Free Georgia 500 Nol Template in PDF

Navigating the complexities of tax adjustments following a net operating loss (NOL) can be challenging for individuals and fiduciaries in Georgia. The Georgia Form 500-NOL serves as a crucial vehicle for addressing these adjustments, offering a structured way to amend taxable income and potentially recuperate taxes from previous years. This form is primarily filed when taxpayers need to adjust their income due to losses that were not fully absorbed in a given tax year, allowing for carryback or carryforward options to better align with financial realities. Taxpayers are required to attach a complete copy of their federal return for the loss year, alongside detailed sections that break down the type of loss incurred, whether it be from normal operations, casualty, or farm-related activities, and specify the tax years affected. The form mandates a close review of residency and filing status, adjustments to both federal adjusted gross income and Georgia adjustments, and a nuanced calculation of the NOL itself. With strict filing deadlines and the necessity of meticulous documentation, including copies of federal applications for NOL adjustment and related Georgia and federal returns, the process underscores the state's methodical approach to ensuring accurate tax recalibrations. This detailed framework not only aids in adjusting taxpayers' obligations in light of operational setbacks but also clarifies the procedural continuity between federal and state tax codes, albeit with certain Georgia-specific provisions that diverge from federal guidelines, particularly concerning NOL carryback and carryforward rules.

Form Sample

Georgia Form

Net Operating Loss Adjustment

For Individuals and Fiduciaries(Rev. 12/31/20)

PAGE 1

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN FOR THE LOSS YEAR

YOUR SSN OR FEIN

SPOUSE’S SSN

DEPARTMENT USE ONLY

YOUR FIRST NAME |

|

MI |

|

LAST NAME |

|

|

|

|

SUFFIX |

|

|

|

|

|

|

|

|

|

|

SPOUSE’S FIRST NAME |

|

MI |

|

LAST NAME |

|

|

|

|

SUFFIX |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

ADDRESS (NUMBER AND STREET or P.O. BOX) (Use 2nd address line for Apt, Suite or Building Number) |

|

|

CHECK IF ADDRESS CHANGED |

||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

CITY |

|

|

|

|

STATE |

ZIP CODE |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(COUNTRY IF FOREIGN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXABLE YEAR OF NET OPERATING LOSS: CALENDAR YEAR |

____________________: |

|

|

|

|

|

|||

OR OTHER YEAR BEGINNING ____________________ |

AND ENDING ____________________ |

|

|

|

|

|

|||

NET OPERATING LOSS: $ _____________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE ATTACH A COPY OF YOUR FEDERAL APPLICATION FOR NOL ADJUSTMENT, PART YEAR AND NONRESIDENTS SEE INSTRUCTIONS ON PAGE 4.

TYPE OF LOSS: |

NORMAL |

CASUALTY LOSS |

FARM LOSS |

FARM LOSS |

OTHER |

|

(2) YEAR |

(3)) YEAR |

(2)) YEAR |

(5)) YEAR |

(EXPLAIN IN ATTACHMENT) |

PORTION: |

$ ________________ |

$ ________________ |

$ ________________ |

$ ________________ |

$ ___________________ |

|

|

|

|

|

|

IS THE LOSS ONLY BEING CARRIED FORWARD? YES

NO |

Form |

Georgia Form |

|

|

|

TAXPAYER’S FEIN |

||||

Net Operating Loss Adjustment |

|

|

|

|

|

|

|

|

For Individuals and Fiduciaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

PAGE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

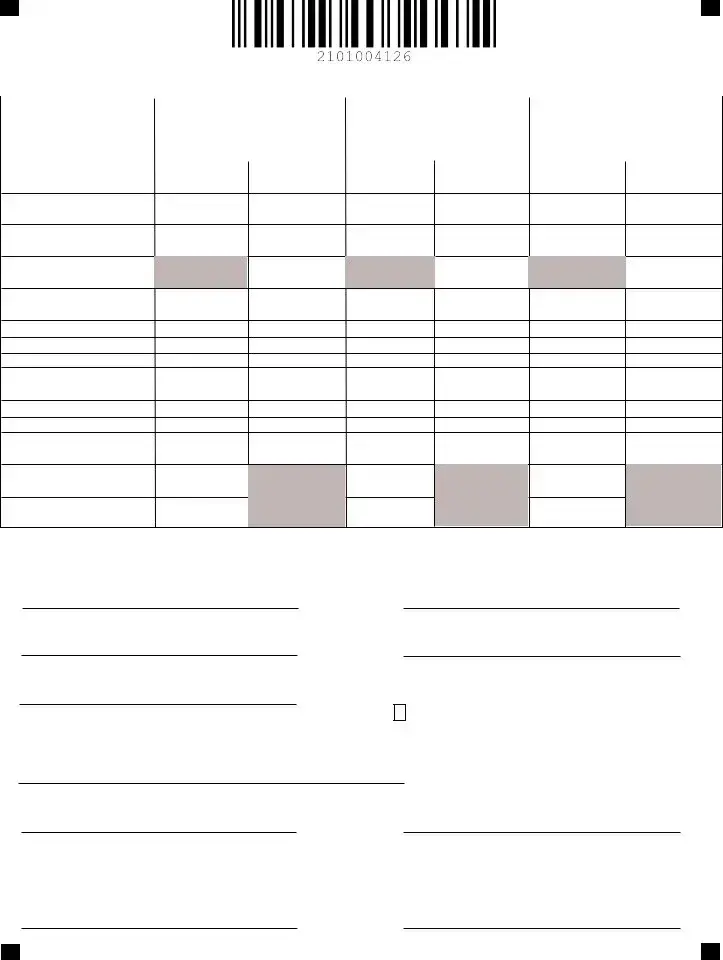

___________________ PRECEDING TAX |

___________________ PRECEDING TAX |

__________________ PRECEDING TAX |

||||

|

TAX YEAR: |

YEAR ENDED ______________________ |

YEAR ENDED ______________________ |

YEAR ENDED ______________________ |

||||

|

RESIDENCY STATUS |

|

|

|

|

|

|

|

|

FILING STATUS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Return as filed or |

(b) Liability after |

(c) Return as filed or |

(d) Liability after |

(e) Return as filed or |

(f) Liability after application |

|

|

Computation of overpayments |

liability as last |

application of |

liability as last |

application of |

liability as last |

of |

|

|

|

determined |

determined |

determined |

||||

1.Federal adjusted gross income (exclude Federal NOL)

2.Georgia adjustments. See Page 5 of the instructions

3.Net operating loss. See Page 5 for 80% rule and other instructions

4.Georgia adjusted gross income Net total of Lines 1, 2 and 3.

5.Deductions. See Page 5 of the instructions.

6.Subtract Line 5 from Line 4

7.Exemptions. See Page 5 of instructions.

8.Taxable Income. Subtract Line 7 from Line 6.

9.Income Tax.

10.Credits. See Page 5 of the instructions.

11.Tax after credits. Subtract Line 10 from Line 9.

12.Enter Line 11 column (b) (d) (f), respectively.

13.Decrease in tax. Subtract Line 12 from Line 11.

Mailing Address: Georgia Department of Revenue Processing Center, PO Box 740318, Atlanta, GA.

Under penalty of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Taxpayer’s Signature

Date

Taxpayer’s Phone Number

Taxpayer’s Spouse Signature

Date

Check the box to authorize the Georgia Department of Revenue to discuss the contents of this return with the named preparer.

By providing my

Taxpayer’s

Signature of Preparer Other Than Taxpayer |

Preparer’s Phone Number |

|

|

|

|

Name of Preparer Other Than Taxpayer |

Preparer’s FEIN |

|

Preparer’s Firm Name |

Preparer’s SSN/PTIN/SIDN |

Georgia Form

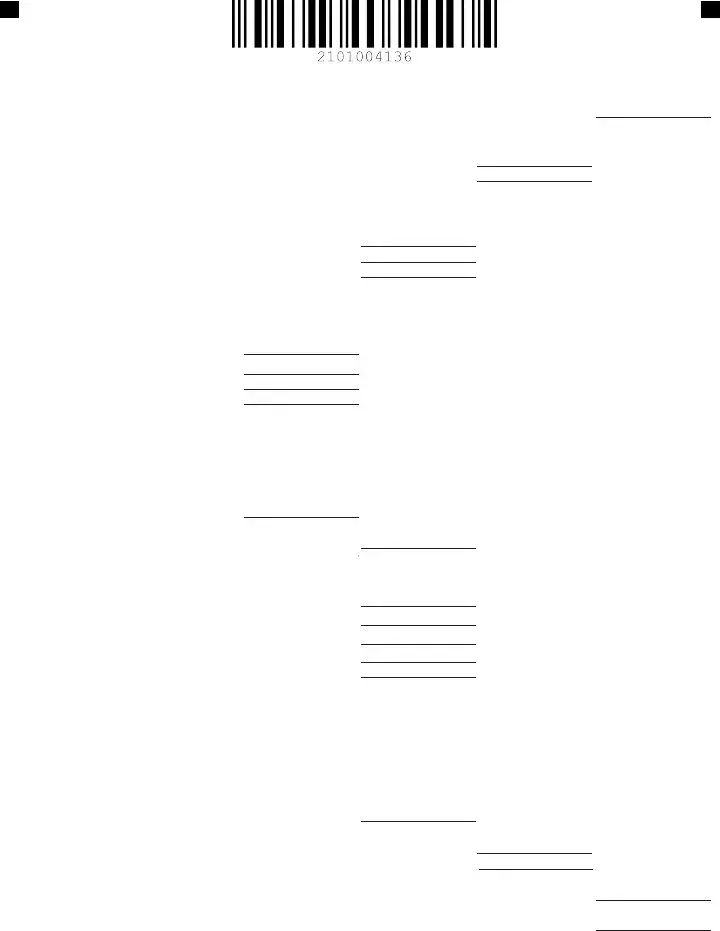

COMPUTATION OF NET |

|

|

|

|

|

TAXPAYER’S FEIN |

|

|

||||

OPERATING LOSS - LOSS YEAR |

|

|

|

|

|

|

|

|

|

|

||

PAGE 3 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

PART YEAR AND NONRESIDENTS, SEE INSTRUCTIONS ON PAGE 4 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Adjusted gross income, Line 8, Page 2 of form 500 |

|

|

|

|

|

|

1. |

|

|

|

|

2. |

Line 9 adjustments |

.... |

................................ |

|

|

2. |

|

|

|

|||

|

. ..........................................................................................................3. Deductions (Applies to individuals only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

. ........................a. Enter amount of your Standard or Itemized Deductions, Line 11c or Line 12 of form 500 |

3a. |

|

|

|

|

|||||

|

|

b. Personal exemption, Line 14c of form 500 |

|

|

|

|

3b. |

|

|

|

|

|

4. |

Total (Lines 3a and 3b) |

|

|

|

|

4. |

|

|

|

|

|

|

5. |

Taxable income. Total of Line 1 and Line 2 less Line 4 |

|

|

|

|

|

|

5. |

|

|

|

|

|

6. Exemptions claimed, Line 14c of form 500 |

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

................Nonbusiness capital losses before limitation. Enter as a positive number |

|

7. |

|

|

|

|

|

|

|||

8. |

Total nonbusiness capital gains (without regard to any I.R.C section 1202 exclusion) |

|

8. |

|

|

|

|

|

|

|||

9. |

If Line 7 is more than Line 8, enter the difference; otherwise, enter |

|

9. |

|

|

|

|

|

|

|||

10. |

If Line 8 is more than Line 7, enter the difference; otherwise, enter |

|

10. |

|

|

|

|

|

|

|||

|

11. Enter either your standard deduction or itemized deductions |

|

|

|

|

|

|

|

|

|||

|

|

less casualty, 2106 deductions, and state and local |

11. |

|

|

|

|

|

|

|

|

|

|

|

income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Contributions to |

|

|

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

|

|

|||

13. |

Alimony (paid) |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Forfeited interest/penalty on early withdrawal |

14. |

|

|

|

|

|

|

|

|

|

|

15. |

Contribution to an IRA |

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

Other (specify) |

16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

17. |

Total nonbusiness deductions (Lines 11 through 16) |

|

|

|

17. |

|

|

|

|

|

|

|

18. |

Dividend income |

18. |

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|

|

|

|

|

|||||

19. |

Interest income |

19. |

|

|

|

|

|

|

|

|

|

|

_______________________ |

|

|

|

|

|

|

|

|||||

20. |

Alimony/pensions/annuities |

20. |

|

|

|

|

|

|

|

|

|

|

21. |

GA adjustment for retirement exclusion, U.S. interest, |

|

|

|

|

|

|

|

|

|

|

|

21. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

22. |

Other (specify) |

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

23. |

Total nonbusiness income other than capital gains (Lines 18 through 22) |

|

23. |

|

|

|

|

|

|

|||

|

24. Add Lines 10 and 23 |

|

|

|

24. |

|

|

|

|

|

|

|

25. |

If Line 17 is more than Line 24, enter the difference; otherwise enter |

|

|

25. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||||

26. |

If Line 24 is more than Line 17, enter the difference; otherwise enter |

|

|

|

|

|

|

|

|

|||

|

|

Do not enter more than Line 10 |

|

|

|

26. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. |

Total business capital losses before limitation. Enter as a positive number |

|

27. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

28. |

Total business capital gains (without regard to I.R.C. section 1202 exclusion) |

|

28. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

29. |

Add Lines 26 and 28 |

|

|

|

29. |

|

|

|

|

|

|

|

30. |

If Line 27 is more than Line 29, enter the difference; otherwise enter |

|

30. |

|

|

|

|

|

|

|||

31. |

Add Lines 9 and 30 |

|

|

|

31. |

|

|

|

|

|

|

|

|

32. Enter your net capital loss before the $3,000 federal limitation, if any. Enter as a |

|

|

|

|

|

|

|

|

|||

|

|

positive number. If you do not have this loss (and do not have an I.R.C. section |

|

|

|

|

|

|

|

|

||

|

|

1202 exclusion) skip Lines 32 through 37 and enter on Line 38 the amount from |

|

|

|

|

|

|

|

|

||

|

|

|

32. |

|

|

|

|

|

|

|||

|

|

Line 31 |

|

|

|

|

|

|

|

|

|

|

33. |

I.R.C. section 1202 exclusion (50% exclusion for gain from certain small business |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

stock). Enter as a positive number |

|

|

|

|

33. |

|

|

|

|

|

34. |

Subtract Line 33 from Line 32. If zero or less enter |

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

35. Enter your net capital loss after the $3,000 Federal limitation. |

|

|

|

|

|

|

|

|

|||

|

|

Enter as a positive number |

|

|

|

35. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36. |

If Line 34 is more than Line 35, enter the difference; otherwise enter |

|

36. |

|

|

|

|

|

|

|||

37. |

........................................................If Line 35 is more than Line 34, enter the difference; otherwise enter |

|

37. |

|

|

|

|

|

||||

38. |

Subtract Line 36 from Line 31. If zero or less, enter |

|

|

|

|

38. |

|

|

|

|

|

|

|

39. Previous net operating loss claimed. Enter as a positive number |

|

39. |

|

|

|

|

|

||||

40. |

Add Lines 6, 25, 33, 37, 38, 39 |

|

|

|

|

|

|

40. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

41. Loss amount. Combine Lines 5 and 40. If the result is less than zero, enter it here. If the loss is being carried back to a part year or nonresident return, |

41. |

|

|

||||||||

|

|

see instructions on Page 4. If the result is zero or more, you do not have a normal net operating loss |

|

|

_______________________ |

|

|

|||||

42. |

IRC Section 461(1) loss eligible to be carried forward only (enter as negative) |

|

|

|

42. |

|

|

|

||||

|

43. |

Total Net Operating Loss. Combine Lines 41 (if Line 41 is a negative) and Line 42. |

Enter on Page 1 |

|

|

43. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia Form

PAGE 4

TAXPAYER’S FEIN

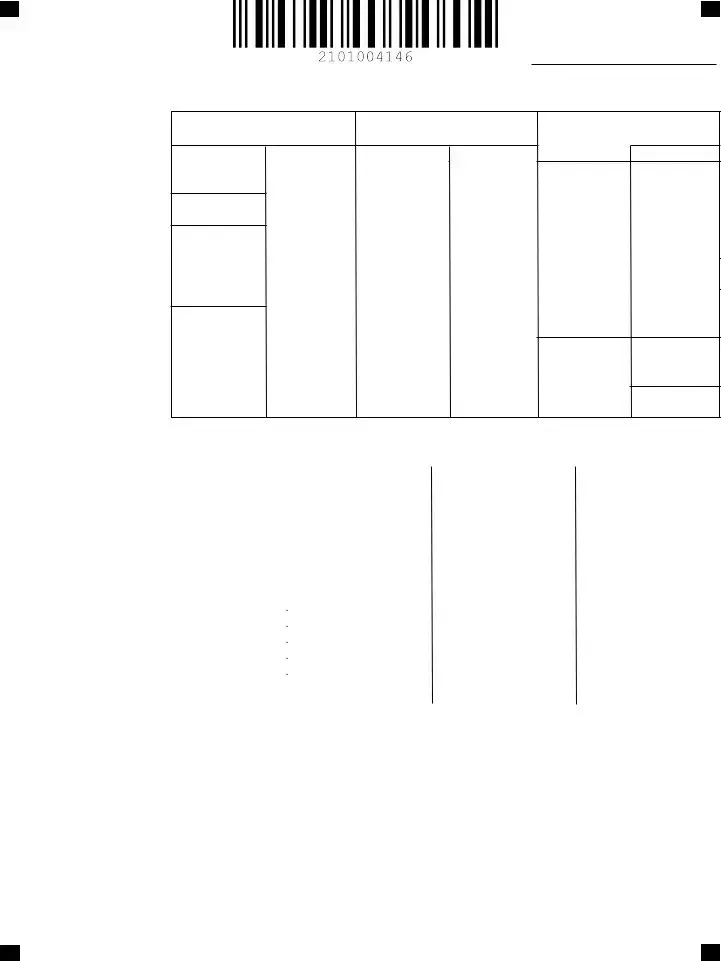

NET OPERATING LOSS CARRYOVER

Complete if applicable. See page 5 for instructions.

Complete one column before going

to the next column. Start with the earliest carryback year.

1.Net operating loss deduction .....

2.Taxable income before N.O.L. carryback .........................................

3.Net capital loss deduction. Enter as a positive number........................

4.I.R.C. section 1202 exclusion. Enter as a positive number..............

5.Adjustments to adjusted gross income ...........................................

6.Adjustments to itemized deductions

7.Exemptions ................................

8.Modified taxable income. Combine Lines 2 through 7. If zero or less, enter

9.Net operating loss carryover. Line

1 less Line 8. If zero or less, enter

___________________ PRECEDING TAX |

___________________ PRECEDING TAX |

__________________ PRECEDING TAX |

||||||||

YEAR ENDED ______________________ |

YEAR ENDED ______________________ |

YEAR ENDED ______________________ |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART YEAR AND NONRESIDENTS

Complete if applicable

Year_________ Use a separate schedule for all applicable years.

1.Georgia Adjusted Gross Income (exclude Federal NOL). See instructions below.....................................................

2.Georgia NOL. See instructions below............................

3.Adjusted AGI for NOL purposes...................................

4.Percentage. Line 3, column C divided by column A. See instructions below.....................................................

5.Itemized or standard deduction. See instructions below.

6.Personal exemptions.......................................................

7.Total deductions and exemptions; add Lines 5 & 6..........

8.Line 4 percentage times Line 7........................................

9.Adjusted taxable income, column C, Line 3 less Line 8, enter here and on taxable income Line 8 of Page 2.......

Column A |

Column B |

Column C |

|

Total |

Non Georgia |

Georgia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part Year and Nonresident schedule instructions. (Use if carrying the loss to a part year or nonresident return regardless of whether the loss year is a part year or nonresident return.)

1.Lines 1 and 5, enter the amounts, after the adjustments that are required by I.R.C. Section 172 if any apply, for the year the loss is being carried to.

2.Line 2 column A and C, enter loss from Page 3, Line 41 or from Page 4, Line 9 of the net operating loss carryover schedule.

3.Line 4, if Georgia AGI is zero or negative, the percentage is zero. If the adjusted Federal AGI is zero or negative, the Line 4 percentage is considered to be 100%. This also applies if both adjusted Federal AGI and Georgia AGI are zero or negative. In this case, the taxpayer is entitled to the full exemp- tion amount and deductions.

Additional instructions for part year and nonresidents.

1.

2.

3.

500- NOL (Rev. 12/31/20)

General Instructions

A net operating loss carryback adjustment may be filed on this form by an individual or fiduciary taxpayer that desires a refund of taxes afforded by carryback of a net operating loss. This form must be filed no later than 3 years from the due date of the loss year income tax return, including any extensions which have been granted. Form 500X should not be used to carryback a NOL Form

Generally a net operating loss must be carried back (if applicable) and forward

in the procedural sequence of taxable |

periods provided by Section 172 |

of the Internal Revenue Code of 1986, |

as defined in Code Section |

the carryback period is 2 |

years (with special |

rules |

for farmers |

(5 |

||

years), |

casualty losses |

(3 years); specified |

liability |

loss (10 |

years), |

|

small |

business loss attributable to federally declared |

disasters |

(3 |

years); |

||

etc.) For losses incurred in taxable years ending after December 31, 2017, there is no carryback (with a 2 year carryback for farmers) and unlimited carryover. Also, Georgia does not follow the following federal provisions:

Special carryback rules enacted in 2009.

Special carryback rules enacted in 2009.

Special rules relating to Gulf Opportunity Zone public utility casualty losses, I.R.C. Section 1400N(j).

Special rules relating to Gulf Opportunity Zone public utility casualty losses, I.R.C. Section 1400N(j).

5 year carryback of NOLs attributable to Gulf Opportunity Zone losses, I.R.C. Section 1400N(k).

5 year carryback of NOLs attributable to Gulf Opportunity Zone losses, I.R.C. Section 1400N(k).

5 year carryback of NOLs incurred in the Kansas disaster area after May 3, 2007, I.R.C. Section 1400N(k).

5 year carryback of NOLs incurred in the Kansas disaster area after May 3, 2007, I.R.C. Section 1400N(k).

5 year carryback of certain disaster losses, I.R.C. Sections 172(b)(1)(J) and 172(j).

5 year carryback of certain disaster losses, I.R.C. Sections 172(b)(1)(J) and 172(j).

The election to deduct public utility property losses attributable to May 4, 2007 Kansas storms and tornadoes in the fifth tax year before the year of the loss, I.R.C. Section 1400N(o).

The election to deduct public utility property losses attributable to May 4, 2007 Kansas storms and tornadoes in the fifth tax year before the year of the loss, I.R.C. Section 1400N(o).

For losses incurred in taxable years beginning on or after January 1, 2018, the net operating loss cannot offset more than 80% of Georgia taxable net income.

Within 90 days from the last day of the month in which this form is filed, the Commissioner of Revenue shall make a limited examination of the form and disallow without further action any form containing errors of computation not correctable within such

*Note: This form shall constitute a claim for credit or refund.

If the commissioner should determine that the amount credited or refunded by an application is in excess of the amount properly attributable to the carry- back with respect to which such amount was credited or refunded, the commissioner may assess the amount of the excess as a deficiency as if it were due to a mathematical error appearing on the face of the return.

What to attach:

1.Copy of Federal Application for Net Operating Loss.

2.Copy of Federal return for the loss year that includes pages 1 and 2, schedules 1, A, D, and E.

3.Copy of Federal returns for the carryback years that includes pages 1 and 2, Schedule 1 and Schedule A and any schedules that were recalculated in carry- back year.

4.Copy of Georgia returns for the carryback or carryforward years

5.Copy of Georgia form 500 for the lossyear.

Be sure to attach all required forms listed above and complete all lines of the Form

The carryback period may be foregone and the NOL carried forward. Election: A taxpayer is bound by the Federal election to forego the carryback period. A copy of this election should be attached to the Georgia return. If there is a Georgia NOL but no Federal NOL, the taxpayer may make an election “for Georgia purposes only” under the same rules and restrictions as the Federal election. The Form

Example: A taxpayer has a large Net Operating Loss in 1998 (both Federal and Georgia). With his timely filed Federal return, he includes a statement that he elects to forgo the carryback period. He must therefore carry his Georgia (as well as his Federal) NOL forward without first carrying it back. Any portion not absorbed after 20 years is lost.

Page 2 Instructions

Columns a, c, and e.

Enter the amounts from your original return or as previously adjusted by you or the Department of Revenue.

Columns b, d, and f.

Lines 1 and 5, enter the amounts after adjustments that are required by I.R.C. Section 172, if any. Line 1 should not be reduced by the Federal or Georgia NOL.

Lines 2 and 7, enter the amounts from your original return or as previously adjusted by you or the Department of Revenue.

Line 3. For the earliest carryback year, in column (b) enter the NOL from page 3, line

41.In column (d) and (f) if applicable, enter the amount from line 9 of the Net Operating Loss Carryover schedule on page 4. For example, a taxpayer has a oss from 2013 which has a two year carryback period. The loss from page 3 line 41 s listed on line 3 in column (b) for 2011. Not all of the loss is utilized. The taxpayer makes the adjustments as required for 2011 in the Net Operating Loss Carryover schedule on page 4 and lists the amount from line 9 (if it is a positive amount) on ine 3 in column (d) for 2012.

Line 10, the credit for taxes paid to other states should be recomputed based on the new Georgia AGI and deductions. Other credits that are based on liability should be adjusted accordingly. Any credits that are not allowed and that are eligible for carry- forward can be carried forward. Do not enter more than Line 9.

Page 3 Instructions

A Georgia Net Operating Loss (NOL) must be computed separately from any Federal NOL. It is possible to have a Federal NOL, but not a Georgia NOL.

Line 21. In computing a Georgia NOL only Georgia amounts can be used. Interest on U.S. savings bonds should be entered as a negative number on this line. Non- Georgia municipal interest should be entered as a positive number on this line. The nonbusiness portion of the retirement exclusion should be entered as a negative number on this line. This should be computed as follows. The total nonbusiness income (as it is defined for NOL purposes) that is included in the retirement exclusion should be divided by the total income that is included in the retirement exclusion. This percentage should then be multiplied by the retirement exclusion. For example, if the taxpayer has $8,000 in wages and $20,000 in interest income, the taxpayer would divide $20,000 by $28,000 and then multiply this by the retirement exclusion amount. When computing the percentage, the following guidelines should be followed:

1.If the total nonbusiness income that is included in the retirement exclusion is zero or less than zero, the percentage is zero. This would apply even if the total income that is included in the retirement exclusion is zero or less than zero.

2.If the total nonbusiness income that is included in the retirement exclusion is greater than zero and exceeds the total income that is included in the retirement exclusion, the percentage is 100%. This would apply even if the total income that is included in the retirement exclusion is zero or less than zero.

Additionally, in situations where two people file married filing joint, a separate computation should be made to determine each taxpayer’s portion of the retirement exclusion that is related to nonbusiness income.

Line 42. Georgia follows the I.RC. Section 461(l) loss limitation. However, before the I.RC. Section 461(l) loss limitation is applied, the business should compute the business income and deductions pursuant to the I.R.C. as defined for Georgia purposes (with the I.R.C. section 168(k) disallowance, etc.). Then the 461(l) provisions should be applied. The 461(l) loss that is disallowed and is eligible to be carried forward should be entered on line 42. This amount must be included when the 500- NOL is filed to establish the NOL on the Department’s systems so the NOL will be available when subsequent year returns are filed.

Page 4 Instructions

Net Operating Loss Carryover

1.A Georgia Net Operating Loss (NOL) carryover must be computed separately from any Federal NOL carryover. It is possible to have a Federal NOL carryover but not a Georgia NOL carryover.

2.Line 3, enter as a positive number the adjustment as required by I.R.C. Section 172, if it applies.

3.Line 4, enter as a positive number the gain excluded under I.R.C. section 1202 on the sale or exchange of qualified small business stock, if it applies.

4.Lines 5 and 6, enter the adjustments that are required by I.R.C. Section 172, if any.

5.Line 9, if the 80% limitation applied to the year the loss was carried to,

an additional adjustment must be made before entering the loss on either the carryover year on page 2 or the carryover year after the loss year. After computing the amount on line 9, add the difference between the taxable income before NOL carryback on line 2 and the NOL actually used considering the 80% limitation. For example, the taxpayer has a 2019 NOL of 200,000. Their taxable income in 2020 is 100,000 (they used 80,000 of the NOL after considering the

80% rule) and that $100,000 is entered on line 2 of the schedule at the top of page 4. For simplicity sake assume the only adjustment that is required on the top of page 4 are exemptions of 7,400 and that is entered on line 7.

Therefore |

the modified taxable |

income on line 8 |

is 107,400. Subtracting |

|

the 107,400 from the 200,000 results in 92,600 being entered on line 9. |

The |

|||

difference |

of the 100,000 line |

2 amount and the |

80,000 is 20,000. |

This |

would be added to the 92,600 and therefore 112,600 is available to be carried to 2021.

500- NOL (Rev. 12/31/20)

Please note that the amount from line 9 of the year directly preceding the loss year is the amount (if any) that can be carried to the year after the loss year (carryover year). The same adjustments from this schedule must be made to each year in the carryover period to determine the amount that is available to be carried to the next carryover year. For example, a taxpayer has a loss from 2013 which has a two year carryback period. The loss is

carried back to 2011 and |

2012 |

on |

page 2 but not all of the |

loss |

is |

|||||||||

utilized. |

The taxpayer makes |

the |

adjustments as |

required |

|

to |

2011 |

|||||||

and 2012 |

in |

the |

Net Operating |

Loss Carryover |

schedule |

at |

the |

top |

||||||

of page 4. |

After computing the |

amount for 2012 |

there |

is |

a |

positive |

||||||||

amount |

on |

line 9 |

of |

the 2012 |

column. This amount |

can |

be carried |

|||||||

to 2014 and the amount used in |

2014 should |

be listed on the 2014 |

||||||||||||

return not on Form |

is |

utilized |

|

in 2014, |

||||||||||

the taxpayer should make the same adjustments |

to |

2014 |

as |

|

are |

|||||||||

listed |

in |

the |

Net |

Operating |

Loss Carryover |

schedule |

|

on |

page |

|||||

4to determine if any loss is available to be carried to 2015. A schedule showing this should be attached to the 2014 return and should not be listed on the Form

If the loss was carried to a part year or nonresident return, on line 2 of the carryover schedule enter the amount from line 14 schedule 3 of Form 500 for the year it was carried to. For lines 3, 4, and 5, enter amount if related to Georgia Income. For lines 6 and 7, multiply the amount by the ratio on line 9, schedule 3 of Form 500 for the year the loss was carried to.

Part Year and Nonresident Instructions. See instructions on page 4.

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | Georgia Form 500-NOL is used for Net Operating Loss Adjustment for Individuals and Fiduciaries. |

| Attachment Requirement | A complete copy of the federal return for the loss year must be attached. |

| Deadline | This form must be filed no later than 3 years from the due date of the loss year income tax return, including any extensions granted. |

| Carryback and Carryforward Rules | For losses incurred in taxable years ending after December 31, 2017, there is no carryback (with a 2-year carryback for farmers) and unlimited carryover, with the loss not able to offset more than 80% of Georgia taxable net income. |

| Special Considerations | Georgia does not follow certain federal provisions, such as special carryback rules enacted in 2009, among other specific rules related to disaster losses. |

| Separate Computation Requirement | A Georgia Net Operating Loss must be computed separately from any Federal NOL, impacting the adjustments and calculations required on this form. |

| Governing Law | Form 500-NOL adheres to Section 172 of the Internal Revenue Code of 1986, as defined in Georgia Code Section 48-1-2, with specific adaptations for Georgia state tax purposes. |

Guide to Using Georgia 500 Nol

Filing the Georgia Form 500-NOL is an important process for individuals and fiduciaries to adjust their income for net operating losses. Following the correct steps ensures the form is filed accurately and efficiently, allowing for the adjustment to be recognized by the Georgia Department of Revenue. This guide provides a straightforward approach for completing the form.

- Prepare all necessary documents: Before starting, make sure you have a complete copy of your federal return for the loss year, as well as any relevant schedules and statements required.

- Provide taxpayer information: Fill in your Social Security Number (SSN) or Federal Employer Identification Number (FEIN), and if applicable, your spouse's SSN. Also, enter your full name, including middle initial (MI) and suffix if applicable, along with your spouse’s first name, MI, and last name suffix.

- Update your address: Write your current address, including apartment, suite, or building number if applicable. Check the box if your address has changed.

- Specify the tax year: Indicate the taxable year of the net operating loss by entering the calendar year or other specific dates if not on a calendar year basis.

- Detail the net operating loss: Enter the dollar amount of your net operating loss and the type of loss (e.g., normal, casualty, farm loss, etc.). Specify if the loss is being carried forward only.

- Attach Federal Application for NOL Adjustment: Include a copy of your federal application for NOL adjustment if this applies to your situation.

- Complete the preceding tax year information: For each column that applies, enter the tax year ended, residency and filing status, and detailed financial information as requested on the form, following the instructions provided for each line closely.

- Sign and date the form: After reviewing the information for accuracy, sign and date the form. Additionally, if applicable, have your spouse sign and date.

- Contact information: Provide your phone number and email address. This authorizes the Georgia Department of Revenue to contact you regarding your form and to provide electronic notifications about your account.

- Preparer’s information: If someone other than the taxpayer prepared the form, complete the preparer’s information section, including name, phone number, FEIN, firm name, and SSN/PTIN/SIDN.

- Send the form: Mail the completed form along with all required attachments to the Georgia Department of Revenue Processing Center, PO Box 740318, Atlanta, GA, 30374-0318.

After the form is filed, it will undergo a review process by the Georgia Department of Revenue. Within 90 days from the last day of the month in which the form is filed, the Department will make a limited examination of the form to determine its validity and completeness. Any errors or omissions may lead to disallowance. It's crucial to attach all required documents and correctly fill out each section of the form to avoid unnecessary delays or rejection of the application.

Obtain Clarifications on Georgia 500 Nol

- What is Georgia Form 500-NOL?

- Who needs to file Form 500-NOL?

- When should Georgia Form 500-NOL be filed?

- Do I need to attach any documents when filing Form 500-NOL?

- Copy of the Federal Application for Net Operating Loss.

- Copy of the Federal return for the loss year, including relevant schedules.

- Copy of the Federal returns for the carryback years, if applicable, with recalculated schedules.

- Copy of Georgia returns for the carryback or carryforward years.

- Copy of Georgia Form 500 for the loss year.

- Can Form 500-NOL be used to amend a previously filed return?

- What if I have a net operating loss but no federal NOL?

- What is the carryback and carryforward period for an NOL in Georgia?

- Is there a penalty for failing to properly file Form 500-NOL?

- What happens if my claim for a net operating loss carryback or carryforward is denied?

Georgia Form 500-NOL, known as the Net Operating Loss Adjustment form, is a document used by individuals and fiduciaries to adjust their taxable income for a net operating loss (NOL) carryback or carryforward. This form allows taxpayers to apply a net operating loss from the current year to past or future years' tax returns, potentially resulting in a tax refund or reduced tax liability.

Individuals or fiduciaries in Georgia who have experienced a net operating loss and wish to apply this loss to previous or future taxable years are required to file Form 500-NOL. This includes those who have losses from business activities, casualties, or farming operations.

Georgia Form 500-NOL must be filed no later than 3 years from the due date of the loss year's income tax return, including any extensions. If the taxpayer is carrying forward the loss, the form should be filed by the due date (including extensions) of the loss year return to establish the NOL in the Department’s system.

Ensuring all required documents are attached is crucial for the processing of your Form 500-NOL.

No, Georgia Form 500-NOL should not be used to amend a previously filed return. It is specifically designed for adjusting net operating losses. For amending a return, taxpayers should use Form 500X.

If there is a Georgia net operating loss (NOL) but no federal NOL, taxpayers may elect to carry forward the loss for Georgia purposes only. This election must follow the same rules and restrictions applicable to the federal election, and a statement to this effect should be attached to the Georgia return.

For losses incurred in taxable years ending on or before December 31, 2017, the carryback period is generally 2 years, with specific rules allowing different periods for certain types of losses. For losses incurred in taxable years ending after December 31, 2017, there is no carryback period (with an exception for farmers) and an unlimited carryover period. However, the net operating loss cannot offset more than 80% of Georgia taxable net income for losses from years beginning on or after January 1, 2018.

Failure to properly complete and file Form 500-NOL with the required attachments can result in the disallowance of the net operating loss adjustment. This could affect the taxpayer’s ability to claim a refund or reduce tax liability based on the NOL.

Should the Georgia Department of Revenue deny the claim, taxpayers have the right to appeal the decision. Detailed instructions on how to appeal can be found on the Department’s website or by contacting the Department directly. It’s essential to keep thorough records to support the NOL claim during the appeal process.

Common mistakes

When filling out the Georgia Form 500-NOL, Net Operating Loss Adjustment for Individuals and Fiduciaries, several common mistakes can lead to processing delays or errors in the calculation of the net operating loss (NOL). Identifying and avoiding these mistakes ensures smoother processing and accurate adjustment claims.

-

Not attaching a complete copy of the federal return for the loss year: Applicants often forget to include a complete copy of their federal return for the loss year, which is crucial for verifying the NOL claimed on the Georgia Form 500-NOL.

-

Incorrect Social Security Number (SSN) or Federal Employer Identification Number (FEIN) entries: Providing incorrect or incomplete SSN or FEIN details can lead to misidentification and processing delays.

-

Failure to check the address change box when applicable: If the address has changed since the last filing, not checking the designated box might result in important correspondences being missed or delayed.

-

Miscalculating the net operating loss: Errors in calculating the NOL amount, not considering the specific instructions or limitations set by the Georgia Department of Revenue, can lead to incorrect adjustment claims.

-

Not specifying the type of loss: The form requires specifying the type of loss (e.g., normal, casualty loss, farm loss, etc.), and failing to do so or selecting the incorrect type can affect the eligibility and calculation of the NOL.

-

Omitting necessary schedules or documents: Forgetting to attach a copy of the federal application for NOL adjustment, or other required documents, can result in the rejection or delay of the NOL adjustment request.

-

Not accurately completing the residency and filing status sections: Overlooking or inaccurately filling these sections can lead to incorrect processing of the NOL adjustment, especially for part-year residents and nonresidents.

Documents used along the form

When dealing with the intricacies of net operating losses (NOLs) in Georgia, it's essential to comprehend the supplementary forms and documents that frequently accompany the Georgia Form 500-NOL. This form is pivotal for individuals and fiduciaries aiming to adjust their income due to a net operating loss. However, navigating through this process efficiently often requires gathering and submitting additional forms that support your NOL claim. Here, we will illuminate some of these essential documents to ensure a smoother, more informed filing process.

- Copy of the Federal Application for Net Operating Loss (Form 1045 or Form 1139): This is essential as it substantiates the NOL adjustment on your federal return, which Georgia requires for parallel consideration.

- Copy of Federal Return for the Loss Year: Including pages 1 and 2, along with Schedules 1, A, D, and E. This comprehensive snapshot provides a basis for your NOL claim by detailing the origin and amount of the loss.

- Copy of Federal Returns for the Carryback Years: This includes the same pages and schedules as the loss year return. These documents are crucial when you're applying an NOL to previous tax years, showing the impact of the loss on those earlier filings.

- Copy of Georgia Returns for the Carryback or Carryforward Years: This helps in verifying the adjustment's accuracy against your state filings and ensuring that the NOL application aligns with Georgia's specific requirements.

- Georgia Form 500: For the loss year, ensuring that all required forms, including the NOL form, are duly attached, supports the state-level review of your NOL claim.

- Election Statement: If you opt to forego the carryback period and instead carry the NOL forward, an election statement is crucial. This document, attached to your Georgia return, outlines your decision in line with both federal and state tax provisions.

Navigating the documentation for a net operating loss can be daunting, but understanding these ancillary forms makes the process more navigable. Each document serves a specific function, from proving the loss occurred to showing its impact on both federal and state returns. It's this holistic approach that provides the Georgia Department of Revenue with a comprehensive view of your NOL and its rightful application, ensuring that you can leverage tax relief opportunities fully. Remember, meticulous preparation and documentation are key to a successful NOL adjustment process.

Similar forms

- Form 1045 (Application for Tentative Refund): Similar to Georgia Form 500-NOL, the Form 1045 is used by taxpayers to apply for a quick refund resulting from the carryback of an NOL, unused credits, or overpayments. Both forms involve calculating NOLs and attaching prior year returns, though Form 1045 is for federal taxes.

- Form 1040X (Amended U.S. Individual Income Tax Return): Like the 500-NOL, this form amends a previous tax return. However, Form 1040X is used to correct forms 1040, 1040-A, 1040-EZ, 1040-NR, or 1040-NR EZ, not just for NOL carrybacks or carryforwards.

- Form 1040 (U.S. Individual Income Tax Return): The connection here is that both the Georgia 500-NOL and the Form 1040 involve reporting income, deductions, and taxes. Information from a federal Form 1040 may be necessary to complete the 500-NOL, especially regarding the NOL calculation.

- Form 540X (Amended Individual Income Tax Return for California): Similarly used to amend previously filed state income tax returns, this form, like the 500-NOL, involves recalculating taxes owed or refundable due to changes, such as NOL adjustments, albeit for California taxpayers.

- Form 1120X (Amended U.S. Corporation Income Tax Return): This form is the corporate equivalent of an amended return, like the 500-NOL for individual and fiduciary adjustments in Georgia, Form 1120X addresses changes in income, deductions, and credits for corporations.

- Schedule A (Itemized Deductions): While Schedule A is a component of the Form 1040, it's related to 500-NOL in that deductions can affect the calculation of taxable income and subsequently the net operating loss.

- Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.): This form reports a partner's share of a partnership's income, deductions, and credits. Like the 500-NOL, it deals with adjustments to income that could influence an individual's NOL calculations.

- Form 8582 (Passive Activity Loss Limitations): This form and the 500-NOL are connected through the treatment of losses. Form 8582 is used to compute passive activity loss (PAL) limitations, which can also affect an individual's NOL.

- Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return): While primarily a filing extension form, it shares relevance with the 500-NOL as obtaining an extension impacts the submission deadline for NOL adjustments.

- Form 8824 (Like-Kind Exchanges): Form 8824 is used to report like-kind exchanges, which can affect taxable income and potentially NOL calculations, tying it back to the relevance of the 500-NOL for individuals and fiduciaries tracking income adjustments.

Dos and Don'ts

When filling out the Georgia Form 500-NOL for Net Operating Loss Adjustment, it's important to take careful steps to ensure accuracy and compliance with the state's tax laws. Here are several do's and don'ts to consider:

- Do attach a complete copy of your federal return for the loss year. This is crucial for validation and calculation purposes.

- Don't overlook the requirement to attach a copy of your federal application for NOL adjustment. This document is essential for processing your Georgia Form 500-NOL.

- Do make sure all personal information is accurate and up-to-date, including your SSN or FEIN, and update your address if it has changed.

- Don't forget to indicate the type of loss (normal, casualty loss, farm loss, etc.) and specify the year(s) the loss applies to.

- Do check the box if your loss is only being carried forward and not applied to past tax years. This will ensure the form is processed correctly.

- Don't submit the form without reviewing the instructions on page 4, especially if you are a part-year resident or nonresident, as special instructions apply.

- Do sign and date the form. If filled out by a preparer other than the taxpayer, ensure the preparer's information is included and that the taxpayer authorizes the Georgia Department of Revenue to discuss the return with the preparer.

Remember, the Georgia Form 500-NOL is a critical document for individuals and fiduciaries dealing with net operating losses. By following these recommendations, you can avoid common mistakes and help ensure your form is processed efficiently and accurately.

Misconceptions

Understanding the Georgia Form 500-NOL, the Net Operating Loss Adjustment for individuals and fiduciaries, can sometimes be complex, leading to numerous misconceptions. Let's discuss and clarify some common misunderstandings:

Only for businesses: A common misconception is that the Georgia Form 500-NOL is exclusively for businesses. In reality, both individuals and fiduciaries can use this form to adjust their taxes due to a net operating loss.

Mandatory carryback: There's a belief that losses must always be carried back. While generally, net operating losses should be carried back before being carried forward, there are exceptions. For taxable years ending after December 31, 2017, Georgia has no carryback for losses, with specific exceptions, such as a two-year carryback for farmers.

Unlimited carryforward: A common mistake is thinking that loss carryforwards are unlimited in time. The truth is, for losses incurred in taxable years beginning on or after January 1, 2018, Georgia does not limit the carryforward period. However, the application of losses is subjected to the 80% rule, restricting the offset of Georgia taxable net income.

No attachment needed: It's erroneously believed that no documents need to be attached with the Form 500-NOL. In fact, taxpayers are required to attach a complete copy of their federal return for the loss year, among other documents, to support their claim.

Use of Form 500X: Another misunderstanding is that Form 500X should be used for carrying back a NOL. Actually, Form 500-NOL must be used for this purpose to ensure the loss is properly recorded and adjusted in the Department's system.

Immediate refund entitlement: Some may think filing Form 500-NOL immediately entitles them to a refund. The process involves a limited examination by the Commissioner of Revenue to confirm the validity of the claim and computation.

Ignoring federal conformity: There's a misconception that Georgia's NOL rules are entirely separate from federal regulations. While there are differences, Georgia generally follows the Internal Revenue Code with specified exceptions, making understanding federal NOL regulations relevant for Georgia taxpayers.

No need to specify type of loss: Taxpayers might overlook the requirement to specify the type of loss (e.g., normal, casualty, farm loss) on the form. This detail is crucial for accurate processing and adherence to varying carryforward and carryback rules.

Electing out of carryback is automatic: Some believe that the election to forgo the carryback period doesn't need to be explicitly made. In reality, taxpayers must make this election on their federal return and reflect it on their Georgia return to carry the NOL forward instead.

Addressing these misconceptions is essential for taxpayers to accurately fulfill their obligations and possibly benefit from the net operating loss provisions under Georgia tax law.

Key takeaways

When managing Georgia Form 500-NOL for Net Operating Loss Adjustment, individuals and fiduciaries need to adhere to specific guidelines to ensure accurate and timely processing. Here are six key takeaways to guide you through this process:

- Ensure a complete copy of the federal return for the loss year is attached. This is required to provide context for the net operating loss (NOL) being reported on Georgia Form 500-NOL.

- Remember to attach a copy of your federal application for NOL adjustment. This document is crucial for verifying the details of the loss you're adjusting.

- For part-year and nonresidents, special instructions provided on page 4 of the form must be followed to accurately adjust your net operating loss. These instructions help tailor the adjustment process to specific taxpayer situations, ensuring fairness and accuracy.

- The ability to carry back losses varies depending on the year the loss was incurred. The form outlines specific rules for losses incurred before and after December 31, 2017, including cases with no carryback and indefinite carryforward for certain losses.

- Georgia Form 500-NOL needs to be filed by the due date (including extensions) of the loss year return even if the loss is only being carried forward. This ensures the NOL is recorded properly in the Department of Revenue’s system.

- All lines on Form 500-NOL that apply must be completed accurately, and all required forms listed in the instructions should be attached. Incomplete submissions or missing information could result in the disallowance of the application.

It's important for taxpayers to familiarize themselves with these guidelines to ensure smooth processing of their NOL adjustments in Georgia.

Popular PDF Forms

Ga 1099 Form - Comprehensive and user-friendly, the Georgia Tax Wage Report form simplifies the payroll reporting process for businesses.

Georgia Lottery Retailer - Understand the importance of providing accurate and truthful information in your application to avoid any potential repercussions or contract cancellations.