Free Ga St 3 Tax Template in PDF

The Ga St 3 Tax Form, formally known as the Sales and Use Tax Return, serves as a crucial document for businesses in Georgia, enabling them to report and remit sales and use taxes effectively. With an exclusive effective date for sales made during March 2017, and a submission deadline of April 20, 2017, this form addresses the specifics of sales sourced to various jurisdictions, including the City of Atlanta which necessitates additional data in Part B, Lines 3 through 5. Key aspects include the general instructions for accurately recording sales and exemptions, the intricate calculation of taxes due including TSPLOST (Transportation Special Purpose Local Option Sales Tax), and the provision for electronic filing through the Georgia Tax Center, enhancing efficiency and accessibility for taxpayers. Additionally, the form encompasses detailed sections for tax summary, sales tax distribution, and vendor’s compensation calculation, signifying its comprehensive nature. It also accounts for scenarios involving pre-paid local sales/use tax for on-road motor fuel, and distinct guidelines for reporting use tax - making it an essential tool for maintaining compliance with Georgia’s tax laws.

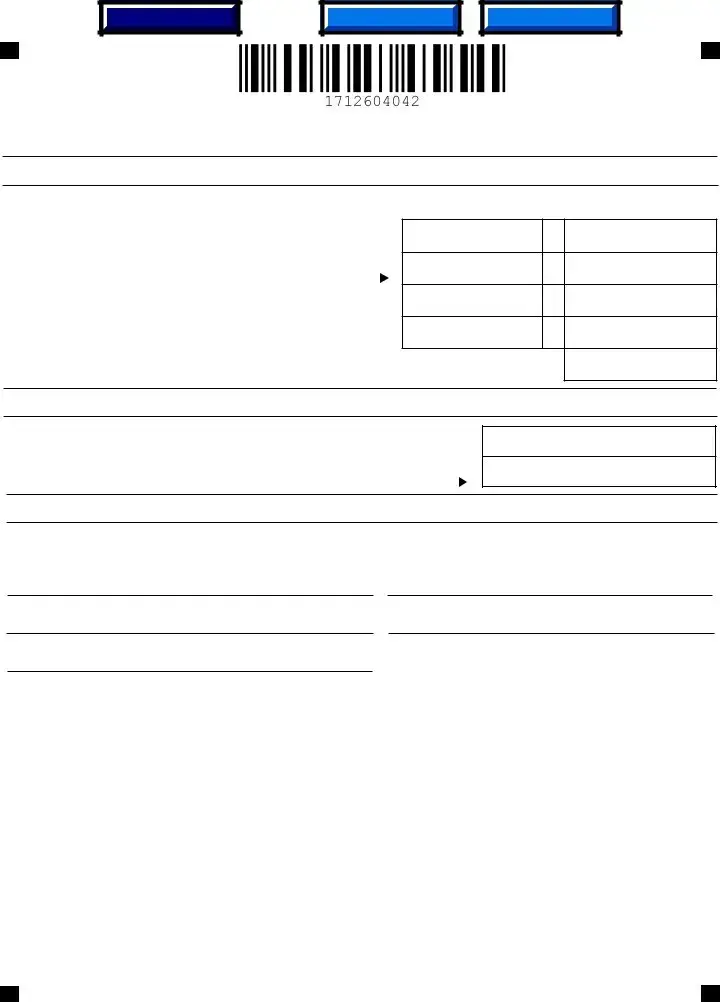

Form Sample

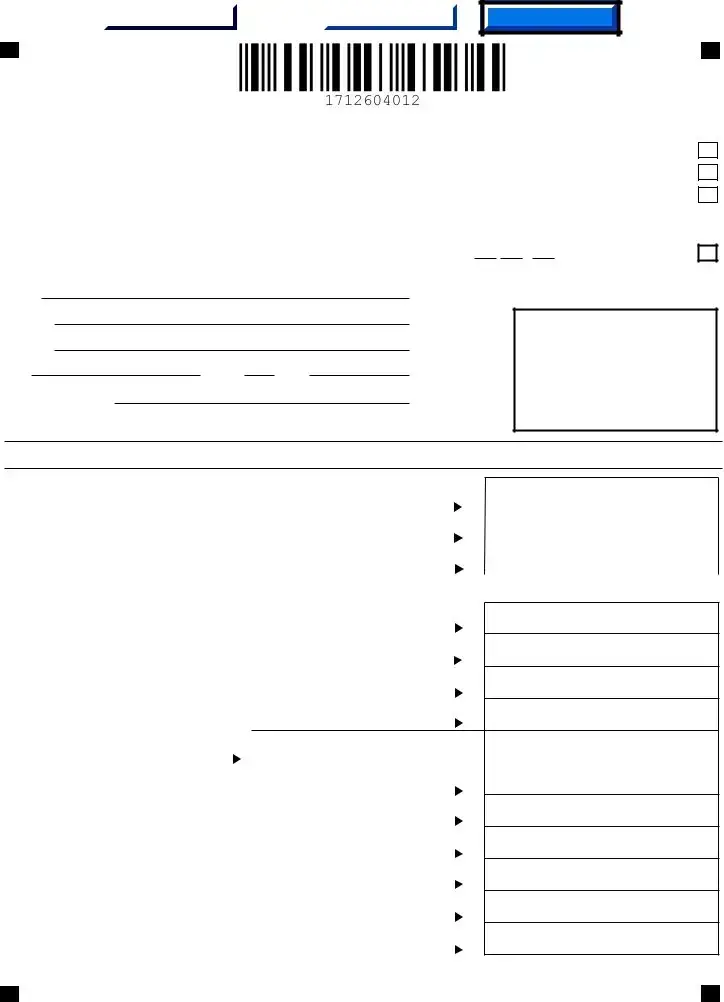

Sales and Use Tax Return

**ATTENTION**

Effective date: This Form

Sourcing: Generally, sales sourced to a jurisdiction include all sales of property in which the property is delivered to the purchaser in the jurisdiction and sales of services that are performed in the jurisdiction. Please refer to O.C.G.A. §

Electronic filing: To file and pay electronically, please visit the Georgia Tax Center at https://gtc.dor.ga.gov. Additional information, instructional videos, and frequently asked questions about electronic filing can be found at

General Instructions:

Record the Sales and Use Tax Number (STN), name, and address of the registered taxpayer. The Period Ending should be the end date (mm/dd/yy) of the reporting period. Check the Amended Return box if you are amending a previously filed return for the same period. Check the No Tax Due box if there were no taxable sales during this period. If there has been no sales and use tax activity during the period, do not complete this form. Please check the No Sales/Use Tax Activity box on Page 5, and complete and submit the payment voucher (Form

Part A - Tax Summary

LINE

1Record Total State Sales (all sales sourced to the State of Georgia) including leases and rentals.

2Record Total Exempt State Sales including leases and rentals. Include all sales that are exempt from state sales tax, even if such sales are subject to local sales tax.

3Subtract Exempt State Sales (Line 2) from Total State Sales (Line 1) and record Taxable State Sales. Complete Part B and Part C.

4Record the Total SALES Tax Amount (from Part B, Line 21).

5Record the Total USE Tax Amount (from Part B, Line 26).

6Record the TSPLOST tax (from Part C, Line 50).

7Record the

8Record Total Sales/Use Tax Collected for reporting period from taxpayer accounting records.

9Record the sum of Lines 4 – 7. (Add Line 4 + Line 5 + Line 6 + Line 7)

10Subtract Total Sales/Use Tax amount (Line 9) from Total Tax Collected (Line 8) amount and record the Excess Tax amount. Include the Excess tax amount in the appropriate sales/use category for vendor’s compensation.

11Record the Total Vendor’s Compensation (from Part D, Line 5).

12Record previous prepaid estimated tax, if applicable. Please reference your annual prepaid estimated tax letter.

13Record current prepaid estimated tax if applicable. Please reference your annual

Page 2

prepaid estimated tax letter.

14Add Lines 9 and 10, subtract Lines 11 and 12, and add Line 13 for the Total Amount Due.

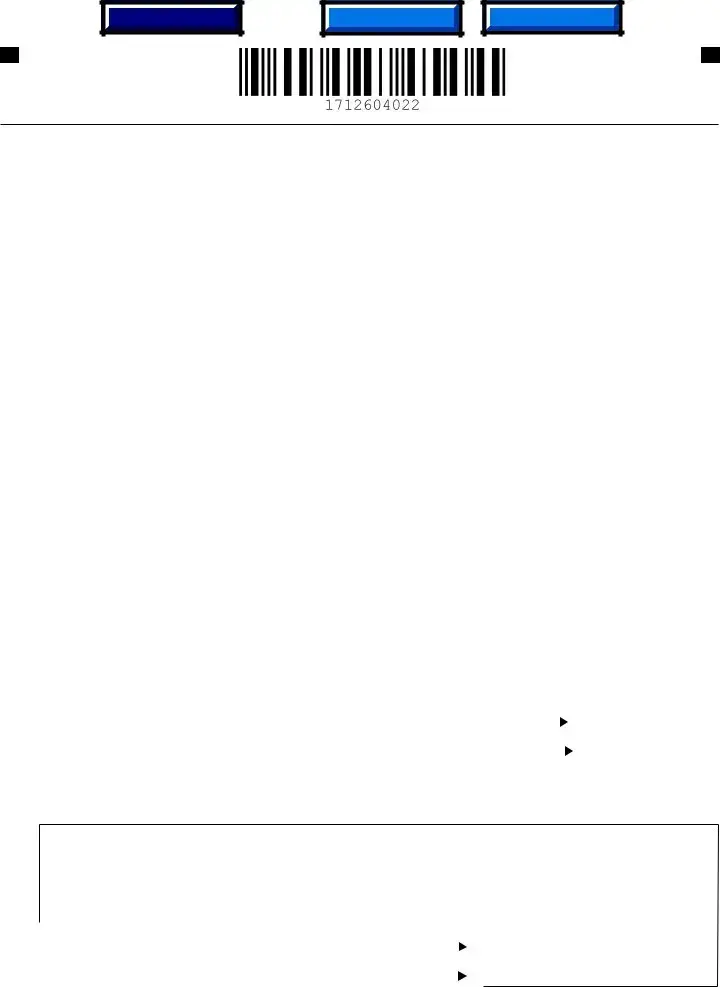

Part B - Sales Tax Distribution Table

Do not report Transportation Local Option (TSPLOST) sales and use tax in Part B. Transportation Local Option (TSPLOST) sales and use tax will be reported in Part C.

LINE

1Record the Taxable State Sales (total sales sourced to the State of Georgia LESS sales of energy to manufacturers and all other tax exempt sales). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount for the State.

2Record ONLY total sales sourced to the State of Georgia of energy sold to manufacturers. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

3Record taxable

4Record ONLY sales of motor vehicles subject to sales tax and sourced to the City of Atlanta. These sales are also required to be included in county sales below (044 Dekalb County and/or 060 Fulton County). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

5Record ONLY Taxable Sales of energy sold to manufacturers that are sourced to the City of Atlanta. These sales are also required to be included in county sales of energy to manufacturers below (044E Dekalb County and/or 060E Fulton County). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

6Record Taxable Sales for Clayton County (Total sales sourced to Clayton County LESS sales of jet fuel, sales of motor vehicles subject to sales tax, sales of energy to manufacturers, and all other tax exempt sales). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

7Record ONLY Taxable Sales of jet fuel sourced to Clayton County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record Sales Tax Amount.

8Record ONLY sales of motor vehicles subject to sales tax and sourced to Clayton County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record Sales Tax Amount.

9Record ONLY Taxable Sales of energy sold to manufacturers in Clayton County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

10Record Taxable Sales for Muscogee County (total sales sourced to Muscogee County LESS sales of motor vehicles subject to sales tax, sales of energy to manufacturers, and all other tax exempt sales). Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

Page 3

11Record ONLY sales of motor vehicles subject to sales tax and sourced to Muscogee County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record Sales Tax Amount.

12Record ONLY Taxable Sales of energy sold to manufacturers that are sourced to

Muscogee County. Multiply this amount by the rate indicated on the Part B Sales Tax Distribution Table and record the Sales Tax Amount.

Example: Taxpayer has $50,000 in total taxable sales for Cobb County which includes $10,000 in energy sold to a manufacturer. On Line 13 (or next available Line item in Part B or related addendum) list Cobb County (jurisdiction code 033), record $40,000 in total sales to Cobb County ($50,000 less $10,000 energy sales to a manufacturer), multiply this amount by the applicable tax rate for Cobb County and record the Sales Tax Amount. On Line 14 (or next available line) list Cobb County (jurisdiction code 033E), record total sales of energy to manufacturers of $10,000, multiply this amount by the applicable tax rate for Cobb County (for energy sold to manufacturers), and record the Sales Tax Amount.

Line |

Jurisdiction |

Jurisdiction |

Taxable |

Tax |

Sales Tax Amount |

|

|

Code |

Sales |

Rate |

|

13. |

Cobb |

033 |

40,000 |

2% |

800 |

|

|

|

|

|

|

14. |

Cobb |

033E |

10,000 |

1.00% |

100 |

|

|

|

|

|

|

Additional addendum pages (Form

20If additional addendum pages were completed, record the total Sales Tax Amount from all forms.

21Record the sum of Lines

Part B – Use Tax Distribution Table

LINE

Page 4

Code Reason

01Georgia Use – item purchased

02 |

Georgia Withdrawal from Inventory. |

03

04 |

Examples of taxable transactions, Jurisdiction of Use, and Reason Codes include:

A contractor purchases an item for $600.00 in a Georgia county where the total Sales Tax rate is 6% and uses the item to fulfill a contract in a jurisdiction where the total sales tax rate is 8%. The contractor owes additional Use Tax of 2% and should record local use tax due of $12.00 ($600.00 x .02). The Use tax Reason Code is 01.

A Georgia furniture manufacturer withdraws a table worth $700.00 from inventory to use in the business’s break room. The manufacturer owes state and local use tax based on the fair market value of the table, at the rate in effect in the jurisdiction where the withdrawal from inventory occurs. The manufacturer should calculate the use tax due by multiplying the combined state and local use tax rate by $700.00 and recording the resulting use tax. The use tax Reason Code is 02.

A Georgia resident or Georgia business purchases an item for $800.00 via the internet or by catalog, and the seller does not charge Sales Tax. The purchaser owes Use Tax based on the rate in effect in the jurisdiction where the purchaser takes possession of the item. The purchaser should calculate State Use Tax by multiplying the applicable State Use Tax rate by $800, and recording the resulting State Use Tax due with the use tax Reason Code 03. The purchaser should calculate the Local Use Tax due by multiplying the applicable Local Use Tax rate by $800.00 and recording the resulting Local Use Tax due with the Use Tax Reason Code 04.

A Georgia resident or Georgia business purchases a $900.00 item outside of Georgia, pays the other state’s 5% state sales tax at the time of purchase and returns to Georgia with the item. The purchaser will receive credit against Georgia’s 4% state use tax due and thus owes no additional state use tax. The purchaser owes local use tax at the rate in effect in the jurisdiction where the purchaser lives or where the business is located. The purchaser should calculate the local use tax due by multiplying the applicable local use tax rate by $900.00 and recording the resulting local use tax due. The Use tax Reason Code is 04.

Additional addendum pages, (Form

25Record the Addendum Page Total.

26Record the sum of Lines

Page 5

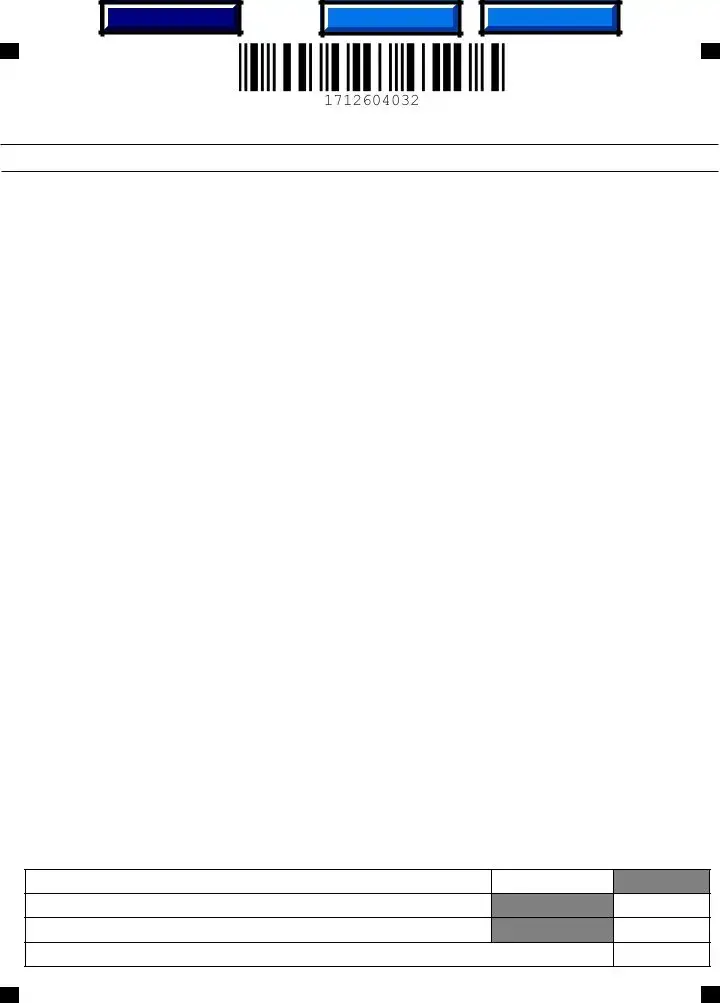

Part C – TSPLOST Sales & Use Tax

LINE

47

48

TSPLOST Sales and Use Tax – This section should ONLY be completed by individuals or businesses who have taxable sales sourced to or owe use tax to the jurisdictions listed in Part C (TSPLOST Sales & Use Tax).

Column A: TSPLOST Taxable Sales - Record Taxable Sales by county (Total County Sales LESS sales of energy to manufacturers and all other tax exempt sales).

Record the sum of taxable sales Lines

Column B: TSPLOST Use Tax - Record TSPLOST use tax amount due. Use tax is due if applicable TSPLOST Sales Tax was not paid on an item purchased or leased and that item has been placed into “use” within one of the listed jurisdictions.

49Record the sum of use tax Lines

50Record the sum of Lines 48 through 49 as total TSPLOST and record this amount on Part A, Line 6.

Part D – Vendor’s Compensation Calculation

LINE

1Record Total Sales and Use Tax on

.03) Vendor’s Compensation and record result.

2Record Total Sales and Use Tax on

3Record

4

5

Record State and Local Sales/Use Tax due on

Total above Vendor’s Compensation amounts for Total Vendor’s Compensation and record this amount on Part A, Line 11.

Part E – Bad Debt Reporting

LINE

1Record bad debt losses incurred on taxable Georgia sales.

2Record recoveries on Georgia bad debt that were previously written off.

Page 6

Part F – Certification and Signature

The return must be completed and signed in order to be considered timely filed.

Additional Instructions

Amended Returns

An amended return must be submitted on an

Master Accounts

Any dealer with four or more locations is required to report on a consolidated Sales and Use Tax form

Penalty and Interest on Delinquent Returns

Returns and payments are considered timely if postmarked by the due date of the return (the 20th day following the close of the reporting period). Taxpayers will be billed penalty and interest for all returns and payments filed after this date.

Penalty is calculated separately for the state and all local taxes in aggregate. A penalty of 5% (.05) of the tax due or five dollars ($5.00), whichever is greater, for the state and for the local taxes will be billed after the return is processed. This penalty will be billed for each month, or fraction of a month, when the return is delinquent. The penalty amount will be 25% (.25) or

For all periods beginning before July 1, 2016, interest is computed at 1% per month. For periods beginning on or after July 1, 2016, the annual interest rate will be the bank prime loan rate published on or after January 1 of each calendar year plus 3%. Interest will accrue on the tax amount owed from the date of the tax is due until the rate is paid.

Vendor’s Compensation is only given when both the payment and return are submitted timely. Taxpayers who are mandated to file electronically will not receive vendor’s compensation if a paper return and/or payment is submitted.

Mailing Instructions

Mail the return to the following address:

State of Georgia, Department of Revenue

PO BOX 105408

Atlanta, GA

Additional forms and information may be obtained from: Department of Revenue website/Forms, http://dor.georgia.gov

If you need additional assistance, please contact Taxpayer Service at

Print Blank Form |

|

|

|

|

|

|

|

|

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Sales & Use #

-

-

/

/

Name:

Address:

Address:

City:State: Zip:

County of Business:

Clear

Page 1

Check/Money Order

No Sales/Use Activity

No Tax Due

/ |

|

Amended Return |

DEPARTMENT USE ONLY

Part A Tax Summary

1. Total State Sales |

|

|

|

|

|

||

2. Total Exempt State Sales |

|

||

|

|||

3. Taxable State Sales |

|

|

|

4. |

Total Sales Tax (from Part B, Line 21) |

+ |

|

5. |

Total Use Tax (from Part B, Line 26) |

+ |

|

6. |

Total TSPLOST Tax (from Part C, Line 50) |

+ |

|

7. |

+ |

|

|

8. |

Total Tax Collected (from accounting records) |

|

|

|

|

||

9. |

Total Sales/Use Tax (Ln 4 + Ln 5+ Ln 6 + Ln 7) |

|

|

10. |

Excess Tax (Subtract Line 9 from Line 8) |

+ |

|

11. |

Total Vendor’s Compensation (from Part D, Line 5) |

- |

|

12. |

Previous Prepaid Amount |

- |

|

13. |

Current Prepaid Amount |

+ |

|

14. Total Amount Due..................................................................................................................................

Print Blank Form

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Clear

Page 2

|

Part B Sales Tax Distribution Table |

|

PERIOD ENDING |

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

JURISDICTION |

TAXABLE SALES |

|

TAX RATE |

SALES TAX AMOUNT |

|

|||||||||||||||

1. |

|

|

|

|

|

CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

State |

|

000 |

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

2. State (Energy to Manufacturers) |

|

|

000E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

||||||||

3. |

|

City of Atlanta |

|

999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1.5% |

|

|

|

|

|

|

|

|

|

|

|

||||||||

4. |

|

City of Atlanta (Motor Vehicle) |

|

|

999R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

0.5% |

|

|

|

|

|

|

|

|

|

|

|

||||||||

5. |

City of Atlanta (Energy to Manufacturers) |

|

999E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

6. |

Clayton |

031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

7. |

Clayton (Jet Fuel) |

|

|

031JF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8. |

Clayton (Motor Vehicle) |

|

|

031R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

9. |

Clayton (Energy to Manufacturers) |

|

|

031E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10. Muscogee |

|

106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

11. Muscogee (Motor Vehicle) |

|

|

106R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

12. Muscogee (Energy to Manufacturers) |

|

|

106E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. |

|

|

|

ADDENDUM PAGE TOTALS (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

21. |

|

|

|

|

TOTAL SALES TAX (Record on Part A, Line 4) |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part B Use Tax Distribution Table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

JURISDICTION OF |

JURISDICTION OF |

USE TAX |

|

|

|

|

STATE AND LOCAL |

|

|||||||||||||||

|

|

|

|

USE CODE |

REASON CODE |

|

|

|

|

USE TAX AMOUNT |

|

||||||||||||||||

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

23. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

25. |

|

|

|

ADDENDUM PAGE TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

26. |

|

TOTAL USE TAX (Record on Part A, Line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Blank Form

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Clear

Page 3

PART C TSPLOST Sales & Use Tax

|

Jurisdiction |

Code |

A. TSPLOST |

B. TSPLOST |

|

Name |

Taxable Sales Amt |

Use Tax Amt |

|

|

|

|

|

|

1 |

Appling |

001 |

|

|

|

|

|

|

|

2 |

Bleckley |

012 |

|

|

|

|

|

|

|

3 |

Burke |

017 |

|

|

|

|

|

|

|

4 |

Candler |

021 |

|

|

|

|

|

|

|

5 |

Chattahoochee |

026 |

|

|

|

|

|

|

|

6 |

Clay |

030 |

|

|

7 |

Columbia |

036 |

|

|

|

|

|

|

|

8 |

Crisp |

040 |

|

|

|

|

|

|

|

9 |

Dodge |

045 |

|

|

10 |

Dooly |

046 |

|

|

11 |

|

|

|

|

Emanuel |

053 |

|

|

|

12 |

|

|

|

|

Evans |

054 |

|

|

|

13 |

|

|

|

|

Glascock |

062 |

|

|

|

14 |

|

|

|

|

Hancock |

070 |

|

|

|

15 |

|

|

|

|

Harris |

072 |

|

|

|

16 |

|

|

|

|

Jeff Davis |

080 |

|

|

|

17 |

|

|

|

|

Jefferson |

081 |

|

|

|

18 |

|

|

|

|

Jenkins |

082 |

|

|

|

19 |

|

|

|

|

Johnson |

083 |

|

|

|

20 |

|

|

|

|

Laurens |

087 |

|

|

|

21 |

|

|

|

|

Lincoln |

090 |

|

|

|

|

|

|

|

|

22 |

Macon |

094 |

|

|

|

|

|

|

|

23 |

Marion |

096 |

|

|

|

|

|

|

|

|

Jurisdiction |

Code |

A. TSPLOST |

B. TSPLOST |

|

Name |

Taxable Sales Amt |

Use Tax Amt |

|

|

|

|||

|

|

|

|

|

24 |

McDuffie |

097 |

|

|

|

|

|

|

|

25 |

Montgomery |

103 |

|

|

|

|

|

|

|

26 |

Muscogee |

106 |

|

|

|

|

|

|

|

27 |

Quitman |

118 |

|

|

|

|

|

|

|

28 |

Randolph |

120 |

|

|

|

|

|

|

|

29 |

Richmond |

121 |

|

|

30 |

Schley |

123 |

|

|

|

|

|

|

|

31 |

Stewart |

128 |

|

|

|

|

|

|

|

32 |

Sumter |

129 |

|

|

33 |

Talbot |

130 |

|

|

|

|

|

|

|

34 |

Taliaferro |

131 |

|

|

|

|

|

|

|

35 |

Tattnall |

132 |

|

|

|

|

|

|

|

36 |

Taylor |

133 |

|

|

|

|

|

|

|

37 |

Telfair |

134 |

|

|

|

|

|

|

|

38 |

Toombs |

138 |

|

|

|

|

|

|

|

39 |

Treutlen |

140 |

|

|

|

|

|

|

|

40 |

Warren |

149 |

|

|

|

|

|

|

|

41 |

Washington |

150 |

|

|

|

|

|

|

|

42 |

Wayne |

151 |

|

|

|

|

|

|

|

43 |

Webster |

152 |

|

|

|

|

|

|

|

44 |

Wheeler |

153 |

|

|

|

|

|

|

|

45 |

Wilcox |

156 |

|

|

|

|

|

|

|

46 |

Wilkes |

157 |

|

|

|

|

|

|

|

TSPLOST Taxable Sales (Add Column A Lines 1 through 46)

48TSPLOST Sales Tax (Multiply Line 47 by 0.01)

49TSPLOST Use Tax (Add Column B Lines 1 through 46)

50Total TSPLOST Tax (Add Line 48 & Line 49, also enter on Part A Line 6)

Print Blank Form

Form

Georgia Department of Revenue

Sales and Use Tax Return

PO Box 105408

Atlanta, Georgia

Clear

Page 4

Part D Vendor’s Compensation Calculation

TAX AMOUNTS RATE VENDOR’S COMPENSATION

1. State and Local

2. State and Local

3.

4. State and Local

5. TOTAL VENDOR’S COMPENSATION(Record on Part A, Line 11)

3%

.5%

3%

3%

Part E Bad Debt Reporting

1. Bad Debt

2. Bad Debt Recovered ..........................................................................................................

Part F Certification and Signature

I certify that this return, including any accompanying schedules or statements, has been examined by me and is to the best of my knowledge and belief a true and complete return made in good faith for the period stated. This_____________ day of ___________________________, ________.

Return prepared by: |

Phone Number |

Title |

Email Address |

Signature

This return must be filed and paid by the 20th of the month following the period for which the tax is due in order to avoid loss of vendor’s compensation and the application of penalty and interest. Businesses must file a timely return for each period even though no tax is due. Do not remit cash in the mail.

File Overview

| Fact Name | Description |

|---|---|

| Form Introduction | This version of the Form ST-3, associated with March 2017 sales, was due by April 20, 2017. |

| Sourcing Rules | Sales are sourced to a jurisdiction if the property is delivered there or the service is performed there, as detailed in O.C.G.A. § 48-8-77. |

| Electronic Filing | Taxpayers are encouraged to file and pay electronically via the Georgia Tax Center at https://gtc.dor.ga.gov. |

| General Instructions | Information such as the Sales and Use Tax Number, business name, and address must be recorded. There's also provision for amending a previously filed return. |

| Tax Summary Section | Taxpayers must record total state sales, exempt state sales, taxable state sales, and various types of sales/use taxes collected, to calculate the total amount due. |

| Vendor’s Compensation Calculation | Allows for a deduction of 3% on sales/use tax of up to $3000, and 0.5% on amounts over $3000, including specifics for various fuel types. |

Guide to Using Ga St 3 Tax

Filing the Georgia Sales and Use Tax Return (Form ST-3) requires careful attention to detail and adherence to specific deadlines. The form is due by April 20, 2017, for sales made in March 2017. Taxpayers, particularly those with sales in the City of Atlanta, need to be mindful of the additional data entry requirements. Electronic filing is encouraged, with resources available at the Georgia Tax Center website. This guide simplifies the process, breaking down each part of the form into actionable steps, ensuring accurate completion and submission.

- Visit the Georgia Tax Center website at https://gtc.dor.ga.gov to access the electronic filing options. Watch instructional videos if needed.

- Enter your Sales and Use Tax Number (STN), name, and address in the designated fields.

- Indicate the reporting period's end date in the format mm/dd/yy in the "Period Ending" section.

- If you are amending a previously filed return for the same period, check the "Amended Return" box.

- Check the "No Tax Due" box if no taxable sales were made during the reporting period.

- For Part A - Tax Summary:

- Record Total State Sales (Line 1).

- Input Total Exempt State Sales (Line 2).

- Calculate Taxable State Sales by subtracting Line 2 from Line 1 (Line 3).

- In Part B - Sales Tax Distribution Table, consider the specific requirements for sales sourced to certain jurisdictions such as the City of Atlanta, Clayton County, and Muscogee County, and record the appropriate amounts on Lines 1 through 13-19 as applicable. Use the special jurisdiction codes for energy sales to manufacturers.

- For additional sales tax amounts, use Form ST-3 Addendum Sales to detail and then sum these on Line 21 (Part A, Line 4).

- Part B - Use Tax Distribution Table requires recording State and Local Use Tax Amount by jurisdiction code for different scenarios (Lines 22-24), including purchasing items out of state or withdrawing items for use from inventory. Use the provided Use Tax Reason Codes.

- Use Form ST-3 Addendum Use for additional use tax records and sum these on Line 26 (Part A, Line 5).

- In Part C – TSPLOST Sales & Use Tax, only complete this section if you have taxable sales or owe use tax to listed jurisdictions. Record taxable sales and TSPLOST use tax due, then sum these for the total TSPLOST (Line 50).

- For Part D – Vendor’s Compensation Calculation, calculate the compensation based on your total sales and use tax collected for non-motor fuel sales/use. Record these on Lines 1 and 2, based on the amount up to and exceeding $3000, and if applicable, record pre-paid local sales/use tax for on-road motor fuel (Line 3), and sales/use tax due on off-road motor fuel (Line 4).

- Part E – Bad Debt Reporting: Record any bad debt losses incurred on taxable Georgia sales (Line 1) and recoveries on previously written off Georgia bad debt (Line 2).

After completing all relevant sections of the ST-3 form based on your sales activities, review the form to ensure accuracy before submission. If filing electronically, follow the instructions on the Georgia Tax Center website to submit your form and payment, if due. If submitting by paper, make sure the form is signed and dated, then mail it to the address provided by the Georgia Department of Revenue. Keeping a copy of the completed form for your records is always a good practice.

Obtain Clarifications on Ga St 3 Tax

-

What is the GA ST-3 Tax Form?

The GA ST-3 Tax Form is a Sales and Use Tax Return used by businesses in Georgia to report and pay the sales and use taxes they have collected. It must be filled out by businesses that sell goods or services within the state.

-

When is the GA ST-3 Tax Form due?

For sales made during March 2017, the form was due by April 20, 2017. Generally, the due date falls on the 20th day of the month following the reporting period. It's important to check the specific due date for your reporting period.

-

Who needs to fill out Part B of the GA ST-3 Tax Form?

Part B must be filled out by taxpayers with sales sourced to the City of Atlanta. This section requires detailed information about sales in this jurisdiction.

-

Can the GA ST-3 Tax Form be filed electronically?

Yes, taxpayers are encouraged to file and pay electronically through the Georgia Tax Center website. This platform also offers instructional videos and FAQs to assist with the electronic filing process.

-

What is Sourcing, and how does it affect the GA ST-3 Tax Form?

Sourcing refers to the rules that determine the jurisdiction in which sales are considered to have taken place. Generally, for goods, it's where the item is delivered, and for services, it's where the service is performed. These rules affect how sales are reported on the form.

-

What happens if there are no taxable sales during the period?

If there were no taxable sales in the period, you should not complete the ST-3 form. Instead, check the "No Sales/Use Tax Activity" box on Page 5 and submit the payment voucher Form PV-ST Sales and Use Tax Voucher only.

-

How is the Total Sales Tax Amount calculated?

The Total Sales Tax Amount is calculated by adding the sales tax amounts from Part B, line 4; use tax from line 5; TSPLOST tax from line 6; and pre-paid local sales/use tax for on-road motor fuel from line 7. This total is reported on Part A, line 9.

-

What is TSPLOST, and how is it reported?

TSPLOST stands for Transportation Special Purpose Local Option Sales Tax. It is reported separately in Part C of the form. Taxable sales and use tax owed to jurisdictions collecting TSPLOST should be recorded in this section.

-

What are Use Tax Reason Codes, and when are they used?

Use Tax Reason Codes are used to specify the reason use tax is due on items purchased or leased where Georgia Sales Tax was not paid. They help identify the circumstances, like if an item was purchased tax-paid in Georgia but used in a county with a higher local tax rate.

-

How do you report and calculate Vendor’s Compensation on the GA ST-3 Tax Form?

Vendor’s Compensation is calculated in Part D of the form. It is a deduction allowed for collecting and remitting the tax. The first $3000 of total sales and use tax is multiplied by 3%, and any amount over $3000 is multiplied by .5%. This compensation is then recorded on Part A, line 11.

Common mistakes

Filling out tax forms can be tricky, and the Georgia State Sales and Use Tax Return (ST-3) is no exception. To stay on track, here are four common mistakes people often make:

Not updating information for the correct tax period. The form clearly states it's for sales made during a specific month and year. Ignoring this detail can lead to incorrect filings.

Missing exempt sales details. It’s crucial to include all sales that are exempt from state sales tax on Line 2, even if these sales might still be subject to local sales tax. This detail is crucial for accurately calculating taxable state sales.

Incorrectly calculating total sales/use tax. All the components, including the TSPLOST tax from Part C, pre-paid local sales/use tax for on-road motor fuel, and the sum of Lines 4 through 7, must be accurately added to avoid discrepancies in the total sales/use tax collected.

Failing to properly assign sales to the correct jurisdiction. This mistake can be particularly problematic in sections like Part B and Part C of the form where sales must be sourced correctly to the jurisdiction for both sales tax and TSPLOST purposes.

Avoiding these mistakes not only helps ensure compliance but also streamlines the process, minimizing the risk of errors and potential audits.

Documents used along the form

Completing and filing sales and use tax involves more than just filling out the Ga ST-3 Tax form. There are several accompanying documents and forms that businesses and individuals frequently use to accurately report and pay taxes. Understanding these documents can streamline tax preparation and ensure compliance with Georgia's tax laws.

- Payment Voucher (Form PV-ST Sales and Use Tax Voucher): Used alongside the ST-3 form when there are no taxable sales during the period but a payment is due. It helps in making payments accurately and is particularly useful for filing amended returns or making payments without submitting a full tax return.

- Form ST-3 Addendum Sales: This addendum allows for detailed reporting of sales tax distribution for multiple jurisdictions beyond what is available on the main ST-3 form. It's essential for businesses operating in or making sales to customers across different Georgia counties.

- Form ST-3 Addendum Use: Similar to the sales addendum, this form is used to report details of use tax distribution across various jurisdictions. It's required when goods or services purchased outside of Georgia are used within the state, and Georgia sales tax has not been paid at the time of purchase.

- Form ST-3 Motor Fuel: Specifically designed for reporting prepaid local sales and use tax for on-road motor fuel. This form is crucial for businesses dealing with fuel sales, ensuring proper tax collection and reporting for motor fuels.

- Off-Road Fuel Worksheet: While not directly filed with the tax return, this worksheet is essential for calculating state and local sales/use tax due on off-road motor fuels. It helps businesses in the fuel sector to correctly report and pay taxes on fuel not used on public highways.

- Annual Prepaid Estimated Tax Letter: This document provides information on the estimated tax payments for the upcoming year, based on the previous year's filings. It is vital for businesses to adjust their budget and tax payments to avoid underpayment or overpayment of sales and use taxes.

Each of these documents plays a unique role in the process of filing and paying sales and use taxes in Georgia. By understanding and properly utilizing these forms, businesses can ensure accurate reporting, comply with state tax regulations, and potentially avoid penalties for incorrect or incomplete tax submissions.

Similar forms

The Ga St 3 Tax Form, known as the Sales and Use Tax Return, has several aspects in common with other types of tax and financial reporting documents. Here's a rundown of six documents that share similarities with the Ga St 3 Tax Form and how they are alike:

- Form 1040 (U.S. Individual Income Tax Return): Similar to the Ga St 3, Form 1040 requires taxpayers to report income, calculate allowable deductions, and determine the amount of tax owed or refund due from the government. Both forms involve calculations based on financial activities, although the Ga St 3 focuses on sales and use tax, while Form 1040 centers on personal income tax.

- Schedule C (Profit or Loss from Business): This form, part of the 1040 filing, is for reporting income and expenses from a business operated or a profession practiced as a sole proprietor. Like the Ga St 3, Schedule C involves detailed record-keeping of financial transactions (sales and expenses) to calculate a net result (profit or tax due).

- Form 1120 (U.S. Corporation Income Tax Return): Similar to the Ga St 3 Tax Form's purpose of reporting sales and use tax for businesses, Form 1120 is used by corporations to report their income, gains, losses, deductions, and to calculate their federal corporate income tax liability.

- Form W-2 (Wage and Tax Statement): Although primarily used for reporting wages paid to employees and taxes withheld from them, the similarity to the Ga St 3 Form lies in its function as a mandatory reporting tool that entities must file with tax authorities. Both involve the reporting of specific financial amounts that affect tax calculations.

- Form 1099 (Miscellaneous Income): This form is used by businesses to report payments made to non-employees, such as independent contractors. Like the Ga St 3, it's part of the tax system's broader aim to ensure all applicable revenues are reported and taxed appropriately, covering different types of income and transactions.

- State Specific Sales Tax Forms: Many states have their own versions of sales and use tax returns that resemble the Ga St 3 Form, such as California's Sales and Use Tax Return. These forms share the common goal of calculating tax due on sales and services, with variations to accommodate specific state laws and rates.

Each of these documents, while unique in their specific focus and purpose, contributes to the comprehensive process of financial and tax reporting within the United States. The Ga St 3 Tax Form is an essential part of this array, focused specifically on reporting sales and use tax for businesses operating within Georgia.

Dos and Don'ts

When preparing the Georgia State Sales and Use Tax Return (ST-3) form, it is essential to be thorough and accurate to ensure compliance and avoid potential penalties. Below is a guide outlining what you should and shouldn't do during the process.

Do:

- Ensure you are using the correct form for the applicable period, as these forms are updated and specific to certain reporting periods.

- Visit the Georgia Tax Center website to file and pay electronically, which is recommended for ease and accuracy.

- Record your Sales and Use Tax Number (STN), name, and address accurately at the beginning of the form to confirm your business identity.

- Check the "Amended Return" box if you are correcting a previously filed return for the same period to avoid confusion with original submissions.

- If you had no taxable sales during the period, check the "No Tax Due" box to communicate this status to the Department of Revenue.

- Accurately calculate your total state sales and exempt state sales. This includes being precise in subtracting exempt sales from your total sales to report your taxable state sales correctly.

- Review the instructions for the Part B - Sales Tax Distribution Table and Part C - TSPLOST Sales & Use Tax sections carefully to report sales and use tax correctly.

- Include any applicable vendor’s compensation calculation if applicable to your filing situation.

- Report any bad debt losses incurred on taxable Georgia sales in the Part E – Bad Debt Reporting section.

- Sign and date your form, as an unsigned form may be considered invalid.

Don't:

- Attempt to file the ST-3 form for periods other than the one specifically indicated on the form, as each form is date-specific.

- Forget to account for sales sourced to the City of Atlanta in Part B, Lines 3 through 5, due to the specific requirements for these sales.

- Overlook the addition of any required addendum pages if you have more detailed sales tax information to report.

- Omit any sections of the form that apply to your business’s tax situation, including motor and non-motor fuel sales and use tax.

- Ignore the pre-paid local sales/use tax for on-road motor fuel if this is applicable to your filing situation, as this must be reported on Form ST-3 Motor Fuel.

- Leave the total amount due calculation blank or incorrect. Ensure Lines 9, 10, 11, 12, and 13 are accurately completed for the Total Amount Due.

- Fail to calculate vendor’s compensation correctly based on your total reported sales/use tax, if you are eligible for such compensation.

- Misreport or not report use tax due for items purchased or leased where Georgia sales tax was not paid and the items were used in Georgia.

- Ignore instructional resources and FAQs available at the Georgia Department of Revenue's website that can assist in correctly filing your return.

- Submit the form after the due date to avoid penalties and interest for late filing.

Misconceptions

One common misconception is that the GA ST-3 Tax Form is applicable for all sales within a fiscal year. In reality, the form is designated for sales made during specific reporting periods, such as March 2017, with its own due dates, exemplified by April 20, 2017.

Many believe electronic filing of the GA ST-3 is optional when, in fact, the Georgia Department of Revenue strongly encourages it and provides extensive resources and FAQs on their website to assist taxpayers with the electronic filing process.

Some taxpayers mistakenly think that if they have no taxable sales in a period, they don't need to file. However, the instructions specify that for periods with no sales and use tax activity, taxpayers should not complete the form but rather check the No Sales/Use Tax Activity box on Page 5 and submit the payment voucher.

A confusion exists around the requirement to report sales sourced to the City of Atlanta. Specific details must be entered on Part B, Lines 3 through 5, for taxpayers with sales in this jurisdiction, contrary to the general belief that all sales are reported uniformly.

Some assume that all exempt sales do not need to be detailed on the form. However, Total Exempt State Sales, including leases and rentals, must be recorded to subtract from Total State Sales to arrive at Taxable State Sales.

There is a misconception that TSPLOST tax applies to all transactions and should be reported in Part B. In reality, TSPLOST tax, found in Part C, applies only to specific transactions sourced to or used in jurisdictions with an activated Transportation Special Purpose Local Option Sales Tax.

A significant misunderstanding is related to Use Tax. Some believe it only applies if items are purchased outside Georgia. However, Use Tax can also apply to items purchased within Georgia but used in a different jurisdiction with a higher local tax rate, amongst other specific circumstances.

It's often misinterpreted that Vendor's Compensation is automatically calculated and applied. Merchants must calculate this themselves based on the total Sales and Use Tax collected and apply the correct percentage for compensation on non-motor fuel sales/use as detailed in Part D.

Another common mistake is overlooking the bad debt reporting section in Part E. Those who incur losses on taxable sales in Georgia can report bad debt losses and any recoveries on previously written-off debts, which can affect the total tax liability.

Lastly, there's a misunderstanding about the obligation to report motor fuel sales. Sellers must record pre-paid local sales/use tax for on-road motor fuel separately and calculate the vendor’s compensation for this, as outlined in Part D, while keeping separate records for off-road motor fuel.

Key takeaways

1. Understanding the Effective Date: It's crucial to note that the Form ST-3 is specific to the sales made during certain periods, such as March 2017, with a due date of April 20, 2017. Always check the form's effective date relevant to your sales period to ensure timely and accurate filing.

2. Electronic Filing: Georgia encourages taxpayers to file and pay electronically via the Georgia Tax Center website. This process is streamlined with additional resources, such as instructional videos and FAQs, to assist taxpayers in completing their e-filing accurately.

3. Sourcing Sales: For the purpose of the ST-3 Tax Form, sales are generally sourced to the jurisdiction where the property is delivered to the purchaser or the services are performed. Understanding how to source your sales correctly is essential for accurate tax reporting.

4. No Tax Due: If there were no taxable sales during the period, you're required to check the "No Tax Due" box. This indicates to the tax authorities that while a return is being filed, there's no tax amount due from sales or use tax during that period.

5. Tax Summary Section Part A: This section requires thorough attention to detail, as it involves recording total state sales, subtracting exempt sales, and calculating taxable state sales, including the total sales and use tax amount collected. Accuracy in this part is crucial for correct total tax liability calculation.

6. Sales and Use Tax Distribution Tables (Part B & C): It's important not to report Transportation Local Option (TSPLOST) sales and use tax in Part B; this is specially reported in Part C. Differentiating between the taxable sales and the specific jurisdictional reporting requirements is essential for compliance.

7. Vendor’s Compensation: Vendors can calculate their compensation based on the total sales and use tax collected. The form instructs on how to calculate compensation depending on whether total tax is up to and including $3,000 or over this amount. Including any pre-paid local sales/use tax for on-road motor fuel in these calculations is also necessary.

8. Bad Debt Reporting: Businesses have the facility to report bad debt losses incurred on taxable Georgia sales and recoveries on bad debts previously written off. This section allows businesses to adjust their tax liability based on their bad debt experience.

Overall, filling out the GA ST-3 requires knowledge of your sales activities, careful calculation, and attention to the specific instructions provided for each part of the form. By following these key takeaways, taxpayers can ensure their sales and use tax return is accurately completed and submitted on time.

Popular PDF Forms

Permit Application - Find detailed instructions and additional resources on the Georgia Department of Transportation's official website.

Georgia Department of Revenue - Submissions are due by the 15th day of the month following the reporting period to ensure timely compliance.

8662110950 - Georgia's application process for Medicaid and Medicare Savings is tailored to assist in significantly reducing healthcare costs.