Free Ga Wc 6 Template in PDF

In the realm of workers' compensation in Georgia, the WC-6 Wage Statement stands as a key document, ensuring that employees who have suffered workplace injuries are fairly compensated. This comprehensive form, mandated by the Georgia State Board of Workers' Compensation, encompasses a plethora of vital sections aimed at capturing all necessary data to accurately compute an injured worker's average weekly wage. From the basic Identifying Information, which includes the employee and employer details, to the intricacies of computing wages over a 13-week period, every aspect is vital for an accurate assessment. It even accommodates for scenarios where an employee hasn't been with the employer long enough, by comparing wages with a similar employee's earnings. With its detailed schedule of weekly earnings including overtime, tips, and other compensations, the form attempts to ensure a fair evaluation of earnings for the computation of benefits. Coupled with strict warnings against falsification and clear instructions for completion, this document plays a crucial role in the workers' compensation claim process, signaling the state's commitment to protecting workers while providing clear guidelines for employers and insurers.

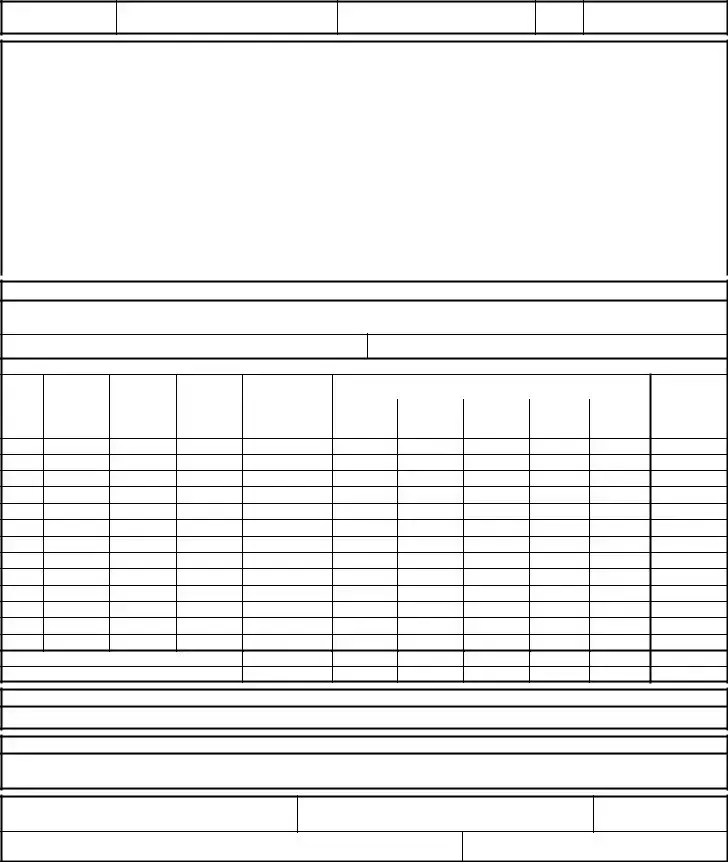

Form Sample

GEORGIA STATE BOARD OF WORKERS' COMPENSATION

WAGE STATEMENT

Board Claim No.

Employee Last Name

Employee First Name

M.I.

Date of Injury

A. IDENTIFYING INFORMATION

EMPLOYEE |

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

EMPLOYER |

Name |

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

INSURER/ |

|

Name |

|

|

|

|

|

|

|

|

|

||

CLAIMS OFFICE |

|

Name |

Mailing Address |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

SBWC ID # |

|

City |

State |

Zip Code |

||

|

|

|

|

|

|

|

B. COMPUTATION OF AVERAGE WEEKLY WAGE

If the weekly benefit is less than the maximum, complete the schedule below for thirteen (13) weeks immediately preceding the accident. If the employee has not been in your employ for the thirteen (13) weeks, complete this schedule showing gross weekly earnings of a similar employee in the same employment. If either of the foregoing methods cannot be reasonably and fairly applied, the full time weekly wage of the injured employee should be used.

13 Weeks of Employee’s Wages 13 Weeks of a Similar Employee’s Wages |

Full Time Weekly Wage of Injured Employee: $__________________ |

SCHEDULE OF WEEKLY EARNINGS

|

From |

To |

No. of |

Gross |

|

Value of Additional Compensation |

|

|

||

|

Amount Paid |

|

|

|

|

|

Total |

|||

Week |

Date |

Date |

Days |

Including |

|

|

|

|

|

|

|

|

|

|

|

Earnings |

|||||

|

MM/DD/YYYY |

MM/DD/YYYY |

Worked |

Overtime or |

Meals |

Lodging |

Rent |

Tips |

Other |

|

|

|

|||||||||

|

|

|

|

Extra Work |

|

|

|

|

|

|

1

2

3

4

5

6

7

8

9

10

11

12

13

Total

Average Weekly Earnings

C. SCHEDULED DAYS OFF

REQUIRED TO COMPLETE: Mon Tue Wed Thur Fri Sat Sun No Off Days

REMARKS:

Type or Print Name

D. REMARKS

Signature |

Date |

Phone Number

IF YOU HAVE QUESTIONS PLEASE CONTACT THE STATE BOARD OF WORKERS’ COMPENSATION AT

WILLFULLY MAKING A FALSE STATEMENT FOR THE PURPOSE OF OBTAINING OR DENYING BENEFITS IS A CRIME SUBJECT TO PENALTIES OF UP TO $10,000.00 PER VIOLATION (O.C.G.A.

REVISION 12/2018 |

6 |

WAGE STATEMENT |

File Overview

| Fact Name | Detail |

|---|---|

| Form Identifier | WC-6 Wage Statement |

| Governing Body | Georgia State Board of Workers' Compensation |

| Purpose | To compute the average weekly wage for workers' compensation benefits |

| Computation Period | 13 weeks immediately preceding the accident |

| Alternative Computation | If the employee has not been employed for 13 weeks, wages of a similar employee are used |

| Penalty for False Statement | Fines up to $10,000.00 per violation as per O.C.G.A. §34-9-18 and §34-9-19 |

| Contact Information | State Board of Workers' Compensation Phone: 404-656-3818 or 1-800-533-0682, Website: http://www.sbwc.georgia.gov |

Guide to Using Ga Wc 6

After a workplace injury, ensuring that you properly fill out the Ga WC-6 Wage Statement is a crucial step in the process of claiming workers’ compensation benefits. This form helps to document your earnings prior to the injury to accurately calculate the benefits you're entitled to. The following steps will guide you in completing the Ga WC-6 form accurately.

- Start with Section A, which gathers Identifying Information. Here, you’ll need to fill out the Board Claim No., your last name, first name, middle initial (M.I.), Social Security Number (SSN) or Board Tracking #, and the date of your injury.

- Input the county where the injury occurred, followed by your complete address, including city, state, and zip code.

- Add your email address in the designated space.

- For the employer section, write the name and address of your employer, including city, state, and zip code. Also, include the employer's email address.

- In the insurer/self-insurer section, enter the name, the SBWC ID# (a five-digit number), and the claims office address. Also, provide the e-mail address, insurer/self-insurer file#, city, state, and zip code.

- Move to Section B, Computation of Average Weekly Wage. This part requires information on wages for the thirteen (13) weeks immediately preceding the accident. If you haven't been employed for thirteen weeks, details for a similar employee should be used instead.

- Fill in the weekly earnings schedule, starting with week 1. Note the from and to dates for each week.

- Record the number of days worked, gross weekly earnings, including overtime, and the value of any additional compensation like meals or lodging.

- Complete this for all 13 weeks, and calculate the total earnings and average weekly earnings.

- In Section C, Remarks, provide any additional information that might be relevant to the calculation of your average weekly earnings.

- This could include details of any unusual payment circumstances or periods of unpaid leave.

- The form must be completed with the required contact information: type or print your name, email address, and sign and date the form. Include your phone number as well.

- Before submitting, recheck the form to ensure all entries are accurate and complete. Mistakes or omissions could delay processing.

- Finally, submit the completed form to the designated authority, as instructed by your employer or the State Board of Workers' Compensation. Keep a copy for your records.

Accurately completing and submitting the WC-6 form is a vital step in securing your workers' compensation benefits. This process will help determine your eligible compensation based on your average weekly wage prior to your injury. Should you have any questions or require assistance, contacting the State Board of Workers' Compensation directly is recommended.

Obtain Clarifications on Ga Wc 6

Frequently Asked Questions about the GA WC-6 Form

What is the GA WC-6 Form?

The GA WC-6 Form, known as the Wage Statement, is a document required by the Georgia State Board of Workers' Compensation. It is used to report the wages of an employee who has suffered a workplace injury. The information provided on this form is critical for calculating the average weekly wage of the injured employee, which determines the compensation benefits.

When do I need to complete the GA WC-6 Form?

This form should be completed when an employee has been injured at work and is claiming workers' compensation benefits. Specifically, it needs to be filled out if the weekly benefit is less than the maximum allowed. It provides a detailed record of the employee's earnings 13 weeks immediately preceding the accident.

What information do I need to complete the form?

To fill out the GA WC-6 Form accurately, you'll require several pieces of information including the employee's identifying information, the employer's details, and the insurer or self-insurer's information. Importantly, a detailed schedule of the employee's weekly earnings for the 13 weeks before the injury needs to be provided, including any additional compensation such as overtime, tips, or the value of meals and lodging.

How do I calculate the average weekly wage using the GA WC-6 Form?

To calculate the average weekly wage, you must list the employee's gross earnings for the 13 weeks preceding the injury. This includes all forms of compensation. If the employee hasn't been employed for 13 weeks, you'll need to use the earnings of a similar employee in the same role. The total earnings are then divided by 13 to get the average weekly wage, which is used in determining compensation benefits.

Where can I find the GA WC-6 Form?

The GA WC-6 Form is available on the Georgia State Board of Workers' Compensation website. You can download the form by visiting their official site and searching for the WC-6 Wage Statement under their forms section.

What are the penalties for not accurately completing the GA WC-6 Form?

It is crucial that the information provided on the GA WC-6 Form is accurate and truthful. Willfully making a false statement for the purpose of obtaining or denying benefits is considered a crime and is subject to penalties of up to $10,000 per violation. Therefore, ensuring the correctness of the filled-out form is of utmost importance to avoid legal repercussions.

Common mistakes

Filling out the GA WC-6 Wage Statement form accurately is crucial for ensuring that employees who get injured at work are adequately compensated. However, individuals often make mistakes during this process. Being aware of these common errors can help in avoiding them:

Incorrectly calculating the average weekly wage: It's essential to accurately add up the gross weekly earnings for the thirteen weeks preceding the accident. Remember to include all additional compensation like overtime, tips, and the value of meals or lodging if provided.

Not using a similar employee's wages when necessary: If the injured employee hasn't been employed for the entire thirteen weeks before the injury, you must compute the average weekly wage based on a similar employee in the same employment.

Failing to fully complete all sections: Each section of the form, including all identifying information and the schedule of weekly earnings, needs to be filled out comprehensively.

Omitting the employer and insurer information: The form requires detailed information about the employer and the insurance company or self-insurer. Leaving this field blank can lead to processing delays.

Leaving out the employee's details: Accurately provide the employee's name, Social Security Number or Board Tracking Number, and the precise date and county of injury.

Misunderstanding the type of compensation to include: It's crucial to correctly determine what constitutes gross earnings. This includes regular pay, overtime, and any additional compensation such as bonuses or benefits.

Not signing the form: A common, yet critical, oversight is the failure to sign the form. A signature, along with the date and required contact information, authenticates the document.

Ignoring the requirement for typewritten or printed names alongside signatures: For the sake of clarity and legibility, names should be typed or printed in addition to the required signature.

Mistakes in completing the GA WC-6 form can delay the processing of workers’ compensation claims or potentially lead to incorrect compensation being awarded. To ensure a smooth and accurate process, carefully review each section before submission to the State Board of Workers' Compensation.

Documents used along the form

When navigating the complexities of workers' compensation in Georgia, understanding the paperwork involved is crucial for employees, employers, insurers, and legal professionals. The WC-6 Wage Statement form plays a pivotal role in calculating an injured employee's compensation by detailing their earnings prior to the accident. However, it's not the only document critical to the workers' compensation process. Several other forms and documents are commonly used in conjunction to ensure all aspects of the claim are comprehensively addressed.

- WC-1 Form - Employer's First Report of Injury or Occupational Disease: This form is the initial report filed by the employer to notify the State Board of Workers' Compensation about an employee's injury or occupational disease. It kickstarts the claims process.

- WC-2 Form - Notice of Payment or Suspension of Benefits: Employers or insurers use this form to notify the SBWC when benefits are started, changed, or stopped, providing details on the type and duration of the benefits.

- WC-3 Form - Notice to Controvert: When an employer or insurer denies a claim or specific benefits, this form is used to officially dispute the claim, outlining the reasons for the denial.

- WC-14 Form - Notice of Claim/Request for Hearing/Request for Mediation: Employees, employers, or insurers can file this form to officially register a claim with the SBWC, request a hearing before an Administrative Law Judge, or seek mediation for dispute resolution.

- WC-104 Form - Notice to Employee of Medical Release to Return to Work with Restrictions or Limitations: This form communicates to the employee that after receiving medical treatment, they are cleared to return to work, albeit with specific restrictions or limitations as noted by a healthcare provider.

- WC-108 Form - Employer/Insurer's Request for WCMSA (Workers' Compensation Medicare Set-Aside) Review: This specific form is used to request a review of a Medicare Set-Aside proposal related to a workers' compensation claim, ensuring future medical expenses covered under Medicare are appropriately considered.

- WC-240 Form - Notice to Employee of Offer of Suitable Employment: Employers use this form to officially offer an injured employee a new or modified position that suits their medical restrictions post-injury, outlining job duties and compensation details.

Navigating the landscape of workers' compensation claims requires a clear understanding of these forms and their purposes within the claims process. Each plays a unique role in ensuring that employees receive the benefits they are entitled to while allowing employers and insurers to comply with state regulations. As daunting as the paperwork might seem, a meticulous approach to filling out and submitting these documents can make a substantial difference in the outcome of a workers' compensation claim.

Similar forms

The Georgia State Board of Workers' Compensation WC-6 Wage Statement form is an essential document for determining an employee's average weekly earnings following an injury at work. Similar documents often serve parallel functions in diverse legal or administrative contexts, facilitating accurate compensation or benefits calculation. The documents listed below share some commonalities with the WC-6 form in terms of their purpose, structure, or the information they seek to gather.

- IRS Form W-2, Wage and Tax Statement: Like the WC-6, the W-2 form collects information on an employee's earnings and the taxes withheld by the employer. Both are critical for verifying an individual's income, albeit for different purposes: the WC-6 for workers' compensation benefits and the W-2 for tax obligations.

- Unemployment Compensation Form: Similar to the WC-6, forms related to unemployment compensation require details about an employee's work history and earnings. These forms help in calculating the unemployment benefits an individual is entitled to based on their previous income.

- SSA-3380-BK, Function Report - Adult: While the SSA-3380-BK form is used by the Social Security Administration to assess an individual’s disability and functioning, it shares the goal of the WC-6 in understanding the impact of an individual's condition on their ability to work and merit specific benefits.

- VA Form 21-526EZ, Application for Disability Compensation and Related Compensation Benefits: This form, used by veterans to claim disability benefits, requires detailed information about employment and how a service-connected disability affects employment. Both this form and the WC-6 involve the assessment of work-related capacity influenced by physical conditions.

- FLSA Overtime Claim Form: Although specifically related to claims for unpaid overtime, this form, like the WC-6, gathers detailed information about hours worked and wages. It also aligns with WC-6 in ensuring employees receive fair compensation, in this case, for overtime hours as opposed to compensation for workplace injuries.

- Long-Term Disability (LTD) Insurance Claim Forms: LTD insurance claim forms require detailed employment and wage information to determine benefit amounts. Both these forms and the WC-6 focus on the financial impact of not being able to work due to injury or illness.

- Payroll Records Request Form: Similar to the WC-6’s requirement for a detailed work and wage history, payroll records request forms are used by various entities to verify an employee’s earnings and employment duration. This verification process is crucial for both administrative purposes and legal proceedings.

- Personal Injury Claim Form: In the realm of personal injury law, claim forms require detailed information on the circumstances of the injury, similarly to the WC-6, but with a broader scope. Both seek to establish the financial ramifications of an injury, although personal injury forms are used in civil litigation outside of the workers' compensation system.

Each of these documents, though tailored to their specific contexts, shares the underlying purpose of documenting an individual's work history or income to assess eligibility and calculate benefits or compensation. The WC-6 form is part of this broader administrative landscape, ensuring that workers receive fair compensation for injuries sustained on the job.

Dos and Don'ts

When filling out the GA WC-6 Wage Statement for Georgia State Board of Workers' Compensation, it's important to follow specific guidelines to ensure the accuracy and integrity of the information provided. Here are six dos and don'ts to consider:

- Do verify the employee's information, including the last name, first name, middle initial, Social Security Number or Board Tracking Number, and the date of injury, is accurately entered in Section A.

- Do accurately fill in the employer and insurer/self-insurer information, ensuring that the name, address, email address, city, state, zip code, and the SBWC ID# are correctly provided.

- Do complete the computation of the average weekly wage thoroughly. If the employee worked for 13 weeks preceding the accident, include their gross weekly earnings. If they haven't been employed for 13 weeks, provide details of a similar employee's wages.

- Don't guess or estimate numbers. When completing the schedule of weekly earnings, use precise figures for gross earnings, value of additional compensation like overtime or meals, and the total amount paid.

- Don't leave sections incomplete. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it blank to indicate that the question was not overlooked.

- Don't sign the form without reviewing all the information for accuracy. Remember, willfully making a false statement for the purpose of obtaining or denying benefits is subject to severe penalties.

It's crucial to complete the WC-6 Wage Statement with attention to detail and uphold the standards set by the Georgia State Board of Workers' Compensation. If there are any questions or if clarification is needed, contacting the Board is recommended to avoid any potential issues. Remember, accurate completion of this form not only helps in the efficient processing of claims but also ensures compliance with state laws.

Misconceptions

When addressing the Georgia State Board of Workers' Compensation WC-6 form, commonly known as the Wage Statement, there are several misconceptions that can lead to confusion. It is crucial to understand the form accurately to ensure that all parties involved are well-informed and compliant with state regulations.

Only applicable for long-term employees: A common misconception is that the WC-6 form is only for employees who have been with a company for a significant amount of time. In reality, the form must be filled out for any employee, regardless of how long they have been employed, if they have suffered a work-related injury. For new employees without 13 weeks of employment history, wages of a similar employee must be used for calculations.

Includes only base pay: Another misunderstanding is that the WC-6 form calculations should only consider the employee's base pay. However, the form explicitly requires that gross weekly earnings include overtime, meals, lodging, rent, tips, and other compensations beyond the base salary.

Optional submission: Some believe that submitting the WC-6 form is optional. This is incorrect. The completion and submission of this form are mandatory following a workplace injury, as it plays a critical role in determining the employee's entitlement to benefits.

For insurer's use only: It's often thought that only insurers need to be concerned with the WC-6 form. While insurers do use the form, employers also need to fill it out and understand its components since it involves the calculation of average weekly wages that affects compensation rates.

Static form without updates: Another false belief is that once the WC-6 form is filled out, it does not require updating. The truth is, if new information becomes available or if there are changes in the employee's earning capacity or employment status, updates to the form may be necessary.

No legal implications for inaccuracies: Lastly, some may think that inaccuracies or falsehoods on the WC-6 form carry no serious consequences. This is not the case, as willfully making a false statement for the purpose of obtaining or denying benefits is a crime, with penalties of up to $10,000.00 per violation.

Understanding these aspects of the WC-6 Wage Statement ensures that employees receive the correct workers' compensation benefits, and both employers and insurers comply with Georgia's legal requirements.

Key takeaways

Understanding how to properly complete the GA WC-6 form is crucial for both employers and employees in the event of a workplace injury. Here are eight key takeaways to help guide you through this process:

- Identifying Information is Critical: The form requires detailed identifying information from both the employee and employer. This includes names, addresses, the county of injury, and both parties’ email addresses. This information ensures that the communication and documents reach the right parties.

- The Importance of Accurate Wage Reporting: The form entails a computation of the employee's average weekly wage based on the 13 weeks immediately preceding the accident. Providing accurate wage information is essential for calculating correct benefits.

- If the employee has been with the employer for less than 13 weeks, it’s necessary to reference the wages of a similar employee in the same employment situation to determine the injured employee's benefits.

- The form requires detailed information about weekly earnings, including gross wages, additional compensation (like overtime or tips), and the value of non-monetary compensation such as lodging or meals.

- Average Weekly Earnings are calculated based on the total amount paid over the 13-week period, divided by 13 to establish a fair compensation rate for the worker.

- Signatures and Dates: The form must be completed with a signature, printed name, date, and contact number of the person filling it out. These elements are necessary to verify the accuracy and submission of the form.

- Contact Information for Assistance is Provided: The form mentions contact details for the State Board of Workers' Compensation for anyone with questions or in need of further guidance, highlighting the resources available for support.

- Legal Obligations and Penalties: The document clearly states that willfully making a false statement for the purpose of obtaining or denying benefits is a criminal offense, punishable by substantial fines. This underscores the importance of accuracy and honesty in the completion of the form.

Filling out the GA WC-6 form correctly is not just a bureaucratic necessity; it's a vital step in ensuring that injured employees receive the benefits they are entitled to in a timely and fair manner. Employers must take care to complete the form accurately, reflecting the true earnings and employment circumstances of the injured worker.

Popular PDF Forms

Are Divorce Records Public Georgia - Addresses financial matters such as income deduction orders, health insurance, and other healthcare expenses for children.

Georgia Workers' Compensation Forms - The built-in certificate of service aids in compliance with notification requirements, keeping the administrative process orderly.

Who Is the Defendant in Court - An officially prescribed form that guides plaintiffs through the process of making a legal claim in Fulton County’s Magistrate Court.