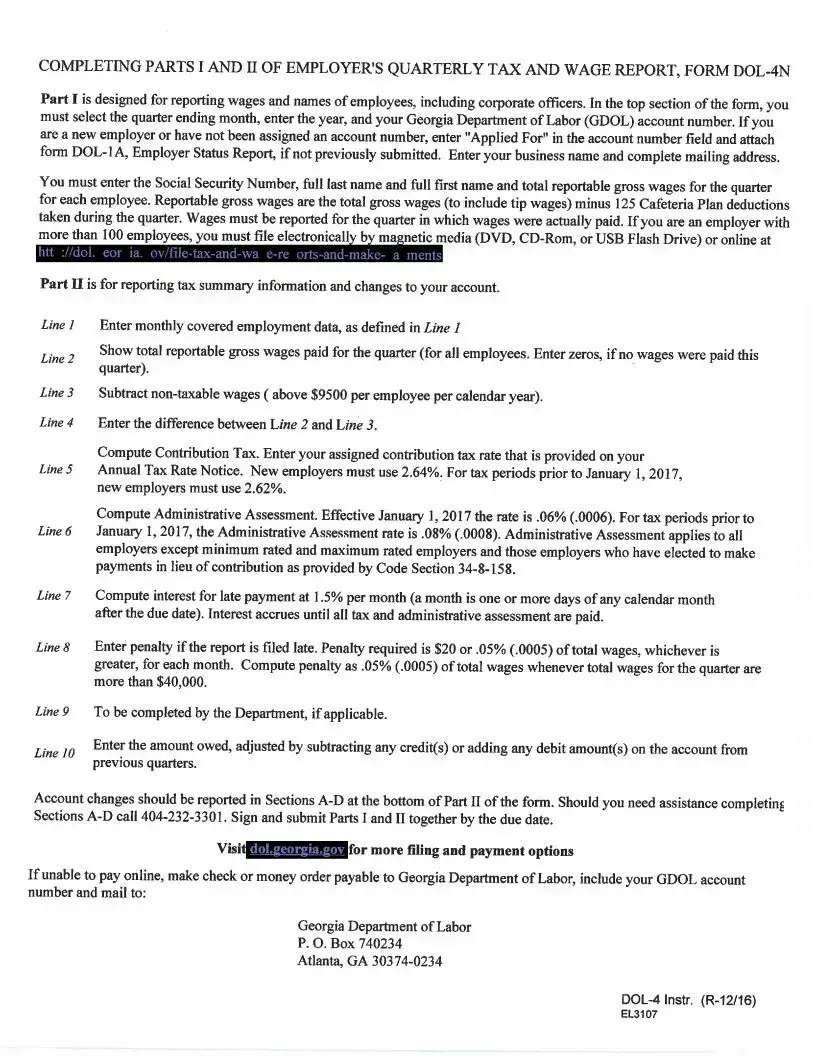

Free Ga Tax Wage Report Template in PDF

Filing taxes accurately and on time is a crucial responsibility for employers across the nation, including those in the state of Georgia. Among the myriad forms and documents that need attention is the Georgia Tax Wage Report Form, a vital tool for reporting wages and payroll taxes to the state's Department of Labor. This form not only ensures compliance with state tax laws but also plays a significant role in the administration of unemployment insurance benefits. It serves as a detailed record of each employee's earnings, facilitating accurate contribution calculations to the unemployment insurance fund. For employers, understanding how to properly complete and submit this form is essential for adhering to legal requirements and avoiding potential penalties. The Georgia Tax Wage Report Form embodies the intersection of tax compliance, employer accountability, and worker protection, making it a key piece of documentation in the broader landscape of employment and taxation.

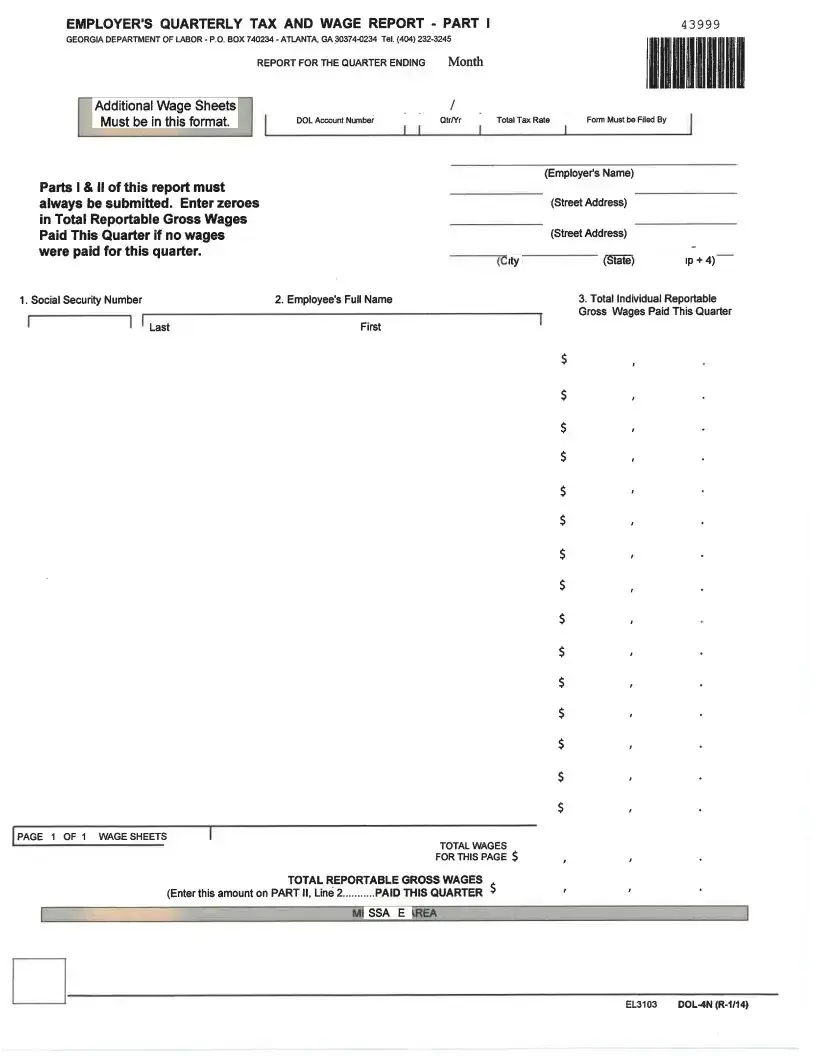

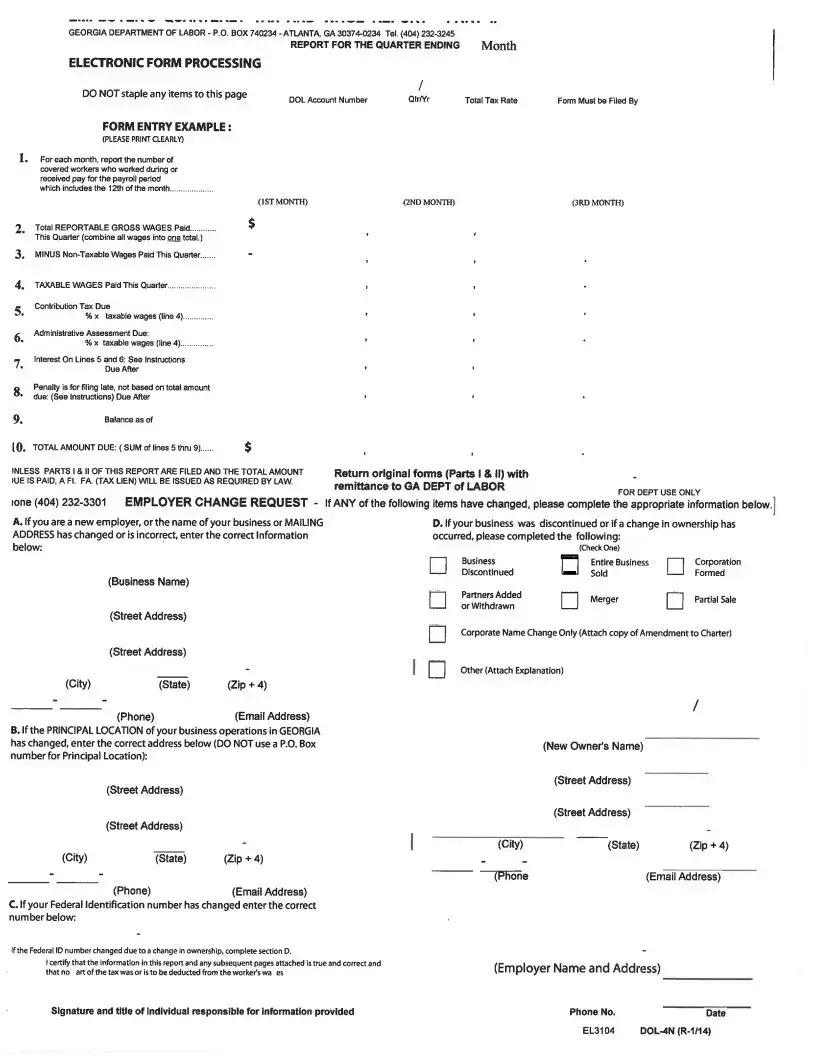

Form Sample

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The Georgia Tax Wage Report form is used by employers to report the wages paid to their employees, as well as the taxes withheld from those wages. |

| Applicable Law | This form is governed by the Georgia Employment Security Law and the regulations under the Georgia Department of Labor. |

| Filing Frequency | Employers are required to file this form quarterly. |

| Due Dates | The form is due by the last day of the month following the end of a quarter. For example, for the first quarter (January - March), the form is due by April 30th. |

| Electronic Filing | Employers are encouraged to file this form electronically through the Georgia Department of Labor's online system for faster processing. |

| Penalties for Late Filing | Failure to file on time or inaccurately reporting wages and taxes can result in penalties and interest charges. |

| Amendment Process | If an employer needs to amend a previously filed report, they can do so by using the same form and marking it as an amended report, providing updated information as necessary. |

Guide to Using Ga Tax Wage Report

Once a business has gathered all the necessary payroll information, the next vital step is filling out the Georgia Tax Wage Report form. This document is crucial for reporting employee wages to the state. Careful accuracy in filling out this form ensures compliance with state tax obligations and helps avoid potential penalties. Below is a simple guide to assist in this process, ensuring the form is completed correctly and efficiently.

- Start by providing the business name and address in the designated section at the top of the form. Make sure to use the official registered name and the address that matches the business registration.

- Enter the Employer Identification Number (EIN) or the State Employer Identification Number (SEIN) in the allocated space. This number is essential for identifying your business on the report.

- Fill in the quarter and year for which you are reporting in the fields marked for this purpose. This information determines the relevant period for the wages you are reporting.

- For each employee, list their full name and Social Security Number (SSN) in the specified columns. It's important to ensure the accuracy of this information to avoid any discrepancies.

- Enter the total wages paid to each employee during the reported quarter. Include all forms of compensation subject to state tax.

- If there are any adjustments to be made for previously reported wages, such as corrections or refunds, include these details in the section provided for adjustments.

- Calculate the total wages for all employees and enter this figure in the designated area at the bottom of the form. This total should include both the current quarter's wages and any adjustments.

- Sign and date the form at the bottom. The signature certifies that the information provided is accurate to the best of the signer's knowledge.

- Submit the completed form to the Georgia Department of Revenue by the due date. Late submissions may incur penalties, so it's important to ensure timely filing.

Filling out the Georgia Tax Wage Report form is a straightforward process, but attention to detail is critical. By following these steps, businesses can fulfill their reporting obligations efficiently, paving the way for a smoother operational flow.

Obtain Clarifications on Ga Tax Wage Report

-

What is the GA Tax Wage Report form and who is required to fill it out?

The GA Tax Wage Report form is a critical document for employers in the state of Georgia. It's designed for reporting wages paid to employees, along with the taxes withheld from these wages. All employers operating in Georgia are required to complete and submit this form, as it's a key component of state tax compliance. This ensures that accurate records are maintained for both state and federal tax purposes.

-

How often do I need to submit the GA Tax Wage Report form?

The frequency at which you must submit the GA Tax Wage Report form typically depends on the size of your business and the volume of your payroll. Generally, employers are required to file this form on a quarterly basis. Deadlines for these quarterly reports are April 30th, July 31st, October 31st, and January 31st for the first, second, third, and fourth quarters, respectively. It's important to adhere to these deadlines to avoid any penalties or fines for late submissions.

-

Can the GA Tax Wage Report form be submitted electronically, and if so, how?

Yes, the GA Tax Wage Report can be submitted electronically, which is actually the preferred method for many businesses. To submit electronically, employers must use the Georgia Department of Labor's online portal. This system streamlines the submission process, making it quicker and more efficient. Employers need to register for an account on the portal, after which they can upload their wage reports directly. This not only saves time but also helps ensure the accuracy of the record-keeping.

-

What information is needed to complete the GA Tax Wage Report form?

To properly complete the GA Tax Wage Report form, employers must have several pieces of information on hand. This includes the total number of employees, the total amount of wages paid during the reporting period, and the amount of Georgia state income tax withheld from these wages. Employers should also be prepared to provide their Employer Identification Number (EIN), as well as detailed employee information such as Social Security Numbers and total wages paid to each employee.

-

What should I do if I make a mistake on my GA Tax Wage Report form?

If you realize that a mistake has been made on your GA Tax Wage Report form, it's important to address it promptly. You should submit an amended report as soon as possible to correct any inaccuracies. This amended report can be filed electronically through the same Department of Labor portal used for the original submission. Correcting mistakes quickly can help avoid potential compliance issues and may help mitigate any penalties associated with the error.

Common mistakes

Filing the Georgia Tax Wage Report form correctly is essential for employers, as inaccuracies can lead to unnecessary delays, penalties, and headaches. While the process is straightforward, certain common mistakes often trip people up. Recognizing these errors can help ensure that your submissions are accurate and compliant.

- Not double-checking the Employer Identification Number (EIN): This number is crucial for your report to be processed correctly. A single digit off can redirect your submission to the wrong account or cause it to be rejected.

- Omitting employee Social Security Numbers: Every employee must have their Social Security Number accurately reported. An incorrect or missing number can cause issues for both the employer and the employee come tax time.

- Failing to report all wages: All wages paid to employees must be reported, including tips, commissions, and other forms of compensation. Overlooking any wage component can result in filing inaccuracies.

- Incorrect classification of workers: Misclassifying employees as independent contractors or vice versa affects tax obligations and can lead to significant penalties.

- Using incorrect tax rates: Tax rates can change, and using an outdated rate can cause discrepancies in your owed taxes.

- Not keeping up with updates to the form: The state may revise the form or its requirements. Using an old version of the form or not adhering to new guidelines can invalidate your submission.

- Leaving mandatory fields blank: Every required field must be completed. Missing information can lead to processing delays or even the rejection of your report.

- Mathematical errors: Simple mistakes in addition or subtraction can affect the total amount of taxes owed. These errors can be flagged and require correction, slowing down the process.

- Submitting the form late: Deadlines are crucial in tax matters. Late submissions can result in penalties and interest charges, increasing your tax burden.

To avoid these common pitfalls, employers should take their time when filling out the Georgia Tax Wage Report form. Reviewing the form for accuracy, confirming that all necessary updates have been incorporated, and adhering to all filing deadlines are critical steps in ensuring a smooth process. Remember, when in doubt, seeking advice from a tax professional can help navigate these complexities.

Documents used along the form

When handling the Georgia Tax Wage Report form, it's crucial to know which additional documents and forms might be necessary to ensure complete and accurate reporting. These documents support the main form in various ways, from providing detailed employee information to ensuring compliance with state tax laws.

- Form G-1003 - This is the Income Statement Transmittal used to summarize wages and tax information reported to the state. It helps in consolidating data from multiple W-2s or 1099s.

- Form DOL-4N - This form is the Employer’s Quarterly Tax and Wage Report. It complements the Georgia Tax Wage Report by detailing the wages paid and taxes withheld for each quarter.

- Form W-3 - The Transmittal of Wage and Tax Statements is a federal form that accompanies Form W-2. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees to the Social Security Administration.

- Form 1096 - This is another federal form, serving as the Annual Summary and Transmittal of U.S. Information Returns. It's used when filing 1099 forms, summarizing information returns being sent to the IRS.

- Form UC-2A - The Employer’s Quarterly Report of Wages Paid to Each Employee details individual employee wage information for the quarter. It’s necessary for unemployment insurance purposes and complements the Ga Tax Wage Report by offering a detailed breakdown of wages.

Together with the Georgia Tax Wage Report form, these documents ensure businesses adhere to tax reporting requirements thoroughly and accurately. By maintaining a complete set of these forms, employers can manage their reporting duties more effectively and stay in good standing with both state and federal tax authorities.

Similar forms

Federal Unemployment Tax Act (FUTA) Tax Return: Similar to the Ga Tax Wage Report form, this document is used to report annual wages paid to employees and calculate the federal unemployment tax that employers must pay to the IRS. Both forms are crucial for compliance with federal and state unemployment tax laws.

State Unemployment Insurance (SUI) Reports: These are similar because they require the employer to report wages paid to employees within the state. Like the Ga Tax Wage Report form, they are used to determine the employer's state unemployment insurance tax liability.

W-2 Wage and Tax Statement: This form shares similarities as it involves reporting wages paid to employees. However, the W-2 is provided to employees and the IRS to report annual income and taxes withheld, showcasing its role in both employee income reporting and tax compliance.

Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return: The Form 940 is closely related to the Ga Tax Wage Report form in its purpose of reporting annual wages and calculating unemployment tax. Although the Form 940 is for federal purposes, both documents are essential for unemployment tax compliance.

Quarterly Federal Tax Return (Form 941): This document is akin to the Ga Tax Wage Report form as it requires the reporting of wages, tips, and other compensation paid to employees. It is used to determine the employer's federal tax liability for employee income taxes, Social Security, and Medicare taxes on a quarterly basis.

Employment Eligibility Verification (Form I-9): While the Form I-9 does not deal directly with tax or wage reporting, it is similar in its requirement for employers to verify an employee's eligibility to work in the United States. This connection underscores the broad responsibilities of employers in managing workforce compliance.

New Hire Reporting Forms: These forms, required by state agencies, require employers to report newly hired or rehired employees. Like the Ga Tax Wage Report form, they play a significant role in the state’s ability to enforce child support obligations and to quickly locate and withhold income from non-custodial parents if necessary.

Payroll Tax Forms: Many payroll tax forms, specific to each state, resemble the Ga Tax Wage Report form in their function of reporting employee wages and calculating taxes owed by the employer. These documents ensure that employers are contributing the correct amounts to state tax agencies and are compliant with local tax legislation.

Dos and Don'ts

When filling out the Georgia Tax Wage Report form, it's important to ensure accuracy and compliance with the state's requirements. Below are crucial dos and don'ts to guide you through the process:

- Do double-check the employer identification number (EIN) to ensure it matches the records with the Georgia Department of Labor. This is crucial for proper identification and processing.

- Do report wages for each employee accurately. This includes all compensation subject to state unemployment insurance.

- Do use the correct format if submitting electronically. Adhering to the prescribed format facilitates smoother processing and prevents delays.

- Do include the quarter and year for which you are reporting. This information is essential for timely and accurate accounting of contributions.

- Do ensure the form is signed by an authorized representative. An unsigned form may be considered invalid and can lead to processing delays.

- Don't forget to report all employees, including part-time, temporary, and seasonal workers. All worker wages must be accounted for.

- Don't leave any required fields blank. Incomplete forms can result in processing delays or requests for additional information.

- Don't submit the form without reviewing it for errors. Mistakes can lead to discrepancies and potential audits.

- Don't ignore deadlines for submission. Late reporting can result in penalties and interest charges.

Adhering to these guidelines will help ensure that the Georgia Tax Wage Report form is completed correctly and submitted on time, thereby avoiding unnecessary penalties and ensuring compliance with state regulations.

Misconceptions

Many businesses, both large and small, grapple with understanding the complexities of the Ga Tax Wage Report form. Misconceptions about this essential document can lead to errors that may impact a company's compliance with Georgia's tax laws. It's crucial to dispel these myths to ensure accurate and timely submissions.

Filing is Optional: A common misconception is that filing the Ga Tax Wage Report is optional, especially for small businesses. However, any business operating in Georgia with employees is required to submit this form each quarter, without exception.

Electronic Submission is Not Allowed: Some employers assume that the state of Georgia only accepts paper submissions of the Tax Wage Report. On the contrary, Georgia encourages electronic filing and, in some cases, mandates it for businesses of a certain size or those using third-party payroll services.

Only Full-Time Employees Need to Be Reported: Another misunderstanding is that part-time or temporary employees do not need to be included in the report. In fact, employers must report all employees who have earned wages during the reporting period, regardless of their employment status.

Information on the Form is Solely for State Tax Purposes: While it's true that the Ga Tax Wage Report is vital for state tax calculations, the information is also used to determine eligibility for unemployment insurance benefits for former employees. The dual purpose of this form extends its significance beyond tax liability alone.

Penalties for Late Filing are Rare: Believing that penalties for late submissions are rare or non-existent can be a costly mistake. Georgia imposes penalties for late or incorrect filings, and these can accumulate over time, significantly increasing the overall financial burden on the business.

All Errors are Corrected by the State: Assuming that any mistakes made on the form will be automatically corrected by state employees is incorrect. While the state may catch and adjust certain errors, it's the employer's responsibility to ensure the accuracy of the information submitted. Errors can lead to penalties or incorrect unemployment insurance premium assessments.

Data from Previous Quarters is Automatically Included: Each quarterly submission must stand alone in terms of its accuracy and completeness; the state does not carry forward data from one quarter to the next. Employers need to provide detailed wage data for each employee for every quarter.

Wage Report is Independent of Federal Tax Filings: Some employers believe that their responsibilities end with federal tax filings and overlook the separate requirements for state wage reporting. The Ga Tax Wage Report is a state-specific obligation that exists alongside federal tax reporting requirements.

Submission Deadlines are the Same Each Year: Although submission deadlines generally follow a quarterly pattern, specific due dates may change due to weekends or holidays. It's essential for employers to verify the current year's deadlines to avoid unintentional late submissions.

Dispelling these misconceptions is crucial in maintaining compliance with Georgia's tax laws and avoiding unnecessary penalties. Employers should ensure they are well-informed and up to date with the state's requirements to submit accurate and timely Ga Tax Wage Reports.

Key takeaways

Filing the Ga Tax Wage Report form is an essential task for businesses operating in Georgia. It's designed to report the wages paid to employees and the amount of state income tax withheld from those wages. Here's a list of key takeaways to guide you through filling out and using this form effectively:

- Accuracy is key: Ensure all information is accurate to avoid any discrepancies. Incorrect information can lead to penalties or additional scrutiny from the state tax authority.

- Deadlines matter: Submitting the form on time is crucial. Late submissions could result in fines. It’s always a good idea to check the latest deadline dates as they can change.

- Understand the requirements: Familiarize yourself with what information is required on the form, such as employer details, employee earnings, and the amount of state tax withheld.

- Use the correct form version: Always use the most current version of the Ga Tax Wage Report form. The state may update the form periodically to capture additional information or reflect changes in legislation.

- Employee identification is critical: Each employee must be clearly identified by their full name and Social Security Number (SSN) to ensure accurate record-keeping.

- Double-check your math: Verify all calculations for total wages paid and taxes withheld to prevent errors. Mistakes can complicate the reconciliation process.

- Know when to file: The Ga Tax Wage Report form is typically filed quarterly. However, check if your business meets any criteria that might require a different filing frequency.

- Electronic filing is an option: Consider filing the form electronically for efficiency and security. Electronic submissions are processed faster and can be more easily tracked.

- Maintain records: Keep copies of the filed reports and any related documentation for at least four years. These records may be necessary for future verifications or audits.

- Seek assistance if needed: Don't hesitate to ask for help from a tax professional if you encounter any difficulties. Getting it right the first time can save a lot of trouble and expense down the line.

Following these guidelines will help ensure that the process of filling out and submitting the Ga Tax Wage Report form is as smooth and error-free as possible. Doing so not only keeps your business in compliance but also contributes to the accurate and fair administration of the state's tax system.

Popular PDF Forms

Ganewhire - Employers contribute to the effectiveness of government programs by reporting new hires as required.

Notice Appeal Georgia - A helpful guide designed to demystify the appellate process for Georgia residents, with a focus on facilitating self-representation in appeals.