Free Georgia 4506 Template in PDF

Understanding the intricacies of tax documentation can often seem daunting. The Georgia Form 4506, provided by the Department of the Treasury Internal Revenue Service (IRS), is a crucial document for those needing a copy of their tax form or transcript. This document is designed to help individuals and entities access previous tax return information, whether for personal, business, or legal reasons. The form allows requests for various types of documents, such as a tax return transcript, a verification of nonfiling, or a specific tax form copy including all attachments. It caters to needs ranging from lending institution requests to personal record keeping. Noteworthy is the form's restriction against using it for obtaining tax account information, for which other procedural avenues are provided. The clear structuring of the form requires detailed information from the requester, such as names, social security numbers, current address, and specifics about the tax form or period in question. Additionally, it highlights the conditions under which a third party may receive the requested information directly, accounting for instances where the requester and the subject of the tax record are not the same. By filling out this form correctly, requesters can ensure timely access to vital tax documentation for a range of purposes, from legal proceedings to loan applications, thus highlighting the necessity of understanding and correctly utilizing the Georgia 4506 form.

Form Sample

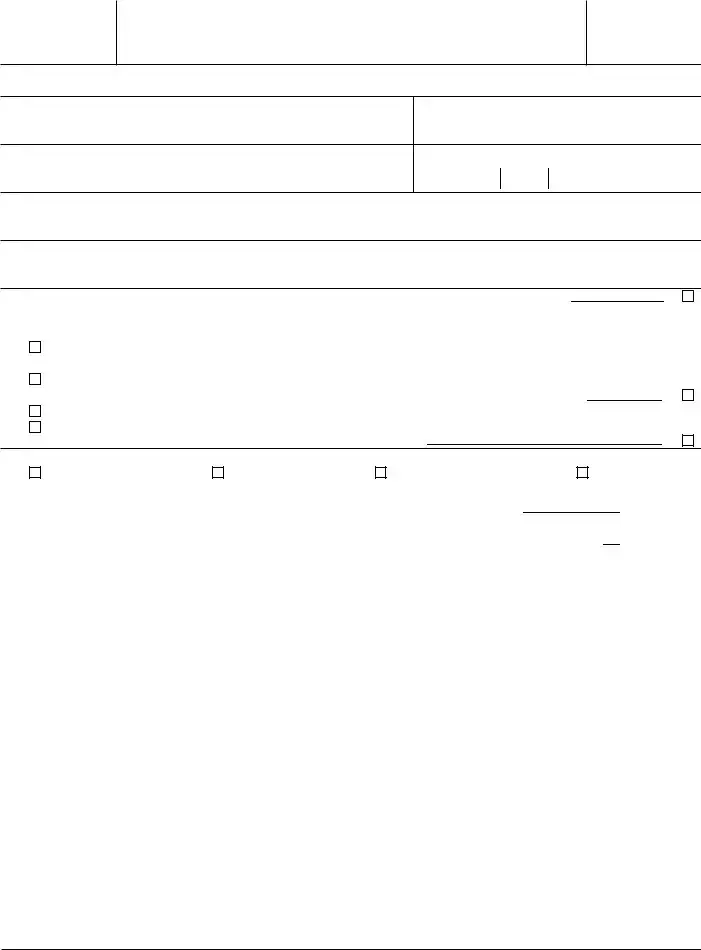

Form 4 5 0 6

(Rev. October 1994)

Department of the Treasury Internal Revenue Service

Request for Copy or Transcript of Tax Form

▶Please read instructions before completing this form.

▶Please type or print clearly.

OMB No.

Note: Do not use this for m to get tax account information. Instead, see instructions below.

1a Name shown on tax form

1b First social security number on tax form or employer identification number (See instructions.)

2a If a joint return, spouse’s name shown on tax form

2b Second social security number on tax form

3Current name, address (including apt., room, or suite no.), city, state, and ZIP code (See instructions.)

4If copy of form or a tax return transcript is to be mailed to someone else, show the third party’s name and address.

5 |

If we cannot find a record of your tax form and you want the payment refunded to the third party, check here |

▶ |

6 |

If name in third party’s records differs from line 1a above, show name here. (See instructions.) ▶ |

|

7Check only one box to show what you want:

a |

Tax return transcript of Form 1040 series filed during the current calendar year and the 2 preceding calendar years. (See instructions.) (The |

|

transcript gives most lines from the original return and schedule(s).) There is no charge for a transcript request made before October 1, 1995. |

b

c d

Copy of tax form and all attachments (including Form(s)

Note: If these copies must be certified for court or administrative proceedings, see instructions and check here |

▶ |

Verification of nonfiling. There is no charge for this. |

|

Copy of Form(s)

Note: If the copy of Form |

▶ |

8If this request is to meet a requirement of one of the following, check all boxes that apply.

|

Small Business Administration |

Department of Education |

Department of Veterans Affairs |

|

Financial institution |

|||||||

9 Tax form number (Form 1040, 1040A, 941, etc.) |

11 |

Amount due for copy of tax form: |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

a |

Cost for each period |

|

|

$ |

14.00 |

|

|

|

|

|

|

|

b Number of tax periods requested on line 10 |

|

|

||||

10 Tax period(s) (year or period ended date). If more than four, see |

c |

Total cost. Multiply line 11a by line 11b |

$ |

|

||||||||

instructions. |

|

|

|

Full payment must accompany your request. Make check |

|

|||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

or money order payable to “Internal Revenue Service.” |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Telephone number of requester |

|||

Please ▶ |

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||||||

Signature. See instructions. If other than taxpayer, attach authorization document. |

|

Date |

Best time to call |

|

|

|||||||

Sign |

▶ |

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

||||

Title (if line 1a above is a corporation, partnership, estate, or trust) |

|

|

|

|

|

|

|

|||||

Instructions

A Change To

Purpose of

Do not use this form to request Forms 1099 or tax account information. If you need a copy of a Form 1099, contact the payer. However, Form 1099 information is available by calling or visiting your local IRS office.

Note: If you had your tax form filled in by a paid preparer, check first to see if you can get a copy from the preparer. This may save you both time and money.

If you are requesting a copy of a tax form, please allow up to 60 days for delivery. However, if your request is for a tax return transcript, please allow 10 workdays after we receive your request. To avoid any delay, be sure to furnish all the information asked for on this form. You must allow 6 weeks after a tax form is filed before requesting a copy of it or a transcript.

Tax Account Information

To request tax account information, do not complete this form. Instead, write or visit an IRS office or call the IRS

If you want your tax account information sent to a third party, complete Form 8821, Tax Information Authorization. You may get this form by calling

Line

Line

Note: If you do not complete line 1b and, if applicable, line 2b, there may be a delay in processing your request.

Line 3.— For a tax return transcript, a copy of Form

For Privacy Act and Paperwork Reduction Act Notice, see back of form. |

Cat. No. 41721E |

Form 4506 (Rev. |

Form 4506 (Rev. |

Page 2 |

|

|

●A copy of two pieces of identification that have your signature, or

●An original notarized statement affirming your identity.

Line

Line

Line

A tax return transcript shows most lines from the original return (including accompanying forms and schedules). It does not reflect any changes you or the IRS made to the original return. If you have changes to your tax return and want a statement of your tax account with the changes, see Tax Account Information Only on the front. A tax return transcript is available for any returns of the 1040 series (such as Form 1040, 1040A, or 1040EZ) filed during the current calendar year and the 2 preceding calendar years.

In many cases, a tax return transcript will meet the requirement of any lending institution such as a financial institution, the Department of Education, or the Small Business Administration. It may also be used to verify that you did not claim any itemized deductions for a residence.

Line

Line

Line

Forms

If you are requesting a copy of your spouse’s Form

Line

Line

Copies of tax forms or tax return transcripts for a jointly filed return may be furnished to either the husband or the wife. Only one signature is required. Sign Form 4506 exactly as your name appeared on the original tax form. If you changed your name, also sign your current name.

For a corporation, the signature of the president of the corporation, or any principal officer and the secretary, or the principal officer and another officer are generally required. For more details on who may obtain tax information on corporations, partnerships, estates, and trusts, see Internal Revenue Code section 6103.

If you are not the taxpayer shown on line 1a, you must attach your authorization to receive a copy of the requested tax form or tax return transcript. You may attach a copy of the authorization document if the original has already been filed with the IRS. This will generally be a power of attorney (Form 2848), or other authorization, such as Form 8821, or evidence of entitlement (for Title 11 Bankruptcy or Receivership Proceedings). If the taxpayer is deceased, you must send Letters Testamentary or other evidence to establish that you are authorized to act for the taxpayer’s estate.

Note: Form 4506 must be received by the IRS within 60 days after the date you signed and dated the request.

Where To

Note: You must use a separate form for each service center from which you are requesting a copy of your tax form or tax return transcript.

If you lived in: |

Use this address: |

|

|

New Jersey, New York |

1040 Waverly Ave. |

(New York City and |

Photocopy Unit |

counties of Nassau, |

Stop 532 |

Rockland, Suffolk, and |

Holtsville, NY 11742 |

Westchester) |

|

|

|

New York (all other |

310 Lowell St. |

counties), Connecticut, |

Photocopy Unit |

Maine, Massachusetts, |

Stop 679 |

New Hampshire, |

Andover, MA 01810 |

Rhode Island, Vermont |

|

|

|

Florida, Georgia, |

4800 Buford Hwy. |

South Carolina |

Photocopy Unit |

|

Stop 91 |

|

Doraville, GA 30362 |

Indiana, Kentucky, |

P.O. Box 145500 |

|

Michigan, Ohio, |

Photocopy Unit |

|

West Virginia |

Stop 524 |

|

|

Cincinnati, OH 45250 |

|

|

|

|

Kansas, New Mexico, |

3651 South Interregional |

|

Oklahoma, Texas |

Hwy. |

|

|

Photocopy Unit |

|

|

Stop 6716 |

|

|

Austin, TX 73301 |

|

|

|

|

Alaska, Arizona, California |

|

|

(counties of Alpine, |

|

|

Amador, Butte, |

|

|

Calaveras, Colusa, |

|

|

Contra Costa, Del Norte, |

|

|

El Dorado, Glenn, |

|

|

Humboldt, Lake, Lassen, |

|

|

Marin, Mendocino, |

|

|

Modoc, Napa, Nevada, |

P.O. Box 9953 |

|

Placer, Plumas, |

||

Photocopy Unit |

||

Sacramento, San Joaquin, |

||

Stop 6734 |

||

Shasta, Sierra, Siskiyou, |

||

Ogden, UT 84409 |

||

Solano, Sonoma, Sutter, |

||

|

||

Tehama, Trinity, Yolo, |

|

|

and Yuba), Colorado, |

|

|

Idaho, Montana, |

|

|

Nebraska, Nevada, |

|

|

North Dakota, Oregon, |

|

|

South Dakota, Utah, |

|

|

Washington, Wyoming |

|

|

|

|

|

California (all other |

5045 E. Butler Avenue |

|

counties), Hawaii |

Photocopy Unit |

|

|

Stop 52180 |

|

|

Fresno, CA 93888 |

|

|

|

|

Illinois, Iowa, Minnesota, |

2306 E. Bannister Road |

|

Missouri, Wisconsin |

Photocopy Unit |

|

|

Stop 57A |

|

|

Kansas City, MO 64999 |

|

|

|

|

Alabama, Arkansas, |

P.O. Box 30309 |

|

Louisiana, Mississippi, |

Photocopy Unit |

|

North Carolina, |

Stop 46 |

|

Tennessee |

Memphis, TN 38130 |

|

|

|

|

Delaware, |

|

|

District of Columbia, |

11601 Roosevelt Blvd. |

|

Maryland, Pennsylvania, |

||

Photocopy Unit |

||

Virginia, a foreign |

||

DP 536 |

||

country, or A.P.O. or |

||

Philadelphia, PA 19255 |

||

F.P.O address |

||

|

||

|

|

Privacy Act and Paperwork Reduction Act

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

13 min. |

Learning about the law or the form |

7 min. |

Preparing the form |

25 min. |

Copying, assembling, and |

|

sending the form to the IRS |

17 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form more simple, we would be happy to hear from you. You can write to both the Internal Revenue Service, Attention: Reports Clearance Officer, PC:FP, Washington, DC 20224; and the Office of Management and Budget, Paperwork Reduction Project

Printed on recycled paper

File Overview

| Fact Number | Fact Detail |

|---|---|

| 1 | Form 4506 allows taxpayers to request a copy or transcript of their tax form. |

| 2 | It was revised in October 1994 by the Department of the Treasury, Internal Revenue Service. |

| 3 | The form prohibits use for obtaining tax account information. |

| 4 | Transcripts for the Form 1040 series for the current and two preceding calendar years can be requested without a charge before October 1, 1995. |

| 5 | A $14.00 charge is applicable for each tax period's copy requested. |

| 6 | Requests for verification of nonfiling and copies of Form W-2 are available at no charge. |

| 7 | The requester must wait 6 weeks after a tax form is filed before requesting a copy of it or a transcript. |

| 8 | Form 4506 must be signed by the taxpayer or an authorized individual and received by the IRS within 60 days from the date signed by the requester. |

| 9 | Governing law includes sections 6103 and 6109 of the Internal Revenue Code, which establish the right of access to tax forms or transcripts. |

Guide to Using Georgia 4506

Once the decision has been made to request tax documents using the Georgia 4506 form, understanding the steps to accurately complete the form is critical for a timely and smooth process. This detailed yet straightforward form requires careful attention to each section to ensure that the request is processed without unnecessary delays. Following the steps outlined will assist in requesting a copy or transcript of tax forms efficiently.

- Fill in the Applicant's Information:

- Line 1a: Enter the name as shown on the tax form.

- Line 1b: Input the first social security number or employer identification number as it appears on the tax form.

- If a Joint Return is Involved:

- Line 2a: Enter the spouse's name as shown on the tax form.

- Line 2b: Provide the second social security number appearing on the tax form.

- Current Contact Details: On line 3, write the current name, address, city, state, and ZIP code clearly to ensure proper delivery.

- Details for Third-Party Delivery (If Applicable):

- Line 4: If the document is to be mailed to a third party, enter their complete name and address here.

- Line 5: Check this box if you wish any payment refund to be directed to the third party mentioned.

- Line 6: If the third party's records have a different name for the applicant, indicate it here.

- Select the Request Type: On line 7, check the appropriate box to indicate whether you are requesting a tax return transcript, a copy of the tax form and attachments, verification of nonfiling, or a copy of Form(s) W-2 only.

- Purpose of the Request: Line 8 demands indicating if this request meets the requirements of listed agencies or institutions by checking all applicable boxes.

- Specify the Tax Form and Period:

- Line 9: Enter the tax form number you are requesting.

- Line 10: List the tax period(s) for which you are requesting documents.

- Line 11: Calculate and enter the total cost for the copies being requested, if applicable.

- Finalize the Form:

- Provide the requester's telephone number and the best time to call.

- Ensure the person whose name is on line 1a or an authorized individual signs and dates the form.

- If applicable, include the title of the authorized representative.

- Payment and Submission: Attach the correct payment as detailed on the form and mail it to the appropriate IRS office based on the provided addresses, ensuring the envelope is properly labeled with the taxpayer's information and "Form 4506 Request."

Once completed and submitted, anticipate a processing period which can vary in length but generally will conform to the timelines provided in the form's instructions. This step marks the final action required by the requester, shifting the responsibility to the IRS for processing and fulfilling the document request as specified.

Obtain Clarifications on Georgia 4506

What is Form 4506, and why would I need it?

Form 4506 is a request form used to obtain a copy of your tax form or transcript from the IRS. You might need it to verify your income for a mortgage or loan application, to apply for student or small business aid, or for legal matters. It allows you to request copies of your tax returns or prove that you did not file in a particular year.

Can I get copies of my tax return for any year using Form 4506?

Yes, but with limitations. You can request tax return transcripts of the Form 1040 series filed during the current calendar year and the two preceding years. For actual copies of your tax forms, you can generally request forms filed within the last six years, but availability might vary. Before October 1, 1995, transcripts are free.

How much does it cost to request a copy of my tax form using Form 4506?

As of the latest update, the charge for requesting a copy of a tax form is $14.00 for each tax period requested. This fee is required to process your request and must accompany your Form 4506.

How long does it take to receive a tax transcript or tax form copy when requested through Form 4506?

If you're requesting a tax return transcript, it typically takes around 10 workdays to receive it once the IRS receives your request. However, if you're requesting a copy of your actual tax return, please allow up to 60 days for delivery.

What should I do if my address has changed since the last tax return I filed?

If your current address differs from the one on your last filed return, and you haven't already notified the IRS through Form 8822, Change of Address, you must attach either a copy of two pieces of identification with your signature or an original notarized statement affirming your identity.

Can Form 4506 be used to request information for a joint return?

Yes, if you're requesting a copy or transcript of a joint tax return, you need to provide both social security numbers on the form. Copies of tax forms or tax return transcripts for jointly filed returns may be furnished to either spouse. Only one signature is required.

Is there a charge for the verification of nonfiling?

No, there is no charge for requesting verification of nonfiling. This service is useful for proving to third parties that you did not file a tax return for a specific year.

Who should sign Form 4506?

The person whose name is shown on line 1a of the form or someone authorized to obtain the requested information should sign the form. For joint returns, either spouse can sign. Corporations and other entities must have an appropriate officer sign. If you've changed your name since you filed the return you're requesting, sign with both your current name and the name on the tax form.

Common mistakes

Not reading the instructions before filling out the form can lead to errors in completing it correctly. The form clearly states at the beginning, "Please read instructions before completing this form,” yet many skip this crucial step.

Failing to print clearly or type the information. The form specifies, "Please type or print clearly,” which is essential for the IRS to process the information accurately.

Using the form to request information it's not designed for, such as tax account information. The form explicitly notes, "Do not use this form to get tax account information.”

Incorrectly filling out the social security number or employer identification number sections incorrectly can significantly delay processing. These fields are crucial for identifying the taxpayer's records.

Omitting the tax form number requested can cause delays or incorrect processing of the request. The form asks for "Tax form number” clearly in section 9.

Requesting a copy of the tax form without checking the appropriate box for what is needed, such as a transcript versus a copy of the form, can lead to receiving the wrong documentation.

Not specifying the tax period(s) desired in detail or requesting periods not available due to IRS record retention policies can result in an unfulfilled request.

Failing to sign the form, or if applicable, attach the proper authorization document for third-party requests. The instructions specify, "Signature. See instructions,” emphasizing the need for an authorized signature to process the request.

Incorrect payment or not understanding the payment requirements, especially since the form outlines specific costs for copies and conditions under which a refund to a third party is applicable.

Many of these mistakes stem from a lack of attention to the detailed instructions provided with the form. Reading carefully, verifying personal information, and understanding the request being made can significantly improve the accuracy and processing time of a Form 4506 request in Georgia.

Documents used along the form

When navigating the complexities of tax documentation in Georgia, understanding and utilizing the correct forms is crucial. The Georgia 4506 form, known for its role in requesting tax return transcripts and other tax-related documents, often necessitates accompanying documentation for comprehensive tax handling or verification purposes. Knowing which forms to pair with the Georgia 4506 can streamline various financial, legal, or personal processes where proof of income or tax compliance is required.

- Form 8821, Tax Information Authorization: This form grants permission to a third party to access and receive your tax information. It's instrumental for individuals who need a representative to handle their tax matters, making it simpler for accountants, financial advisors, or attorneys to access necessary data.

- Form 2848, Power of Attorney and Declaration of Representative: When needing someone to act on your behalf with the IRS, this form is essential. It authorizes an individual, such as a tax attorney or a certified public accountant, to represent you before the IRS, allowing them to make decisions and requests related to your tax affairs.

- Form 8862, Information To Claim Certain Refundable Credits After Disallowance: If your claim for a certain tax credit was previously disallowed, and you wish to claim it again, this form is required. It's often used in conjunction with tax return filings to rectify or argue past disqualifications of tax benefits.

- Form 4506-T, Request for Transcript of Tax Return: For those who need a detailed transcript of their tax return rather than a copy, this form serves as a request. It's commonly utilized for loan applications and to verify income for scholarships, housing, or other financial concerns.

Understanding these forms and their specific purposes can empower individuals to manage their taxes more effectively. Each form addresses different needs, from authorizing representation to rectifying credit disputes or simply obtaining tax return transcripts. Whether for personal records, legal matters, or financial planning, knowing how to navigate these documents ensures smoother interactions with federal and state tax agencies.

Similar forms

The IRS Form 8821, Tax Information Authorization, is similar to the Georgia 4506 form in that both allow individuals to request and authorize the release of their tax information to third parties. While Form 4506 is used to request copies of tax returns or transcripts, Form 8821 authorizes a third party, such as a tax professional, to access and receive the taxpayer's information directly from the IRS.

The IRS Form 2848, Power of Attorney and Declaration of Representative, is akin to the Georgia 4506 form in the aspect of permitting a designated individual—typically a tax advisor or attorney—to obtain tax documents and information on behalf of the taxpayer. It goes further than the 4506 form by granting the representative broader powers, including the ability to represent the taxpayer before the IRS.

The IRS Form 4506-T, Request for Transcript of Tax Return, shares a purpose with the Georgia 4506 form in facilitating the retrieval of tax return information. However, Form 4506-T is specifically tailored for requesting transcripts rather than copies, offering a quick summary of the tax return information often sufficient for loans and financial aid applications.

The FAFSA (Free Application for Federal Student Aid) application process correlates with the Georgia 4506 form when students or parents need to provide proof of income through tax return transcripts. The FAFSA application often requires information that can be obtained via Form 4506, such as IRS tax return transcripts for verifying the financial status of the applicant's family.

The IRS Form 1040, U.S. Individual Income Tax Return, while primarily a form for filing annual income tax returns, is connected to the Georgia 4506 form as it is one of the key documents that can be requested through Form 4506. Taxpayers might need past copies of Form 1040 when dealing with loan applications or legal matters.

The SBA loan application process is relevant to the Georgia 4506 form since entrepreneurs seeking Small Business Administration (SBA) loans are often required to submit tax return transcripts or copies as part of the financial documentation needed to assess the loan application.

The mortgage application process mirrors the utility of the Georgia 4506 form, as lenders frequently request tax return transcripts to verify an applicant's income. This ensures the borrower has the financial stability necessary for undertaking the responsibility of a mortgage loan.

Dos and Don'ts

When dealing with the Georgia 4506 form, a request for a copy or transcript of a tax form, it's important to handle the process correctly to avoid any delays or problems. Here are some dos and don'ts to guide you through filling out this form smoothly:

- Do read the instructions carefully before starting to fill out the form. This helps ensure that you understand the requirements and provide all the necessary information.

- Do type or print clearly in ink to make sure that all the information you provide is readable. This reduces the chance of errors in processing your request.

- Do not use this form for obtaining tax account information. If you need tax account information, you should follow the alternative procedures outlined in the instructions.

- Do enter your social security number or employer identification number as required on the form. This is crucial for the IRS to locate your tax records.

- Do not request copies of Form W-2 for social security purposes using this form. Contact your local Social Security Administration office for those requests.

- Do provide your current name and address, and make sure they are accurate. If they have changed since your last filing and you haven't notified the IRS, attach the appropriate documentation.

- Do check the appropriate box on line 7 to indicate what you're requesting – whether it’s a transcript, a copy of a tax return, verification of nonfiling, or copy of Form(s) W-2.

- Do include the correct payment, if applicable. As noted, there is a fee for some requests, so ensure you attach the correct amount to avoid delays.

- Do not forget to sign and date the form. Your request cannot be processed without your signature, which also verifies that you are authorized to make the request.

Being careful and thorough when completing the Georgia 4506 form not only ensures a smoother process but also helps you receive the documents you need without unnecessary delay. Remember, accuracy and following the instructions closely are key to a successful request.

Misconceptions

When dealing with the Georgia Form 4506, it's crucial to clarify common misunderstandings to navigate the process effectively. Here are six misconceptions:

- It's Only for Getting Copies of Your Tax Return: While the form is primarily used to request copies of tax forms or transcripts, it also allows for the request of verification of nonfiling and copies of Form W-2.

- Requesting a Transcript Costs Money: One common mistake is thinking that requesting a tax return transcript incurs a cost. Before October 1, 1995, there was no charge for this service, highlighting the importance of understanding the specific details regarding fees.

- Instant Access to Information: Many expect immediate results upon submission. However, obtaining a transcript typically takes about 10 workdays after receipt of the request, and a copy of the tax form can take up to 60 days for delivery.

- Use Form 4506 for Current Year Tax Information: The form allows requests for tax return transcripts for the current calendar year and the two preceding calendar years, not for obtaining current year tax account information or Forms 1099.

- Submission Without Full Information Will Be Processed: Failure to provide complete information, specifically on lines 1b and, if applicable, 2b, can lead to delays in processing your request. Full and accurate completion of the form is vital for timely service.

- Electronic Filing is an Option: This form must be mailed with the correct payment, if required, to the Internal Revenue Service Center for your area. There isn't an option to file this form electronically, which means planning ahead for mailing time is crucial.

Understanding these key points helps in avoiding delays and ensures that individuals and businesses can effectively manage their tax information requests through the Georgia Form 4506. Always double-check the most current form and instructions directly from the Internal Revenue Service for any updates or changes to the process.

Key takeaways

When using Georgia's Form 4506 to request a copy or transcript of a tax form, it’s essential to keep several key points in mind to ensure the process goes smoothly:

- Form 4506 is designed for obtaining a copy or transcript of your tax records from the IRS, but not for retrieving tax account information. For tax account details, you'll need to look elsewhere as per the form's instructions.

- The form enables you to request different types of documents, such as a tax return transcript of Form 1040 series for the current and the past two calendar years, a copy of your tax form and attachments, verification of nonfiling, and a copy of Form(s) W-2. Charges may apply depending on the document type.

- Before sending your request, ensure all required fields are correctly filled out to avoid delays. This includes your name, social security number or employer identification number, and current address. If the tax form is to be mailed to a third party, their name and address must be specified on the form.

- There's no charge for requesting a tax return transcript before October 1, 1995. If you're requesting a copy of a tax form, prepare to wait up to 60 days for delivery. For transcripts, the waiting time is generally around 10 workdays after the IRS receives your request.

- Finally, if you're paying for a copy of your tax form, the correct amount must accompany your Form 4506. The form must be signed by the requester, and if it involves a third party, proper authorization should be attached.

Proper handling of Form 4506 is crucial for timely and accurate processing of your request. Whether you're verifying nonfiling status, obtaining a transcript for loan applications, or needing a copy for your records, following these guidelines will help you navigate the process.

Popular PDF Forms

Workers Comp Insurance in Georgia - This document fulfills legal obligations under Georgia's O.C.G.A. 34-9-240, ensuring that employees are offered employment suitable to their recovery status.

Georgia Workers Compensation Forms - Completing the Ga WC 10 form accurately is critical for the timely processing of worker's compensation claims.

Georgia Lottery Retailer - The retailer contract, a crucial part of the application, outlines the terms and conditions, including ticket sales, prize payments, and promoting lottery sales at your location.