Free Georgia 700 Template in PDF

The Georgia 700 form, also referred to as the Partnership Tax Return, serves a pivotal role in the tax reporting and accounting processes for partnerships operating within the state of Georgia. As of its revision in October 2014, this form encompasses a range of vital information that partnerships must provide to comply with state tax obligations. Initially, it distinguishes between original, amended, and final returns, guiding entities through various stages of their lifecycle. Key elements include identifying partnership details such as federal employer identification numbers, Georgia Withholding Tax Numbers, and sales tax registration numbers, which collectively facilitate tax administration and compliance. Moreover, it prompts reporting on the nature of the business through NAICS codes, business commencement dates, and accounting basis, ensuring a comprehensive understanding of the entity’s operational scope. The form also delves into the financial intricacies of partnerships by calculating Georgia net income, necessitating detailed schedules of total income, apportionments, and allocations specific to Georgia. Importantly, it serves as a conduit for claiming various Georgia tax credits, underscoring the state’s incentives for business activities within its jurisdiction. Additionally, schedules included within the form address alterations to federal taxable income, emphasizing the state-specific tax adjustments required for an accurate tax liability assessment. With its declaration section mandating verification under penalties of perjury, the Georgia 700 form underscores the seriousness of truthful and complete tax reporting. Through its comprehensive design, the form facilitates not only the fulfillment of tax obligations but also the strategic planning opportunities available to partnerships operating in Georgia.

Form Sample

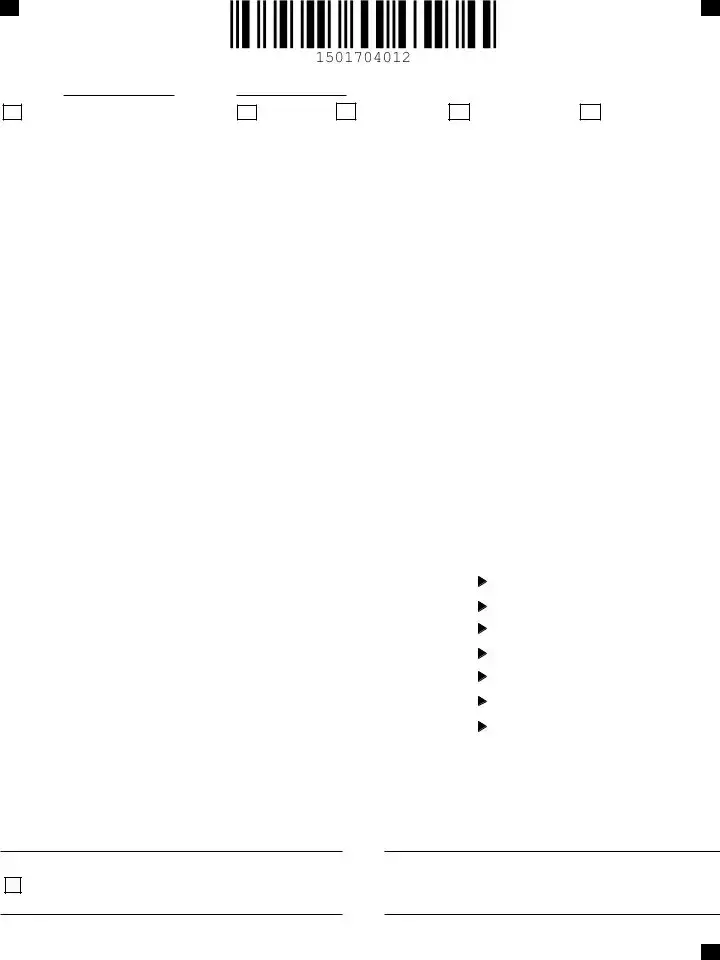

Georgia Form 700 (Rev. 10/14)

Partnership Tax Return

2014 Income Tax Return

BeginningEnding

Original Return |

|

Amended Return |

Final Return

Name Change

Address Change

Page 1

Composite Return Filed

A. Federal Employer Id. No. |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

Location of Books for Audit (City) & (State) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. GA. Withholding Tax Numbers |

|

|

Number and Street |

|

|

|

|

Country |

|

Telephone Number |

||||||||||||||

Payroll WH Number |

Nonresident WH Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C. GA. Sales Tax Reg. No. |

|

|

City or Town |

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Name (if different from last year’s return) |

|

|

|

|

Number and Street (if different from last year’s return) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

Zip Code |

|

If no return was filed last year, state the reason why |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. NAICS Code |

|

F. Kind of Business |

|

|

G. Date began doing |

|

|

H. Basis of this return |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

business in GA |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( ) CASH ( ) ACCRUAL ( ) OTHER |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

I. Indicate latest taxable year |

J. Number of Partners |

K. Do you have Nonresident |

L. Number of Nonresident |

|

M. Amount of Nonresident |

|||||||||||||||||||

|

adjusted by the IRS |

|

|

|

|

|

Partners? |

|

|

Partners |

|

Withholding paid for tax year |

||||||||||||

|

|

|

|

|

|

|

|

|

( ) Yes or ( ) No |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPUTATION OF GEORGIA NET INCOME |

|

|

|

|

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 1 |

||||||||||||||||

1. |

Total Income for Georgia purposes (Line 12, Schedule 7) |

|

|

|

|

|

1. |

|

|

|

|

|

||||||||||||

2. |

Income allocated everywhere (Attach Schedule) |

............................................................ |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|||||||

3. |

Business income subject to apportionment (Line 1 less Line 2) |

.................................. |

|

|

|

|

|

3. |

|

|

|

|

|

|||||||||||

4. |

Georgia ratio (Schedule 6, Column C) |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

||||||||

5. |

Net business income apportioned to Georgia (Line 3 x Line 4) |

|

|

|

|

|

5. |

|

|

|

|

|

||||||||||||

6. |

Net income allocated to Georgia (Attach Schedule) |

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

||||||||

7. |

Total Georgia net income (Add Line 5 and Line 6) |

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

||||||||

Copy of the Federal Return and supporting Schedules must beattached. Otherwise this return shall be deemed incomplete.

DECLARATION

I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of which the preparer has any knowledge.

MAIL TO: Georgia Department of Revenue, Processing Center, PO Box 740315, Atlanta, Georgia

Signature of Partner (Must be signed by partner) |

Signature of Preparer other than partner or member |

I authorize the Georgia Department of Revenue to electronically notify me at the below

Email Address |

Preparer’s Firm Name |

|

|

|

|

|

|

Date |

Preparer’s SSN or PTIN |

Date |

|

TRIAL MODE − a valid license will remove this message. See the keywords property of this PDF for more information.

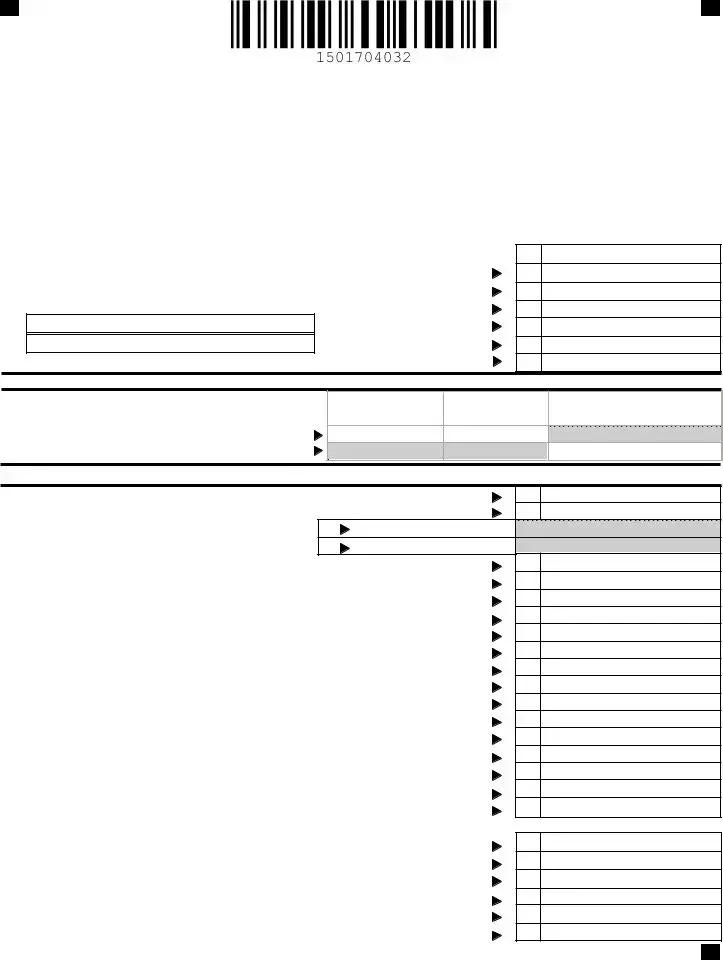

Georgia Form 700/2014

Page 2

(Partnership) Name |

|

|

FEIN |

|

|

|

|

|

|

||

GEORGIA TAX CREDITS |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 2 |

|||

|

|

|

|

|

|

These are for information purposes only and do not affect Schedules 1 or

Credit Type Code |

Company Name |

|

FEIN |

% |

|

Amount of Credit |

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

11. |

Enter the total from attached schedule(s) |

|

11. |

|

|||

12. TOTALALLOWABLE GEORGIATAXCREDITS FOR THEYEAR |

......................................... |

|

12. |

|

|||

Attach the appropriate form or a detailed schedule for each credit claimed (See pages

|

INCOME TO PARTNERS |

|

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 3 |

|||||

|

|

(1.) Name |

(3.) City, State and Zip |

|

|

|

|

|

||

|

|

(2.) Street and Number |

(4.) I.D. Number |

Profit Sharing % |

|

Georgia Source Income |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

A |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

B |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

C |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

D |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

5. |

|

|

6. |

|

|

E |

|

2. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

SCHEDULE 4 |

||||||

|

|

|

|

|

|

|||||

1. |

State and municipal bond interest other than Georgia or political subdivision thereof |

|

1. |

|

|

|||||

2. |

Net income or net profits taxes imposed by taxing jurisdictions other than Georgia |

|

2. |

|

|

|||||

3. |

Expenses attributable to tax exempt income |

|

3. |

|

|

|||||

|

Schedule 4 continued on Page 3 |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

TRIAL MODE − a valid license will remove this message. See the keywords property of this PDF for more information.

Georgia Form 700/2014 |

Page 3 |

(Partnership) Name |

|

|

FEIN |

|

|

|

|

|||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

|

SCHEDULE 4 (continued) |

|||||

|

|

|

|

|

|

|

|

|

|

|

4. |

|

Federal deduction for income attributable to domestic production activities (IRC section 199) |

|

4. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

5. |

|

Intangible expenses and related interest costs |

|

|

|

5. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

6. |

|

Captive REIT expenses and costs |

|

|

|

6. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

7. |

|

Other additions (Attach schedule) |

|

|

|

7. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

.......................................................... |

|

8. |

|

|

||

9. Total (Add Lines 1 through 8) Enter here and on Line 9, Schedule 7 |

|

9. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

(ROUND TO NEAREST DOLLAR) |

|

|

SCHEDULE 5 |

|||||

1.Interest on obligations of United States (must be reduced by direct and indirect interest expenses)

2. Exception to intangible expenses and related interest cost (Attach

3. Exception to captive REIT expenses and costs (Attach

4. Other subtractions (Attach Schedule) ..............................................................................

5.

6.

7. Total (Add Lines 1 through 6) enter here and on Line 11, Schedule 7..........................

1.

2.

3.

4.

5.

6.

7.

APPORTIONMENT OF INCOME |

(ROUND TO NEAREST DOLLAR) |

SCHEDULE 6 |

|

A. WITHIN GEORGIA B. EVERYWHERE |

C. DO NOT ROUND COL (A)/ COL (B) |

|

|

COMPUTE TO SIX DECIMALS |

1. Gross receipts from business |

|

|

2. Georgia Ratio (Divide Column A by Column B) |

|

|

|

COMPUTATION OF TOTAL INCOME FOR GEORGIA PURPOSES (ROUND TO NEAREST DOLLAR) |

SCHEDULE 7 |

||

1. |

Ordinary income (loss) |

|

1. |

|

2. |

Net income (loss) from rental real estate activities |

....................................... |

2. |

|

3. |

a. Gross income from other rental activities |

3a. |

|

|

|

b. Less expenses (attach schedule) |

3b. |

|

|

|

c. Net income (loss) from other rental activities (Line 3a less Line 3b) |

3c. |

||

4. |

Portfolio income (loss): |

a. Interest Income |

4a. |

|

|

|

b. Dividend Income |

4b. |

|

|

|

c. Royalty Income |

4c. |

|

|

|

d. Net |

4d. |

|

|

|

e. Net |

4e. |

|

|

|

f. Other portfolio income (loss) |

4f. |

|

5. |

Guaranteed payments to partners |

5. |

||

6. |

Net gain (loss) under Section 1231 |

6. |

||

7. |

Other Income (loss) |

|

7. |

|

8. |

Total Federal income (add Lines 1 through 7) |

8. |

||

9. |

Additions to Federal income (Schedule 4, Line 9) |

9. |

||

10. |

Total (add Lines 8 and 9) |

............................................................................................ |

10. |

|

11. |

Subtractions from Federal income (Schedule 5, Line 7) |

11. |

||

12. |

Total income for Georgia purposes (Line 10 less Line 11) |

12. |

||

Other Required Federal Information

1.Salaries and wages (Form 1065) ...............................................................................

2.Taxes and licenses (Form 1065) ................................................................................

3.Section 179 deduction (Form 1065) ...........................................................................

4.Contributions (Form 1065) .......................................................................................

5.Investment interest expense (Form 1065) .................................................................

6.Section 59(e)(2) expenditures (Form 1065) ...............................................................

1.

2.

3.

4.

5.

6.

TRIAL MODE − a valid license will remove this message. See the keywords property of this PDF for more information.

File Overview

| Fact | Detail |

|---|---|

| Form Type | Georgia Form 700 - Partnership Tax Return 2014 |

| Purpose | Income Tax Return for Partnerships |

| Revision Date | October 2014 (Rev. 10/14) |

| Key Features | Original, Amended, Final Return; Name and Address Change |

| Special Sections | Composite Return Filed, Georgia Net Income Computation, Georgia Tax Credits |

| Declaration Requirement | Must be signed under penalties of perjury by a partner |

| Submission Address | Georgia Department of Revenue, Processing Center, PO Box 740315, Atlanta, Georgia 30374-0315 |

| Governing Law | Georgia State Tax Law |

Guide to Using Georgia 700

When preparing to file the Georgia Form 700 for a Partnership Tax Return, it is important to gather all necessary information and documents. Having a copy of the federal return and relevant schedules at hand will ensure accuracy and completeness. The form requires careful attention to detail, as it includes several sections that must be accurately filled out to comply with Georgia state tax regulations. Below are the steps to take when filling out the Georgia Form 700, aimed at streamlining the process and helping to avoid common errors.

- Start by filling in the general information about the partnership at the top of the form, including the type of return (Original, Amended, or Final), any name or address changes, and whether a Composite Return is filed.

- Enter the Federal Employer Identification Number (FEIN), the partnership's name, and the location of books for audit.

- Provide Georgia Withholding Tax Numbers, including Payroll WH Number and Nonresident WH Number, if applicable.

- Fill in the Georgia Sales Tax Registration Number (GA Sales Tax Reg. No.) and the partnership’s address and telephone number.

- If the partnership's name or address changed from the last year, enter the new details in the designated section.

- Specify the North American Industry Classification System (NAICS) code that best describes the partnership’s primary business activity.

- Indicate the kind of business, the date the business began in Georgia, and the basis of the return (Cash, Accrual, or Other).

- Mark whether the IRS has adjusted the latest taxable year and if the partnership has Nonresident Partners. Also, provide the number of Nonresident Partners and the amount of Nonresident Withholding paid for the tax year.

- Proceed to the computation of Georgia Net Income on SCHEDULE 1, carefully filling in each line as instructed, using information from your federal return and attached schedules.

- Complete the DECLARATION section at the bottom of the first page, ensuring that a partner signs the form. If prepared by someone other than a partner, that individual must also sign and provide their information.

- On the second page, detail any Georgia Tax Credits on SCHEDULE 2 by listing the credit type code, the company name, FEIN, percentage of credit claimed, and the amount of credit for up to ten credits. Enter totals as directed.

- Fill out SCHEDULE 3 with Income to Partners, including name, address, I.D. number, Profit Sharing percentage, and Georgia Source Income for each partner.

- Complete SCHEDULES 4, 5, 6, and 7, providing information on Additions and Subtractions to Federal Taxable Income, Apportionment of Income, and Calculation of Total Income for Georgia purposes, following each section's instructions carefully.

- Ensure all other required Federal information is accurately provided in the designated section.

- Review the entire form to ensure accuracy, then mail it to the provided address of the Georgia Department of Revenue along with any required attachments.

It is beneficial to retain a copy of the filed form and all supporting documents for your records. Filing accurately and on time helps avoid potential penalties and ensures compliance with Georgia state tax requirements. For specific questions or concerns, consider consulting a tax professional familiar with Georgia tax laws.

Obtain Clarifications on Georgia 700

FAQ Section: Georgia Form 700

- What is Georgia Form 700?

- Who needs to file Georgia Form 700?

- What information is required to complete Form 700?

- How do partnerships determine their Georgia net income?

- Are there any specific tax credits available to partnerships filing Form 700?

- What are the filing requirements for Georgia Form 700?

Georgia Form 700, also known as the Partnership Tax Return, is a document that partnerships use to report their income, gains, losses, deductions, and credits to the Georgia Department of Revenue. It helps determine the state tax responsibilities of partnerships operating in Georgia.

All partnerships that conduct business in Georgia or earn income from Georgia sources are required to file Form 700. This includes both domestic and foreign partnerships.

To complete Form 700, partnerships need to provide details about their federal income, adjustments specific to Georgia, their Georgia net income, and the distribution of income to partners. This includes their Federal Employer Identification Number (FEIN), Georgia withholding tax numbers, details about their business, and a computation of Georgia net income. A complete copy of the federal return and supporting schedules must also be attached.

Partnerships calculate their Georgia net income by first determining their total income for Georgia purposes, making adjustments for income allocated everywhere, and then subtracting or adding specific amounts as required by Georgia law. This includes adjustments for business income, Georgia ratio computations, and net income apportioned to Georgia.

Yes, Georgia Form 700 provides an opportunity to claim various state tax credits. These credits are listed in Schedule 2 of the form and require detailed information about the type of credit claimed, the percentage of credit claimed, and the total amount of allowable Georgia tax credits for the year. Partnerships should refer to the instructions for a list of available credits and applicable codes.

Georgia Form 700 must be completed and signed by a partner of the partnership. It should include all necessary schedules, statements, and attachments, including a complete copy of the federal tax return. The form should be mailed to the Georgia Department of Revenue, Processing Center, as indicated in the form's instructions. Partnerships must ensure that the form is filed by the designated deadline to avoid any penalties or interest due to late filing.

Common mistakes

Filling out Georgia Form 700 accurately is crucial for any partnership to ensure compliance with state tax obligations. However, mistakes can happen, and here are some common errors to avoid:

Not attaching a copy of the Federal Return and supporting schedules - The form explicitly requires this documentation. Failure to attach it can result in the return being considered incomplete.

Incorrectly rounding numbers to the nearest dollar - This detail might seem minor but can lead to discrepancies in reported income or deductions.

Omitting the Georgia Sales Tax Registration Number or Federal Employer Identification Number (FEIN) - This information is crucial for the state to identify and process your return correctly.

Forgetting to indicate the kind of business, the date business began in Georgia, and the basis of the return (cash, accrual, or other) - These details are essential for accurate tax assessment.

Failure to list nonresident partners and to include the amount of nonresident withholding paid for the tax year if applicable - This oversight can lead to underpayment of tax liabilities.

Not accurately completing the computation of Georgia net income, including failing to attach the required schedules or accurately applying the Georgia ratio - Accurate calculation is key to determining the correct tax owed.

Incorrectly reporting state and municipal bond interest or mistakenly claiming tax credits without attaching the appropriate forms or detailed schedules - This mistake can affect your taxable income calculation and lead to penalties.

Leaving the declaration unsigned or not authorizing the Georgia Department of Revenue to electronically notify updates about the account(s) - The declaration is a critical part of the form, affirming the accuracy of the information provided.

Ensuring accuracy and completeness when filling out Georgia Form 700 can help avoid delays, penalties, and potential legal complications related to state tax obligations. It's always wise to double-check entries and required attachments before submission.

Documents used along the form

When filing the Georgia 700 Form, several supplementary documents and forms may be required to provide a comprehensive overview of a partnership's financial activities for the tax year. These forms ensure that the Georgia Department of Revenue receives all necessary information for accurate and efficient tax processing. Here is a breakdown of other commonly used forms and documents alongside the Georgia 700 Form:

- Form IT-REIT: This form is specifically designed for entities that have to report adjustments related to captive Real Estate Investment Trust (REIT) expenses. It supports the adjustments to taxable income where direct and indirect ownership of REIT shares are involved.

- Form 1065 (U.S. Return of Partnership Income): A federal form that captures the partnership's financial information, including income, gains, losses, deductions, and credits for the tax year. This form is foundational for filling out Georgia Form 700 as it provides the initial details required by state bodies.

- Schedule K-1 (Form 1065): This document reports the share of a partnership's income, deductions, credits, etc., passed through to partners. It must be filed with Form 1065 and given to each partner for individual tax reporting purposes.

- Form IT-Addback: Used for reporting specific items that are added back to taxable income, such as state taxes or interest expense deductions that are not allowed under Georgia law.

- Georgia Department of Revenue's Power of Attorney Form: This form authorizes an individual, such as a tax professional, to handle tax matters and communicate with the Georgia Department of Revenue on behalf of the partnership.

- Schedule of Apportionment: Required for businesses operating both within and outside of Georgia to calculate the portion of income attributable to the state. It helps determine what percentage of the overall income will be subject to Georgia state tax.

- NAICS (North American Industry Classification System) Code Documentation: This provides the specific industry code that applies to the partnership’s primary business activity. Although not a form, this code is crucial for accurately completing Section E of the Georgia 700 Form.

Collectively, these documents facilitate a thorough understanding of a partnership's finances, ensuring compliance with Georgia's tax laws. Each plays a unique role in helping partnerships and their members fulfill their state tax obligations correctly. For a smooth and accurate tax filing process, it's essential for partnerships to prepare and review these forms and documents in conjunction with the Georgia 700 Form.

Similar forms

The IRS Form 1065 is similar to the Georgia 700 form in that both are used by partnerships for tax reporting purposes. Form 1065 is a federal return required by the IRS to report a partnership's income, deductions, gains, losses, etc., on a national level, while the Georgia 700 form serves a similar purpose at the state level for Georgia.

Form 565, the Partnership Return of Income for California, is analogous to the Georgia 700 form in structure and function, being a state-specific partnership income tax return. Like the Georgia 700, it collects details about the partnership’s income, losses, and deductions, but it is tailored for the tax laws and requirements of California.

The Form IT-204 used in New York, also known as the Partnership, LLC, and LLP Filing Fee Payment Form, shares similarities with the Georgia 700 form. Although it primarily focuses on filing fee payments, it also includes elements of income reporting for the state, reflecting the principle of state-level partnership income declarations akin to Georgia’s approach.

Form NJ-1065, the Partnership Return and New Jersey Partnership NJK-1, operates similarly to the Georgia 700 form by addressing the state-specific reporting needs for partnerships operating within New Jersey. It gathers information on the partnership's earnings and allocates income to the partners, paralleling the purpose and function of Georgia’s form.

The Schedule K-1 (Form 1065) aspect of the federal tax filing process is connected to the Georgia 700 form. While the Schedule K-1 itself is a component of the broader Form 1065, it details each partner's share of income, deductions, credits, etc., which is information also crucial to completing state-level returns like the Georgia 700, highlighting the interplay between federal and state tax responsibilities for partnerships.

Dos and Don'ts

Filling out the Georgia Form 700, the Partnership Tax Return for 2014, requires diligence and attention to detail. Here are several things you should and shouldn’t do to ensure the process goes smoothly.

- Do double-check the Federal Employer Identification Number (FEIN) and Georgia Withholding Tax Numbers for accuracy to avoid processing delays.

- Do indicate clearly whether the return is an original, amended, or final return to streamline the processing and avoid confusion.

- Do make sure to attach a copy of the Federal Return and all necessary schedules. The return is considered incomplete without them.

- Do accurately calculate Georgia Net Income, rounding to the nearest dollar as instructed to ensure precise tax calculations.

- Don't leave the declaration unsigned. A partner must sign the return for it to be processed.

- Don't forget to list the appropriate credit type codes in Schedule 2 if you are claiming Georgia tax credits. Incorrect or missing codes can lead to missed tax benefits.

- Don't neglect to provide an email address if you wish to receive electronic notifications regarding updates to your account(s).

- Don't overlook the NAICS code and the kind of business information, as these details are crucial for accurate tax assessment.

Following these guidelines will help partners ensure that their Georgia Form 700 submissions are complete, accurate, and processed efficiently.

Misconceptions

When it comes to navigating tax forms, particularly for partnerships in Georgia, understanding the versatility and complexities of the Georgia Form 700 can be daunting. There are several misconceptions that often circulate among taxpayers, potentially leading to errors or misunderstandings. Let's clear up some of these misconceptions to help ensure partnerships are better informed when approaching their tax duties.

- Misconception #1: The Georgia Form 700 is only for reporting income.

While the Georgia Form 700 is indeed a tax return form primarily used to report income, it encompasses much more. It's a comprehensive form used by partnerships to detail their income, losses, deductions, and credits specific to Georgia, ensuring that state tax liabilities are accurately calculated and reported.

- Misconception #2: All partnerships must file the Georgia Form 700.

While many partnerships operating in Georgia are required to file this form, there are exceptions. The need to file depends on various factors such as the partnership's income, nexus in Georgia, and whether they are subject to withholding requirements for nonresident partners. It's important for each partnership to assess their specific situation.

- Misconception #3: Filing a federal partnership return means the state return is not needed.

This is a common misunderstanding. Filing a federal partnership tax return does not exempt a partnership from filing a state tax return in Georgia. In fact, the state return requires information from the federal return, making it necessary for partnerships to file both.

- Misconception #4: The Georgia Form 700 is simple and doesn't require detailed records.

On the contrary, completing the Georgia Form 700 requires meticulous record-keeping and detailed financial information. Partnerships must accurately report their income, allocations, and apportionments among other detailed financial data specific to their operation in Georgia.

- Misconception #5: Amendments to the original return are not permitted.

In fact, partnerships can file amended returns using the Georgia Form 700 if they need to correct or update information on a previously filed return. This ensures that partnerships have the opportunity to rectify any inaccuracies or omissions.

- Misconception #6: Nonresident partners do not affect filing requirements.

The presence of nonresident partners can significantly affect a partnership's filing obligations. Georgia requires partnerships to withhold income tax on behalf of nonresident partners, making the understanding and management of these requirements crucial for compliance.

- Misconception #7: Electronic filing is not available or required for the Georgia Form 700.

Georgia encourages and, in some cases, requires electronic filing for the Form 700. This not only streamlines the filing process but also expedites the handling and processing of returns, making it a mutually beneficial approach for both the state and the filing partnerships.

- Misconception #8: The Georgia Form 700 covers all state tax obligations for a partnership.

While the Georgia Form 700 is a critical component of a partnership's tax obligations, it does not encompass all tax liabilities that a partnership may incur in Georgia. Partnerships must also consider other taxes such as sales and use tax, payroll withholding tax, and others as applicable to their operation.

Understanding these nuances of the Georgia Form 700 can help partnerships navigate their state tax obligations more effectively, ensuring compliance and avoiding potential pitfalls associated with common misconceptions.

Key takeaways

Understanding how to correctly complete and use the Georgia 700 form is crucial for partners and tax professionals involved with partnership tax returns in Georgia. The form can appear daunting at first glance, but with the right guidance, you can navigate through it smoothly. Here are ten key takeaways that will assist you in managing the Georgia 700 form effectively:

- The Georgia 700 form is a Partnership Tax Return form specifically tailored for the state of Georgia, used to report income tax for partnerships operating within the state.

- Designated as an original, amended, or final return, the form accommodates various filing circumstances, including name and address changes, indicating its versatility in different partnership scenarios.

- It is essential to include the Federal Employer Identification Number (FEIN) and other pertinent details like the GA Withholding Tax Numbers and GA Sales Tax Registration Number, ensuring the partnership is correctly identified and linked to its respective tax responsibilities.

- The form asks for detailed information regarding the partnership's income, with specific sections devoted to allocating income sourced within Georgia and instructions for computing Georgia net income with an emphasis on precision to the nearest dollar.

- Documentation of income to partners, including their share of profit and Georgia source income, is a critical section of the form, requiring meticulous detail to ensure accurate income reporting for each partner.

- To successfully complete the form, attachments, including a copy of the federal return and applicable schedules, are mandatory. This requirement underscores the form's interconnection with federal tax obligations and the need for comprehensive documentation.

- Georgia Tax Credits, as referenced in Schedule 2 of the form, highlight available tax incentives for partnerships, with detailed instructions provided in the form's instructions guide for claiming these credits.

- The declaration section mandates a signature from a partner, emphasizing the form's legal implications and the importance of the information being accurate and truthful, under penalty of perjury.

- Electronic communication consent indicates a modern approach to tax communications, allowing the Georgia Department of Revenue to notify filers about updates to their account(s) via email.

- Finally, the form caters to apportionment and adjustments to federal taxable income, with schedules dedicated to such modifications, reflecting the state-specific tax considerations that partnerships must navigate in Georgia.

Armed with these insights, partnerships can approach the Georgia 700 form with confidence, understanding its requirements and the detailed financial and operational information it demands. This knowledge is vital for ensuring compliance with Georgia's tax laws and maximizing potential benefits available through accurate and strategic tax filing.

Popular PDF Forms

G-7 Return - The “Amount Enclosed” section indicates the payment accompanying the form, critical for reconciling the reported tax liability.

Georgia Workers' Compensation Forms - A crucial form for both employers and employees in the event of a workplace injury requiring compensation.

Georgia Car Title Template - Georgia residents can rely on the MV-1S form for salvage title applications, offering a clear path to obtaining or replacing a title.