Free Ga 508 Template in PDF

The Ga 508 form, issued by the Georgia Department of Human Services, serves as a critical document for individuals seeking to renew their Food Stamp, Medicaid, or Temporary Assistance for Needy Families (TANF) benefits. It underscores the state's commitment to aiding its citizens in accessing vital health and nutritional support through a streamlined process. Applicants can initiate their renewal with minimal information but are encouraged to provide a complete application to expedite the processing. The form facilitates joint renewals for multiple programs, ensuring that applicants do not face discontinuation of Food Stamp benefits due to the denial or cessation of other services. Moreover, it includes provisions for applicants with disabilities, offering various reasonable modifications or communication assistance to ensure equitable access to the application process. The form also addresses the designation of authorized representatives, allowing others to act on behalf of the applicant in managing Food Stamp or TANF interviews or Medicaid applications. It reflects a comprehensive approach to welfare assistance, incorporating safeguards against fraud while ensuring the needs of Georgia’s diverse population are met with integrity and compassion. Importantly, it articulates the language accessibility, emphasizing the provision of interpreters and other communication aids at no cost, thereby promoting an inclusive and accessible application process for all residents.

Form Sample

Georgia Department of Human Services

FOOD STAMP/MEDICAID/TANF Renewal Form

If you need help reading or completing this document or need help communicating with us, ask us or

call

For Office Use only: Date Received Load # |

|

Client ID # _____________Date Initiated_________________ |

Programs Initiated: TANF Food Stamps Medicaid |

|

|

If you are reapplying for Food Stamps or renewing your TANF or Medicaid benefits, you can file this renewal/application form with only your name, address and signature. However, it will help us to process your application, recertification/renewal more quickly if you complete the entire form and provide verification of information, if it is requested. You may use this form to file a joint renewal/application for the Food Stamp/Medicaid and/or TANF program or for the Food Stamp Program (FS) only. Your Food Stamp renewal will not be terminated solely on the basis that your renewal/application for another program has been denied/terminated. We will make a separate eligibility determination for your Food Stamp renewal.

Please PRINT the name and address of the person who is reapplying for benefits in the space below:

Client Name: |

|

Date of Birth: |

Social Security Number: |

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

Main Phone Number: |

|

Other Contact Number: |

Email Address: |

|

|

|

(Optional) |

|

|

|

|

(optional) |

Texting: Yes__ or No__(optional) |

|

|

|

|

|

|

What is your Preferred Language? |

|

If an interview is required, will you |

|

|

|

need an interpreter? |

Yes ____ or No ____ |

|

|

|

|

Americans with Disabilities Act: Request for Reasonable Modification & Communication Assistance (if applicable):

Do you have a disability that will require a Reasonable Modification or Communication Assistance? Yes__ No ___

(If yes, please describe the reasonable modification or Communication Assistance that you are requesting):

Sign Language interpreter ___; TTY ____; Large Print ____; Electronic communication (email) ____; Braille ____; Video

Relay ___; Cued Speech Interpreter___ ; Oral Interpreter ___; Tactile Interpreter ___; Telephone call reminder of program deadlines ___; Telephonic signature (if applicable) ___;

Do you need this Reasonable Modification or Communication Assistance

__________________________________________________________________________________________

Form 508 (Rev. 09/20) |

- 1 - |

I declare under penalty of perjury to the best of my knowledge and belief that the person(s) for whom I am applying for benefits is/are U.S. citizen(s) or are noncitizen(s) lawfully present in the United States. I further certify that all of the information provided on this application is true and correct to the best of my knowledge. I understand and agree that

I will report any change in my situation according to Food Stamp/Medicaid and/or TANF program requirements. I will also report If anyone in my household receives lottery or gambling winnings, gross amount of $3500 or more (before taxes or other amounts are withheld). I will report these winnings within 10 days from the end of the month in which my household receives the winnings. I understand if any information is incorrect, my benefits may be reduced or denied, and I may be subject to criminal prosecution or disqualified from

Signature: |

Date |

Witness Signature if signed by ‘X’

Date

Form 508 (Rev. 09/20) |

- 2 - |

Authorized Representative:

Complete this section only if you want someone to fill out your application/renewal, complete your interview for Food Stamps or TANF, and/or use your Food Stamp EBT card to buy food when you cannot go to the store. If you are applying for Medicaid, you can choose more than one person to apply for Medical Assistance on your behalf.

Name 1: ____________________________________________ |

Phone: |

_________________________ |

|

||||

Address: ____________________________________________ |

Apt: |

_____________ |

|

|

|||

City: |

____________________________________________ |

State: |

|

______________ Zip: ___________ |

|||

|

|

|

|

|

|||

Preferred Language: __________________________________ |

Is an interpreter needed? Yes ____ or |

No ____ |

|||||

Name 2: ____________________________________________ |

Phone: |

_________________________ |

|

||||

Address: ____________________________________________ |

Apt: |

_____________ |

|

|

|||

City: |

____________________________________________ |

State: |

|

______________ Zip: ___________ |

|||

|

|

|

|

|

|||

Preferred Language: __________________________________ |

Is an interpreter needed? Yes ____ or |

No ____ |

|||||

For Medicaid, do you want this individual to have a copy of your Medicaid card? ❑ Yes ❑ No |

|

||||||

Americans with Disabilities Act: Request for Reasonable Modification & Communication Assistance for Authorized Representatives (if applicable):

Does the authorized representative have a disability that will require a Reasonable Modification or Communication Assistance? Yes__ No ___ (If yes, please describe the reasonable modification or Communication Assistance that you are requesting):

Sign Language interpreter ___; TTY ____; Large Print ____; Electronic communication (email) ____; Braille ____;

Video Relay ___; Cued Speech Interpreter___ ; Oral Interpreter ___; Tactile Interpreter ___; Telephone call reminder of program deadlines ___; Telephonic signature (if applicable) ___;

Does the authorized representative need this Reasonable Modification or Communication Assistance

FOR MEDICAID ONLY:

Do you expect to file a federal income tax return NEXT YEAR? (You can still apply for health insurance even if you don’t file a federal income tax return.)

YES If Yes, Please answer questions a, b, and c |

NO If No, Please answer question c. |

||

a. Will you file jointly with a spouse? Yes No If yes, name of spouse: |

|

||

b. Will you claim any dependents on your tax return? Yes |

No |

||

If yes, list name(s) of dependents: _ |

|

|

|

c. Will you be claimed as a dependent on someone's tax return? Yes No If yes, list the name of the tax filer: ________________________________

Form 508 (Rev. 09/20) |

- 3 - |

If you need help reading or completing this document or need help communicating with us, ask us or call

COMMUNITY OUTREACH SERVICES:

For more information about other DHS services, please visit our website at www.dfcs.georgia.gov or call

Please answer all questions and provide proof of all income and any expenses as requested.

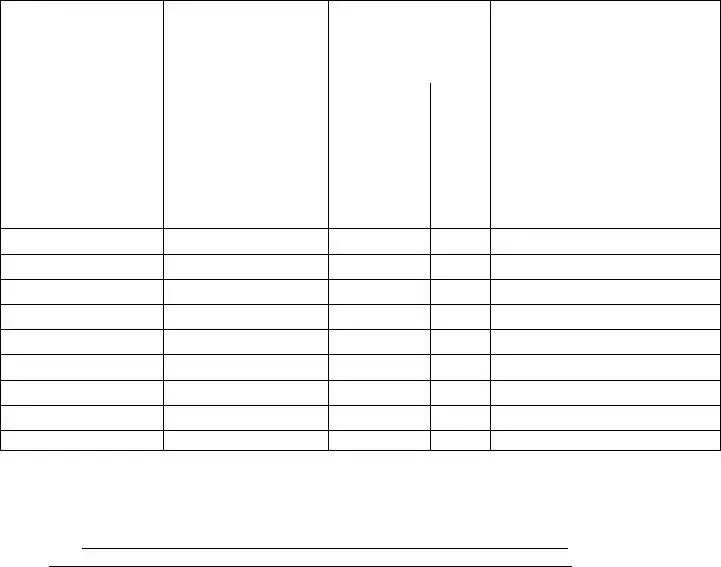

CITIZENSHIP IMMIGRATION STATUS AND SOCIAL SECURITY NUMBERS:

Please fill out the chart below about the applicant and all household members. The following federal laws and regulations: The Food and Nutrition Act of 2008, 7 U.S.C. §

§205.52, 42 C.F.R. § 435.910, and 42 C.F.R. § 435.920, authorize DFCS to request you and your household members social security number(s). Anyone who is living in your household and is not applying for benefits may be treated as a

eligible for benefits, you will still need to tell us about their citizenship or immigration status and give us their social |

|

|||||||||||||

security number (SSN). You will still need to tell us about their income and resources to determine the eligibility and |

|

|||||||||||||

benefit level of the household. We will not report any |

|

|

|

|||||||||||

Citizenship and Immigration Services (USCIS) Systematic Alien Verification for Entitlements (SAVE) system if they |

|

|||||||||||||

do not give us their citizenship or immigration status. However, if immigration status information has been submitted |

|

|||||||||||||

on your application, this information may be subject to verification through the SAVE system and may affect the |

|

|||||||||||||

household’s eligibility and benefit level. We will match your information with other Federal, state, and local agencies |

|

|||||||||||||

to verify your income and eligibility. This information may also be given to law enforcement officials to use to catch |

|

|||||||||||||

people who are running from the law. If your household has a Food Stamp claim, the information on this application, |

|

|||||||||||||

including SSN, may be given to Federal and State agencies and private claims collection agencies for them to use in |

|

|||||||||||||

collecting the claim. We will not deny benefits to |

applicant household members because other household members |

|

||||||||||||

fail to provide their SSN, citizenship, or immigration status. If you are applying for emergency medical services only, |

|

|||||||||||||

you do not have to provide your SSN or information about your immigration status. |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ethnicity |

|

|

|

|

|

|

youArea U.S citizen, immigrantqualified or in satisfactorya immigrationstatus? (Applicantsonly) (Y/N) |

theDoesmother of this livechildin the home? (Y/N) |

theDoesfather of this livechildin the home? (Y/N) |

|

wantyouDo Medicaid? (Y/N) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hispanic |

|

|

|

|

|

Social |

|

|

|

|

|

|

|

|

or |

|

|

|

|

|

Security |

|

|

|

|

|

|

M |

|

Latino? |

Race |

Sex |

|

Date |

Relationship |

Number |

|

|

|

|

|

First Name |

I |

Last Name |

(Optional) |

(Optional) |

M/F |

|

Of Birth |

To You |

(Applicants only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

SELF |

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|

|

|

|

|

|

Y/N |

Y/N |

Y/N |

|

Y/N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Race Codes (Choose all that apply): |

|

|

AI – American Indian or Alaska Native |

AS – Asian |

BL – Black or African American |

HP – Native Hawaiian or Other Pacific Islander |

WH – White |

|

By providing Race/Ethnicity information, you will assist us in administering our programs in a

Form 508 (Rev. 09/20) |

- 4 - |

For Medicaid only:

Was anyone in your household in Foster Care at age 18? ☐Yes ☐No

If you have tax dependents that do not live in the home with you, please list below. |

|

|

|||||||||

Name: |

|

|

|

Social Security Number_ |

|

|

Sex: M F (please circle |

||||

|

|

|

|

|

|||||||

one) |

Date of Birth: |

|

|

Citizenship: |

|

|

|||||

|

|

|

|

|

|

|

|

|

|||

Relationship to you: |

|

|

|

(Please add additional pages as needed) |

|

|

|||||

For Food Stamp Program only - DISQUALIFICATIONS:

(1)Have you or any household member been convicted of giving false information about where they live and who they

are to get multiple FS benefits in more than one area after 8/22/96? |

Yes No |

||||

If yes, Who: |

|

Where: |

|

When: |

|

|

|

|

|

|

|

(2)Do you or any household member have a felony conviction because of behavior related to the possession, use or distribution of a controlled substance after 8/22/96? Yes No

If yes, Who: |

|

|

When: |

|

|||

Date of offense: |

|

Date of Conviction: |

|

|

|||

Does this person have 1st Offender Status? |

Yes No |

||||||

a)Are you in compliance with any terms of probation related to any sentence received as a result of a drug felony conviction? (For Food Stamps only) ❑Yes ❑ No

b)Are you in compliance with the terms of parole related to any sentence received as a result of a drug felony conviction? (For Food Stamps only) ❑Yes ❑ No

c)Have you successfully completed all the terms of probation or parole related to any drug related conviction? (For Food Stamps only) ❑Yes ❑ No

(3) Is anyone trying to avoid prosecution or jail for a felony?Yes |

No |

|

If yes, who |

|

|

(4) Is anyone violating conditions of probation or parole? |

Yes No |

|

If yes, who |

|

|

(5)Have you or any household member been convicted of trading SNAP benefits for drugs after 8/22/96? Yes No

If yes, who; |

|

when: |

(6)Have you or any household member been convicted of buying or selling SNAP benefits over $500 after 8/22/96?

Yes No |

|

If yes, who; |

when: |

(7)Have you or any household member been convicted of trading SNAP benefits for guns, ammunition or explosives after 8/22/96? Yes No

If yes, who; |

|

when: |

|

|

(8) Have you or any household member received lottery or gambling winnings? |

❑ Yes ❑ No |

|||

If yes, who: _____________________________________when: ___________________________________

Amount received: ________________________________

For the TANF Program only - DISQUALIFICATIONS

(1) Has anyone been convicted of a violent felony? |

Yes No |

|

If yes, who: |

|

|

(2)Has anyone been convicted on or after January 1997 of misrepresenting their residency in order to receive TANF

benefits in multiple states? |

Yes No |

|

If yes, who: |

|

|

Form 508 (Rev. 09/20) |

- 5 - |

|

(3)Has anyone been convicted of using the TANF cash assistance or TANF debit MasterCard at prohibited places listed below: liquor stores, casinos, poker rooms, adult entertainment business, bail bonds, night clubs/salons/taverns, bingo halls, race tracks, gun/ammunition stores, cruise ships, psychic readers, smoking shops, tattoo/piercing shops, and

spa/massage salons. |

|

Yes No |

|

If yes, who: |

|

when: |

|

Food Stamps and TANF only:

STUDENTS IN HIGHER EDUCATION: Is anyone in your household enrolled at least

School Name: |

|

|

|

Grade/Status |

_Graduation date: |

||

|

|

|

|

|

|

|

|

Is the student employed? Yes No Enrolled in work study? |

Yes No |

||||||

If yes, hours worked per week |

|

(Please complete the employment section below as well.) |

|||||

For Medicaid and TANF Only:

Is anyone in your household pregnant?

Yes No Number of expected births:Name of pregnant woman: __________________________________

Baby’s Due Date: _____________ Unborn baby’s father’s Name: _____________________________________________

Father’s address: ___________________________________________________________________________________

_________________________________________________________________________________________________

MEDICAL:

For Medicaid Only:

Does anyone in the household have any unpaid medical bills? Yes No

If yes, please send the unpaid bills if you have a Medicaid case.

For Food Stamps Only:

Does anyone age 60 or older or disabled have medical expenses? Yes No

Did your medical expenses such as Medicare premiums, prescription drug cost, or hospital bills change? Yes No

If yes, list expenses on chart below. Attach bills, prescription drugs for most recent month(s).

|

Type of Expense |

Amou |

|

Will |

|

Household Member Billed |

Date of Bill |

Insurance |

|||

(Doctor, Hospital, |

nt |

||||

|

|

Pay? |

|||

|

Prescription) |

Owed |

|

||

|

|

Yes/No |

|||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does anyone 60 years of age or older or disabled have medical expenses for transportation? Yes No

If yes, please provide the information below. If you are receiving Medicaid, provide proof:

Purpose of the trip (doctor or hospital visit; pharmacy pick- up)

Total miles driven:

Cost of taxi, bus, parking or lodging:

Does someone else pay any of these medical expenses for you? Yes No

If yes, please provide information below:

Which expense is paid? |

|

Who pays the expense? |

|

|

|

To whom does this person pay the bills? |

|

Address: |

|

|

|

Form 508 (Rev. 09/20) |

- 6 - |

|

For Medicaid only

OTHER HEALTH COVERAGE

Is anyone enrolled in health insurance now from the following?

Georgia Department of Human Services Medicaid |

PeachCare for Kids |

Medicare |

VA Healthcare Programs TRICARE (Don’t check if you have direct care or Line of Duty)

Employer Insurance: Name of Insurance_ |

|

|

Policy Number |

|

|||

Other: Name of Insurance |

|

|

Policy Number |

|

|

|

|

Do you have any health insurance other than Medicaid? Yes No If yes, send us a copy of your insurance card.

RESOURCES:

(Not needed for MAGI Medicaid): Does any person in your household have any of the following resources? Yes No (If yes provide the information below. If you are receiving Aged, Blind or Disabled Medicaid (other than Medicare Savings Plans such as QMB, SLMB or

|

|

Account/Policy # |

|

|

|

|

|

(Do not complete |

|

|

|

Resource Type |

Owner |

If your |

|

Value |

Name of Bank, Insurance Company etc. |

account/policy # |

|

||||

|

|

|

|

|

|

|

|

is the same as |

|

|

|

|

|

your SSN) |

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

Checking/Savings |

|

|

|

|

|

|

|

|

|

|

|

Credit Union |

|

|

|

|

|

|

|

|

|

|

|

Annuities |

|

|

|

|

|

|

|

|

|

|

|

Stocks or Bonds |

|

|

|

|

|

|

|

|

|

|

|

Safe Deposit Box |

|

|

|

|

|

|

|

|

|

|

|

Retirement Account |

|

|

|

|

|

(For

Vehicles

(For

CD’s/Annuities

(For

(For

Cemetery Plots

(For

Trust Funds

(For

(For

Home Place Property

(For

Life Insurance

(For

Other

For Aged, Blind or Disabled Medicaid only:

Have you, your spouse or someone you are applying for sold, traded, or given away a resource in the last 60 months. Yes No

If yes, what?

When?

Form 508 (Rev. 09/20) |

- 7 - |

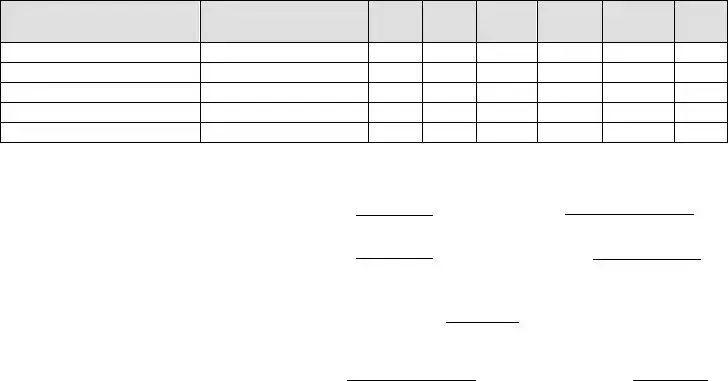

EMPLOYMENT: Does anyone in your household work? Yes No If yes, list information of the employed person’s pay from employment such as wages, bonus, and tips, and attach proof of ALL gross income received in the last 4 weeks.

PERSON WORKING

EMPLOYER

PAY

PER

HOUR

HOURS

PER

WEEK

HOW

OFTEN

PAID

DATE(S)

PAID

BONUS

PAY

TIPS

For Medicaid only

Health Insurance |

$____ How Often? |

|

How Often? |

||||||||||||

|

|

|

|||||||||||||

_________________ |

|

|

|

|

|

|

|

|

|

|

|||||

Dental Insurance |

$ |

|

|

|

|

|

|

|

How Often? |

||||||

$ |

|

How Often? |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

$_ |

|

|

Other Deduction Type: |

|

|

|

||||||||||||

|

|

|

|

|

|||||||||||

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||

How Often? |

|

|

|

|

|

|

|

|

|

Other Deduction Type: |

|||||

More? Please attach on a separate sheet of paper.

Vision Insurance $

Other Deduction Type:

How Often?Other Deduction Type:

$_ |

|

How Often? |

TAX RETURN DEDUCTIONS:

Check all that apply and give the amount and how often you pay it.

NOTE: You shouldn’t include a cost that you already considered in your answer to

Alimony Paid $ |

How Often? |

Student Loan Interest $_ |

|||||||||||

How Often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Deduction Type |

|

|

|

$ |

|

|

|||||||

How Often? |

|

|

|

|

|

|

|

|

|

|

|

||

Did anyone in your household voluntarily quit a job or voluntarily reduce his/her work hours to below 30 hours per week within the last 30 days of the date of this renewal?

If yes, who quit? |

|

Date of quit: |

|

|

||

What Job was quit? |

|

|

|

|

||

Why did he/she quit? |

|

|

|

|

||

Has anyone stopped working? Yes No If yes, complete the following and provide proof:

What job stopped? |

|

Name of Household Member who stopped working: |

|

|

|

|

|

Place of employment: |

|

|

|

|

|

|

|

Date Pay Stopped: |

|

Date of Final Check: |

Amount of final Pay (gross): |

|

|

|

|

Form 508 (Rev. 09/20) |

- 8 - |

|

|

Has anyone started working? Yes No If yes, complete the following and provide proof:

Name of person who started working: |

|

Date Started: |

|

|

|

Phone Number: |

||

|

||||||||

|

|

|

|

|

|

|

|

|

Name of employer/business: |

|

|

Rate of Pay: |

|

Date |

|

first check received/will be |

|

|

|

|

$ |

|

received: |

|

||

|

|

|

|

|

|

|

|

|

How often paid (please check one): |

|

|

|

|

|

|

|

|

Weekly |

|

Twice a month |

Monthly |

Other |

||||

Is anyone

Please provide proof of

Is this business incorporated? |

Yes No |

Does this person have any

If yes, what type of expenses does this person have?

For Medicaid and TANF only: provide proof for

UNEARNED INCOME:

Does anyone in your household receive money from Contributions, Social Security, SSI, VA, Child Support, Unemployment, Retirement or any other income? Yes No

If yes, complete the information below and provide proof of all income received in the last 4 weeks or the most recent award letter.

Name

Source

Amount

How Often?

For MAGI Medicaid: Income from Child support, veteran’s payment, Supplemental Security Income (SSI), or Workman’s Compensation Benefits will not be counted.

DEPENDENT CARE COSTS:

Do you pay for the care of a dependent child or a disabled adult household member? Yes No If yes, complete the questions below; provide proof for Food Stamps (if the monthly amount is over $200).

Person who requires care:

Person who pays for care:

Provider’s Name:

How much provider is paid:

How often paid:

Provider’s Phone #:

Reason for Care:

Do you pay transportation expenses for a dependent child or disabled adult household member? Yes No

Are these expenses included in the dependent care expenses? Yes No

If no, please answer this question: Total miles driven weekly: ________________________

Form 508 (Rev. 09/20) |

- 9 - |

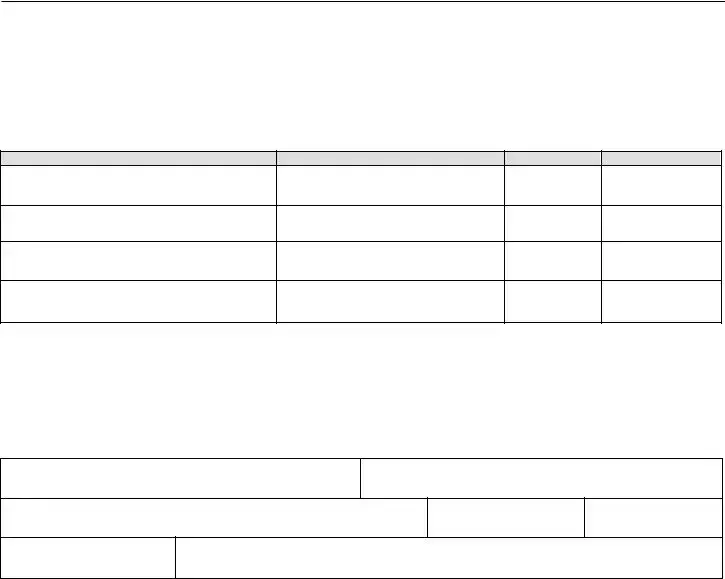

SHELTER COSTS:

Did you or any household member start paying shelter costs or did your shelter costs change? Yes No

If yes, complete the chart below.

Expense |

Amount |

How Often? |

Who paid? |

|

|

|

|

Rent/Mortgage |

|

|

|

|

|

|

|

Property Taxes |

|

|

|

|

|

|

|

Property Insurance |

|

|

|

|

|

|

|

Electricity |

|

|

|

|

|

|

|

Gas |

|

|

|

|

|

|

|

Fuel oil/Wood/ |

|

|

|

Kerosene |

|

|

|

Well/Septic |

|

|

|

Tank/Water/Sewage |

|

|

|

Garbage |

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

What is the home’s primary heating or cooling source? (electricity, gas, air conditioner)

Does someone else pay any of these household bills for you? Yes No If yes, complete the chart below:

Who pays the bill?

What amount is paid?

What bills are paid?

To whom does this person pay the bills?

Have you received energy assistance in the last 12 months? Yes No

If yes, amount received $

Do you share monthly household expenses with anyone in the home? Yes No

If yes, who?

Comments/Documentation

Paid to whomAmount paid $___________________________ per ________________

Landlord Name ______________________ Landlord Address ______________________________________

CHILD SUPPORT PAYMENT: |

|

|

Do you or someone in your household pay child support to someone living outside of the home? |

Yes No |

|

If yes, complete the chart below: |

|

|

Who is obligated to pay? |

How much is the obligated amount? |

|

|

|

|

For whom is the child support paid? |

How much is the actual amount paid? |

|

|

|

|

To whom is the child support paid? |

How often is the child support paid? |

|

|

|

|

For Food Stamps only, please provide proof of amount paid in the past 3 months and the legal obligation to pay.

This section is FOR TANF RECIPIENTS ONLY – You must complete the following:

Shot Records:

Is there any child under age 7, who is not yet enrolled in school?

If yes, send Form 3231- Child Care Immunization form for each child under age 7.

Form 508 (Rev. 09/20) |

- 10 - |

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for the renewal or application of Food Stamps, Medicaid, and TANF in Georgia. |

| Minimum Requirements | Applicants can file with just their name, address, and signature, but providing complete information expedites processing. |

| Joint Application Feature | Applicants may use this form to file a joint renewal/application for Food Stamp/Medicaid and/or TANF program. |

| Non-Termination Clause for Food Stamps | Food Stamp renewal will not be terminated if renewal/application for another program is denied. |

| Verification and Certification | The form includes a declaration that all provided information is true and allows for verification by DHS-DFCS, DCH, and authorized Federal Agencies. |

| Governing Laws | The form adheres to various federal laws and regulations including The Food and Nutrition Act of 2008, 7 U.S.C. § 2011-2036, and others related to social security numbers and eligibility verification. |

| Accessibility and Assistance | Provides provisions for assistance, including interpreters and communication aids, for applicants with disabilities or those who need help communicating with the department. |

Guide to Using Ga 508

Filling out the Georgia Department of Human Services Form 508 is an essential step for individuals seeking to renew their Food Stamps, Medicaid, or TANF (Temporary Assistance for Needy Families) benefits. This form ensures that your benefits continue without interruption. Completing it accurately helps the department process your renewal efficiently. Follow these steps to correctly fill out the form:

- Start with providing the Client Name, including the Date of Birth and Social Security Number, at the top of the form.

- Fill in your Street Address and, if different, your Mailing Address.

- Enter your Main Phone Number, an alternate contact number, and Email Address if you wish to provide one. Indicate your preference for email communication and texting by ticking Yes or No.

- Specify your Preferred Language and whether you require an interpreter for an interview.

- If applicable, detail any needs for a Reasonable Modification or Communication Assistance under the Americans with Disabilities Act, specifying the type of assistance required and whether it is a one-time or ongoing need.

- Under the section For Office Use Only, leave the information intended for office use blank, such as the Date Received, Load #, Client ID #, Programs Initiated, and Date Initiated.

- On the statement of declaration regarding perjury, sign and date at the bottom to affirm the truthfulness and correctness of the information provided. If the form is signed with an 'X', a witness must also sign and date.

- If you have an Authorized Representative, complete that section with the representative’s name, phone number, address, preferred language, and need for an interpreter.

- Answer the questions related to applying for Medicaid concerning filing a federal income tax return, and provide information as applicable.

- Complete the section regarding Citizenship, Immigration Status, and Social Security Numbers for all household members. Fill in details such as their names, relationships to you, whether they live in the home, and their Medicaid preferences.

- For Medicaid only, indicate if anyone in the household was in foster care at age 18, and list any tax dependents not living with you.

- Address the Disqualification section relevant to the Food Stamp Program and the TANF Program by answering Yes or No to the specific questions and providing details as required.

- Review the entire form to ensure all necessary information has been filled in accurately and completely. Missing or incorrect information may delay processing.

- Finally, submit the completed form as directed by the Georgia Department of Human Services, either by mail or in person, to the appropriate office handling your benefits.

After submitting the form, the Georgia Department of Human Services will process your renewal. This might involve verifying the information you've provided, and they may contact you for further documentation or clarification. Staying responsive to such requests will facilitate the seamless continuation of your benefits.

Obtain Clarifications on Ga 508

What is the GA 508 form?

The GA 508 form is a renewal/application form used by Georgia residents to apply for or renew Food Stamps, Medicaid, and/or Temporary Assistance for Needy Families (TANF) benefits. It serves as a crucial document for individuals and families seeking assistance to ensure continuation or initiation of their benefits under these programs.

How can I complete the GA 508 form if I need assistance?

If you require help reading, completing, or communicating regarding the GA 508 form, assistance is available. You can request help directly from the Georgia Department of Human Services or call 1-877-423-4746 for support, including free interpreter services. For individuals who are deaf, hard-of-hearing, deaf-blind, or have speech difficulties, the Georgia Relay Service can be accessed by dialing 711.

What information do I need to provide when filling out the GA 508 form?

At a minimum, the form requires your name, address, and signature for processing. However, for a quicker and smoother application or renewal process, completing the entire form and providing verification of the information requested (if asked) is recommended. This could encompass details pertaining to your household, income, and any specific needs you might have, like interpreter services or reasonable modification requests under the Americans with Disabilities Act.

Can I use the GA 508 form to apply for more than one program?

Yes, the GA 508 form can be used to file a joint renewal/application not only for Food Stamps but also for Medicaid and/or TANF programs, or exclusively for the Food Stamp Program. Your application for Food Stamps won't be affected adversely if your application for another program is denied or terminated; eligibility determinations are made separately for each program.

What happens if I fail to report changes in my situation or provide incorrect information?

It's imperative to report any changes in your situation in line with the requirements of the Food Stamp/Medicaid and/or TANF programs. Failure to report, such as receiving lottery or gambling winnings over $3,500, within the stipulated time frame can result in reduction, denial, or discontinuation of your benefits. Providing false information or failing to disclose required information may lead to disqualification from DHS-DFCS programs, criminal prosecution, or both.

What is the role of an Authorized Representative mentioned on the GA 508 form?

An Authorized Representative is someone you designate to complete your application/renewal, conduct the interview on your behalf for the Food Stamps or TANF programs, and/or use your Food Stamp EBT card for purchasing food when you're unable to visit the store. For Medicaid, you have the option to select more than one person to apply for medical assistance on your behalf. This section of the form requires detailed information about the authorized representative(s), including their name, contact details, and whether they require any reasonable modifications or communication assistance.

Common mistakes

Not completing the entire form: People often submit the GA 508 form with just their name, address, and signature. While this is enough to file the form, providing full information and verification of details allows for faster processing and ensures accuracy in determining eligibility for Food Stamp/Medicaid/TANF benefits.

Forgetting to report income changes or household circumstances: It's essential to report any changes in income, household size, or financial status to maintain eligibility and avoid discrepancies. Failure to report such changes within 10 days from the end of the month can lead to denial or reduction of benefits.

Incorrectly listing household members: Many applicants do not accurately include all household members or fail to provide their Social Security numbers, citizenship, or immigration status. This mistake can impact the eligibility and benefit level for the entire household.

Omitting contact information details: Some applicants leave out vital contact information such as main phone numbers, other contact numbers, or email addresses (optional). These details are crucial for communication, especially if the department needs to verify information or discuss the application.

Not specifying the need for communication assistance or reasonable modification: Applicants with disabilities or those who require an interpreter for the renewal process must indicate their needs on the form. Missing this step can hinder effective communication between the applicant and the department, potentially delaying the process.

Failing to sign the form: An unsigned form is considered incomplete and cannot be processed. Both the applicant and a witness (if the form is signed with an ‘X’) must sign the document to certify that the provided information is accurate to the best of their knowledge.

Avoiding these common mistakes can streamline the renewal/application process for Georgia’s Food Stamp/Medicaid/TANF programs, ensuring that individuals and families receive the benefits they need without unnecessary delays.

Documents used along the form

When applying for or renewing benefits with the Georgia Department of Human Services, particularly through the Ga 508 form for programs like Food Stamps/Medicaid/TANF, individuals might need to prepare and submit additional documents to ensure their application is processed efficiently and accurately. Understanding these documents can help streamline the process and ensure that applicants provide all the necessary information to qualify for benefits.

- Proof of Income Documents: These can include recent pay stubs, tax returns, or employer statements. They are critical for the Georgia Department of Human Services to determine eligibility based on income levels for programs like Medicaid, TANF, and Food Stamps.

- Proof of Citizenship or Legal Residency: Applicants may need to provide birth certificates, passports, or alien registration cards. This documentation helps verify U.S. citizenship or lawful presence in the country, which is a requirement for receiving state benefits.

- Proof of Expenses: Documents such as receipts for rent or utilities, medical bills, or childcare expenses are important, particularly for determining Food Stamp benefits, as DHS-DFCS considers certain expenses when calculating benefit levels.

- Identification Documents: A state ID, driver's license, or other government-issued identification helps verify the identity of the applicant. This is a standard requirement across various DHS-DFCS programs to prevent fraud and misrepresentation.

In conclusion, properly preparing and submitting the necessary supplemental documents alongside the Ga 508 form can facilitate a smoother application process for Georgia's Food Stamp, Medicaid, and TANF programs. It’s essential for applicants to pay close attention to the requirements outlined in the application process, including specific documents needed, to ensure they can receive the benefits they are applying for without unnecessary delay.

Similar forms

The Ga 508 form, used for renewing Food Stamp/Medicaid/TANF benefits in Georgia, shares similarities with various other government and state documentation due to its function, elements, and requirements. These similarities are evident in the way personal, financial, and eligibility information is collected, used, and verified. Here are eight documents that show resemblance to the Ga 508 form:

- Medicare Application Form - Like the Ga 508 form, the Medicare application requires personal and financial information to determine eligibility for health insurance under federal guidelines, focusing on citizens or permanent residents who are 65 years old or older, or those with specific disabilities.

- Social Security Benefits Application - This application collects personal data, financial information, and citizenship status to ascertain eligibility for retirement, disability, or survivors' benefits, mirroring the Ga 508’s comprehensive approach to gathering applicant information.

- State Unemployment Insurance (UI) Claim Forms - UI claim forms require extensive personal information, employment history, and reasons for unemployment to assess eligibility for state unemployment benefits, similar to the employment and income verification aspects of the Ga 508 form.

- Free Application for Federal Student Aid (FAFSA) - The FAFSA form, used to determine eligibility for student financial aid, collects detailed family financial information and personal details much like the Ga 508 form does for program eligibility determination.

- Supplemental Security Income (SSI) Application - This form gathers detailed personal, financial, and disability information to establish eligibility for SSI benefits, akin to how the Ga 508 form determines eligibility for Medicaid based on various criteria including income and disability.

- Affordable Care Act (ACA) Marketplace Enrollment Application - Similar to the Ga 508 form, the ACA Marketplace application is used to enroll individuals and families in health insurance plans, requiring personal, financial, and household information to determine eligibility for insurance plans and subsidies.

- Children's Health Insurance Program (CHIP) Application - CHIP applications collect detailed information on children’s health coverage eligibility, mirroring the family and household information collection aspect of the Ga 508 form for the purpose of assessing eligibility for health and nutritional benefits.

- Public Housing and Section 8 Application - These applications require personal information, income verification, and family size to determine eligibility for housing assistance, similar to the criteria used in Ga 508 for assessing eligibility for economic assistance programs.

Each of these documents, while serving specific and varied purposes, shares the key functions of collecting, verifying, and employing personal and financial information to determine eligibility and benefits, akin to the process outlined in the Ga 508 form for Food Stamp/Medicaid/TANF renewal in Georgia.

Dos and Don'ts

When filling out the Georgia Department of Human Services Form 508 for Food Stamp/Medicaid/TANF Renewal, here are essential guidelines to ensure your application process is smooth and error-free. The list below highlights what you should and shouldn't do:

- Do provide all requested personal information such as your name, address, date of birth, and social security number. This basic information is crucial for processing your application.

- Don't skip sections relevant to your application. Even though the form states that you can file with minimal information, providing complete and detailed information where possible speeds up the processing time.

- Do ask for help if you need it. Whether it's reading the form, completing sections, or needing an interpreter, the Department offers services to assist you, all of which are free.

- Don't fabricate or hide information. Honesty in providing your details and your household's information is paramount since discrepancies could lead to denied benefits or even criminal prosecution.

- Do report any changes in your situation as required by the Food Stamp/Medicaid and/or TANF program requirements, including household income or size.

- Don't ignore the request for information about everyone in your household. Even if they are not applying for benefits, their information could affect your eligibility.

- Do consider the authorized representative section if you want someone to complete your application or renewal on your behalf. Ensure you trust this person and provide their complete information.

- Don't provide incomplete or inaccurate descriptions of any disabilities or the need for reasonable modifications and communication assistance. Accurate descriptions ensure you receive the appropriate assistance and modifications.

- Do verify all the information before signing. Your signature attests to the accuracy of the information provided to the best of your knowledge. A false statement could lead to severe consequences.

Adhering to these guidelines will facilitate a smoother process in the renewal or application for Food Stamps, Medicaid, or TANF through the Georgia Department of Human Services.

Misconceptions

Understanding the complexities of the Georgia Department of Human Services FOOD STAMP/MEDICAID/TANF Renewal Form, also known as Form GA 508, is crucial for applicants. However, several misconceptions can lead to confusion or missteps in the application process. Here are six common misunderstandings clarified to ensure applicants have accurate information:

- Completing the form is only necessary for new applicants. This is not true. Both new applicants and those looking to renew their Food Stamps, Medicaid, or TANF benefits need to submit Form GA 508. It serves as a critical piece for both initiating and continuing assistance.

- Legal assistance is required to complete the form. While some may seek help, the form is designed to be accessible without legal representation. Free resources and support, such as interpreters and help with reading or filling out the document, are available through the Department of Human Services for anyone who needs them.

- The entire form must be filled out for renewal. While providing complete information can facilitate a faster renewal process, applicants reapplying for benefits are only required to fill in their name, address, and signature at a minimum for the form to be processed.

- You can’t request assistance for communication or accessibility needs on this form. The form explicitly offers the opportunity to request reasonable modifications or communication assistance for individuals with disabilities, ensuring accessible service for all applicants.

- Information regarding citizenship or immigration status will be used against applicants. The form collects data on citizenship and immigration status solely for eligibility and benefit level determination. The Department pledges not to report non-applicant household members to immigration authorities if they do not provide this information.

- The form only applies to individual benefits. Applicants may use Form GA 508 to apply for joint benefits, including Food Stamps, Medicaid, and/or TANF, streamlining the process for households seeking multiple forms of assistance.

Dispelling these misconceptions is vital for ensuring that individuals and families seeking assistance through the Georgia Department of Human Services can do so confidently and effectively, armed with the correct information to support their application or renewal efforts.

Key takeaways

When completing the Georgia Department of Human Services Form 508 for Food Stamp/Medicaid/TANF renewal, it's crucial to understand the following key takeaways:

- Applying or renewing for benefits like Food Stamps, Medicaid, or TANF can be initiated with just your name, address, and signature. Providing complete information, however, expedites the process.

- You can use Form 508 to renew or apply jointly for Food Stamps, Medicaid, and/or TANF. Each program's eligibility is determined separately.

- Communication support, including free interpreter services, is available for those who need assistance in completing the form or during the communication process with the department.

- To apply as a representative or have someone assist you with your application and communication, complete the Authorized Representative section of the form. This can also include authorization to use a Food Stamp EBT card on behalf of the applicant.

- Disclosing your and your household members' Social Security numbers, citizenship, or immigration status is mandatory for those applying for benefits, but it is not required for non-applicants living in the household who are not seeking benefits.

- Non-applicant household members' information will not be reported to immigration authorities or used to determine eligibility for those applying for benefits.

- Applicants must report any changes in household circumstances according to program requirements, including receiving significant lottery or gambling winnings.

- It is critical to be honest in the application. Providing false information or failing to report changes can lead to reduced benefits, denial of the application, criminal prosecution, or disqualification from DHS-DFCS programs.

- For Medicaid applicants, questions related to next year's federal income tax return are necessary to determine eligibility and should be answered accurately.

Understanding and accurately completing form 508 ensures you receive the appropriate benefits while complying with state and federal regulations. Remember, assistance is available if you require help with this process or need communications support. Always review your application for accuracy before submission to avoid any potential delays or issues with your benefits.

Popular PDF Forms

Alford Plea Georgia - It provides a systematic approach for managing minor legal matters without necessitating the defendant's presence in the courtroom, promoting efficiency.

Georgia Separation Notice - Contributes to the integrity and professionalism of construction practices in Georgia through standardized project initiation documentation.