Free Georgia 231 Template in PDF

Navigating the intricacies of legal documentation can sometimes feel overwhelming, particularly when it comes to forms that are pivotal for specific processes. Among these, the Georgia 231 form plays a crucial role for individuals and businesses in the state of Georgia. This document is integral in a variety of situations, often associated with tax related procedures, property transactions, or legal proceedings within the state. Its purpose varies widely, from facilitating the filing of taxes to serving as a necessary step in acquiring or transferring property, making it a versatile instrument in the legal toolkit of residents and professionals alike. The importance of accurately completing and submitting this form cannot be understated, as it directly impacts compliance with state regulations and the timely progress of the processes it supports. Understanding the major aspects of the Georgia 231 form, including its applications, requirements for submission, and the potential consequences of errors, is essential for anyone looking to navigate these procedures smoothly.

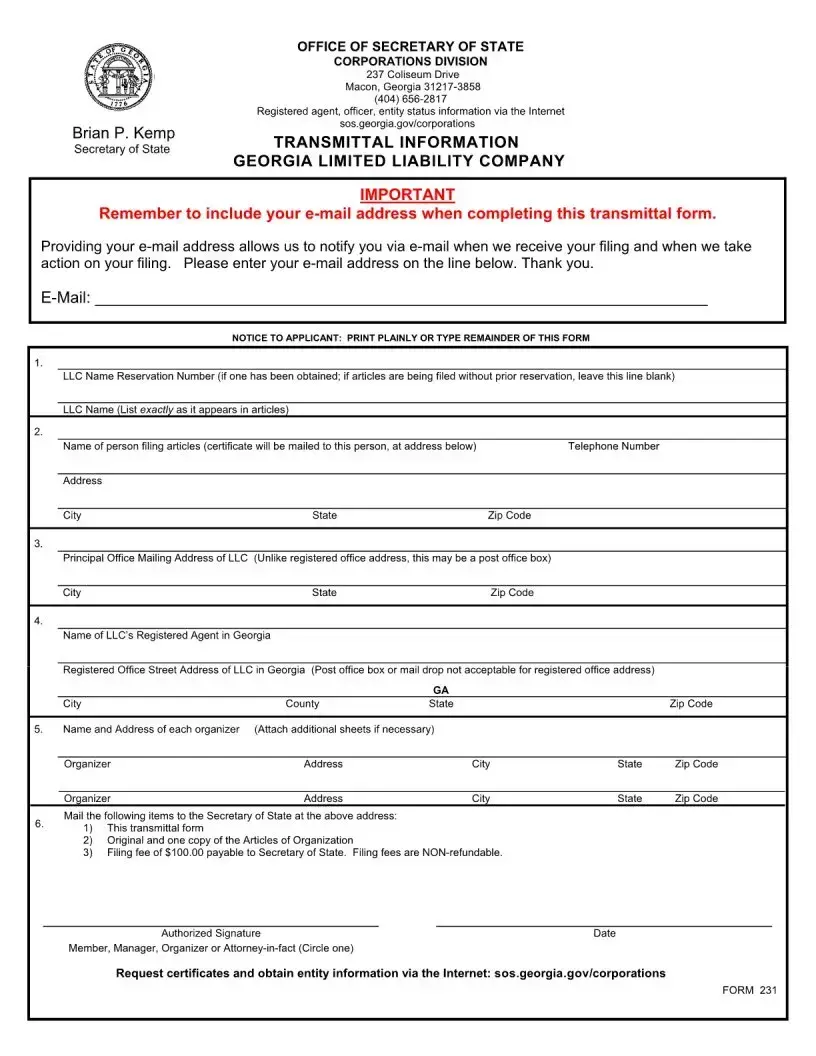

Form Sample

File Overview

| Fact | Details |

|---|---|

| Form Name | Georgia Form 231 |

| Form Purpose | To request a Certificate of Existence/Authorization for a business entity |

| Applicable To | Businesses registered in the state of Georgia |

| Governing Law | Georgia Business Corporation Code |

| Where to File | Georgia Secretary of State's Office |

| Available Formats | Online and PDF |

| Processing Time | Typically processed within 5-7 business days |

Guide to Using Georgia 231

Filling out forms can often seem like a tedious task, especially when you're unsure of the purpose behind the paperwork. However, understanding each step can streamline the process, making it less daunting. The Georgia 231 form is no exception. Designed for a specific function within the state's regulatory framework, it's crucial for individuals to fill it out accurately to ensure compliance and expedite the process they are involved in. The following steps aim to simplify the completion of the form, ensuring that every section is addressed properly and efficiently.

- Start by entering your personal information in the designated section. This includes your full name, address, and contact details. Make sure that this information is current and matches your legal documents.

- Move on to the section that requires detailed information about your specific situation. Depending on the purpose of the form, you might need to provide context or explain certain circumstances. Be as precise and concise as possible.

- Check if there’s a section dedicated to declarations or consent. If so, read it carefully to understand what you’re agreeing to. It’s essential to comprehend these statements before signing.

- Look for any parts of the form that require financial information, if applicable. This could include income details, property ownership, or other financial assets. Fill in these fields accurately to avoid any misrepresentation.

- If the form asks for attachments or additional documentation, ensure you have these documents at hand. Scan or photocopy them as instructed, making sure they are clear and legible.

- Before you finalize the form, review every section and answer. Double-check for typos, inaccuracies, or omitted information. Completing the form correctly the first time can prevent delays.

- Sign and date the form in the designated area. Your signature is a crucial part of the form, as it validates the information you've provided. Ensure that the date is correct and matches the day you're submitting the form.

- Lastly, follow the submission instructions specific to the Georgia 231 form. This might involve mailing it to a specific address, submitting it in person, or filing it online, depending on the requirements.

After you've completed and submitted the Georgia 231 form, the relevant department within the state of Georgia will process your paperwork. Processing times can vary, so it’s important to submit your form with ample time to spare, especially if it's related to time-sensitive matters. Following the submission, you may be contacted for additional information or to clarify any details you've provided. Being responsive and cooperative can further expedite the process. Remember, the accuracy and completeness of your form are vital to a smooth and efficient handling of your request or requirement.

Obtain Clarifications on Georgia 231

What is the Georgia 231 form?

The Georgia 231 form is a document required by the state of Georgia for certain legal or administrative processes. Its specific use can vary, depending on the context in which it's required, serving various purposes in different departments or legal proceedings.

Who needs to fill out the Georgia 231 form?

Typically, individuals or entities engaged in activities regulated by a specific Georgia state department or those involved in legal cases might need to complete this form. The precise requirements depend on the form's current use, which is outlined by the specific department or court issuing or requesting the form.

Where can I find the Georgia 231 form?

The form is available through the official website of the Georgia state department that requires it, or it can be obtained directly at their office. If it's for a legal proceeding, the clerk's office at the court might also provide you with the necessary form.

Is there a fee to submit the Georgia 231 form?

Fees associated with the submission of the Georgia 231 form vary. Some scenarios might require a fee, especially if the form is part of a larger application or filing process. Always check with the specific department or authority to understand any fees that may apply.

What information is required on the Georgia 231 form?

The information needed on the Georgia 231 form can significantly vary. Commonly, it requires detailed personal information, case specifics, or descriptive details about the situation or entity it concerns. Always thoroughly read the form instructions to ensure accurate completion.

How do I submit the Georgia 231 form?

The submission process for the Georgia 231 form depends on the department or legal body handling the form. It might be submitted in person, by mail, or electronically. Check the specific submission guidelines provided with the form or on the issuing authority's website.

Can I fill out the Georgia 231 form online?

Some forms can be filled out and submitted online, depending on the department's capabilities and the form's purpose. Verify on the official website or contact the issuing department to see if an online submission option is available for the Georgia 231 form.

What happens after I submit the form?

After submission, the form will be reviewed by the appropriate department or authority. The next steps may involve additional requests for information, a determination based on the form's contents, or another form of resolution. You should receive communication regarding the status or outcome.

Can I get help filling out the Georgia 231 form?

Assistance with completing the form is usually available. You can seek help from the department that issued the form or consult a legal professional. Some departments might offer guides or FAQs on their website as well.

What if I make a mistake on the form?

Making a mistake on the form is not uncommon. If you realize an error after submission, contact the issuing department or authority as soon as possible. They can advise on the best course of action, which may involve submitting an amended form or providing additional documentation.

Common mistakes

Not verifying personal information: Accuracy is crucial when inputting your name, address, and other personal information. Mistakes here can lead to processing delays or even the rejection of your form.

Skipping sections: Every section of the Georgia 231 form serves a purpose. Skipping any part, thinking it's not applicable or irrelevant, might result in an incomplete application, delaying the process.

Incorrect dates: Dates are often formatted differently around the world. On the Georgia 231 form, ensure you follow the American standard (month/day/year) to prevent any confusion or processing delays.

Misunderstanding the questions: Some questions on the form may seem straightforward but read each query carefully. Misinterpreting a question can lead to incorrect answers, affecting the outcome of your submission.

Failing to double-check for typos or inaccuracies: Before submitting the form, review it thoroughly. Typos or inaccuracies, especially in critical sections like social security numbers or contact information, can lead to significant delays.

Omitting required signatures: The Georgia 231 form, like many official documents, requires a signature to validate the information. Forgetting to sign the form renders it incomplete.

Using incorrect or outdated forms: Make sure you're filling out the most recent version of the Georgia 231 form. Using an outdated form can result in your application being deemed invalid.

Here are a few tips for avoiding these common mistakes:

Take your time to read through each section carefully before writing anything.

Have all the necessary information and documents next to you for easy reference while filling out the form.

If you're unsure about a question, seek clarification before answering to avoid making assumptions that could lead to errors.

Use a pen with black ink and write legibly to ensure all information is readable.

After completing the form, review it with a trusted friend or family member to catch any potential errors you might have overlooked.

Completing the Georgia 231 form with attention to detail can significantly impact the efficiency of your application process, leading to a smoother interaction with official procedures and requirements.

Documents used along the form

When preparing or updating legal documents, numerous forms may need to be considered to ensure comprehensive coverage of all necessary legal bases. In the context of Georgia legal documentation, the Georgia Form 231 is often accompanied by various other forms and documents that serve specific purposes in legal, tax, and estate planning. Below is a list of up to 10 other forms and documents frequently utilized alongside the Georgia Form 231, along with brief descriptions of each to help individuals understand their function and importance.

- Georgia Form 500: This is the Individual Income Tax Return form. It is used by residents to file their state income tax returns with the Georgia Department of Revenue.

- Power of Attorney (POA): A legal document that allows an individual (the principal) to appoint another person (the agent) to make decisions on their behalf, including financial, legal, and health-related decisions.

- Advanced Healthcare Directive: This document outlines an individual’s preferences regarding medical treatment and care in cases where they are unable to communicate their wishes due to incapacitation.

- Last Will and Testament: A legal document that expresses an individual’s wishes regarding the distribution of their property and the care of any dependents after their death.

- Georgia Form G-4: The Employee's Withholding Allowance Certificate, used by employees to determine the amount of state income tax to be withheld from their paychecks.

- Revocable Living Trust: A legal document that allows an individual to specify how their assets should be handled and distributed during their lifetime and after death, while allowing changes to be made to the trust as needed.

- Georgia Form PT-61: The Real Estate Transfer Tax Declaration Form, required for documenting the transfer of property ownership and calculating any applicable transfer tax.

- Probate Court Forms: A series of forms used in the probate process for administering an estate, including filing petitions and inventories of assets.

- Guardianship Forms: Legal documents required for establishing guardianship over another person, often used in cases involving minors or adults unable to make decisions for themselves.

- Articles of Incorporation: Documents filed with the state to legally establish a corporation, outlining the structure, purpose, and regulations governing the corporation’s operation.

In the landscape of legal documentation within Georgia, compiling the correct assortment of forms and documents pertinent to an individual’s specific situation is critical for ensuring legal compliance and protecting the rights and intentions of all parties involved. The forms and documents listed provide a foundational guide to some of the most commonly required or associated legal materials but should be tailored to fit precise legal needs and contexts.

Similar forms

The California Declaration for Mental Health Treatment forms are similar to the Georgia 231 form in that they both allow individuals to make decisions about their mental health treatment in advance. These documents outline preferences for treatment should individuals be unable to make decisions for themselves in the future.

The Florida Designation of Health Care Surrogate form likewise parallels the Georgia 231 form by letting a person appoint someone else (a surrogate) to make health care decisions on their behalf if they become unable to do so. This includes decisions on a wide range of medical treatments and services.

Similar to the Georgia 231, the New York Health Care Proxy form gives individuals the chance to appoint a health care agent. This agent is responsible for making health care decisions on the person's behalf under certain conditions, particularly when the individual cannot make these decisions themselves.

The Texas Directive to Physicians and Family or Surrogates is akin to the Georgia 231 form in providing directives concerning medical treatments at the end of life. It allows an individual to state their wishes regarding the use of life-sustaining treatments.

The Illinois Power of Attorney for Health Care shares similarities with the Georgia 231 form by enabling a person to designate an agent who will have the authority to make all types of health care decisions in the event that the principal is unable to do so.

New Jersey Instruction Directive (Living Will) is analogous to the Georgia 231 form. It permits individuals to document their health care wishes, including decisions about life-sustaining treatment, in the event they are unable to communicate these desires themselves.

Washington Health Care Directive is like the Georgia 231 form in that it allows people to express their wishes regarding medical treatment and end-of-life care through a legal document, thereby guiding future health care decisions if they become incapable of making decisions.

The Oregon Advance Directive is similar to the Georgia 231 form as it combines elements of a living will and health care power of attorney, letting individuals set forth their health care preferences and appoint a health care representative.

Pennsylvania Living Will closely resembles the Georgia 231 form by enabling people to declare their wishes concerning medical treatment, particularly about life-sustaining measures, when they are no longer able to make those decisions independently.

Dos and Don'ts

The Georgia 231 form is the cornerstone for documenting a specific process, and its correct completion is paramount. Ensuring the accuracy and completeness of this form is not merely about adhering to administrative protocols; it is about maintaining the integrity of the process it supports. The following advice is culled from meticulous review and understanding of the procedural requirements inherent to this form.

Here are some guidelines to follow when filling out the Georgia 231 form:

- Do review the form in its entirety before beginning to fill it out. Understanding the scope of information required will help in collecting all the necessary data beforehand.

- Do ensure that all written entries are legible. Clear handwriting or typed information prevents misunderstandings and processing delays.

- Do use black ink or type directly onto the form if electronic completion is an option. This improves readability and ensures that the document can be copied without issue.

- Do double-check for any errors or omissions. Once submitted, correcting mistakes can be a cumbersome process.

- Do contact the appropriate authority if you have questions. It's better to seek clarification than to submit incorrect information.

Conversely, there are actions and omissions that one should avoid:

- Don't leave any required fields blank. If a section does not apply, the standard practice is to denote this with “N/A” (not applicable).

- Don't surpass the deadline for submission. Late submissions can lead to penalties, or at the very least, delay the process the form intends to facilitate.

- Don't use correction fluid or tape. Mistakes should be neatly crossed out, and the correct information should be added nearby. If necessary, start with a fresh form to ensure clarity.

- Don't submit the form without retaining a copy for your records. Having a personal copy is essential for future reference or in case of disputes.

In essence, the conscientious completion of the Georgia 231 form requires attention to detail, understanding the importance of each question, and adhering to the specified guidelines. Taking these steps ensures that the individual respects the form's purpose and contributes to a smoother procedural flow.

Misconceptions

The Georgia 231 form is a document associated with vehicle registration and titling in the state of Georgia. However, there are several misconceptions surrounding this form that can lead to confusion. Let's clarify some of these common misunderstandings.

- Only vehicle owners can complete the Georgia 231 form. In reality, not just vehicle owners, but also authorized representatives or agents acting on behalf of the owner, such as family members or legal attorneys, can fill out and submit this form. This flexibility helps individuals manage vehicle-related documentation on behalf of others when necessary.

- The form is used exclusively for new vehicle registrations. While the Georgia 231 form is indeed used for new vehicle registrations, its use is not limited to that alone. It can also be used for vehicle titling and in certain cases, to update information on existing registrations or titles. This means the form plays a vital role not just at the initial point of purchase, but throughout the life of vehicle ownership.

- Completing the form online is the only option. Given the digital age we live in, it's a common misconception that the Georgia 231 form can only be completed and submitted online. However, the state of Georgia provides options for individuals to submit their form in person at a local DMV office or through mail, ensuring accessibility for all residents, regardless of their internet access or comfort with online transactions.

- The 231 form is a lengthy and complicated document. The form may seem daunting at first glance, but it is designed to be straightforward and user-friendly. Clear instructions are provided to guide individuals through each section, ensuring the process is as smooth as possible. Furthermore, help resources are available from the Georgia Department of Revenue and its website for those who have questions or need assistance completing their forms.

- There's a fee to submit the 231 form. While it's common for government forms and processes to involve fees, submitting the Georgia 231 form itself does not incur a charge. However, there are other fees associated with vehicle registration and titling that applicants should be aware of. The form submission is merely a part of the documentation process, and the fees pertain to the registration or titling services being requested.

Key takeaways

The Georgia 231 form, essential for various transactions within the state, requires careful attention to detail and understanding prior to completion and submission. Here are key takeaways to guide individuals and entities through the process:

- Accuracy is paramount when filling out the Georgia 231 form. Providing incorrect or incomplete information can lead to processing delays or the outright rejection of the application. It is crucial to double-check all entries for accuracy before submission.

- The form serves multiple purposes and might require different pieces of information based on the specific use case. Identifying the correct section applicable to your needs is essential to ensure that the form is filled out correctly.

- Supporting documents are often required when submitting the Georgia 231 form. These can include identification documents, proof of residency, or other legal paperwork relevant to the form's purpose. Knowing what additional documents are needed and ensuring they are current and accessible will streamline the process.

- Signatures on the Georgia 231 form must be original and made in the presence of a notary or an authorized official, depending on the form's requirements. Electronic signatures may not be accepted for all sections or purposes of the form, underscoring the need to understand the specific guidelines related to signature verification.

- Timeliness in submission plays a critical role. There are often deadlines associated with the Georgia 231 form, whether tied to annual filings, specific transactions, or legal deadlines. Missing a deadline can have significant consequences, including penalties, fines, or the invalidation of the form.

Considering these key points can greatly enhance the effectiveness and efficiency of dealing with the Georgia 231 form, minimizing potential setbacks and ensuring that the intended outcomes are achieved. Whether used for personal or professional purposes, understanding the form's requirements, and preparing accordingly, is critical.

Popular PDF Forms

What Is a Rule Nisi in Georgia - Facilitates a structured legal environment where disputes related to family issues are brought to the forefront for resolution.

Georgia Dma-6 Form for Nursing Home - This form mandates details on the patient's medication regimen, diagnostic tests, treatment procedures, and a comprehensive treatment plan.