Free Georgia 600 Template in PDF

Filing corporate taxes in Georgia requires comprehensive understanding and careful attention to detail, particularly when it comes to completing the Georgia Form 600 for Corporation Tax Return. This form, a crucial document for any corporation operating within the state, encompasses various aspects of tax filing, from Income Tax Returns to Net Worth Tax Returns. With a structure designed to consolidate information regarding the corporation's earnings, deductions, and net worth, it facilitates the accurate computation of taxes owed to the state. The form mandates the inclusion of a corporation's Federal Employer Identification Number (FEIN), business and mailing addresses, as well as detailed schedules that reflect the corporation's financial activities throughout the fiscal year. Moreover, adjustments to federal taxable income, allocations of net operating losses, and the application of tax credits or assigned credits all play a pivotal role in the determination of the corporation’s tax responsibilities. Also, for corporations with out-of-state operations or those consolidating returns, the form provides specific sections to address these scenarios, ensuring compliance and proper tax calculation. Particularly notable is the requirement to attach a copy of the federal return and any supporting schedules, underlining the interconnectedness of state and federal tax reporting. Overall, the Georgia Form 600 serves as a comprehensive tool for corporations to report their income, evaluate their net worth, and fulfill their tax obligations with the Georgia Department of Revenue, making it a foundational element of corporate tax adherence in the state.

Form Sample

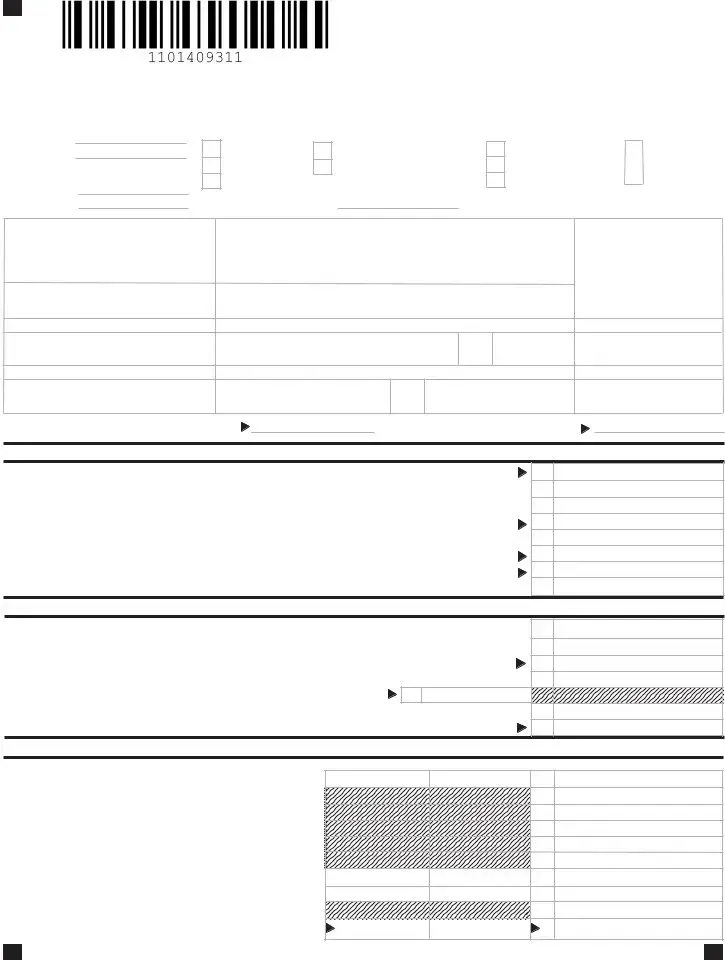

Georgia Form 600 (Rev. 11/10)

Corporation Tax Return

Georgia Department of Revenue (Approved booklet version)

2010 Income Tax Return

Beginning

Ending

2011 Net Worth Tax Return

Beginning

Ending

Original Return

Initial Net Worth

Amended Return

Consolidated GA Parent Return

(attach approval)

GA Consolidated Subsidiary Consolidated Parent FEIN

|

|

|

UET Annualization |

Address Change |

|

|

Exception attached |

Name Change |

|

||

|

|||

Final (attach explanation) |

|

Extension attached |

|

|

|

||

A. Federal Employer I.D. Number |

Name (Corporate title) Please include former name if applicable. |

E. Date of Incorporation |

|

|

|

|

|

B. GA. Withholding Tax Account Number |

Business Address (Number and Street) |

F. Incorporated under laws |

|

|

|

of what state |

|

C. GA. Sales Tax Registration Number

City or Town |

State |

Zip Code |

G. Date admitted into GA

D. NAICS Code

Location of Books for Audit (city) &(sta te ) |

Telephone Number |

H. Kind of Business

Indicate latest taxable year adjusted by IRS |

|

|

And when reported to Georgia |

||

|

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 1 |

||

1. |

Federal Taxable Income (Copy of Federal return and supporting schedules must be attached) .... |

1. |

|||

2. |

Additions to Federal Income (from Schedule 4) |

|

|

2. |

|

3. |

Total (add Lines 1 and 2 ) |

|

|

3. |

|

4. |

Subtractions from Federal Income (from Schedule 5) |

|

|

4. |

|

5. |

Balance (Line 3 less Line 4) |

|

|

5. |

|

6. |

Georgia Net Operating loss deduction (from Schedule 11) |

|

6. |

||

7. |

Georgia Taxable Income (Line 5 less Line 6 or Schedule 7, Line 9) |

|

7. |

||

8. |

Income Tax - (6% x Line 7) |

|

|

8. |

|

|

COMPUTATION OF NET WORTH TAX |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 2 |

||

1. |

Total Capital stock issued |

|

|

1. |

|

2. |

Paid in or Capital surplus |

|

|

2. |

|

3. |

Total Retained earnings |

|

|

3. |

|

4. |

Net Worth (Total of Lines 1, 2, and 3) |

|

|

4. |

|

5. |

Ratio (GA. and Dom. For. |

5. |

|

||

6. |

Net Worth Taxable by Georgia (Line 4 x Line 5 ) |

|

|

6. |

|

7. |

Net Worth Tax (from table in instructions) |

|

|

7. |

|

|

COMPUTATION OF TAX DUE OR OVERPAYMENT |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 3 |

||

|

|

A. Income Tax |

B. Net Worth Tax |

C. Total |

|

1. |

Total Tax (Schedule 1, Line 8, and Schedule 2, Line 7) |

|

|

|

1. |

2. |

Less Credits and payments of estimated tax |

|

|

|

2. |

3. |

Less Credits from Schedule 9, Line 6* |

|

|

|

3. |

4. |

Withholding Credits |

|

|

|

4. |

5. |

Balance of tax due (Line 1, less Lines 2, 3, and 4) .. |

|

|

|

5. |

6. |

Amount of overpayment (Lines 2, 3, and 4 less Line1) |

|

|

|

6. |

7. |

Interest due (See Instructions) |

|

|

|

7. |

8. |

Penalty due (See Instructions) |

|

|

|

8. |

9. Balance of Tax, Interest and Penalty due with return |

|

|

|

9. |

|

10. |

Amount of Line 6 to be credited to 2011 estimated tax |

|

|

Refunded |

|

*NOTE: Any tax credits from Schedule 9 may be applied against income tax liability only, not net worth tax liability.

Georgia Form 600/2010 (Corporation) Name_______________________________________FEIN____________________

|

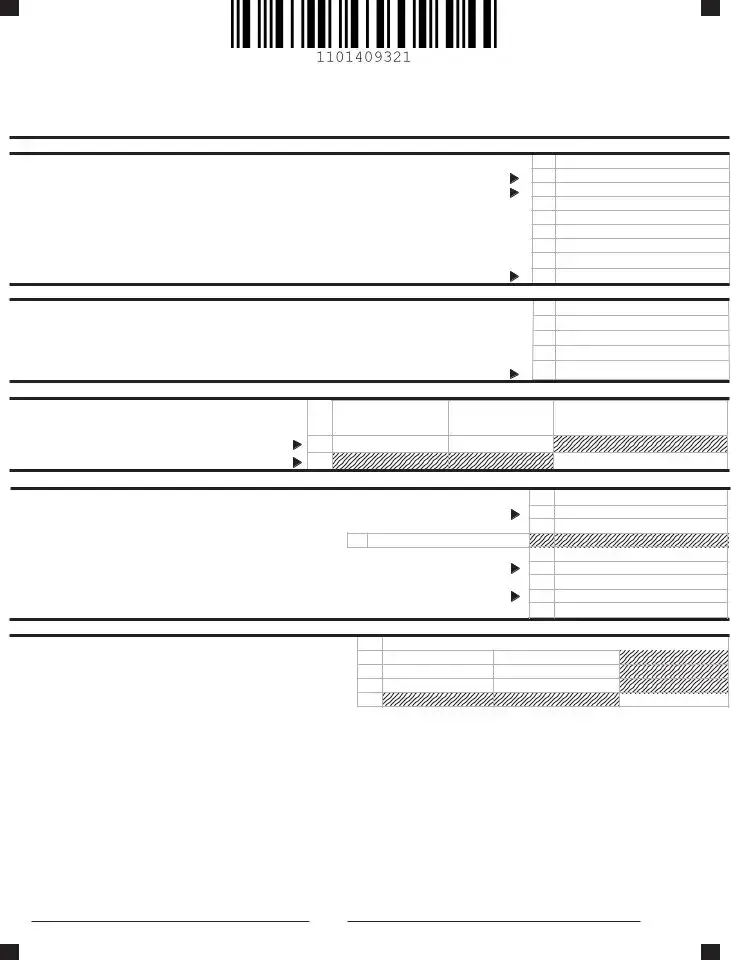

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 4 |

|

1. |

State and municipal bond interest (other than Georgia or political subdivision thereof) |

..................... |

1. |

|

|

2. |

Net income or net profits taxes imposed by taxing jurisdictions other than Georgia |

2. |

|

||

3. |

Expense attributable to tax exempt income |

|

3. |

|

|

4. |

Net operating loss deducted on Federal return |

|

4. |

|

|

5. |

Federal deduction for income attributable to domestic production activities (IRC Section 199) |

5. |

|

||

6. |

Intangible expenses and related interest cost |

|

6. |

|

|

7. |

Captive REIT expenses and costs |

|

7. |

|

|

8. |

Other Additions (Attach Schedule) |

|

8. |

|

|

9. |

TOTAL - Enter also on LINE 2, SCHEDULE 1 |

|

9. |

|

|

|

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 5 |

|

1. |

Interest on obligations of United States (must be reduced by direct and indirect interest expense) . |

1. |

|

||

2. |

|

||||

2. |

Exception to intangible expenses and related interest cost (Attach |

|

|

||

|

|

||||

3. |

Exception to captive REIT expenses and costs (Attach |

|

3. |

|

|

|

|

||||

4. |

Other Subtractions (Must Attach Schedule) |

|

4. |

|

|

|

|

|

|||

5. |

TOTAL - Enter also on LINE 4, SCHEDULE 1 |

|

5. |

|

|

|

|

|

|||

|

APPORTIONMENT OF INCOME |

|

|

|

SCHEDULE 6 |

|

|

A. WITHIN GEORGIA |

B. EVERYWHERE |

|

C. DO NOT ROUND |

|

|

|

|

|

COL (A)/ COL (B) |

|

|

|

|

|

COMPUTE TO SIX DECIMALS |

1. Gross receipts from business |

1. |

|

|

|

|

|

|

|

|

||

2. |

Georgia Ratio (Divide Column A by Column B) |

2. |

|

|

|

|

COMPUTATION OF GEORGIA NET INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 7 |

|

1. |

Net business income (Schedule 1, Line 5) |

|

1. |

|

|

2. |

Income allocated everywhere (Must Attach Schedule) |

|

2. |

|

|

3. |

Business income subject to apportionment (Line 1 less Line 2) |

3. |

|

||

4. |

Georgia Ratio (Schedule 6, Column C) |

4. |

|

|

|

5. |

Net business income apportioned to Georgia (Line 3 x Line 4) |

5. |

|

||

6. |

Net income allocated to Georgia (Attach Schedule) |

|

6. |

|

|

7. |

Total of Lines 5 and 6 |

|

7. |

|

|

8. |

Less: net operating loss apportioned to GA. (from Schedule 11) |

8. |

|

||

9. |

Georgia taxable income (Enter also on Schedule 1, Line 7 ) |

............................................................... |

9. |

|

|

|

COMPUTATION OF GEORGIA NET WORTH RATIO |

(TO BE USED BY FOREIGN CORPS ONLY) |

SCHEDULE 8 |

||

1.Total value of property owned (Total assets from Federal balance sheet)

2.Gross receipts from business ............................................................

3.Totals (Line 1 plus Line 2) .................................................................

4.Georgia Ratio (Divide Line 3A by 3B) .................................................

A. Within Georgia |

B.TotalEverywhere |

C. GA. ratio (A/B) |

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

A copy of the Federal Return and supporting Schedules must be attached, otherwise this return shall be deemed incomplete. No extension of time for filing will be allowed unless a copy of the request for a Federal extension or Form

Make check payable to: Georgia Department of Revenue

Mail to: Georgia Department of Revenue, Processing Center, P.O. Box 740397, Atlanta, Georgia

Georgia Public Revenue Code Section

my/our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, their declaration is based on all information of which they |

||||||||

have any knowledge. |

|

|

|

|

|

|

Checktheboxto |

|

Email Address: |

|

|

|

|

|

|

|

authorize the |

|

|

|

|

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

Department of |

|

|

|

|

|

|

|

|

Revenue to discuss |

|

|

|

|

|

|

|||

SIGNATURE OF OFFICER |

DATE |

|

SIGNATURE OF INDIVIDUAL OR FIRM PREPARING THE RETURN the contents of this |

|||||

tax return with the named preparer.

TITLE |

IDENTIFICATION OR SOCIAL SECURITY NUMBER |

Georgia Form 600/2010 (Corporation) Name_______________________________________FEIN____________________

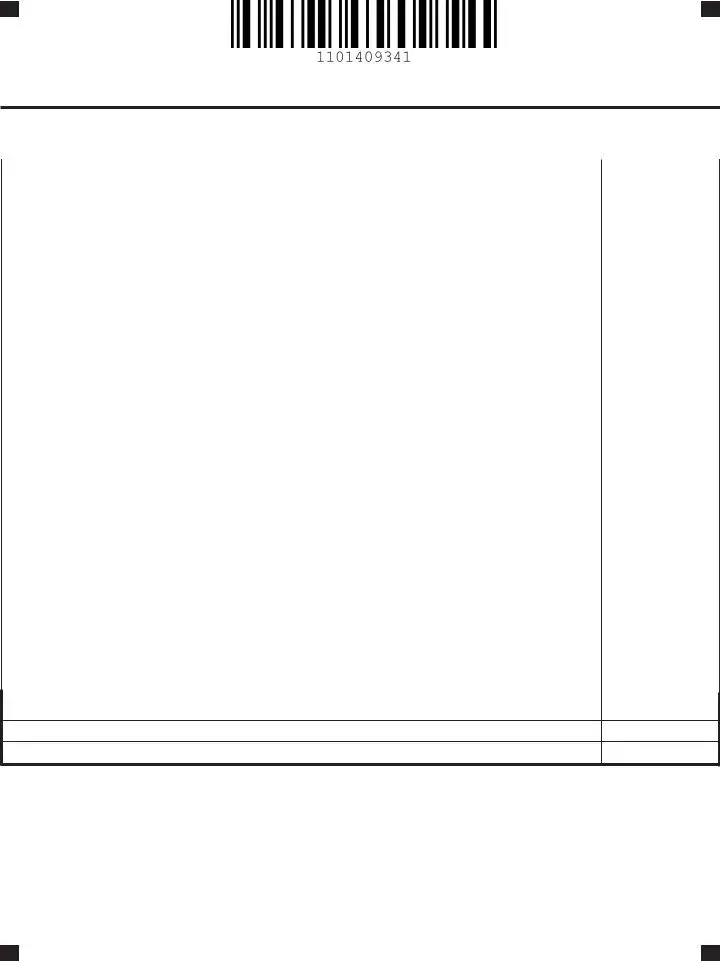

CLAIMED TAX CREDITS |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 9 |

See pages 14 through 19 for a list of available credits and their applicable codes. You must list the appropriate credit type code in the space provided. If you claim more than four credits, attach a schedule. Enter the total of the additional schedule on Line 5. If the tax credit is flowing or being assigned into this corporation from another corporation, please enter the name and FEIN of the corporation where the tax credit originated. If the credit originated with the corporation filing this return, enter “Same” in the spaces for corporation and FEIN.

|

Credit Type Code |

|

Corporation Name |

|

FEIN |

|

Amount of Credit |

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

1. |

|

2. |

|

|

|

|

|

2. |

|

3. |

|

|

|

|

|

3. |

|

4. |

|

|

|

|

|

4. |

|

5. |

Enter the total from attached schedule(s) |

|

5. |

|

|||

6. |

...............................Enter the total of Lines 1 through 5 here and on Schedule 3, Line 3, Page 1 |

6. |

|

||||

|

|

|

|

|

|

||

|

ASSIGNED TAX CREDITS |

|

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 10 |

||

Georgia Code Section

1)A corporation that is a member of the taxpayer’s affiliated group within the meaning of Section 1504(a) of the Internal Revenue Code; or

2)An entity affiliated with a corporation, business, partnership, or limited liability company taxpayer, which entity:

(a)Owns or leases the land on which a project is constructed;

(b)Provides capital for construction of the project; and

(c)Is the grantor or owner under a management agreement with a managing company for the project.

No carryover attributable to the unused portion of any previously claimed or assigned credit may be assigned or reassigned, except if the assignor and the recipient of an assigned tax credit cease to be affiliated entities, then any carryover attributable to the unused portion of the credit is transferred back to the assignor of the credit. The assignor is permitted to use any such carryover and also shall be permitted to assign the carryover to one or more affiliated entities, as if such carryover were an income tax credit for which the assignor became eligible in the taxable year in which the carryover was transferred back to the assignor. In the case of any credit that must be claimed in installments in more than one taxable year, the election under this subsection may be made on an annual basis with respect to each such installment. For additional information, please refer to Georgia Code Section

If the corporation filing this return is assigning tax credits to other affiliates, please provide detail below specifying where the tax credits are being assigned.

All assignments of credits must be made before the statutory due date (including extensions) per O.C.G.A. §

|

Credit Type Code |

Corporation Name |

FEIN |

|

Amount of Credit |

1. |

|

|

|

1. |

|

2. |

|

|

|

2. |

|

3. |

|

|

|

3. |

|

4. |

|

|

|

4. |

|

If this corporation and its affiliates to whom credits are being assigned are filing as part of a Georgia consolidated return, you must provide the name and FEIN of the corporation under which the consolidated Georgia return is being filed to ensure that the tax credits are properly applied.

Corporation: ____________________________________________ FEIN __________________

Georgia Form 600/2010 (Corporation) Name_______________________________________FEIN____________________

GA NOL Carry Forward Worksheet |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 11 |

|||

|

|

|

|

|

|

For calendar year or fiscal year beginning |

|

and ending |

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

A |

B |

C |

D |

E |

F |

Loss Year |

Loss Amount |

Income Year |

NOL Utilized |

Balance |

Remaining NOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

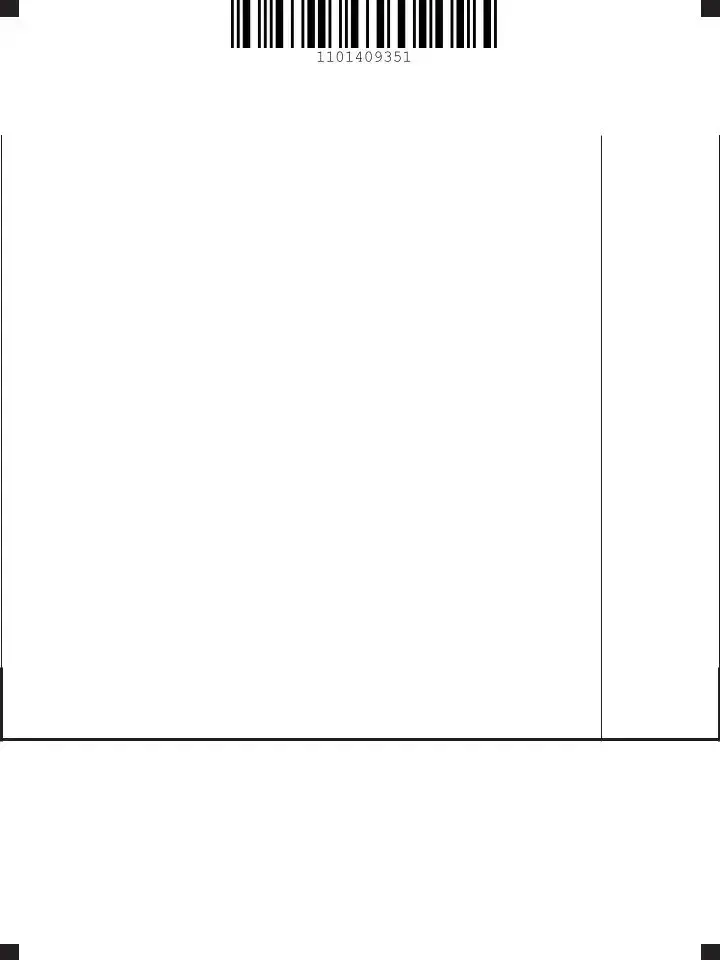

1.NOL Carry Forward Available to Current Year (Enter on Schedule 1, Line 6 or Schedule 7, Line 8)

2.Current Year Income / (Loss)

3.NOL Carry Forward Available to Next Year (Subtract Line 2 from Line 1)

INSTRUCTIONS

Column A:List the loss year(s).

Column B:List the loss amount for the tax year listed in Column A.

Columns C& D:List the years in which the losses were utilized and the amount utilized each year.

Column E:List the balance of the NOL after each year has been applied.

Column F: List the remaining NOL applicable to each loss year.

Total the remaining NOL (Col. F) and enter in the space at the bottom of the worksheet for “NOL Carry Forward Available to Current Year”. Then insert “Current Year Income / (Loss)” in the space provided and compute the “NOL Carry Forward Available to Next Year” in the last space. DO NOT check the box for IT 552 on the return if Schedule 11 is used.

Create photocopies as needed. See example worksheet on page 9.

GEORGIA NOL CARRY FORWARD WORKSHEET EXAMPLE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

A |

|

B |

C |

|

D |

|

E |

|

F |

Loss Year |

Loss Amount |

Income Year |

|

NOL Utilized |

|

Balance |

Remaining NOL |

||

1994 |

$ |

225,351 |

1996 |

$ |

49,052 |

$ |

176,299 |

|

|

1994 |

|

|

1997 |

$ |

39,252 |

$ |

137,047 |

|

|

1994 |

|

|

1998 |

$ |

26,880 |

$ |

110,167 |

|

|

1994 |

|

|

2000 |

$ |

59,504 |

$ |

50,663 |

$ |

50,663 |

1999 |

$ |

86,280 |

|

|

|

|

|

$ |

86,280 |

2001 |

$ |

116,287 |

|

|

|

|

|

$ |

116,287 |

2002 |

$ |

18,765 |

|

|

|

|

|

$ |

18,765 |

2003 |

$ |

52,711 |

|

|

|

|

|

$ |

52,711 |

2004 |

$ |

35,972 |

|

|

|

|

|

$ |

35,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. NOL Carry forward Available to Current Year (Enter on Schedule 1, Line 6 or Schedule 7, Line 8) |

360,678 |

2. Current Year Income / (Loss) |

100,000 |

3. NOL Carry forward Available to Next Year (Subtract line 2 from line 1) |

260,678 |

INSTRUCTIONS

Column A: List the loss year(s).

Column B List the loss amount for the tax year listed in Column A.

Columns C& D:List the years in which the losses were utilized and the amount utilized each year.

Column E: List the balance of the NOL after each year has been applied.

Column F: List the remaining NOL applicable to each loss year.

Total the remaining NOL (Col. F) and enter in the space at the bottom of the worksheet for “NOL Carry forward Available to Current Year”. Then insert “Current Year Income / (Loss)” in the space provided and compute the “NOL Carry forward Available to Next Year” in the last space. Do not check the box for IT 552 on the return if schedule 11 is used. Create photocopies as needed.

Page 9

File Overview

| Fact Name | Description |

|---|---|

| Form Type | Georgia Form 600 is a Corporation Tax Return. |

| Revising Date | The form revision is from November 2010. |

| Governing Body | The form is governed by the Georgia Department of Revenue. |

| Tax Years Covered | The form covers both the 2010 Income Tax Return and the 2011 Net Worth Tax Return. |

| Usage | It is used for original returns, amended returns, and consolidated parent or subsidiary returns. |

| Net Worth Tax Calculation | Includes a schedule for computing Net Worth Tax, rounding amounts to the nearest dollar. |

| Requirement for Attachments | A copy of the Federal Return and supporting schedules must be attached for the return to be considered complete. |

| Governing Law for Payments | Georgia Public Revenue Code Section 48-2-31 requires taxes to be paid in lawful money of the United States, free of expense to the State of Georgia. |

Guide to Using Georgia 600

Filling out the Georgia Form 600 is a task that requires attention to detail to ensure that all the information provided is accurate and complete. This form is essential for reporting corporation tax and net worth to the Georgia Department of Revenue. Following a structured approach helps streamline the process and ensures compliance with state tax laws.

- Start by entering the Federal Employer Identification Number (FEIN) at the top of the form.

- Provide the corporation's name and include the former name if applicable.

- Fill in the date of incorporation and the state under which the corporation is incorporated.

- Enter the corporation's business address, including number, street, city, state, and zip code.

- Specify the corporation's Georgia Withholding Tax Account Number, Georgia Sales Tax Registration Number, and the NAICS Code.

- List the location of books for audit, including city and state, and provide a contact telephone number.

- Describe the kind of business under "H. Kind of Business."

- Check the appropriate boxes for Original Return, Amended Return, and others as applicable, including noting any changes in address or name and attachment of relevant exceptions or explanations.

- Under "COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX," enter the Federal Taxable Income on Line 1.

- Follow through the form by adding or subtracting amounts as instructed to calculate the Georgia Taxable Income and tax due.

- For the "COMPUTATION OF NET WORTH TAX" section, provide details about the total capital stock, paid-in or capital surplus, total retained earnings, and compute the net worth.

- In the "COMPUTATION OF TAX DUE OR OVERPAYMENT" section, summarize the income tax, net worth tax, and total tax, then subtract any credits and payments to determine the balance of tax due or overpayment.

- Claim any tax credits in the "CLAIMED TAX CREDITS" section by listing the appropriate codes and amounts. If assigning tax credits, complete the "ASSIGNED TAX CREDITS" section accordingly.

- If there are net operating loss (NOL) carryforwards, complete the "GA NOL Carry Forward Worksheet" as instructed and ensure the information is accurately reflected in the tax return calculations.

- Review the form to ensure all sections are completed and attach a copy of the Federal Return and supporting schedules as required.

- Lastly, the declaration section must be signed and dated by an authorized officer and the individual or firm preparing the return, if applicable. Provide the necessary contact information for further communication with the Georgia Department of Revenue.

After completing and reviewing Georgia Form 600 for accuracy, mail it to the Georgia Department of Revenue at the address provided on the form along with any payment due to ensure compliance with Georgia tax obligations. Remember, punctuality in filing and accuracy in reporting are vital to avoid penalties and ensure the corporation's good standing within the state.

Obtain Clarifications on Georgia 600

Frequently Asked Questions about Georgia Form 600

- What is Georgia Form 600?

- Who needs to file Georgia Form 600?

- When is Georgia Form 600 due?

- How do I calculate the net worth tax on Georgia Form 600?

- Can tax credits be claimed on Georgia Form 600?

- What should I do if my corporation's information changes?

Georgia Form 600 is the Corporation Tax Return form that businesses must use to report their income tax and net worth tax to the Georgia Department of Revenue. This form encompasses information from a corporation's annual financial activities, calculations for taxable income, net worth tax, and any applicable tax credits or deductions.

Any corporation operating within Georgia that is subject to state income tax or net worth tax is required to file Form 600. This includes corporations headquartered in Georgia as well as out-of-state corporations with taxable income derived from Georgia sources.

Form 600 must be filed by the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, the due date would be April 15th of the following year. If an extension is granted, a copy of the request for a federal extension or Form IT-303 must be attached to the return.

The net worth tax is calculated based on the corporation's capital stock, paid-in or capital surplus, and retained earnings. These amounts are totaled to determine the net worth, which is then multiplied by a specified ratio to ascertain the portion of net worth taxable by Georgia. The net worth tax due is found using a table provided in the instructions for Form 600.

Yes, corporations can claim various tax credits on Form 600. Schedule 9 of the form is dedicated to claiming these credits, which must be listed with the appropriate credit type code, the name and FEIN of the corporation where the tax credit originated, and the amount of credit. It's important to note that any tax credits claimed can only be applied against the income tax liability, not the net worth tax liability.

If there are changes to your corporation's information, such as a name change or address change, you must indicate these changes on Form 600. For a name change, include the former name where applicable. If there is an address change, ensure the correct new address is provided on the form. Additionally, if this is a final return, an explanation must be attached.

This FAQ is meant to guide you through the basics of completing and filing Georgia Form 600. Be sure to refer to the official instructions provided by the Georgia Department of Revenue for more detailed information and specific filing requirements.

Common mistakes

Filling out the Georgia Form 600, the Corporation Tax Return, requires attention to detail and an understanding of the specific instructions provided by the Georgia Department of Revenue. Common mistakes can lead to processing delays or incorrect tax liabilities. Below are nine common mistakes individuals make when completing this form.

- Not attaching the Federal Return - It's a requirement to attach a copy of the Federal Tax Return and supporting schedules. Failure to do so renders the Georgia Form 600 incomplete.

- Incorrect rounding - All figures should be rounded to the nearest dollar. Inaccuracies in rounding can affect the computation of taxable income and tax due.

- Omitting schedules for additions and subtractions - For accurate reporting, it's necessary to attach schedules for all additions to and subtractions from Federal Taxable Income as outlined in Schedules 4 and 5.

- Not properly computing the Georgia Net Worth Tax - The Net Worth Tax computation is a common area of error due to misunderstanding of capital stock, paid-in capital, and retained earnings components.

- Failing to claim or improperly claiming tax credits - Schedule 9 needs to be completed accurately to include all applicable tax credits. Overlooking available credits or incorrect calculations can impact the tax due.

- Mistakes in apportionment calculation - Incorrectly calculating the Georgia ratio in Schedule 6, which affects the Net Business Income apportioned to Georgia, can lead to an inaccurate tax liability.

- Not reporting or miscalculating Georgia Net Operating Loss (NOL) deduction - Schedule 11 needs to accurately reflect the NOL deduction, which impacts the Georgia taxable income.

- Overlooking final, amended, and initial return checkboxes - Failing to appropriately mark the tax return status (original, amended, initial net worth, final) can result in misprocessing of the return.

- Incorrect payment information - Payments must be made in lawful money of the United States, and checks should be correctly addressed and payable to the Georgia Department of Revenue. Incorrect payment information can delay processing.

Ensuring accuracy in these areas can help avoid common pitfalls when completing the Georgia Form 600. Taking the time to carefully review the form and attached documents before submission can greatly reduce errors and the potential for unintended tax liabilities.

Documents used along the form

When filing the Georgia Form 600, a myriad of supplemental forms and documents might be necessary to provide a comprehensive overview of a corporation's tax obligations and entitlements for the fiscal year. These documents not only enhance the precision of the tax return but also ensure compliance with Georgia's tax regulations. Understanding these additional forms can alleviate some of the complexities inherent in tax preparation.

- IT-303: This form serves as a request for an extension of time to file a Georgia income tax return. It is essential for corporations that are unable to file their Form 600 by the due date. By filing Form IT-303, corporations can avoid penalties for late filing, provided they pay any estimated taxes owed.

- IT-552: Accompanied by the Georgia Form 600 when amendments are made to previously filed returns. This form outlines the changes to the corporation's income or deductions and provides a detailed explanation for each amendment. Its use ensures accuracy and transparency in tax reporting and adjustments.

- Schedule 11 (GA NOL Carry Forward Worksheet): This document is pivotal for corporations that have net operating losses (NOLs) they wish to carry forward to offset taxable income in future years. It meticulously tracks the loss year, loss amount, income year the NOL was utilized, and the remaining NOL balance, guiding corporations through the process of NOL utilization.

- Form G-2A, G-2LP, and/or G-2RP: These forms pertain to withholding credits for Georgia taxpayers. They are relevant for corporations that have had Georgia income tax withheld from payments received and can offset the amount owed on their corporate tax return with these credits. The forms are specific to the type of income and the entity making the withholding.

Together, these forms and documents provide the scaffolding for a thorough and compliant corporate tax return under Georgia’s taxation regime. By furnishing detailed financial data, justifying amendments, and claiming eligible credits, corporations can navigate the complexities of tax preparation with confidence. Ensuring each relevant document accompanies the Georgia Form 600 is not just a matter of regulatory compliance; it's a reflection of a corporation's commitment to fiscal responsibility and accuracy in its financial reporting.

Similar forms

The IRS Form 1120 (U.S. Corporation Income Tax Return) bears a resemblance to the Georgia Form 600 in several ways. Both forms are designed for corporations to report their annual income, deductions, and calculate the owed taxes. They require essential information about the corporation, such as the Employer Identification Number (EIN), business address, and the reporting of income and deductions to calculate taxable income. Additionally, they allow for adjustments to taxable income based on state-specific or federally allowed modifications.

Form IT-203 (Nonresident and Part-Year Resident Income Tax Return), used in states like New York, parallels the Georgia Form 600 in its requirement for businesses or individuals to report income sourced within the state and calculate the tax due. Both forms adjust reported federal income for state-specific items and require detailed financial information, including income sources and tax calculations based on a mix of state and federal guidelines.

The California Form 100 (California Corporation Franchise or Income Tax Return) shares similarities with Georgia's Form 600, especially in reporting income, calculating a corporation's tax liability, and providing detailed financial statements. Both forms require the attachment of federal return information, adjustments specific to the state's tax code, and detail any credits or deductions to which the corporation is entitled.

Florida Form F-1120 (Florida Corporation Income/Franchise Tax Return) mirrors the structure of Georgia Form 600 by asking for corporation information, including EIN, business address, and the calculation of tax liabilities based on income. While Florida does not have a state income tax, the form still requires similar computation methodologies for apportioning income and determining the net worth tax, akin to Georgia's requirement for corporations.

The New Jersey CBT-100 (Corporation Business Tax Return) and Georgia Form 600 share the fundamental requirement of corporations to report income, deductions, and compute tax liabilities according to state-specific regulations. Both forms necessitate details regarding the corporation's net worth, business activity within the state, and adjustments to income that influence the overall tax calculation, demonstrating their focus on corporate tax responsibilities within their respective states.

Dos and Don'ts

When filling out the Georgia Form 600 for corporation tax return, it’s important to be thorough and accurate. Below are key dos and don’ts to consider:

Do:- Double-check the Federal Employer Identification Number (FEIN): Ensure that the FEIN on your Georgia Form 600 matches the one on your federal tax return and all other official documents.

- Attach a copy of your Federal return: Failing to attach the Federal return and supporting schedules can result in your Georgia return being deemed incomplete.

- Round figures to the nearest dollar: This simplifies the computation process and aligns with the form’s instructions.

- Sign and date the form: The form must be signed and dated by an authorized officer of the corporation. If someone other than the taxpayer prepares the form, their signature is also required.

- Report any changes in address or corporate title: If there have been any changes since the last filing, make sure these are updated on the form.

- Use lawful money of the United States for payment: Ensure that payments made to the Georgia Department of Revenue are in lawful money of the United States, free of any expense to the State of Georgia.

- Forget to attach Schedule 11 for NOL Carry Forward: If you have a net operating loss (NOL) that you are carrying forward, be sure to complete and attach Schedule 11, but do not check the box for IT 552 if using Schedule 11.

- Ignore tax credits: If you are eligible for any tax credits, ensure they are claimed correctly using Schedule 9. Failing to do so could result in losing out on beneficial deductions.

- Overlook the need for approval for consolidated returns: If filing a consolidated return, remember to attach the necessary approval documentation.

- Miscalculate the Georgia Net Worth Tax: Pay careful attention when calculating net worth tax to ensure accuracy, especially when determining the applicable ratio for foreign corporations using Schedule 8.

- Fail to report any name changes: If the corporate name has changed since the last filing, be sure to include the former name for record accuracy.

- Submit the form without reviewing: Always review the entire form for accuracy before submission. This includes checking computations, ensuring all required schedules and attachments are included, and verifying that all necessary sections are filled out completely and correctly.

Misconceptions

Understanding the complexities of the Georgia Form 600, the Corporation Tax Return, can sometimes be challenging. There are common misconceptions that need to be clarified to ensure accurate and compliant submissions to the Georgia Department of Revenue. Below are ten misconceptions explained to help navigate the filing process with greater ease.

Form 600 is only for income tax computation. This is incorrect. The Georgia Form 600 serves a dual purpose, calculating both income tax and net worth tax for corporations.

Net worth tax is calculated on global assets. Actually, the net worth tax is calculated based on the corporation's net worth apportioned to Georgia, not on the global or total assets of the company.

All corporations must file using the actual net worth. While many corporations will file using their actual net worth, there are special computations for foreign corporations, where only the Georgia proportion of their net worth is taxable.

Submitting the federal return is optional. In fact, a copy of the federal return and supporting schedules must be attached to the Georgia Form 600. Failure to do so can result in the return being considered incomplete.

There's no need to report IRS adjustments. Corporations must indicate the latest taxable year adjusted by the IRS and report these adjustments to the state of Georgia as soon as possible.

Payment of taxes in forms other than money is acceptable. Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States, contradicting this misconception.

Any tax credit can offset both income and net worth tax liabilities. Tax credits from Schedule 9 may only be applied against income tax obligations, not against the net worth tax liability.

Estimating tax due or overpayment is sufficient. The Georgia Form 600 requires precise computation of taxes due or overpayment, rounding to the nearest dollar, rather than estimations.

Electronic filing or payments are not allowed. While the form does not specify, the Georgia Department of Revenue does accommodate electronic filing and payments, promoting efficiency and environmental conservation.

Authorization to discuss return details with preparers isn't necessary. Actually, there's a specific section on the form where officers of the corporation can authorize the Georgia Department of Revenue to discuss the return with the preparer, enhancing transparency and accuracy in tax matters.

Tackling these misconceptions head-on can lead to a smoother, more accurate tax filing experience for Georgia corporations. Careful attention to the details of Form 600 and the requirements laid out by the Georgia Department of Revenue ensures compliance and reduces the likelihood of errors or audit triggers.

Key takeaways

The process of completing the Georgia Form 600 is critical for corporations filing their tax returns in the state, and understanding its various components ensures compliance and optimized tax management. Here are key takeaways to adequately prepare and navigate through the form:

- Ensure the accurate representation of corporate information, including Federal Employer I.D. Number, business address, and corporate title, acknowledging any changes in name or address to maintain proper records with the Georgia Department of Revenue.

- Accurately report your beginning and ending net worth as this influences the computation of your Net Worth Tax, a component alongside the Income Tax to calculate the total tax obligation.

- Attachments are crucial: a copy of the federal return and supporting schedules must accompany the Form 600. Failure to include these documents renders the return incomplete, possibly resulting in delays or complications with your tax filing.

- Understand and correctly apply the adjustments to Federal Taxable Income (Additions and Subtractions) as per Schedules 4 and 5. These adjustments ensure your Georgia Taxable Income is calculated accurately, reflecting any state-specific tax considerations.

- Tax credits can significantly reduce your tax liability. Pay close attention to Schedule 9 for Claimed Tax Credits and ensure you've explored all available credits for which your corporation may be eligible. Proper documentation and calculation of these credits are paramount.

- For corporations with net operating losses, the Georgia NOL Carry Forward Worksheet is vital for tracking and applying these losses to current or future years, potentially offsetting taxable income and reducing tax liabilities. Familiarity with the use and limitations of NOLs in Georgia is beneficial.

- The declaration section at the end of the form requires careful attention, confirming that the information provided is accurate and truthful under penalty of perjury. This declaration reinforces the importance of thorough and honest tax reporting.

Proper completion and understanding of Georgia Form 600 not only facilitate compliance with state tax laws but also equip corporations to more effectively manage their tax obligations, potentially leading to fiscal benefits through optimized tax positions and credit utilization.

Popular PDF Forms

Free Purchase Agreement Form - This document guides sellers through disclosing legal, structural, and environmental aspects of a property to inform buyers.

Mv66 Ga Form - This document serves as a crucial step for dealers in managing their vehicle inventory legally and efficiently in Georgia.

Georgia Department of Revenue - Part of broader regulatory measures aimed at controlling the alcohol industry within state boundaries.