Free Georgia 501X Template in PDF

For those navigating the complexities of fiduciary income tax amendments in Georgia, understanding the Georgia Form 501X is crucial. Revised in November 2011, this form is specifically designed for fiduciaries needing to amend previously filed income tax returns. The requirement for such amendments may arise from various scenarios, including changes triggered by IRS adjustments, modifications in the trust or estate's name, alterations in fiduciary details, or even a shift in the fiduciary’s address. The Georgia Department of Revenue mandates the submission of this amended return to address discrepancies or adjustments post the original filing. It intricately details income computations, beneficiary income distributions, tax calculations, and outlines potential adjustments both in terms of additions and subtractions. Furthermore, it encompasses sections for tax credits that might be applicable, underlining the necessity for meticulous attention to detail to ensure accuracy and compliance. Interestingly, the form also provision for direct deposit refunds, underscoring the state's move towards efficient, electronic transactions. Importantly, filing this form correctly can avoid potential penalties related to late amendments or incorrect tax reporting, making it essential for fiduciaries to thoroughly understand and accurately complete the document.

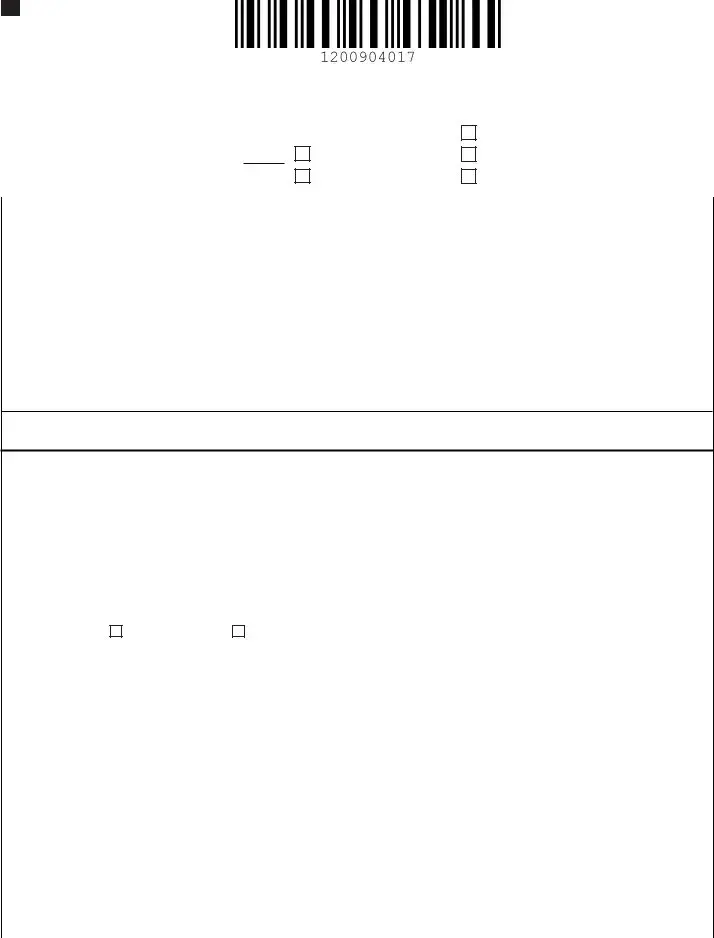

Form Sample

Georgia Form 501X(Rev. 11/11) |

Mailing Address: |

|

|

|

|||

|

|

||

Georgia Department of Revenue |

|||

Amended Fiduciary Income Tax Return |

|||

Processing Center |

|||

|

|||

|

P.O. Box 740316 |

||

|

Atlanta, Georgia |

||

|

Page 1 |

||

FOR FILING YEAR 2011

BEGINNING ____/____/ |

|

ENDING ____/____/ |

Federal Amended Return Filed (please attach copy)

Amended due to IRS changes

Change in Trust or Estate Name |

|

|

Change in Fiduciary |

|

500 UET |

|

||

|

|

Exception Attached |

Change of Address |

|

|

A. Federal Employer Id. No. |

Name of Estate or Trust |

|

|

|

|

|

Date of Creation of Trust |

|

|

|

|

|

|

|

|

|

|

B. Date of Decendent’s Death |

Name of Fiduciary |

|

|

|

Title of Fiduciary |

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

C. Address of Fiduciary (Number and Street) |

|

|

( Apt., Suite or Building Number) |

|

|

|||

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code |

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

D. If no return was filed last year, state reason |

|

|

|

|

|

|

|

|

Schedule 1 - Computation of Tax

1. |

|

Income of fiduciary (Adjusted total income from attached Form 1041) |

|

1. |

|

|

|

||

|

|

|

|

|

|||||

2. |

|

Adjustments: (List of all items in Schedule 3, Page 3) |

|

2. |

|

|

|

||

|

|

|

|

|

|||||

3. |

|

Total (Net total of Line 1 and 2) |

|

|

3. |

|

|

|

|

4. |

|

Beneficiaries’ Share of Income (Total of Schedule 2) |

|

4. |

|

|

|

||

|

|

|

|

|

|||||

5. |

|

Balance (Line 3 less Line 4) |

|

|

5. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

6. |

|

Exemptions: |

6a. Trust $1350 |

6b. Estate $2700 |

6. |

|

|

|

|

7. |

|

Net taxable income of fiduciary (Line 5 less Line 6) |

|

7. |

|

|

|

||

|

|

|

|

|

|||||

8. |

|

Total tax |

|

|

8. |

|

|

|

|

9. |

|

Less Credits: |

9a. Other State Credit |

|

9a. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

9b. Pass Through and Business Credits |

|

9b. |

|

|

|

|

|

|

|

9c. Total |

|

9c. |

|

|

|

|

10. |

Tax less credit |

(Net total of Line 8 less Line 9, if 0 or less, enter 0) |

|

10. |

|

|

|

||

|

11a. |

|

|

|

|||||

11. Less payments: 11a. Georgia Estimated Tax Paid |

|

|

|

|

|||||

|

|

|

|

||||||

|

|

|

.................................................................11b. Georgia Tax Withheld |

|

11b. |

|

|

|

|

|

|

|

11c. Amount paid with original return, plus any additional payments |

|

11c. |

|

|

|

|

|

|

|

made after it was filed |

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

11d. Total |

|

11d. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

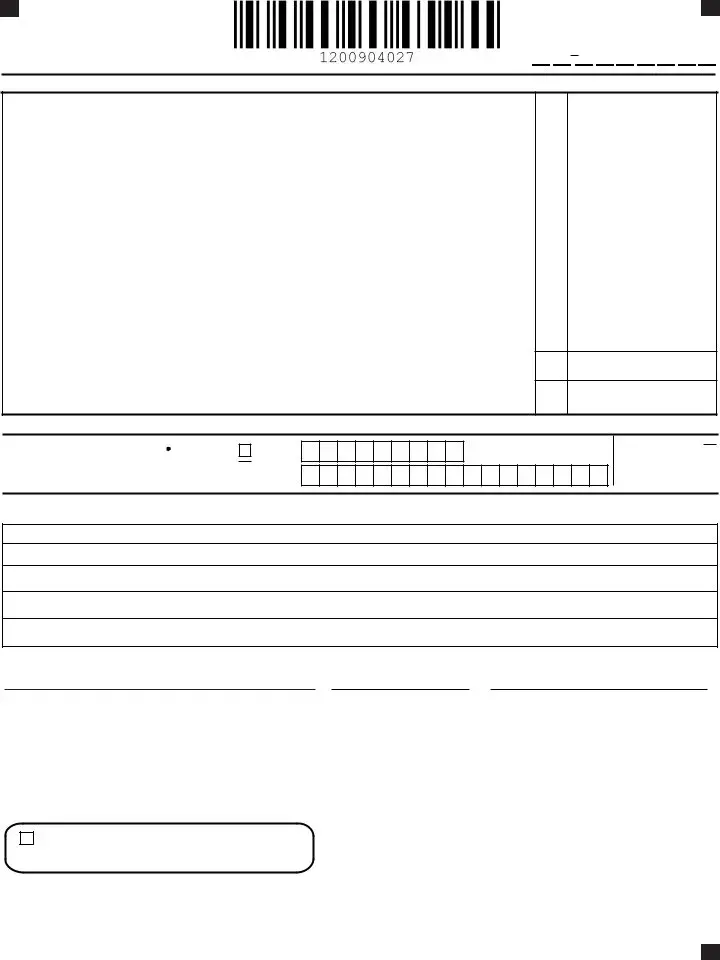

Georgia Form 501X |

Page 2 |

Amended Fiduciary Income Tax Return

TAXPAYER’S FEIN

____ ____ ____ ____ ____ ____ ____ ____ ____

Schedule 1- Computation of Tax (continued)

12. |

Previous refund(s), if any, shown on previous return(s) |

12. |

13. |

Net (Line 11d minus Line 12) |

13. |

14. |

Balance of tax due. If Line 10 exceeds Line 13, enter Line 10 less Line 13 |

14. |

15. |

Overpayment. If Line 13 exceeds Line 10, enter Line 13 less Line 10 |

15. |

16. |

Amount from Line 15 to be credited to next year’s estimated tax |

16. |

17. |

Interest |

17. |

18. |

Late payment penalty |

18. |

.........................................................................................................19. Late filing penalty |

19. |

|

20. Penalty for underpayment of estimated tax (UET) |

20. |

|

21.(If you owe) Add lines 14, 17 thru 20. Make check payable to Georgia Department of Revenue. 21.

22. (If you are due a refund) Subtract Lines 16 and 20 from Line 15. This is your refund |

22. |

Direct Deposit Options

22a. Direct Deposit (For U.S. Accounts Only)

See Instructions in the

Type: Checking |

Routing |

|

Number |

Savings

Account

Account

Number

22b.Paper Check

DECLARATION: I/we declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of our knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer this delcaration is based on all information of which the preparer has any knowledge.

EXPLANATIONS OF CHANGES: Provide an explanation of changes below. Attach any supporting documents and schedules.

|

SIGNATURE OF FIDUCIARY |

|

DATE |

|

PHONE NUMBER |

||||

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY |

|

DATE |

|

PREPARER’S IDENTIFICATION NUMBER |

||||

|

|

|

|

|

|

|

|

|

|

|

NAME OF PREPARER OTHER THAN FIDUCIARY |

|

PHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

I authorize Georgia Department of Revenue to electroni- |

|

|

|

|

Department Use Only |

|

||

|

cally notify me at the below email address regarding any |

|

|

|

|

|

|

|

|

|

updates to my account(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIDUCIARY EMAIL ADDRESS |

|

|

|

|

|

|

|

|

THE FIDUCIARY MUST ATTACH TO THIS RETURN A COPY OF ITS FEDERAL RETURN AND SUPPORTING SCHEDULES

THE FIDUCIARY MUST ATTACH TO THIS RETURN A COPY OF ITS FEDERAL RETURN AND SUPPORTING SCHEDULES

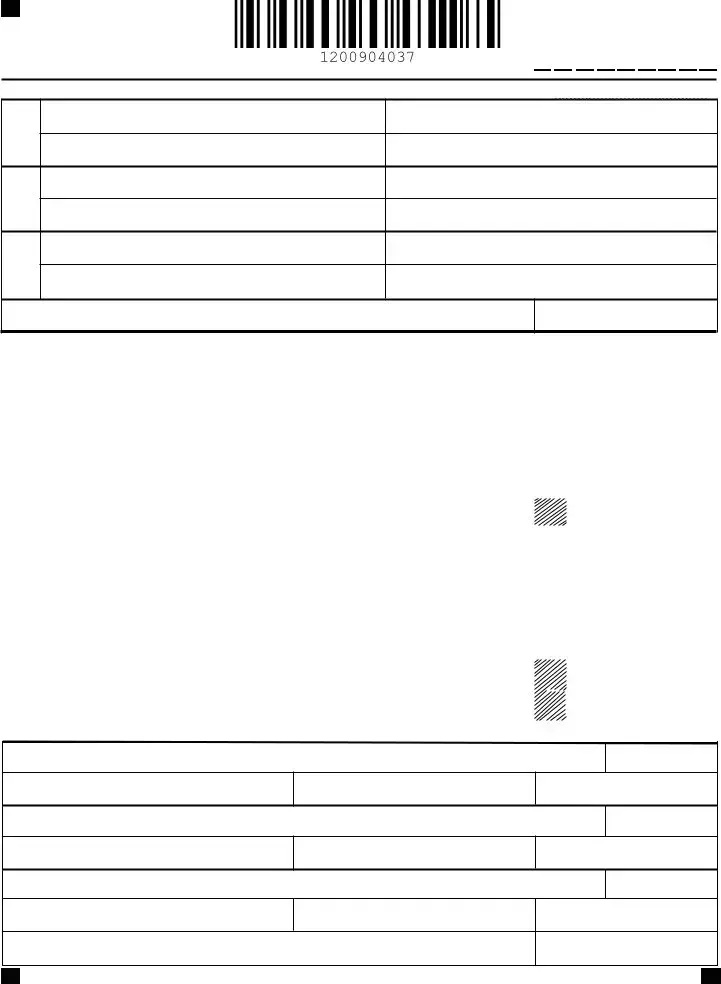

Georgia Form 501X |

|

Page 3 |

|

|

|

|

|

Amended Fiduciary Income Tax Return |

|

|

|

TAXPAYER’S FEIN |

|||

____ ____ |

|

||

|

____ ____ ____ ____ ____ ____ ____ |

||

Schedule 2 - Beneficiaries’ Share of Income

Name

AAddress

Name

BAddress

Name

CAddress

ID Number |

|

Share of Income |

|

|

|

|

|

City |

State |

ZIP |

|

|

|

|

|

ID Number |

|

Share of Income |

|

|

|

|

|

City |

State |

ZIP |

|

|

|

|

|

ID Number |

|

Share of Income |

|

|

|

|

|

City |

State |

ZIP |

|

|

|

|

|

Enter total (Including additional Beneficiaries’ Share of Income from attached schedule).

Schedule 3 - Adjustments to Income

ADDITIONS |

|

|

||||

1. |

Municipal bond interest - Other states |

1. |

|

|||

2. |

Income tax deduction other than Georgia |

2. |

|

|||

3. |

Expense allocable to exempt income (Other than US obligations) |

3. |

|

|||

|

|

|

|

4a. |

|

|

4a. Other |

|

................................................. |

|

|||

|

|

|

4b. |

|

||

4b. Other |

|

................................................. |

|

|||

.............................................................................................................................................TOTAL ADDITIONS |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTRACTIONS |

|

|

||||

1. Interest - U.S. Government Bonds (Must be reduced by direct and indirect interest expense) |

1. |

|

||||

2. |

|

|||||

2. Income Tax Refund other than Georgia |

|

|||||

3a. |

|

|||||

|

|

|

|

|||

3a. Other |

|

............................................... |

|

|||

|

|

|

3b. |

|

||

|

|

|||||

3b. Other |

|

............................................... |

|

|||

|

|

|

|

|

||

TOTAL SUBTRACTIONS |

|

|

||||

............NET ADJUSTMENT: Total additions less total subtractions. (Enter also on Line 2, Schedule 1) |

|

|

||||

|

|

|

|

|

|

|

Schedule 4 - Pass Through and Business Credits - If more than 3 enclose schedule

Company Name

Credit Code Type

Ownership Percentage

FEIN

Credit Claimed

Company Name

Credit Code Type

Ownership Percentage

FEIN

Credit Claimed

Company Name

Credit Code Type

Ownership Percentage

FEIN

Credit Claimed

Enter total (Including additional

Georgia Form 501X |

Page 4 |

Amended Fiduciary Income Tax Return |

|

Instructions

Every resident and nonresident fiduciary having income from sources within Georgia or managing funds or property for the benefit of a resident of this state is required to file a Georgia income tax return on Form 501.

Returns are required to be filed by the 15th day of the 4th month following the close of the taxable year. If the due date falls on weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday.

The Georgia Code provides penalties for failure to comply with its provisions and for interest on late payments of tax and deficiencies.

SPECIFIC INSTRUCTIONS

Schedule 1

Enter on Line 1 the amount of gross income less the itemized deductions shown on the Federal Form 1041.

Enter on Line 2 the net adjustment from Schedule 3.

Enter on Line 4 the total portion of income distributable to all beneficiaries as listed in Schedule 2.

Enter on Line 6 the exemption: Trusts $1,350, Estates $2,700.

Compute the total income tax on the amount shown on Line 7 from the following tax

rate schedule, entering the total tax due on Line 8. |

|

|

||||

If the amount |

But Not |

Amount of |

|

Of |

||

on Line 7 is |

|

Over |

|

Tax is |

Excess |

|

Over |

|

|

|

|

Over |

|

............................... |

$ |

750 |

|

1% |

........................ |

|

$ 750 |

$ |

2250 |

$ |

7.50+2%. |

............ $ |

750 |

$ 2250 |

$ |

3750 |

$ |

37.50+3% |

............. $ |

2250 |

$ 3750 |

$ |

5250 |

$ |

82.50+4% |

$ |

3750 |

$ 5250 |

$ |

7000 |

$ |

142.50+5% |

$ |

5250 |

$ 7000 |

|

$ |

230.00+6% |

$ |

7000 |

|

Line 9a

A credit is allowed on Line 9a for income tax period to other States. A copy of the other state’s(s) return must be attached.

Line 9b

For more information about pass through and business credits, see our website. Submit a schedule for the total credit claimed if more than 3 credits are claimed. The amount on the schedule must equal the amount claimed on Line 9b.

Line 11b

Credit for nonresident withholding on distributions from pass through entities and sale of property by nonresidents. See O.C.G.A. Sections

The amount withheld from a

Schedule 2

If there are more than 4 beneficiaries, attach a list showing the same information for each.The total of Schedule 2 must be the same as the amount on Line 4, Schedule 1

Schedule 3

Georgia taxable income of a fiduciary is its Federal income with certain adjustments as provided in Code Section

Schedule 4

Pass - through and business Credits are from ownership of Sole Proprietor, S Corp., LLC or

ADDITIONS: Interest on State and Municipal bonds other than Georgia and its political subdivisions. Any income tax claimed as a deduction on Form 1041 other than Georgia. Fiduciary fee and other expense allocable to income exempt from Georgia tax (other than U.S. obligations).

SUBTRACTIONS: Interest and dividends on U.S. Government bonds and other U.S. obligations. U.S. obligation income must be reduced by direct and indirect interest expense. To arrive at this reduction, the total interest expense is multiplied by a fraction, the numerator of which is the taxpayers average adjusted basis of the U.S. obligations, and the denominator of which is the average adjusted basis of all assets of the taxpayer. NOTE: Interest received from the Federal National Mortgage Association (FNMA), Government National Mortgage Association (GNMA), Federal Home Loan Mortgage Corporation (FHLMC), and interest derived from repurchase agreements are not considered to be obligations of the United States and are taxable. Federally taxable interest on “Build America Bonds” and other Georgia municipal interest for which there is a special exemption under Georgia law. “ Recovery Zone Economic Development Bonds” under Section

Income Tax refunds included as income on Form 1041 other than Georgia. Enter the total adjustments on the indicated line of Schedule 3 and on Line 2, Schedule 1.

GENERAL INFORMATION

PENALTIESAND INTEREST

DELINQUENT FILING OF RETURN - 5% of the tax not paid by original due date

for each month or fractional part thereof - up to 25%.

FAILURE TO PAY tax shown on a return by due date - 1/2 of 1% of the tax due for each month or fractional part thereof - up to 25%. Failure to pay is not due if the return is being amended due to an IRS audit.

Note: Late payment and late filing penalties together cannot exceed 25% of tax not paid by original due dates.

A PENALTY OF $1,000 may be assessed against an individual who files a frivolous return.

NEGLIGENT underpayment of tax - 5% of the underpayment. FRAUDULENT UNDERPAYMENT - 50% thereof.

FAILURE TO FILE ESTIMATED TAX - 9% per annum for the period of underpayment. Form 500UET is available upon request for computation of underestimated installment payments. If you were eligible for an estimated tax penalty exception on Form 500 UET, please check the “500 UET Exception Attached” box, include the revised penalty on line 18 of the Form 501 (if the revised penalty is zero enter zero), and include the 500UET with the return.

INTEREST is computed at 12% per year on any unpaid tax from the date due until paid. An extension of time for filing does not relieve late payment penalty or interest.

ESTIMATEDTAX

Code Section

WHEN AND WHERE TO FILE ESTIMATED TAX. Estimated tax payments required to be filed by persons not regarded as farmers or fishermen shall be filed on or before April 15th of the taxable year, except that if the above requirements are first met on or after April 1st, and before June 1st, the tax must be paid by June 15th; on or after June 1st and before September 1st, by September 15th; and on or after September 1st, by January 15th of the following year. If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday. Fiduciaries filing on a

The estimate coupon, Form 500ES, should be mailed to the Department of Revenue, Processing Center, P.O. Box 740319, Atlanta, GA

PAYMENT OF ESTIMATED TAX. Payment in full or your estimated tax may be made with the first required payment or in equal installments during this year on or before April 15th, June 15th, September 15th, and the following January 15th. Make your check or money order payable to “Georgia Department of Revenue.” Georgia Public Revenue Code Section

TAX CREDITS

Page 5

The following

NOTE: Credit code numbers are subject to change annually. Current code numbers are listed below. See Form

For additional information on the

Code |

Name of Credit |

101Employer’s Credit for Basic Skills Education

102Employer’s Credit for Approved Employee Retraining

103Employer’s Jobs Tax Credit

104Employer’s Credit for Purchasing Child Care Property

105Employer’s Credit for Providing or Sponsoring Child Care for Employees

106Manufacturer’s Investment Tax Credit

107Optional Investment Tax Credit

108Qualified Transportation Credit

109Low Income Housing Credit (enclose Form

110Diesel Particulate Emission Reduction Technology Equipment

111Business Enterprise Vehicle Credit

112Research Tax Credit

113Headquarters Tax Credit

114Port Activity Tax Credit

115Bank Tax Credit

116Low Emission Vehicle Credit (enclose DNR certification)

117Zero Emission Vehicle Credit (enclose DNR certification)

118New Facilities Job Credit

119Electric Vehicle Charger Credit (enclose DNR certification)

120New Facilities Property Credit

121Historic Rehabilitation Credit (enclose Form

122Film Tax Credit

123Teleworking Credit

124Land Conservation Credit (enclose Form

125Qualified Education Expense Credit (enclose Form

126

127Clean Energy Property Credit (enclose Form

128 Wood Residual Credit

129 Qualified Health Insurance Expense Credit (enclose Form

130Quality Jobs Tax Credit

131Alternate Port Activity Tax Credit

File Overview

| Fact Name | Description |

|---|---|

| Purpose of Form 501X | Georgia Form 501X is used as an Amended Fiduciary Income Tax Return to report changes or corrections to an originally filed Form 501, or to amend a return due to IRS changes, change in Trust or Estate Name, change in Fiduciary, or a change of address. |

| Governing Law | The form adheres to the guidelines specified under the Georgia Public Revenue Code, particularly focusing on aspects related to fiduciary income taxation and the amendments thereof. |

| Filing Deadline | Fiduciaries must file Form 501X by the 15th day of the 4th month following the close of the taxable year. If this date falls on a weekend or holiday, the deadline extends to the next business day. |

| Attachment Requirements | When filing Form 501X, fiduciaries are required to attach a copy of the federal amended return, if applicable, along with any other supporting documents or schedules that validate the changes being reported. |

| Penalties and Interest for Late Filing | Penalties for late filing of Form 501X include 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Interest is also charged at a rate of 12% per year on any unpaid tax balance from the due date until the tax is paid. |

Guide to Using Georgia 501X

Filing an amended fiduciary income tax return in Georgia using Form 501X is a process that requires attention to detail and accuracy. This form is used to correct or update a previously filed fiduciary income tax return. Whether the changes are due to adjustments from the IRS, amendments in the trust or estate details, or any other reason, ensuring that the updated information is accurately reported is crucial for compliance with Georgia tax laws. Below are step-by-step instructions to guide you through filling out the Georgia 501X form.

- Identify the filing year at the top of the form and enter the beginning and ending dates of the tax year.

- If a federal amended return was filed, check the appropriate box and attach a copy of the amended federal return.

- Select the reason(s) for amending the return by checking the appropriate box(es) such as IRS changes, change in Trust or Estate Name, change in Fiduciary, or other listed reasons.

- Enter the Federal Employer Identification Number (FEIN) of the estate or trust in section A.

- Provide the name of the estate or trust, the date of creation, and if applicable, the date of the decedent's death.

- Fill in the name, title, and contact information of the fiduciary, including the telephone number.

- Enter the address of the fiduciary, ensuring to include number, street, apt/suite/building number, city, state, zip code, and country if applicable.

- If no return was filed for the previous year, state the reason in the provided section.

- Proceed to Schedule 1 - Computation of Tax. Enter the income of the fiduciary, adjustments, and beneficiaries’ share of income as required. Follow through the computation steps to determine the tax, credits, payments made, and determine if there's a balance due or an overpayment.

- On Schedule 2, list the beneficiaries’ share of income. If more beneficiaries exist than spaces provided, attach an additional schedule.

- In Schedule 3, disclose adjustments to income, including additions and subtractions as prescribed.

- Complete Schedule 4 for Pass Through and Business Credits if applicable. Include additional schedules if more than three credits are claimed.

- Calculate and enter any owed amounts or expected refunds, along with the direct deposit information if you're due a refund and choose this option.

- Review the declaration, sign and date the form. If someone other than the fiduciary prepared the form, their signature, identification number, and contact information are also required.

- If authorizing electronic communication, include the fiduciary's email address.

- Ensure that all required attachments, such as a copy of the federal amended return and supporting schedules, are included.

- Review the entire form for accuracy. Once satisfied, mail the completed Form 501X and all attachments to the Georgia Department of Revenue at the address provided on the form.

Once the amended return is filed, it's important to monitor any correspondence from the Georgia Department of Revenue for possible follow-up or confirmation of the amendments. Keeping a copy of the submitted documents for your records is also advisable.

Obtain Clarifications on Georgia 501X

What is the purpose of the Georgia Form 501X?

The Georgia Form 501X is an amended fiduciary income tax return for use by estates and trusts. It allows fiduciaries to correct or update a previously filed Georgia fiduciary income tax return. Changes that may necessitate the filing of this form include adjustments due to IRS changes, updates in trust or estate details, changes in fiduciary information, or corrections in income, deductions, or credits reported.

Who is required to file the Georgia Form 501X?

Any fiduciary, including estates or trusts, that needs to amend a previously filed Georgia fiduciary income tax return must file Form 501X. This requirement applies to both resident and nonresident fiduciaries who have income sources within Georgia or are managing funds or property for the benefit of a resident of this state.

When is the Georgia Form 501X due?

The due date for filing the Form 501X aligns with the original filing deadline, which is the 15th day of the 4th month following the close of the taxable year. Should the due date fall on a weekend or holiday, the form is due on the next business day. Importantly, filing an amended return does not alter the original due date for payment purposes.

What documents must be attached to the Form 501X when filed?

Fiduciaries are required to attach a copy of the federal amended return, including all supporting schedules and documents, to the Georgia Form 501X. This ensures that the state can verify the changes made to the federal return and correctly process the state amended return. Additionally, any schedules or documents that support the amendments made on the Georgia return must also be attached.

How should adjustments to income be reported on Form 501X?

Adjustments to fiduciary income should be detailed on Schedule 3 of Form 501X, where fiduciaries list all additions and subtractions applying to their Georgia taxable income. These adjustments account for differences between federal and state taxable income, such as interest on state and municipal bonds from other states or income exempt from Georgia tax.

Can a refund from an amended return be direct deposited?

Yes, if a refund is due from the amended return, fiduciaries can opt for direct deposit into a U.S. checking or savings account. This option requires completing the direct deposit information section on Form 501X, providing both the account type and routing and account numbers. Alternatively, fiduciaries can opt to receive a paper check.

What are the consequences of failing to file the Form 501X timely or accurately?

Late filing or inaccuracies on the Form 501X can result in penalties and interest charges. Penalties may include a percentage of the unpaid tax for late filing or payment and additional charges for negligent or fraudulent underpayment. Interest is charged on any unpaid tax from the due date until payment is made. To avoid these consequences, fiduciaries should ensure accurate and timely filing of the amended return.

Common mistakes

Failing to attach a copy of the Federal Amended Return: The instruction clearly states that a copy of the Federal Amended Return should be attached when filing the Georgia Form 501X. People often overlook this requirement, resulting in incomplete submissions that can delay processing.

Incorrect calculation of beneficiaries’ share of income: Schedule 2 of the form requires a detailed account of the beneficiaries’ share of income. A common mistake is incorrectly calculating or reporting these figures, which can affect the distribution and taxation of the estate or trust income.

Not listing all adjustments to income properly on Schedule 3: Taxpayers sometimes miss out on listing all necessary additions and subtractions on Schedule 3. This section adjusts the income of the fiduciary with specific inclusions and exclusions, and failure to accurately complete it can lead to incorrect tax computations.

Omitting the Direct Deposit information or making errors while filling it: For those opting for a refund via direct deposit, accurately providing banking details under section 22a is crucial. Mistakes in the routing or account number can lead to delays or misdirected refunds.

Additionally, here are a few other common errors to avoid, presented in an unordered list for clarity:

Not updating the address or fiduciary information if there has been a change. Section C and the checkbox related to the Change of Address are often overlooked. Updated information ensures that all correspondence reaches the right place.

Incorrectly calculating tax due or refund owed: On the computation section (Schedule 1), mistakes in arithmetic or not understanding which credits and payments apply can lead to either underpayment or expecting a refund that is not accurate.

Forgetting to sign and date the return: At the end of the Georgia Form 501X, the signature of the fiduciary and the date are required. An unsigned return is not considered valid and will not be processed.

Failure to explain the changes made: The section titled "EXPLANATIONS OF CHANGES" is critical for providing the rationale behind the amendments made to the originally filed return. Not providing a clear explanation can raise questions and potentially delay the amendment process.

Documents used along the form

Filing tax returns and ensuring compliance with the Georgia Department of Revenue's requirements can be a daunting task, especially when dealing with amended returns for estates or trusts. If you're taking care of a Georgia Form 501X for an amended fiduciary income tax return, it's crucial to gather not just the form itself but also any documents and forms that support the amendments you are reporting. Here's a list of documents and forms often used in conjunction with Georgia Form 501X to make sure your filing is complete, accurate, and submitted on time.

- Federal Form 1041: U.S. Income Tax Return for Estates and Trusts. This form is necessary to adjust the income of the fiduciary as reported to the federal government and must be attached to the 501X form.

- Schedule K-1 (Form 1041): Beneficiary’s Share of Income, Deductions, Credits, etc. This helps document each beneficiary's share of income, which impacts the adjusted total income figure on the 501X.

- Form IT-QEE-TP2: Qualified Education Expense Credit. If claiming this credit, attaching documentation is essential.

- Form IT-CONSV and DNR certification: For those claiming a Land Conservation Credit, both the form and certification from the Department of Natural Resources are needed.

- Form IT-RHC and DNR certification: Historic Rehabilitation Credit documentation is vital for outlining costs associated with rehabilitating historic buildings.

- Form IT-CEP: Clean Energy Property Credit. Required for claiming credits related to investments in clean energy on the property.

- Form IT-QEE-SS01: Another form related to the Qualified Education Expense Credit, necessary for certain educational expense credits.

- Form IT-HC and K-1: Low Income Housing Credit information, fundamental for real estate within trusts or estates dedicated to low-income housing projects.

- G-2RP or G-2A Form: Documents related to Georgia Tax Withheld for nonresident beneficiaries or sale of property by nonresidents.

- Power of Attorney and Declaration of Representative (Form RD-1061): If a representative is handling the amended return, this form authorizes their action on behalf of the estate or trust.

Collecting and accurately completing these support documents in tandem with the Georgia Form 501X ensures thorough compliance with the Georgia Department of Revenue's regulations. More importantly, it safeguards against potential penalties associated with incomplete or incorrect filing. The goal is always clear and compliant reporting, ensuring that fiduciaries meet their obligations while maximizing the estate or trust's financial health. As tax laws and requirements can change, always verify the most current forms and regulations with the Georgia Department of Revenue.

Similar forms

The Georgia 501X form is similar to the Federal Form 1041, "U.S. Income Tax Return for Estates and Trusts." Both forms are used to report the income, deductions, and credits of estates and trusts. They require the fiduciary to calculate the taxable income of the entity and determine the tax liability or refund due. The 501X requires a copy of the amended federal return, emphasizing their interconnectedness.

Another similar document is the Federal Form 1040X, "Amended U.S. Individual Income Tax Return." This form is for individuals to amend a previously filed Form 1040. Like the 501X, the 1040X is used when changes are necessary to an already filed return, such as reporting additional income or claiming missed deductions. Both forms require explanations for the amendments and may result in an additional refund or tax due.

The Georgia Form 500X, "Amended Individual Income Tax Return," closely resembles the 501X. The 500X is utilized by individual taxpayers in Georgia to correct their state income tax return after it has been filed. Similar to the 501X, adjustments might include changes in income, filing status, or corrections to credits and deductions. Both forms serve the purpose of rectifying inaccuracies or omissions on original state tax returns.

Lastly, the Georgia Form IT-303, "Application for Extension of Time for Filing State Income Tax Returns," shares a procedural similarity with the 501X form. While it is an application for an extension rather than an amended return, it reflects the necessity for accuracy and compliance in tax matters, offering taxpayers additional time to gather information necessary for accurate filings. Both forms highlight the importance of meeting tax obligations and the accommodation the system provides for adjustments or extensions.

Dos and Don'ts

When completing the Georgia 501X form, fiduciaries must adhere to specific guidelines to ensure compliance and accuracy in amending a fiduciary income tax return. Below is a comprehensive breakdown of recommended actions and practices to avoid.

Do:

- Read the instructions thoroughly before filling out the form to avoid common errors.

- Ensure that all applicable sections of the form are completed based on the current tax year being amended.

- Attach a copy of the federal amended return, if applicable, as required by the instructions.

- Provide detailed explanations for any changes or adjustments made on the form, including supporting documents or schedules.

- Double-check all financial figures for accuracy, ensuring they match those on supplementary schedules and documents.

- Include the estate's or trust's Federal Employer Identification Number (FEIN) on every page of the form.

- If there are changes in fiduciary or address, make sure these are clearly indicated on the form.

- Ensure that the calculation of tax, credits, payments, and refunds or amounts owed are correct.

- Sign and date the form, including the contact information of the fiduciary and, if prepared by someone other than the fiduciary, the preparer's information.

- Mail the completed form to the proper address provided in the instructions, considering the use of certified or registered mail for proof of delivery.

Don't:

- Overlook attaching a copy of the federal amended return if a federal amendment has been filed; this is a crucial component of the submission process.

- Forget to explain the reasons behind any amendments, as a lack of explanation can cause delays in processing.

- Enter incorrect tax years or dates that do not correspond to the year being amended.

- Miscalculate the amounts, such as the balance of tax due, overpayments, or other financial figures, which could result in errors in processing or potential penalties.

- Fail to provide the fiduciary’s contact information and, if different, the contact details of the preparer.

- Miss checking the box that applies to changes caused by IRS adjustments, changes in trust or estate name, fiduciary, or address if these situations apply.

- Ignore the necessity to attach any additional schedules or supporting documents that validate the amendments reported.

- Submit the form without ensuring all applicable fields and sections are completed, particularly those related to deductions, income adjustments, and tax computations.

- Overlook the declaration section, where the fiduciary affirms the accuracy and completeness of the information provided under the penalties of perjury.

- Delay filing beyond the prescribed deadlines, as this could lead to penalties and interest charges for late filing and payment.

Adhering to these guidelines will facilitate a smoother amendment process, helping to ensure that the fiduciary income tax return accurately reflects the necessary adjustments while complying with Georgia tax laws.

Misconceptions

When it comes to the Georgia 501X Form, which is the Amended Fiduciary Income Tax Return, several misconceptions can lead to confusion for fiduciaries managing the estates or trusts. Understanding these misconceptions is crucial for accurate tax filing and compliance with Georgia tax laws. Here are four common misconceptions explained:

Misconception 1: The form is only for corrections to the income reported. One of the prevalent misunderstandings is that the Georgia 501X form is solely used to correct previously reported fiduciary income. In reality, the form serves multiple purposes, including reporting changes due to IRS audits, adjustments in the trust or estate’s information (such as a change in fiduciary or address), and applying for credits not previously considered. It's a comprehensive tool for amending various aspects of the originally filed fiduciary income tax return.

Misconception 2: Only trusts and estates that have filed a federal amended return need to file a Georgia 501X. It’s often incorrectly assumed that a Georgia 501X form should only be filed if the trust or estate has amended its federal tax returns. While attaching a copy of the federal amended return, if available, is part of the process, the need to file a Georgia 501X can arise from multiple state-specific reasons, including changes to Georgia taxable income or corrections independent of federal tax filings.

Misconception 3: The form is lengthy and requires extensive detailed financial information. Another common misconception is related to the complexity and length of the form. The Georgia 501X form, while thorough, is designed to be straightforward, focusing on the specifics of the amendments needed. Detailed instructions provided with the form guide fiduciaries through each section, emphasizing the computation of tax, adjustments to income, and declarations of changes, thereby simplifying the amendment process.

Misconception 4: Filing Georgia Form 501X automatically leads to audits or penalties. The fear of increased scrutiny or penalties discourages some from correctly amending their tax returns. However, filing a 501X form is a standard procedure for correcting or updating previously filed information. Correcting errors or updating information proactively can help avoid discrepancies and potential penalties in the future. It's a part of ensuring the fiduciary's compliance with Georgia tax laws rather than a trigger for audits.

In understanding these misconceptions, fiduciaries can accurately assess their obligations and opportunities when managing estate or trust taxes in Georgia. The key is attentive reading of the form instructions and seeking clarification when necessary to ensure compliance and take advantage of potential tax benefits appropriately.

Key takeaways

Filing an amended fiduciary income tax return in Georgia using Form 501X requires attention to detail and understanding of the specific requirements. Here are six key takeaways to guide individuals and fiduciaries through the process:

- Attach Federal Amended Return: When submitting the Georgia Form 501X, it's crucial to include a copy of the amended federal income tax return (Form 1041). This ensures consistency between federal and state tax information and supports the changes made on the Georgia amended return.

- Reason for Amendment: Clearly indicate the reason for amending the fiduciary income tax return. Common reasons may include changes due to the Internal Revenue Service adjustments, changes in trust or estate name, change of fiduciary, or a change of address. Understanding the specific reason will assist in accurately completing the form.

- Computing Tax: The computation of tax on Form 501X requires detailed information from the fiduciary's adjusted total income, adjustments, beneficiaries' share of income, exemptions, and the net taxable income. Carefully review Schedules 1, 2, and 3 to ensure all income and deductions are accurately reported and calculated.

- Addressing Credits and Payments: Take advantage of applicable credits, such as other state credit and business credits, and accurately report Georgia estimated tax paid and taxes withheld. These amounts can significantly impact the balance of tax due or the overpayment amount to be refunded or credited towards next year's estimated tax.

- Documentation and Supporting Schedules: To support adjustments to income, credits claimed, and distribution to beneficiaries, attaching relevant schedules and documents is essential. For instance, adjustments to income and pass-through and business credits require detailed listing in Schedules 3 and 4, respectively.

- Penalties and Interest: Understanding the implications of late filing or late payment is crucial as it affects the overall tax obligation. The form outlines penalties for delinquent filing, failure to pay, and underestimation of tax, as well as the interest calculated on unpaid taxes. However, Form 501X also provides for penalty exceptions in certain circumstances which can mitigate the financial impact.

Completing and filing the Georgia Form 501X requires a thorough review of the fiduciary's income, deductions, and credits to ensure compliance with state tax laws while maximizing potential benefits. Individuals and fiduciaries are encouraged to seek guidance if they encounter questions or complexities during this process.

Popular PDF Forms

Georgia Lien Release Form - Specific instructions are provided for the completion and submission of the form to the relevant authorities.

Change Name of Llc Georgia - This form also plays a role in updating public records to assist in legal matters such as litigation or lien enforcement.