completing and submitting the Georgia Form 600S for your S Corporation.

Popular PDF Forms

Ga Form 500 - Clear instructions guide taxpayers on calculating the final amount due or refund owed, ensuring accurate financial settlement with the state.

Georgia Dispossessory Process - Clarifies the importance of presenting all relevant evidence, such as witnesses and documents, at the time of the court hearing.

Mv66 Ga Form - By fulfilling the requirements of the MV-66 form, dealers contribute to the integrity of the vehicle market in Georgia.