Free Georgia 500 Template in PDF

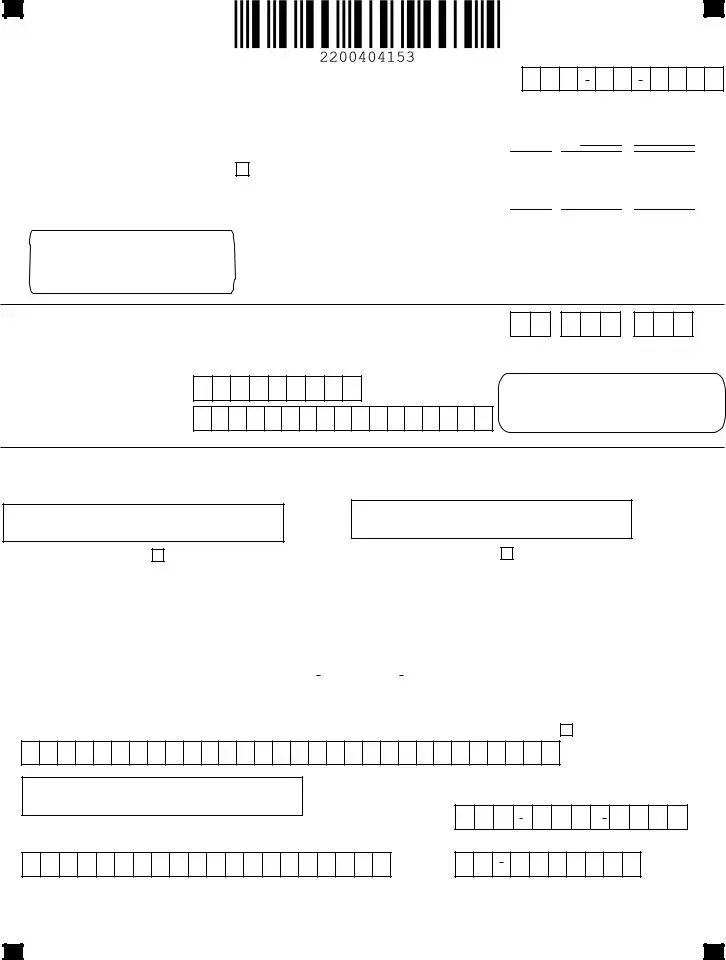

Filing taxes is a civic duty that, while sometimes complex, is made smoother by understanding the necessary forms, such as the Georgia Form 500 for individual income tax returns. Revised on June 20, 2020, and approved for web submission, this form is integral for Georgia residents to correctly report their income to the Georgia Department of Revenue. It encompasses various sections that cater to diverse filing needs—whether one is a full-year resident, a part-year resident, or a nonresident. The form requires detailed personal and financial information, including social security numbers, residency status, income calculations, and potential deductions and credits. Designed to ensure taxpayers can claim all applicable allowances, the Georgia Form 500 also includes provisions for standard and itemized deductions, exemptions for dependents, and specifics on income adjustments. Moreover, it addresses various credits and prepayment credits toward the taxpayer's obligation, alongside options for designating refunds to specific funds or future estimated taxes, illustrating a comprehensive tool for managing one’s income tax responsibilities in the state.

Form Sample

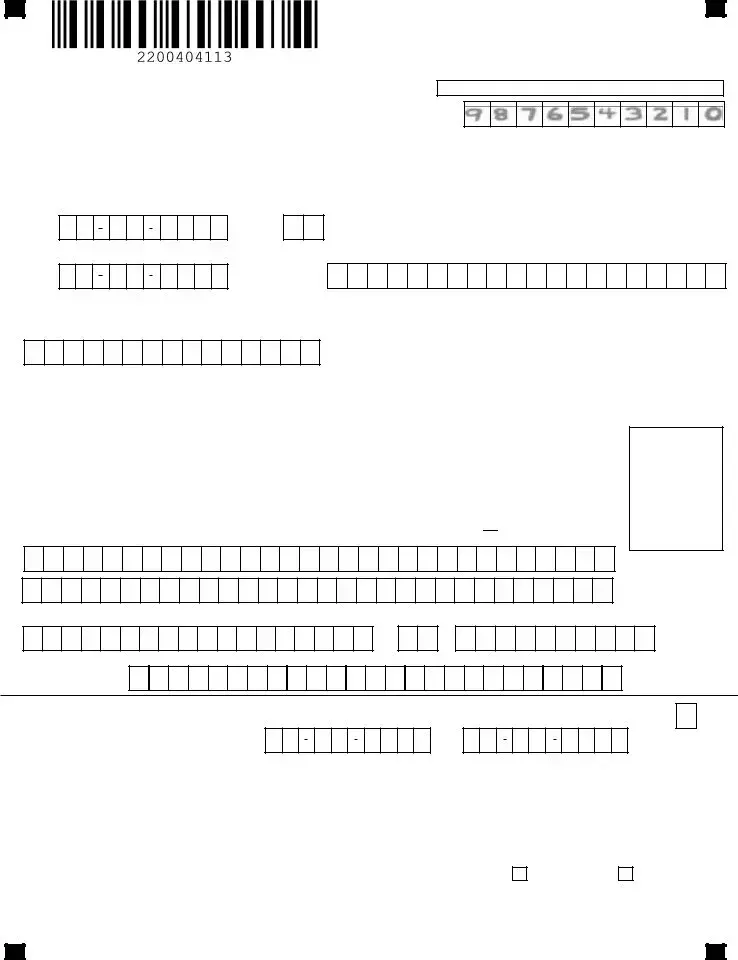

Georgia Form 500 (Rev. 08/02/21) Individual Income Tax Return

Georgia Department of Revenue

2021(Approved web2 version)

Please print your numbers like this in black or blue ink:

Page 1

Fiscal Year

Beginning

Fiscal Year

Ending

YOUR FIRST NAME

1.

STATE

ISSUED

YOUR DRIVER’S

LICENSE/STATE ID

MI |

YOUR SOCIAL SECURITY NUMBER |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME (For Name Change See |

SUFFIX |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S FIRST NAME |

|

|

|

|

|

|

|

|

|

|

MI |

|

SPOUSE’S SOCIAL SECURITY NUMBER |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUFFIX |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS (NUMBER AND STREET or P.O. BOX) (Use 2nd address line for Apt, Suite or Building Number)

CHECK IF ADDRESS HAS CHANGED

CHECK IF ADDRESS HAS CHANGED

2.

DEPARTMENT USE ONLY

CITY (Please insert a space if the city has multiple names) |

STATE |

ZIP CODE |

3.

(COUNTRY IF FOREIGN)

|

ResidencyStatus |

4. Enter your Residency Status with the appropriate number |

4. |

1. FULL- YEAR RESIDENT 2. PART- YEAR RESIDENT

TO

3. NONRESIDENT

Omit Lines 9 thru 14 and use Form 500 Schedule 3 if you are a

|

|

|

Filing Status |

|

||

5. |

Enter Filing Status with appropriate letter (See IT - 511 Tax Booklet) |

|

|

|

||

|

A.Single B.Marriedfilingjoint C.Marriedfilingseparate(Spouse’ssocialsecuritynumbermustbeenteredabove) |

|

|

|

||

|

D.HeadofHouseholdorQualifyingWidow(er) |

|

||||

|

|

|

|

|

|

|

6. |

Number of exemptions (Check appropriate box(es) and enter total in 6c.) 6a. Yourself |

6b. Spouse |

6c. |

|

|

|

7a. Number of Dependents (Enter details on Line 7b., and DO NOT include yourself or your spouse) |

|

7a. |

|

|

||

|

|

|||||

PAGES

Georgia Form 500

Individual Income Tax Return

Georgia Department of Revenue |

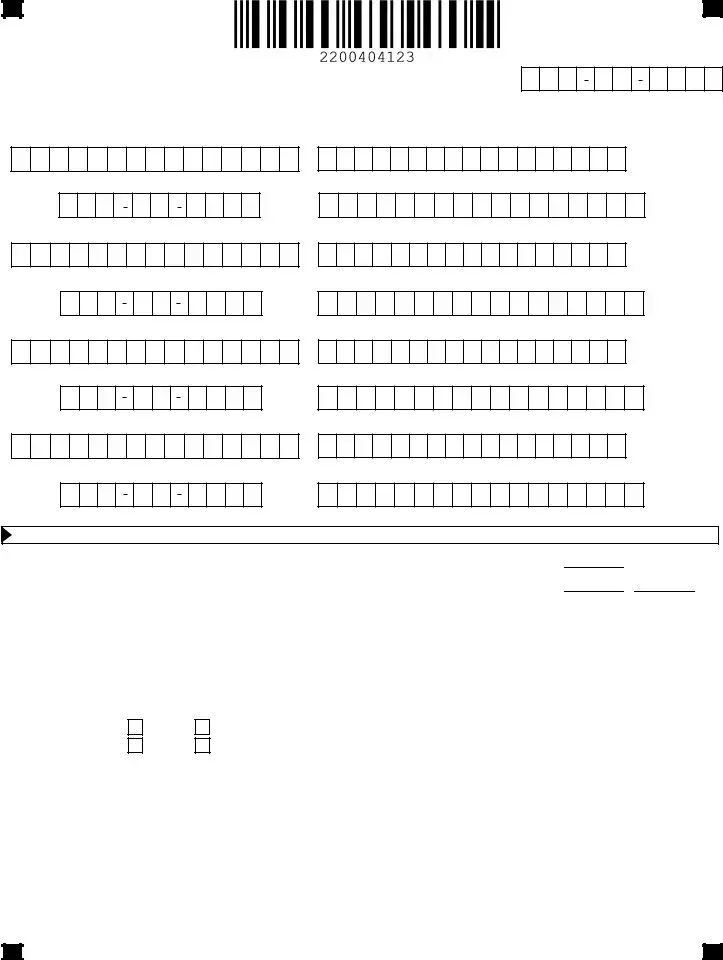

YOUR SOCIAL SECURITY NUMBER |

2021

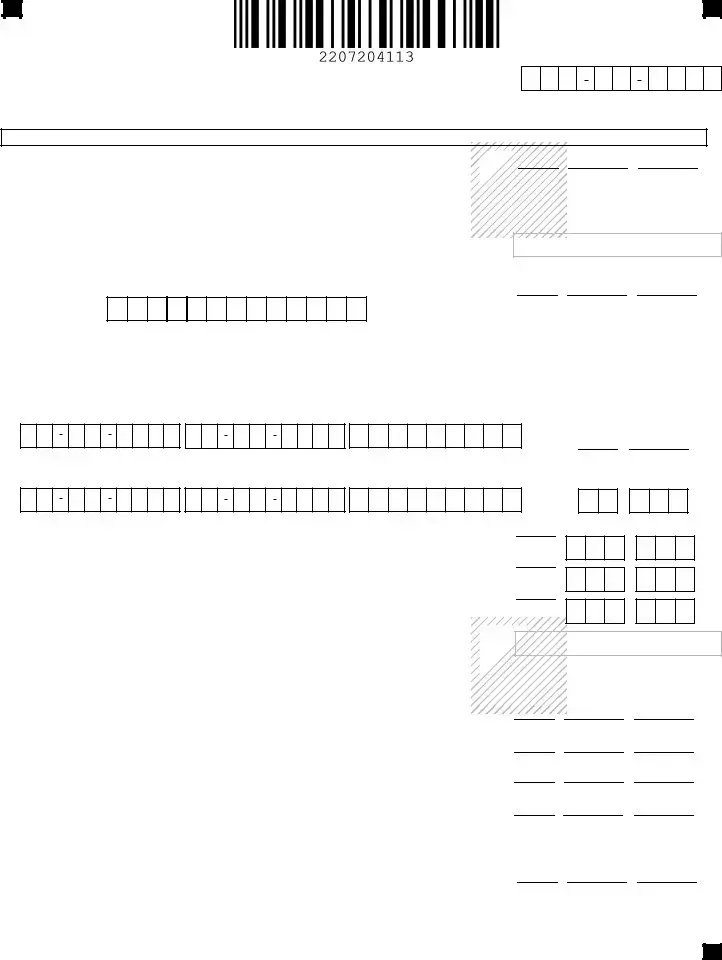

Page 2

7b. Dependents (If you have more than 4 dependents, attach a list of additional dependents)

First Name, MI.

Social Security Number

First Name, MI.

Social Security Number

First Name, MI.

Social Security Number

First Name, MI.

Social Security Number

Last Name

Relationship to You

Last Name

Relationship to You

Last Name

Relationship to You

Last Name

Relationship to You

INCOME COMPUTATIONS

If amount on line 8, 9, 10, 13 or 15 is negative, use the minus sign

.....................................8. Federal adjusted gross income (From Federal Form 1040) |

8. |

|

|

, |

|

|

|

|

,

,

.00

.00

(Do not use FEDERAL TAXABLE INCOME) If the amount on Line 8 is $40,000 or more, or your gross income is less than your |

|

|

|

||||||||||||||

|

|

, |

|

|

|

, |

|

|

|

. |

00 |

||||||

9. Adjustments from Form 500 Schedule 1 (See |

9. |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

, |

|

|

|

.00 |

||||

.............................10. Georgia adjusted gross income (Net total of Line 8 and Line 9) |

10. |

|

|

, |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

..............11. Standard Deduction (Do not use FEDERAL STANDARD DEDUCTION) |

11a. |

|

|

|

|

|

, |

|

|

|

.00 |

||||||

(See |

|

|

|

11b. |

|

|

|

|

|

, |

|

|

|

.00 |

|||

b. Self: 65 or over? |

Blind? |

Total |

|

x 1,300= |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||||

Spouse: 65 or over? |

Blind? |

|

|

|

11c. |

|

|

|

|

|

, |

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|||||||

c. Total Standard Deduction (Line 11a + Line 11b) |

|

|

|

|

|

|

|

|

|

|

|||||||

Use EITHER Line 11c OR Line 12c (Do not write on both lines)

12. Total Itemized Deductions used in computing Federal Taxable Income. If you use itemized deductions, you must include Federal Schedule A.

a. Federal Itemized Deductions (Schedule A- Form 1040) |

12a. |

b. Less adjustments: (See |

12b. |

c. Georgia Total Itemized Deductions |

12c. |

13. Subtract either Line 11c or Line 12c from Line 10; enter balance |

13. |

|

|

|

, |

|

|

|

, |

|

|

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

, |

|

|

|

, |

|

|

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

, |

|

|

|

|

, |

|

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

PAGES

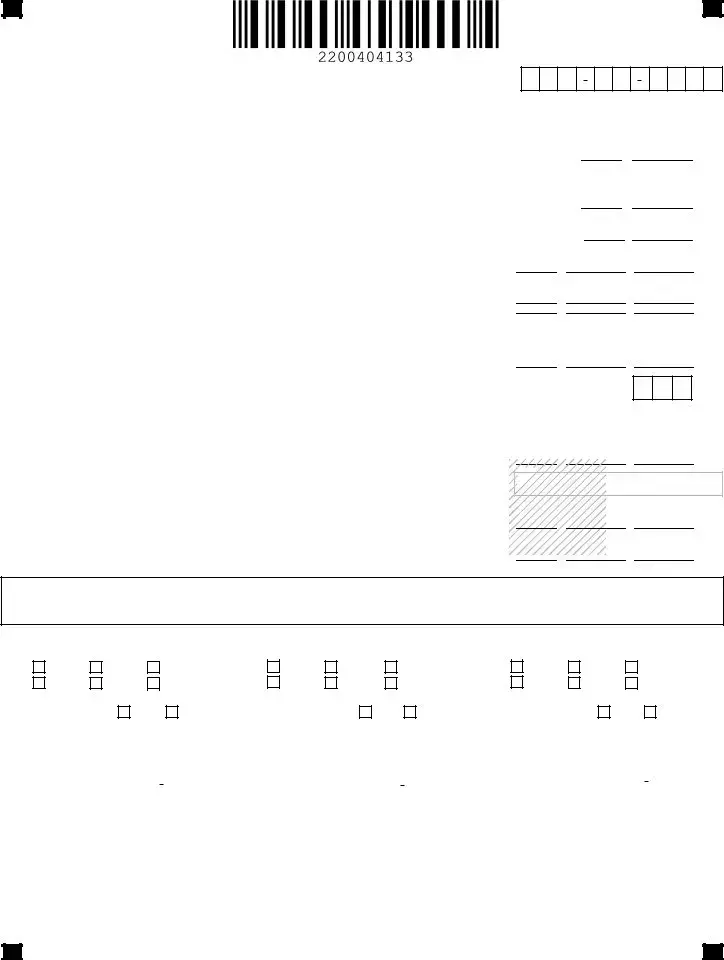

Georgia Form 500

Individual Income Tax Return

Georgia Department of Revenue |

YOUR SOCIAL SECURITY NUMBER |

2021

Page 3

14a. Enter the number from Line 6c. |

|

Multiply by $2,700 for filing status A or D 14a. |

or multiply by $3,700 for filing status B or C

,

,

.00

.00

14b. Enter the number from Line 7a. |

|

|

|

Multiply by $3,000 |

.......................................... |

14b. |

||||||

|

|

|

|

|||||||||

14c. Add Lines 14a. and 14b. Enter total |

|

|

|

|

|

14c. |

||||||

15a. Income before GA NOL (Line 13 less Line 14c or Schedule 3, Line 14) |

15a. |

|||||||||||

15b. Georgia NOL utilized (Cannot exceed Line 15a or the amount after |

|

|||||||||||

|

applying the 80% limitation, see |

....15b. |

||||||||||

15c. Georgia Taxable Income (Line 15a less Line 15b) |

15c. |

|||||||||||

16. |

Tax (Use Tax Table or Tax Rate Schedule in the |

16. |

||||||||||

17. |

Low Income Credit |

17a. |

|

|

17b. |

|

|

........................ |

17c. |

|||

|

|

|

|

|

||||||||

18. |

Other State(s) Tax Credit (Include a copy of the other state(s) return) |

18. |

||||||||||

19. |

Credits used from |

19. |

||||||||||

20.Total Credits Used from Schedule 2 Georgia Tax Credits (must be filed 20. electronically)

21. |

Total Credits Used (sum of Lines |

21. |

22. |

Balance (Line 16 less Line 21) if zero or less than zero, enter zero |

22. |

,

,

.00

.00

,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

, ,

,

.00

.00

,

,

,

, .00

.00

INCOME STATEMENT DETAILS Only enter income on which Georgia tax was withheld. Enter income from

|

|

(INCOME STATEMENT A) |

|

|

(INCOME STATEMENT B) |

|

|

|

|

|

|

|

|

|

(INCOME STATEMENT C) |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

1. |

WITHHOLDING TYPE: |

|

|

|

|

|

|

|

|

|

|

|

1. |

WITHHOLDING TYPE: |

|

|

|

|

|

|

|

|

|

|

|

1. |

WITHHOLDING TYPE: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

1099 |

|

|

|

|

|

|

|

1099 |

|

|

|

|

1099 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

2. |

EMPLOYER/PAYER FEDERAL |

2. |

EMPLOYER/PAYER FEDERAL |

|

|

|

|

|

|

|

2. |

EMPLOYER/PAYER FEDERAL |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

ID NUMBER (FEIN) |

SSN |

|

ID NUMBER (FEIN) |

|

SSN |

|

|

|

|

|

|

|

|

ID NUMBER (FEIN) |

|

SSN |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. EMPLOYER/PAYER STATE WITHHOLDING ID |

3. |

EMPLOYER/PAYER STATE WITHHOLDING ID |

3. EMPLOYER/PAYER STATE WITHHOLDING ID |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. GA WAGES / INCOME |

|

|

|

|

|

|

|

|

|

.00 |

4. GA WAGES / INCOME |

|

|

|

|

|

|

|

|

|

.00 |

4. GA WAGES / INCOME |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

.00 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

5.GA TAX WITHHELD

,

,

,

,

5. |

GA TAX WITHHELD |

|

|

|

|

|

5. GA TAX WITHHELD |

|

|

|

|

.00 |

|||||||||||

.00 |

|

|

, |

|

|

|

, |

|

|

|

.00 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

PLEASE COMPLETE INCOME STATEMENT DETAILS ON PAGE 4.

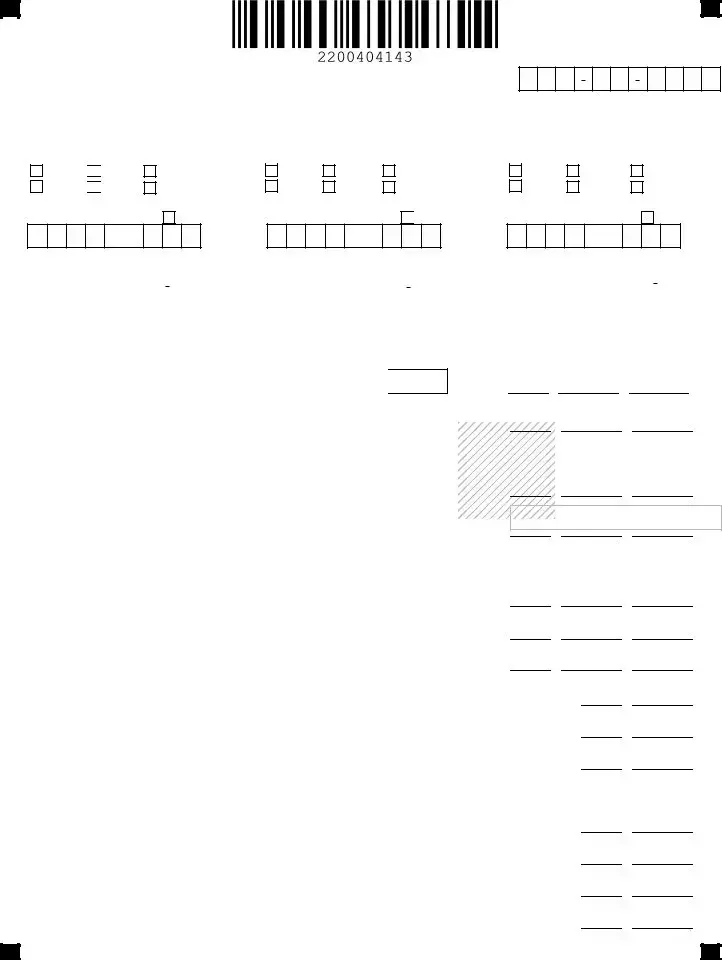

PAGES

Georgia Form 500 |

|

Individual Income Tax Return |

|

Georgia Department of Revenue |

YOUR SOCIAL SECURITY NUMBER |

|

2021

Page 4

(INCOME STATEMENT D)

1.WITHHOLDING TYPE:

1099

2.EMPLOYER/PAYER FEDERAL

ID NUMBER (FEIN) |

|

SSN |

|

|

|

(INCOME STATEMENT E)

1.WITHHOLDING TYPE:

|

||||||

1099 |

|

|||||

2. |

EMPLOYER/PAYER FEDERAL |

|||||

|

ID NUMBER (FEIN) |

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

(INCOME STATEMENT F) |

|||||

1. |

WITHHOLDING TYPE: |

|

|||||

|

|||||||

1099 |

|

||||||

2. |

EMPLOYER/PAYER FEDERAL |

||||||

|

|

ID NUMBER (FEIN) |

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

3. EMPLOYER/PAYER STATE WITHHOLDING ID |

3. |

EMPLOYER/PAYER STATE WITHHOLDING ID |

3. EMPLOYER/PAYER STATE WITHHOLDING ID |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. GA WAGES / INCOME |

|

|

|

|

|

|

|

|

.00 |

GA WAGES / INCOME |

|

|

|

|

|

|

|

|

|

|

4. GA WAGES / INCOME |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

.00 |

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

5. |

GA TAX WITHHELD |

|

|

|

|

.00 |

5. GA TAX WITHHELD |

|

|

|

|

|||||||||||

23. |

|

|

, |

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Georgia Income Tax Withheld on Wages and 1099s |

23. |

|||||||||||||||||||||

|

(Enter Tax Withheld Only and include |

|

|

|

|

|||||||||||||||||

24. |

Other Georgia Income Tax Withheld |

|

|

|

|

|

|

24. |

||||||||||||||

|

(Must include |

|

|

|

|

|||||||||||||||||

25. Estimated Tax paid for 2021 and Form |

25. |

|||||||||||||||||||||

26. |

Schedule 2B Refundable Tax Credits |

|

|

|

|

|

|

26. |

||||||||||||||

|

(Cannot be claimed unless filed electronically) |

|

|

|

|

|||||||||||||||||

27. Total prepayment credits (Add Lines 23, 24, 25 and 26) |

27. |

|||||||||||||||||||||

28. If Line 22 exceeds Line 27, subtract Line 27 from Line 22 and enter |

|

|

|

|

||||||||||||||||||

|

balance due |

|

|

|

|

|

|

|

|

|

|

|

28. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

29. If Line 27 exceeds Line 22, subtract Line 22 from Line 27 and enter |

|

|

|

|

||||||||||||||||||

|

overpayment |

|

|

|

|

|

|

|

|

|

|

|

29. |

|||||||||

30. Amount to be credited to 2022 ESTIMATED TAX |

30. |

|||||||||||||||||||||

31. |

Georgia Wildlife Conservation Fund (No gift of less than $1.00) |

31. |

||||||||||||||||||||

32. Georgia Fund for Children and Elderly (No gift of less than $1.00) |

32. |

|||||||||||||||||||||

33. |

Georgia Cancer Research Fund (No gift of less than $1.00) |

33. |

||||||||||||||||||||

34. |

Georgia Land Conservation Program (No gift of less than $1.00) |

34. |

||||||||||||||||||||

35. |

Georgia National Guard Foundation (No gift of less than $1.00) |

35. |

||||||||||||||||||||

36. Dog & Cat Sterilization Fund (No gift of less than $1.00) |

36. |

|||||||||||||||||||||

37. |

Saving the Cure Fund (No gift of less than $1.00) |

37. |

||||||||||||||||||||

38. |

Realizing Educational Achievement Can Happen (REACH) Program |

38. |

||||||||||||||||||||

|

(No gift of less than $1.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

5.GA TAX WITHHELD

.00

,

,

,

,

.00

.00

,

,

,

, .00

.00

,

, ,

,

.00

.00

,

,

,

, .00

.00

,

, ,

,

.00

.00

,

, ,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, .00

.00

,

,

.00

.00

,

, .00

.00

,

,

.00

.00

,

, .00

.00

,

,

.00

.00

,

, .00

.00

,

,

.00

.00

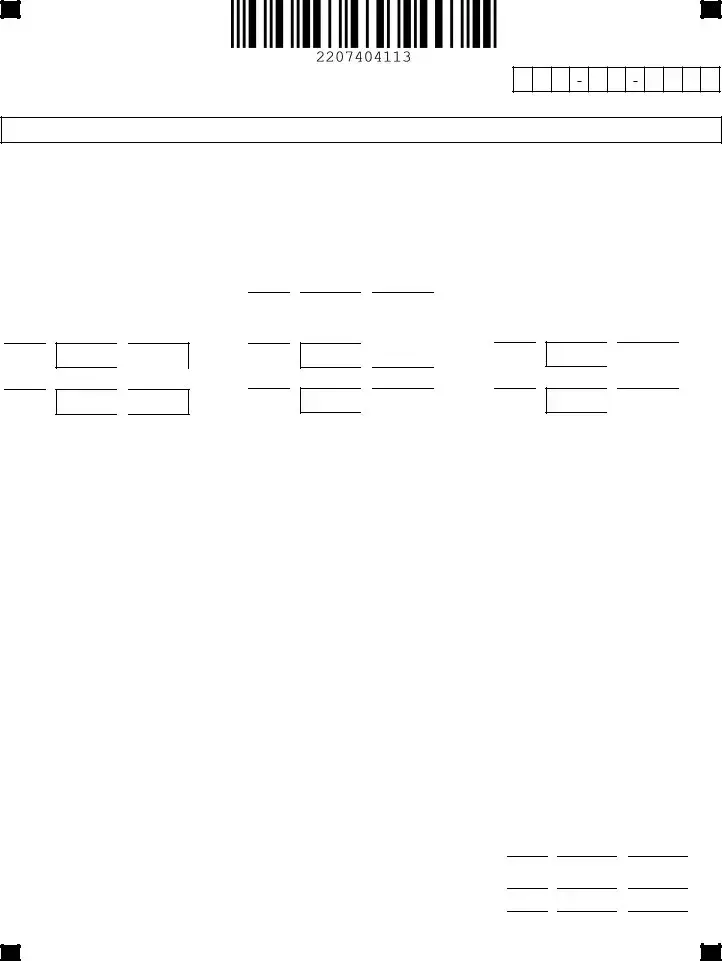

PAGES

Georgia Form 500

Individual Income Tax Return

Georgia Department of Revenue

2021

Page 5

39. |

Public Safety Memorial Grant (No gift of less than $1.00) |

39. |

40. |

Form 500 UET (Estimated tax penalty) 500 UET exception attached |

40. |

41. (If you owe) Add Lines 28, 31 thru 40 |

41. |

|

|

MAKE CHECK PAYABLE TO GEORGIA DEPARTMENT OF REVENUE.. |

|

Amount Due Mail To:

GEORGIA DEPARTMENT OF REVENUE

PROCESSING CENTER, PO BOX 740399

ATLANTA, GA

YOUR SOCIAL SECURITY NUMBER

,

, .00

.00

,

, ,

, .00

.00

,

, ,

, .00

.00

42. (If you are due a refund) Subtract the sum of Lines 30 thru 40 from Line 29 |

|

, |

, |

.00 |

THIS IS YOUR REFUND |

42. |

If you do not enter Direct Deposit information or if you are a first time filer you will be issued a paper check.

42a. Direct Deposit (U.S. Accounts Only)

Type: Checking |

|

Routing |

|

|

Number |

||

|

|

|

|

Savings |

|

|

Account |

|

|

||

|

|

|

|

|

|

|

Number |

Refund Due Mail To:

GEORGIA DEPARTMENT OF REVENUE PROCESSING CENTER, PO BOX 740380 ATLANTA, GA

INCLUDE ALL ITEMS IN ENVELOPE, DO NOT STAPL E YOUR CHECK,

I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer(s), this declaration is based on all information of which the preparer has knowledge.

Taxpayer’s Signature

(Check box if deceased) |

Spouse’s Signature |

(Check box if deceased) |

Taxpayer’s Date of Death |

Spouse’s Date of Death |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s Signature Date |

Taxpayer’s Phone Number |

Spouse’s Signature Date |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By providing my

Taxpayer’s

Signature of Preparer

Name of Preparer Other Than Taxpayer

I authorize DOR to discuss this return with the named preparer.

Preparer’s Phone Number

Preparer’s FEIN

Preparer’s Firm Name |

Preparer’s SSN/PTIN/SIDN |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGES

Georgia Form500 |

(Rev. 08/02/21)

Schedule 1 Page 1

Schedule 1

Adjustments to Income

YOUR SOCIAL SECURITY NUMBER

2021(Approved web2 version)

SCHEDULE 1 ADJUSTMENTS to INCOME BASED on GEORGIA LAW |

See |

ADDITIONS to INCOME

1. |

Interest on |

1. |

2. |

Lump Sum Distributions |

2. |

3. |

Reserved |

3. |

4. Net operating loss carryover deducted on Federal return |

4. |

|

5. |

Other (Specify) |

5. |

6. |

Total Additions (Enter sum of Lines |

6. |

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

,

.00

.00

,

, ,

,

.00

.00  ,

, ,

, .00

.00

SUBTRACTION from INCOME

7. Retirement Income Exclusion (See

a. Self: Date of Birth |

Date of Disability: |

Type of Disability: |

7a.

b. Spouse: Date of Birth |

Date of Disability: |

Type of Disability: |

,

,

.00

.00

8. |

Social Security Benefits (Taxable portion from Federal return) |

8. |

9. |

Path2College 529 Plan |

9. |

10. |

Interest on United States Obligations (See |

10. |

11. |

Reserved |

11. |

12. |

Other Adjustments (Specify) |

|

7b.

,

,

,

,

,

,

, |

.00 |

, |

.00 |

, |

.00 |

, |

.00 |

|

Adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

||

|

Adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Total |

12. |

|||||

|

13. Total Subtractions (Enter sum of Lines |

13. |

||||||||||||||||

|

14. Net Adjustments (Line 6 less Line 13). Enter Net Total here and on |

|

|

|||||||||||||||

|

|

Line 9 of Page 2 (+ or |

14. |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

,

,

,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

,

.00

.00

,

,

,

, .00

.00  ,

,

,

, .00

.00

Georgia Form500 |

Schedule 1

Page 2

(Rev. 08/02/21)

Schedule 1

Adjustments to Income

YOUR SOCIAL SECURITY NUMBER

2021(Approved web2 version)

SCHEDULE 1 RETIREMENT INCOME EXCLUSION |

See |

(TAXPAYER) |

(SPOUSE) |

1.Salary and wages......................................

2.OtherEarnedIncome (Losses).....................

3.TotalEarnedIncome....................................

4. Maximum EarnedIncome...........................

5.Smaller of Line 3 or 4; if zero or less, enter zero ..........................................................

6. Interest Income.........................................

7.DividendIncome .......................................

8.Alimony......................................................

9.CapitalGains (Losses)...............................

10. Other Income (Losses)..............................

(See

11. Taxable IRA Distributions.........................

12. TaxablePensions .....................................

13.Rental,Royalty,Partnership, S Corp, etc. Income(Losses).....(See

14.TotalofLines6through 13; if zero or less, enter zero ................................................

15.AddLines5 and14 ....................................

16.MaximumAllowable Exclusion* ..................

17.SmallerofLines15and16;enterhere and on Form 500, Schedule 1, Lines 7a. & b........

,

,

,

, .00

.00

,

, ,

, .00

.00

,

,

,

, .00

.00

,

4 , 0 0 0 .00

4 , 0 0 0 .00

,

, ,

, .00

.00

,

, ,

,

.00

.00

,

,

,

,

.00

.00

,

, ,

,

.00

.00

,

,

,

, .00

.00

,

, ,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

,

,

,

.00

.00

,

,

,

,

.00

.00  ,

,

,

, .00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

4 , 0 0 0 .00

4 , 0 0 0 .00

,

,

,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

, ,

, .00

.00

,

, ,

,

.00

.00

,

, ,

, .00

.00

,

,

,

,

.00

.00

,

,

,

, .00

.00

*If age

Georgia Form500 |

(Rev. 08/02/21)

Schedule 3 Page 1

Schedule 3 |

YOUR SOCIAL SECURITY NUMBER |

2021 (Approved web2 version)

DO NOT USE LINES 9 THRU 14 OF PAGES 2 AND 3 FORM 500 or 500X

SCHEDULE 3 COMPUTATION OF GEORGIA TAXABLE INCOME FOR ONLY

Income earned in another state as a Georgia resident is taxable but other state(s) tax credit may apply. See

FEDERAL INCOME AFTER GEORGIA ADJUSTMENT |

INCOME NOT TAXABLE TO GEORGIA |

GEORGIA INCOME |

(COLUMN A) |

(COLUMN B) |

(COLUMN C) |

1.WAGES, SALARIES, TIPS,etc

,

,

,

,

.00 |

1. WAGES, SALARIES, TIPS,etc |

.00 |

1. WAGES, SALARIES, TIPS,etc |

.00 |

||||||||||||||||||||

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

2. INTEREST AND DIVIDENDS |

|

2. INTEREST AND DIVIDENDS |

.00 |

2. INTEREST AND DIVIDENDS |

.00 |

|||||||||||||||||||||||||||||

|

|

, |

|

|

|

, |

|

|

|

.00 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

3. BUSINESS INCOME OR (LOSS) |

3. BUSINESS INCOME OR (LOSS) |

3. BUSINESS INCOME OR (LOSS) |

,

,

,

,

4.OTHER INCOME OR (LOSS)

.00  ,

, ,

, .00

.00  ,

, ,

, .00

.00

4. OTHER INCOME OR (LOSS) |

4. OTHER INCOME OR (LOSS) |

,

,

,

,

.00

.00

,

,

,

, .00

.00  ,

,

,

,

.00

.00

5. TOTAL INCOME: TOTAL LINES 1 THRU 4 |

5. TOTALINCOME: TOTAL LINES 1 THRU 4 |

5. TOTAL INCOME: TOTAL LINES 1 THRU 4 |

,

,

,

,

.00  ,

,

,

, .00

.00  ,

,

,

,

.00

.00

6. |

TOTAL ADJUSTMENTS FROM FORM 1040 |

6. |

TOTAL ADJUSTMENTS FROM FORM 1040 |

6. |

TOTAL ADJUSTMENTS FROM FORM 1040 |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

, |

|

|

|

, |

|

|

|

.00 |

|

|

|

|

, |

|

|

|

, |

|

|

|

.00 |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. |

TOTAL ADJUSTMENTS FROM FORM 500, |

|

7. |

TOTAL ADJUSTMENTS FROM FORM 500, |

|

7. |

|

TOTAL ADJUSTMENTS FROM FORM 500, |

|

||||||||||||||||||||||||||||||

|

|

SCHEDULE 1 |

, |

|

|

|

.00 |

|

|

SCHEDULE 1 |

, |

|

|

|

.00 |

|

|

SCHEDULE 1 |

, |

|

|

|

|

.00 |

|||||||||||||||

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8. |

ADJUSTED GROSS INCOME: |

|

8. |

ADJUSTED GROSS INCOME: |

|

8. |

|

ADJUSTED GROSS INCOME: |

|

||||||||||||||||||||||||||||||

|

|

LINE 5 PLUS OR MINUS LINES 6AND 7 |

|

|

|

LINE 5 PLUS OR MINUS LINES 6AND 7 |

|

|

|

LINE 5 PLUS OR MINUS LINES 6 AND 7 |

|

||||||||||||||||||||||||||||

,

,

,

, .00

.00  ,

, ,

, .00

.00

9. RATIO: Divide Line 8, Column C by Line 8, Column A enter percentage .......

10a. Itemized |

|

or Standard Deduction |

|

........................................................(See |

|

|

||||||||

|

|

|

|

|

||||||||||

10b. Additional Standard Deduction |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||||||

Self: 65 or over? |

|

|

Blind? |

|

Spouse: 65 or over? |

|

Blind? |

|

Total |

|

X 1,300= |

|||

11. Personal Exemptions from Form 500 or Form 500X (See

11a. Enter the number on Line 6c from Form 500 or Form 500X |

|

multiply by $2,700 for |

filing status A or D or multiply by $3,700 for filing status B or C |

|

|

|

|

|

11b. Enter the number on Line 7a from Form 500 or Form 500X |

|

multiply by $3,000 .. |

12.Total Deductions and Exemptions: Add Lines 10a, 10b, 11a, and 11b

13.Multiply Line 12 by Ratio on Line 9 and enter result............................................

14.Income before GA NOL: Subtract Line 13 from Line 8, Column C

Enter here and on Line 15a, Page 3 of Form 500 or Form 500X....................................

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

||||||

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Not to exceed 100% |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||||

|

|

|

|

, |

|

||||||||||||||||||||

10a. |

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|||||||||||||||||||||

10b. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

. |

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11a. |

|

|

|

, |

|

|

|

, |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

.00 |

|

11b. |

|

|

|

, |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

, |

|

|

|

|

.00 |

|

12. |

|

|

|

, |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

13.

,

,

,

, .00

.00

14.

,

,

,

,

.00

.00

|

|

|

|

Page 1 |

|

|

||||||||

Form |

|

|

||||||||||||

State of Georgia Individual Credit Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 (Rev. 08/02/21) (Approved web2 version) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

– Include with Form 500 or 500X, if this schedule is applicable.– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR SOCIAL SECURITY NUMBER |

|

||||||||||||

SCHEDULE 201 Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201

SCHEDULE 201 Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201

Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201

O.C.G.A.§

One

Reinforcements in bathroom walls allowing installation of grab bars around the toilet, tub, and shower, where such facilities are provided.

Light switches and outlets placed in accessible locations.

To qualify for this credit, the disabled person must be permanently disabled and have been issued a permanent parking permit by the Department of Revenue or have been issued a special permanent parking permit by the Department of Revenue.

This credit can be carried forward 3 years. For more information, see Regulation

1. Credit remaining from previous years |

1. |

2.Purchase of a home that contains all four accessibility features OR total of accessibility

features added to retrofit a home (up to $125 per feature) cannot exceed $500 |

|

per residence |

2. |

,

,

,

,

.00

.00

3. Credit used this tax year (enter here and include on

4. Potential carryover to next tax year (Line 1 plus Line 2 less Line 3) |

4. |

,

, . 00

. 00

,

,

. 00

. 00

|

|

|

|

Page 1 |

|

|

||||||||

Form |

|

|

||||||||||||

State of Georgia Individual Credit Form |

|

|

|

|

|

|

|

|

|

|

|

|

||

Georgia Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||

2021 (Rev. 08/02/21) (Approved web2 version) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– Include with Form 500 or 500X, if this schedule is applicable. – |

YOUR SOCIAL SECURITY NUMBER |

|

|||||||||||

SCHEDULE 202 Child and Dependent Care Expense Credit - Tax Credit 202

SCHEDULE 202 Child and Dependent Care Expense Credit - Tax Credit 202

Child and Dependent Care Expense Credit - Tax Credit 202

O.C.G.A. §

1. Amount of child & dependent care expense CREDIT claimed on Federal Form 1040. |

1. |

|

|

|

, |

|

|

|

.00

2.Georgia allowable rate ......................................................................................

3.Allowable Child & Dependent Care Expense Credit (Line 1 x .30)............................

4. Credit used this tax year (enter here and include on

Line 2).....................................................................................................................

2.

3.

4.

30%

,

,

.00

.00

,

, .00

.00

File Overview

| Fact Name | Description |

|---|---|

| Form Type | Georgia Form 500 is an Individual Income Tax Return. |

| Issuing Body | The form is issued by the Georgia Department of Revenue. |

| Revision Date | The form was last revised on June 20, 2020. |

| Processing Requirement | All pages (1-5) of the form are required for processing. |

| Governing Law | The form is governed by the Georgia Public Revenue Code Section 48-2-31 regarding lawful payment of taxes. |

Guide to Using Georgia 500

Filling out the Georgia Form 500, the state's individual income tax return, is a crucial step for residents looking to accurately report their income to the Georgia Department of Revenue. This detailed form covers various sections including personal information, income details, deductions, and credits, ensuring a comprehensive assessment of your fiscal obligations. To efficiently tackle this task, having all necessary documents on hand, such as your W-2s, 1099s, federal income tax return, and any relevant schedules or receipts for deductions and credits, is essential. The following steps will guide you through the process of completing the Georgia Form 500.

- Personal Information:

- Start by entering your first and last name, including a middle initial if applicable. If you have a suffix (e.g., Jr., Sr.), include that as well.

- For your driver’s license or state ID and social security number, fill those in the designated boxes.

- If you're filing jointly, include your spouse’s first name, middle initial, last name, suffix, and social security number.

- Provide your complete address, including any apartment, suite, or building number. Check the box if your address has changed.

- Enter city, state, and ZIP code in their respective fields.

- Residency Status: Select your residency status by entering the appropriate number (1 for full-year resident, 2 for part-year resident, 3 for nonresident).

- Filing Status: Indicate your filing status by entering the letter that corresponds to your situation (e.g., A for single, B for married filing jointly).

- Exemptions: Record the number of exemptions for yourself, your spouse, and total them in box 6c.

- Dependents: In section 7a, list the number of dependents. Provide their first names, middle initials, last names, social security numbers, and relationships to you in section 7b.

- Income Computations:

- Enter your federal adjusted gross income from your Federal Form 1040.

- Record adjustments from Form 500 Schedule 1 to find your Georgia adjusted gross income.

- Deductions: Choose between the standard deduction or itemized deductions and fill in the amount.

- Tax Computation: Use your taxable income to find your tax from the tax table in the IT-511 Tax Booklet.

- Credits: List any applicable credits, including low income and other state's tax credit. Total your credits.

- Income Statement Details: Only fill this in if Georgia tax was withheld on income such as W-2s or 1099s.

- Payments: Include Georgia income tax withheld, other Georgia income tax withheld, estimated tax paid, and any refundable tax credits.

- Refund or Amount You Owe: Calculate whether you have a refund or an amount you owe, and fill in the respective sections.

- Direct Deposit Information: If you're due a refund and prefer direct deposit, fill in your banking information.

- Sign and Date: Both you and your spouse (if filing jointly) must sign and date the form. If a preparer filled out the form, they also need to sign and include their information below your signature.

After completing these steps, review your form carefully to ensure all entered information is accurate and complete. Attach all required schedules, W-2s, 1099s, and other withholding documents. Make sure to include a check for any amount owed, following the payment instructions on the form. Once everything is in order, mail the form to the Georgia Department of Revenue at the address indicated for your return type (refund due or amount owed). Properly submitting the Georgia Form 500 helps ensure your tax obligations are met accurately and on time.

Obtain Clarifications on Georgia 500

- What is Georgia Form 500 and who needs to file it?

- How do you determine your residency status for filing Form 500?

- Full-year resident if you lived in Georgia for the entire tax year or consider it your primary place of residency.

- Part-year resident if you moved to or from Georgia during the tax year, meaning you were not a resident for the entire year.

- Nonresident if you lived outside Georgia but earned income from a Georgia source during the tax year.

- What information do you need to complete Form 500?

- Your federal adjusted gross income (from Federal Form 1040)

- Details on any adjustments to income specific to Georgia

- Information on dependents and exemptions claimed

- Your total income, deductions, and credits to calculate your Georgia taxable income

- Details of any Georgia tax withheld from wages (W-2s, 1099s)

- Any estimated tax payments made to Georgia during the tax year

- Can you claim deductions on Georgia Form 500?

- How do you claim dependents on Georgia Form 500?

- What are the tax credits available on Form 500?

- Low Income Credit

- Other State(s) Tax Credit

- Credits from IND-CR Summary Worksheet

- Refundable Tax Credits filed electronically via Schedule 2B

- What should you do if you owe tax or are due a refund on Form 500?

Georgia Form 500, known officially as the Individual Income Tax Return, is a document that must be filed by residents, part-year residents, and nonresidents who have earned income in the state of Georgia during the tax year. This form is used to report income, calculate taxes owed, and claim any deductions or credits to determine the final tax liability or refund due. Full-year residents will file using the complete form, while part-year and nonresidents should use Form 500 along with Schedule 3 to accurately report their Georgia-sourced income.

Your residency status for the purpose of Georgia Form 500 is based on the amount of time you resided in the state during the tax year. You are considered a:

To accurately complete Georgia Form 500, you will need:

Yes, Georgia Form 500 allows you to claim either the standard deduction or itemized deductions, depending on which lowers your tax liability. If you itemize deductions on your federal income tax return and believe these deductions will benefit you on your state return, you can claim them on Form 500, provided you include a copy of your Federal Schedule A.

To claim dependents on Georgia Form 500, you'll need to provide the name, social security number, and relationship to you for each dependent on lines 7a and 7b. If you have more than four dependents, attach a list with the additional dependent's information. This information helps accurately calculate exemptions and potential credits related to dependents.

Georgia Form 500 offers various credits to taxpayers, including but not limited to:

If you calculate that you owe additional tax when filing Form 500, you should include the payment when submitting your return to the Georgia Department of Revenue. Conversely, if you are due a refund, you can opt to have it directly deposited into your bank account or issued as a paper check. Ensure that your return and any payment due are postmarked by the filing deadline to avoid penalties and interest.

Common mistakes

When filling out the Georgia Form 500 for Individual Income Tax Return, taxpayers often make mistakes that can lead to delays in processing or incorrect assessments of taxes owed or refunds due. Understanding these common errors can help ensure a smoother filing process. Here are seven mistakes to avoid:

- Not using black or blue ink to fill out the form, as specifically requested in the instructions. This can cause issues with machine readability.

- Incorrectly entering social security numbers or inadvertently omitting them, both for the taxpayer and the spouse if filing jointly. This error can lead to processing delays and potential mismatches in the system.

- Failing to properly indicate a change of address. If you've moved since you last filed, this oversight could lead to misdirected communication from the Department of Revenue.

- Selecting the wrong filing status or residency status. These selections significantly impact tax calculations and the applicability of certain credits and deductions.

- Omitting or inaccurately reporting income details. It's crucial to ensure all income, as well as any Georgia tax withheld, is reported correctly to avoid discrepancies.

- Neglecting to include essential forms such as the Federal Form 1040 and Schedule 1 if required based on income thresholds or the use of itemized deductions.

- Overlooking the addition or subtraction of certain credits, such as estimated tax payments or credits for taxes paid to other states, on the final tax calculation. This oversight can lead to incorrect calculation of the amount owed or refund due.

By paying careful attention to these common pitfalls, taxpayers can improve the accuracy of their filings and facilitate a more efficient processing of their Georgia Form 500 Individual Income Tax Return.

Documents used along the form

When filing Georgia Form 500, Individual Income Tax Return, several other forms and documents may be required or beneficial to ensure accurate and complete tax submission. These documents support the tax information provided, help fulfill tax obligations, and can aid in securing possible tax benefits.

- Federal Form 1040: This is the U.S. Individual Income Tax Return form. It provides the federal adjusted gross income which is necessary for the Georgia Form 500.

- Schedule 1 (Form 1040): Additional Income and Adjustments to Income. This schedule accompanies Form 1040 to report income or adjustments not listed on the main form.

- Schedule A (Form 1040): Itemized Deductions. Taxpayers must include this if they itemize deductions instead of taking the standard deduction.

- W-2 Forms: These forms report an employee's annual wages and the amount of taxes withheld from their paycheck.

- 1099 Forms: These forms report various types of income other than salaries, wages, and tips. This includes independent contractor income, interest, dividends, and more.

- Form 500 Schedule 1: Adjustments to Income. Used to make specific adjustments to your income on the Georgia Form 500.

- Form 500 Schedule 3: For part-year residents or nonresidents to calculate Georgia taxable income.

- IND-CR Summary Worksheet: Used to summarize tax credits that an individual is claiming on their Georgia tax return.

- Form IT-560: Estimated Tax Payment form for individuals making advance payments towards their expected Georgia income tax liability.

Each of these documents plays a crucial role in the filing process, ensuring that taxpayers correctly report their income, calculate their taxes, and claim eligible credits and deductions. Proper completion and submission of these forms and supporting documents are essential for compliance with Georgia's tax laws and to maximize potential refunds or minimize tax liabilities.

Similar forms

The Georgia Form 500, which is an individual income tax return, shares similarities with several other tax-related documents. Each of these documents plays a unique role in the tax filing process, serving specific purposes for taxpayers, be it at the federal or state level. Here, we explore eight documents and how they relate to the Georgia Form 500:

- Federal Form 1040 (U.S. Individual Income Tax Return): This form is the federal counterpart to the Georgia Form 500, used by individuals to file their yearly income tax with the Internal Revenue Service (IRS). Both forms require detailed income information, calculate taxable income after deductions and credits, and determine the amount of tax owed or refund due.

- Schedule A (Form 1040) for Itemized Deductions: Similar to the sections in Georgia Form 500 that adjust income based on specific deductions, Schedule A allows taxpayers to itemize deductions like medical expenses, state and local taxes, and charitable contributions on their federal return, impacting their taxable income.

- Form 500 Schedule 3 (Nonresident or Part-Year Resident Schedule): For Georgia, this form complements the Form 500, addressing the unique filing needs of nonresidents or part-year residents, similar to how federal nonresident or part-year schedules adjust for income sourced within jurisdictions.

- Form IT-511 (Georgia Income Tax Instruction Booklet): This booklet provides detailed instructions for completing the Georgia Form 500, similar to how the IRS publication 17 serves as a comprehensive guide for taxpayers filing the Federal Form 1040.

- Form W-2 (Wage and Tax Statement): Essential for both Georgia Form 500 and Federal Form 1040 filers, this document reports an employee's annual wages and the amount of taxes withheld from their paycheck, serving as a key income documentation for both federal and state tax returns.

- Form 1099 (Various Types): These forms report various types of income other than wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT, 1099-DIV), and are important for both Georgia Form 500 and Federal Form 1040 to accurately reflect total income.

- Estimated Tax Payment forms (e.g., Form 500-ES for Georgia and Form 1040-ES for federal): Used by taxpayers to make quarterly estimated tax payments throughout the year if not enough tax is withheld from their income. Both the Federal and Georgia forms help taxpayers avoid underpayment penalties.

- Form 500 UET (Underpayment of Estimated Tax by Individuals/Fiduciaries for Georgia): It's akin to the federal Form 2210, where both are used to calculate penalties for underpayment of estimated tax. These forms assess whether taxpayers have paid enough in taxes throughout the year via withholding or estimated tax payments.

Each of these documents, while serving distinct functions, collectively ensures taxpayers fulfill their obligations accurately and benefit from eligible deductions and credits to reduce their tax liability. Understanding their nuances aids in navigating the complexities of both state and federal tax compliance.

Dos and Don'ts

When it comes to navigating the complexities of filing Georgia Form 500, the Individual Income Tax Return, knowing what to do and what to avoid can transform a potentially overwhelming process into a manageable task. Here is a list of essential dos and don'ts to guide you through filling out the form accurately.

- Do use black or blue ink when printing numbers and information on the form. This ensures that your information is clearly legible and can be correctly processed by the Georgia Department of Revenue.

- Do include all required pages (1-5) for processing. Omitting pages can delay the processing time and may result in errors with your return.

- Do double-check your Social Security Number (SSN) and that of your spouse, if applicable. Incorrect SSNs can lead to processing delays and issues with your tax return.

- Don't use your federal taxable income or federal standard deduction amounts. Georgia Form 500 requires specific state calculations, so ensure you're using the right figures according to the state guidelines.

- Don't include dependents on line 7a that are yourself or your spouse. Dependents listed should only be those who qualify other than the filer or their spouse.

- Don't forget to sign and date the form. An unsigned tax return is like an unsigned check – it’s not valid. And, if filing jointly, both spouses need to sign.

Attention to detail can make all the difference in avoiding common pitfalls. Taking the time to carefully review your Georgia Form 500 for accuracy and completeness before submission not only ensures compliance but can lead to a more favorable outcome with your state income tax return.

Misconceptions

There are several misconceptions about the Georgia Form 500, which is the state's Individual Income Tax Return form. Addressing these misconceptions can help taxpayers understand the requirements and provisions of this form more accurately:

Misconception 1: You only need to file Form 500 if your income is above a certain threshold. Reality: All Georgia residents who are required to file a federal income tax return are also required to file a Georgia Form 500, regardless of the amount of income earned.

Misconception 2: Part-year residents cannot file Form 500. Reality: Part-year residents should file Form 500 and use Form 500 Schedule 3 to report their income correctly.

Misconception 3: The standard deduction on your Georgia return is the same as on your federal return. Reality: Georgia has its own standard deduction amounts that may differ from the federal standard deduction.

Misconception 4: All income reported on your federal return must be reported on your Georgia Form 500. Reality: While much of the income on your federal return should be reported on your Georgia return, there may be adjustments and exclusions specific to Georgia.

Misconception 5: You can electronically file Georgia Form 500 by itself. Reality: Georgia Form 500 can be e-filed, but all pages (1-5) are required for processing, and certain schedules or documentation may also need to be electronically submitted.

Misconception 6: Nonresidents do not need to file Georgia Form 500. Reality: Nonresidents with income from Georgia sources are required to file Form 500 to report that income.

Misconception 7: The Georgia Form 500 is used to calculate the amount of taxes you will receive as a refund. Reality: Form 500 is used to calculate both the taxes owed to the state by the filer or the refund due back, depending on the particulars of the individual’s income and deductions.

Misconception 8: You must itemize deductions if you did so on your federal return. Reality: Taxpayers have the choice between itemizing deductions or taking the standard deduction on their Georgia return, regardless of what was chosen on their federal return.

Misconception 9: Direct deposit is the default method for refunds. Reality: Unless direct deposit information is provided or specific conditions are met, the Georgia Department of Revenue will issue a paper check for refunds.

Misconception 10: Estimated tax payments are only for self-employed individuals. Reality: Any taxpayer who expects to owe $1,000 or more when their return is filed may need to make estimated tax payments to avoid penalties, not just those who are self-employed.

Understanding these key points about the Georgia Form 500 can help taxpayers avoid errors and ensure their tax returns are filed correctly and efficiently.

Key takeaways

When preparing and submitting the Georgia Form 500 for an individual income tax return, it is crucial to pay attention to several key points to ensure the process is smooth and error-free. Here are four essential takeaways to keep in mind:

- Residency Status Matters: The form requires you to enter your residency status, which plays a significant role in how your tax is calculated. Whether you're a full-year resident, a part-year resident, or a nonresident affects which sections of the form you must fill out and could have implications on the amount of tax you owe or the refund you are eligible to receive.

- Accuracy in Documentation: It is imperative to use black or blue ink and print numbers clearly when filling out the form. In addition, if your adjusted gross income is $40,000 or more, or if your gross income differs from the amounts reported on your W-2 forms, you are required to attach a copy of your Federal Form 1040 along with Schedules 1 and A, if applicable. This step ensures that all income is accurately reported and helps verify your tax calculations.

- Deductions and Exemptions: Detailed attention must be given to claiming deductions and exemptions accurately. You must decide between taking the standard deduction or itemizing deductions if it benefits you more. Key to this process is understanding the different thresholds and qualifications for each option, as explained in the IT-511 Tax Booklet, which accompanies the form. Additionally, accurately reporting the number of dependents and exemptions is vital for correct tax calculation.

- Electronic Filing for Certain Tax Credits: If you plan to claim any of Georgia's tax credits, note that some of them require electronic filing. This method of filing is not only environmentally friendly but often results in faster processing times and quicker refunds. Always review the latest guidelines to ensure you correctly claim any tax credits to which you are entitled.

Understanding these key aspects of the Georgia Form 500 can help taxpayers navigate the complexities of filing state taxes more confidently and efficiently. Keep these takeaways in mind to help maximize your refund or minimize your tax liability effectively.

Popular PDF Forms

Mv-6 - It underscores the legal obligations of dealers, distributors, manufacturers, and transporters in the state of Georgia.

Georgia Form 600 - Designated sections for calculating overpayment or dues, including interest and penalties, help corporations to reconcile their tax obligations comprehensively.

Georgia G-1003 - Overview on mailing the G-1003 to the Georgia Department of Revenue, emphasizing the exclusion of payments with this submission.