Free Georgia Department Of Labor Template in PDF

When businesses in Georgia embark on the journey of hiring employees, one critical step involves interacting with the Georgia Department of Labor through a form that outlines essential information about the employer and the nature of the employment it offers. This form, known as the Employer Status Report, is not just a formality but a crucial document that affects how employment is regulated and encompasses a variety of data points, including business name and address, type of organization (whether it's an individual, partnership, corporation, nonprofit organization, etc.), trade name, principal business location in Georgia, and specifics about the workforce such as dates of employment commencement and payroll details. It delves into federal unemployment tax liability, changes in business ownership, and sector-specific employment such as agricultural, domestic, or nonprofit work. The form also seeks detailed information about the organization's officers and requires certification under penalties of perjury. This ensures the integrity of the information provided, which plays a vital role in the administration of employment and labor laws within the state. Understanding the aspects of this form is pivotal for businesses to comply with Georgia's employment security law, which aims to streamline employment practices and safeguard both employer and employee interests.

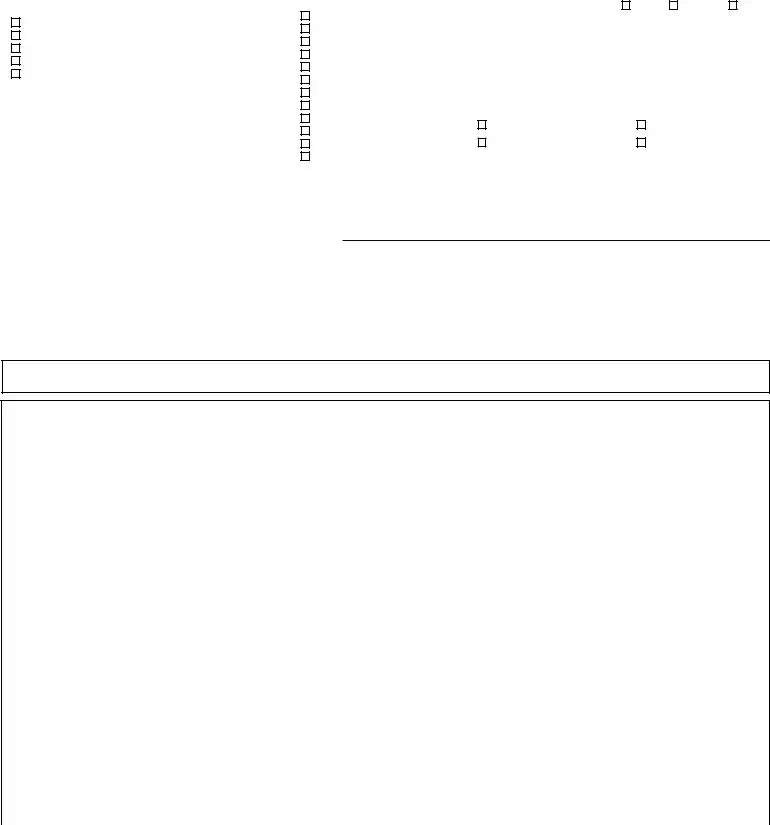

Form Sample

GEORGIA DEPARTM ENT OF LABOR

SUITE 850 - 148 ANDREW YOUNG INTERNATIONAL BLVD NE - ATLANTA, GA 30303- 1751

EM PLOYER STATUS REPORT

READ INSTRUCTIONS ON REVERSE SIDE

BEFORE COM PLETION OF FORM

1 . ENTER OR CORRECT BUSINESS NA M E A ND A DDRESS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN ORIGINAL W ITHIN 1 0 DAYS |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GEORGIA DOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A CCOUNT NUM BER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|||||||||||||

3 . T RA DE NA M E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(I f |

al ready |

assi gned) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. TYPE OF ORGA NI ZA TI ON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I ndi vi dual |

|

|

|

Part nershi p |

|

|

Corporat i on |

|

|

|

Nonprof i t org. |

|

|||||||||||||||||||||||||

4 . PRI NCI PA L BUSI NESS, |

|

St reet |

A ddress |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Li mi t ed Li abi l i t y CO. (LLC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

FA RM O R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

HO USEHO LD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ot her (speci f y)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

LO CA T I O N I N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

GEO RGI A |

|

Ci t y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zi p Code |

|

|

|

Count y |

|

|

|

|

Tel ephone Number |

|

||||||||||||||||||||||||||||||||||||||||

(Do not use a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

GA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

P. O. Box number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

5 . DA T E FI RST BEGA N |

|

|

|

|

DA T E O F |

|

6 . A RE Y O U LI A BLE |

|

|

|

|

|

FEDERA L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

EM PLO Y I NG W O RKERS |

|

|

|

|

FI RST GA . |

|

|

FO R FEDERA L Y ES |

|

NO |

|

|

I . D. |

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

W I T HI N ST A T E O F GA . |

|

|

|

|

PA Y RO LL |

|

|

UNEM PLO Y M ENT T A X ? |

|

|

NUM BER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

7. HA VE YOU |

|

|

|

|

|

|

|

DA T E A CQ UI RED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DI D Y O U A CQ UI RE |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

A cqui red anot her busi ness? |

Yes |

|

No |

|

|

|

O R CHA NGED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A l l of Georgi a operat i ons? |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREDECESSO R' S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

M erged wi t h anot her busi ness? Yes |

|

No |

|

|

|

GEO RGI A DO L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subst ant i al l y |

|

al l of Georgi a operat i ons |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

A CCO UNT NUM BER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(90% or more) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Formed a corporat i on or |

|

|

|

|

|

|

|

DOES THE FORM ER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

OWNER CONTI NUE TO |

|

|

|

Yes |

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part of Georgi a operat i ons (l ess t han 90%) |

|

|||||||||||||||||||||||||||||||||||||

part nershi p? |

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

HA VE EM PLOYEES? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

M ade any ot her change i n t he |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ownershi p of your busi ness? |

Yes |

|

No |

|

|

I f yes, ex pl ai n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM WHOM ? (Organi zat i on name, i ncl udi ng t rade name)

A DDRESS

8. I F YOU HA D PRI VA TE BUSI NESS EM PLOYM ENT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. I F YOU HA D DOM ESTI C EM PLOYM ENT: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Di d you, or do you ex pect t o empl oy at |

l east one worker Yes* |

|

|

|

No |

|

|

Di d you, or do you ex pect t o pay cash wages |

|

|

Yes* |

|

No |

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

of |

$ 1,000 or more |

i n any cal endar quart er? |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

i n 20 |

di f f erent cal endar weeks duri ng a cal endar year? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

* I f |

yes, show |

dat e |

t he 20t h week f i rst |

occurred: |

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

I f |

yes, show dat e t hi s f i rst |

occurred: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes* |

|

|

|

|

No |

|

|

|

10. I F YOU HA D A GRI CULTURA L EM PLOYM ENT: |

|

|

Yes* |

|

No |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Di d you, or do you ex pect t o have a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Di d you, or do you ex pect t o empl oy 10 or more agri cul t ural |

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

quart erl y payrol l |

of $ 1,500 or more? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

workers i n 20 di f f erent cal endar weeks duri ng a cal endar year? |

|

|

|

|

|

||||||||||||||||||||

|

* I f |

yes, show |

dat e |

t hi s f i rst occurred: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

I f |

yes, show dat e t he 20t h week f i rst occurred: |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

11. I F YOU A RE A NONPROFI T ORGA NI ZA TI ON EX EM PT |

|

|

|

|

|

|

|

|

|

|

|

|

|

Di d you, or do you ex pect t o have a gross cash agri cul t ural Yes* |

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

||||||||||||||||||||||||||||||||

|

FROM I NCOM E TA X |

UNDER I RS CODE 501(c)(3): |

Yes* |

|

|

|

|

No |

|

|

|

|

payrol l of $ 20,000 or more i n any cal endar quart er? |

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Di d you, or do you ex pect t o empl oy f our or more |

|

|

|

|

|

|

|

* |

I f |

yes, show dat e t hi s f i rst |

occurred: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

workers i n 20 di f f erent cal endar weeks duri ng a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

cal endar year? |

( ATTACH COP Y OF 5 0 1 ( C) ( 3 ) |

|

EXEMP TI ON LETTER) |

|

|

12. HOW M A NY EM PLOYEES do you have, (or ant i ci pat e |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

* I f |

yes, show |

dat e |

t he 20t h week f i rst |

occurred: |

|

|

|

|

|

|

|

|

|

|

|

|

|

when i n f ul l |

operat i on)? |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

I NF ORMATI ON |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I NFO RM A T I O N |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A BO UT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ABOUT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSO N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

OWNER, |

|

Soci al Securi t y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O R FI RM |

|

A ddress |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

ALL |

|

Number |

|

|

|

|

|

|

|

_ |

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

W HO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

P ARTNERS , |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M A I NT A I NS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

OR P RI NCI P AL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FI NA NCI A L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Resi dence A ddress |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ci t y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECO RDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

OF F I CER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O F BUSI NESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

( ATTACH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADDI TI ONAL |

Ci t y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

St at e |

|

Zi p Code |

|

Tel ephone |

|

|

|

|

|

||||||

S HEET, OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

S HEETS , |

I F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

NECES S ARY) |

St at e |

|

Zi p Code |

|

|

CERTI FI CA TI ON: I |

hereby cert i f y under penal t i es of perj ury, t hat t he f oregoi ng st at ement and t hose cont ai ned |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i n any at t ached sheet s si gned by me are t rue and correct , and t hat I am aut hori zed t o ex ecut e t hi s report on |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

behal f of t he empl oyi ng uni t . Thi s report must be si gned by owner, part ner or pri nci pal of f i cer. |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

Tel ephone |

|

|

Si gnat ure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ti t l e |

|

|

|

|

Dat e |

|

|

|

|

|

|||||||||||||

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE COM PLETE INDUSTRY INFORM ATION ON REVERSE SIDE.

DO L- 1 A (R- 5 / 0 1 )

T A 4 8 9 A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CONTINUED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NATURE OF BUSINESS: Inf ormation |

is |

required on all items. Attach additional sheets, |

if |

necessary. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

A . How many Georgia locations do |

you operate? |

|

|

|

|

|

|

C. Enter in order of importance and indicate |

|||||||||||||||||||||||||||||

|

Provide |

the |

f ollow ing |

inf ormation |

f or |

each location, |

attaching |

additional |

|

|

|

approximate % of total annual income derived |

|||||||||||||||||||||||||

|

sheets |

if |

necessary. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f rom each: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

B. Check the box that best |

describes |

the industry |

that |

relates |

to |

your |

|

|

|

Principal |

Service(s) |

OR |

|

Principal Product(s) |

|||||||||||||||||||||||

|

business |

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rendered* |

|

|

|

Mf g. |

Grow n |

Sold |

||||||||||||||

|

|

|

|

|

|

|

|

|

Manuf acturing |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Agriculture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

||||||||

|

Forestry |

|

|

|

|

|

|

|

|

|

|

Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

||||||

|

|

|

|

|

|

|

|

|

|

|

Communication |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Fishing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Public |

Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Mining |

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

I f |

Transport at i on- Trucki ng, |

i ndi cat e |

i f i nt erst at e carri er |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

W holesale Trade |

|

|||||||||||||||||||||||

|

Construction (specif y): |

|

|

|

|

|

|

|

|

D. If |

this report includes |

establishment(s) |

that |

only |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

Retail |

Trade |

|

|||||||||||||||||||||||||||

|

General |

Contractors |

Industrial_ |

_ |

_ |

% |

|

|

|

|

|

perf orm |

services |

f or other units of |

the |

company, |

|||||||||||||||||||||

|

|

|

Finance |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

indicate |

the primary type of |

|

service or support |

|||||||||||||||

|

Residential_ |

_ |

_ % Commercial_ |

_ |

_ |

% |

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Insurance |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Speculative |

Building |

|

|

|

|

|

|

|

|

|

|

|

|

provided. |

Check |

as many as apply: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

Real Estate |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Special |

Trade |

Contractor |

(specif y plumbing, |

|

|

|

1 . |

|

Central |

Administration |

3 . |

Storage (w arehouse) |

||||||||||||||||||||||||

|

|

|

Services |

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

etc.,)_ |

_ _ |

_ |

_ _ _ _ |

_ |

_ _ _ |

_ |

_ |

_ |

_ _ |

|

|

|

|

2 . |

|

Research,development, |

4 . |

Other: (specif y), |

||||||||||||||||||

|

|

|

Public |

Administration |

|

|

|||||||||||||||||||||||||||||||

|

Heavy Construction (specif y cable, |

highw ay, |

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

Private |

Household |

|

|

|

|

and |

testing |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

etc.,)_ |

_ |

_ _ |

_ _ _ _ |

_ |

_ _ _ _ _ |

_ |

_ _ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR ASSISTANCE, |

call |

the Industry Classif ication |

Unit, |

(4 0 4 ) 6 5 6 - 3 1 7 7 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT - This report must be f iled! The law provides that all employing units shall f ile a report of its employment during a calendar year. For the purpose of aiding you in complying w ith OCGA Section 3 4 - 8 - 1 2 1 of the Employment Security Law , this f orm has been prepared to assist you in f urnishing the required inf ormation. Answ er all questions f ully and if additional space is necessary under any item, attach signed and dated sheets w hich bear the w ords "Supplement to Form DOL- 1 ."

Each f alse statement or w illf ul f ailure to f urnish this report is punishable as a crime. Each day of such f ailure or ef usal constitutes a separate of f ense.

The Georgia Employer Status Report is required of all employers having individuals perf orming services in Georgia regardless of number or duration of time.

The f iling of this f orm is required at the time your business f irst had individuals perf orming service in Georgia, or w hen you acquired another legal entity, and may also be required again upon request.

NOTE: Disclosure of your social security number is mandatory. It will be used f or the purpose of identif ication and it is required under the authority of 42 U.S.C. Section405(2)(c)andOCGASection 34- 8- 121(a).

IN S TRUCTIO N S

(NUMBERS CORRESPOND TO ITEMS ON FORM)

1 . Enter or correct name and address of individual ow ner, partners, corporation or organization. This is the address to w hich you authorize us to mail all reports, correspondence, etc. If you have already been assigned a Georgia Department of Labor Account Number (Ga. DOL Acct. No) by this Department, please insert the number.

2 . Indicate by check mark type of organization. If a nonprof it organization, attach copy of I.R.S. letter ex empting the organization f rom Federal Income Tax under Section 5 0 1 (c)(3 ) of Internal Revenue Code.

3 . Trade name by w hich business is know n if dif f erent than 1 .

4 . Physical location of business, f arm or household in Georgia if dif f erent than 1 . Please include telephone number w ith area code.

5 . Enter the f irst date of employment in Georgia and the f irst date of Georgia payroll.

6 . If you are subj ect to the Federal Unemployment Tax Act, and are required to f ile Federal Form 9 4 0 , answ er this question "yes". Be sure to enter your Federal Employer Identif ication Number w hether answ ered "yes" or "no".

7 . Answ er this question if you acquired this business f rom another employer or if af ter you began employing w orkers you have acquired other businesses; merged w ith other businesses; f ormed or dissolved partnerships, corporations, prof essional associations; or if any other change in the ow nership of the business has occurred. Indicate the date of acquisition or change and provide all inf ormation concerning the previous ow ner's name, trade name, address and DOL Account Number. Indicate by checking the appropriate block the portion of the previous ow ner's business involved in the acquisition or change. No transf er of ex perience rating history can be made unless inf ormation concerning the previous ow ner is provided.

8 . Private Business Employment - Most employment is considered private business employment. This includes all types of w ork ex cept domestic service such as maids, gardeners, cooks, etc., agricultural service and service perf ormed f or governmental or nonprof it organizations.

9 . Domestic employment includes all service f or a person in the operation and maintenance of a private household, local college club or local chapter of a college f raternity or sorority such as chauf f eurs, cooks, babysitters, gardeners, maids, butlers, private and/ or social secretaries, etc. If you had such employment, consider only cash payments made to all individuals perf orming domestic services to determine if $1 ,0 0 0 or more cash w ages w ere paid in any calendar quarter during 1 9 7 7 and subsequent quarters.

1 0 |

. Consider only cash payments made to all individuals perf orming agricultural services to determine if $2 0 ,0 0 0 or more cash w ages w ere paid in |

|||

|

any calendar quarter during 1 9 7 7 and subsequent quarters. |

|

||

1 1 |

. Answ er this question only if this business is a nonprof it organization ex empt f rom Federal Income Tax under Section 5 0 1 (c)(3 ) of the Internal |

|||

|

Revenue Code. Attach a copy of the I.R.S. letter granting this ex emption. Nonprof it organizations w ith tax ex emptions other than under Section |

|||

|

5 0 1 (c)(3 ) should answ er question 8 , Private Business Employment. |

|

||

1 2 |

. Self - ex planatory. |

|

|

|

|

|

|

|

|

|

|

FOR ASSISTANCE, call the Adj udication Section, (4 0 4 ) 6 5 6 - 3 0 6 9 |

|

|

Please RETAIN a copy f or your |

f iles. |

RETURN ORIGINAL WITHIN TEN (10) DAYS TO: |

Georgia Department of Labor |

|

|

|

|

|

P O Box 7 4 0 2 3 4 |

The |

enclosed envelope requires |

postage. |

|

Atlanta, GA 3 0 3 7 4 - 0 2 3 4 |

|

|

|||

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The form is used by employers to report their employment status and any employee activities in Georgia. |

| Key Sections | It includes sections for business information, type of organization, business and employee details, and certification. |

| Governing Law | The form is governed by the Georgia Employment Security Law, specifically OCGA Section 34-8-121. |

| Mandatory for Employers | All employers with individuals performing services in Georgia must file this report, highlighting its importance for compliance. |

| Penalties for Non-Compliance | Failure to submit the completed form can result in penalties, emphasizing the legal requirement for accurate and timely filing. |

Guide to Using Georgia Department Of Labor

Completing the Georgia Department of Labor Employer Status Report is a vital step for employers in the state. This form helps determine your responsibilities under Georgia's unemployment insurance laws. It gathers information about your business and employment history, which the Department of Labor uses to classify your business correctly and assess your tax obligations. Below are the step-by-step instructions to ensure you fill out the form accurately and comply with state regulations.

- Enter or correct your business name and address in the provided fields. If you already have a Georgia Department of Labor Account Number, make sure to include it.

- Check the appropriate box to indicate your type of organization (e.g., Individual, Partnership, Corporation, Nonprofit organization, LLC, etc.). If your organization is a nonprofit, attach a copy of the IRS letter exempting the organization from federal income tax under Section 501(c)(3) of the Internal Revenue Code.

- Provide the trade name of your business if it differs from the name given in step 1.

- List the principal business location in Georgia including the physical address, city, zip code, county, and telephone number. Do not use a P.O. Box number for this address.

- Enter the dates your business first began employing workers in Georgia and the first date of Georgia payroll.

- If your business is liable for federal unemployment tax, indicate "Yes" and provide your Federal Employer Identification Number. Otherwise, indicate "No".

- If you have acquired another business, merged, or made significant ownership changes, provide details including the date of the transaction, the predecessor’s Georgia DOL account number, and the extent of the operations acquired or merged.

- For private business employment, indicate whether you employed or expect to employ at least one worker in 20 different calendar weeks during a calendar year or expect to pay cash wages of $1,000 or more in any calendar quarter.

- If you had or expect to have domestic employment, state whether you paid or expect to pay $1,000 or more in cash wages in any calendar quarter.

- For agricultural employment, indicate if you had or expect to have a quarterly payroll of $1,500 or more, or to employ 10 or more agricultural workers during a calendar year.

- If you are a nonprofit organization exempt under IRS code 501(c)(3), indicate whether you employ or expect to employ four or more workers in 20 different calendar weeks during a calendar year. Attach a copy of the 501(c)(3) exemption letter.

- Specify how many employees you have or anticipate having when in full operation.

- Provide owner, partners, or principal officer information, including names, social security numbers, addresses, and telephone numbers. If more space is needed, attach additional sheets.

- Review all information, sign and date the report, affirming the accuracy of all provided information under the penalty of perjury.

- Finally, complete the industry information on the reverse side, indicating the nature of your business, the number of Georgia locations, principal services or products, and any other relevant details.

After completing the form, retain a copy for your records and return the original within 10 days to the address provided by the Georgia Department of Labor. Accurate and prompt submission of this form ensures compliance with state laws and contributes to the efficient operation of Georgia's unemployment insurance system.

Obtain Clarifications on Georgia Department Of Labor

-

What is the purpose of the Georgia Department of Labor Employer Status Report?

The Employer Status Report is a mandatory form that all employers with individuals performing services in Georgia, including those acquiring another legal entity, must file. Its main purpose is to provide the Georgia Department of Labor (DOL) with essential information about the business, such as the type of organization, employment details, and the employer's identification information. Filing this form aids in complying with Georgia's Employment Security Law and helps determine the employer's liability for the Federal Unemployment Tax Act (FUTA).

-

When is an employer required to file this report?

An employer must file the report at the time their business first has individuals performing service in Georgia or upon acquiring another business entity performing services within the state. Additionally, the Georgia DOL may require the form to be filed again at certain times. It is crucial to submit the original form within ten days after these instances to ensure compliance with state employment regulations.

-

What information do I need to provide in the form?

Employers need to furnish detailed information, including:

- Business name and address, and if already assigned, the Georgia DOL Account Number.

- Type of organization (e.g., individual, partnership, corporation).

- Trade name, if different from the business name.

- Principal business location and contact information in Georgia.

- Details regarding the commencement of employment and payroll in Georgia.

- Information on any business acquisition or organizational change.

- Employment details, including numbers of employees and specific employment types like domestic or agricultural employment.

- Nonprofit organizations exempt under IRS Code 501(c)(3) must attach a copy of the exemption letter.

This comprehensive data assists the DOL in accurately classifying and assessing the employer’s obligations under state employment laws.

-

What are the consequences of not filing the report or providing false information?

Failure to file the Employer Status Report or providing false information on the form is regarded as a criminal offense under Georgia law. Each day of non-compliance is considered a separate offense, which can lead to significant penalties. The law mandates full and truthful disclosure of the required information to ensure accurate employment records and to determine an employer’s liability correctly.

Common mistakes

Filling out the Georgia Department of Labor forms accurately is crucial for employers to ensure compliance and avoid potential penalties. However, common mistakes can easily occur. Recognizing and avoiding these errors can help streamline the process and mitigates issues down the line. Here are ten mistakes to watch for:

Not using the business's legal name and address: It is essential to enter the correct legal name and address of the business to ensure there are no discrepancies.

Ignoring the trade name section: If the business operates under a different name, this needs to be correctly noted in the trade name section.

Incorrectly identifying the type of organization: Businesses must correctly identify whether they are an Individual, Partnership, Corporation, Nonprofit org., etc., and provide the necessary documentation if applicable.

Providing a P.O. Box instead of a physical address: A physical address is required for the principal business location, not a P.O. Box number.

Forgetting to provide the date of first employment in Georgia: This date is crucial for determining certain liabilities and tax responsibilities.

Lack of clarity regarding federal unemployment tax liability: The question must be correctly answered with a "Yes" or "No" and, if applicable, accompanied by the Federal Employer Identification Number.

Omitting details about business acquisition or changes: Any acquisitions, mergers, or ownership changes must be fully detailed, including previous owner information.

Incorrectly reporting the type of employment: Employers need to correctly categorize employment as private, domestic, or agricultural and meet the reporting thresholds for each.

Failure to attach the 501(c)(3) exemption letter: Nonprofit organizations exempt under IRS code 501(c)(3) must attach a copy of the exemption letter.

Not providing accurate employee counts or future operation estimates: Misreporting the number of employees or anticipated full operation levels can lead to misclassification and compliance issues.

By paying close attention to these areas and ensuring accuracy in every section of the form, employers can fulfill their reporting requirements effectively and maintain compliance with the Georgia Department of Labor.

Documents used along the form

When dealing with paperwork related to the Georgia Department of Labor, additional forms and documents often play a crucial role in ensuring compliance and smooth operations for businesses. Understanding these documents can help in navigating the complexities of employment and labor requirements in Georgia.

- IRS Form W-4: Employees fill out this form to determine the amount of federal income tax to withhold from their paychecks.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification, used by freelancers or independent contractors to provide their tax details to the person or company that is paying them.

- IRS Form 940: Employers who pay wages subject to income tax withholding, Social Security, and Medicare taxes must file this form annually to report federal unemployment taxes.

- IRS Form 941: Employers use this quarterly form to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks and to pay the employer's portion of Social Security or Medicare tax.

- Form I-9: Employment Eligibility Verification form used by employers to verify an employee's identity and to establish that the worker is eligible to accept employment in the United States.

- Georgia New Hire Reporting Form: Employers are required to report new hires and rehires to the state to assist in child support collection efforts.

- State Tax Withholding Forms: Similar to the federal W-4, this form is used for state income tax withholding purposes.

- Form UI-1: Report to Determine Liability under the Georgia Employment Security Law, used to determine if a business is liable for state unemployment taxes.

- Safety and Health Protection on the Job Poster: Federal and state laws require employers to display this poster in a prominent place to inform employees of their rights to a safe workplace.

- Workers' Compensation Insurance Forms: Documents related to coverage, claims, and compliance for workers' compensation insurance, which is mandatory for most employers in Georgia.

Together, these forms and documents ensure that businesses adhere to the necessary federal and state employment laws. They cover a wide range of purposes, from tax withholding to employee rights, and are integral to the responsible operation of any business. Keeping accurate and current records on all these documents is essential for compliance, avoiding penalties, and ensuring a smooth administrative process for both employers and employees.

Similar forms

The IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, is similar because it also requires employers to report whether they are subject to federal unemployment tax, similar to the Georgia Department of Labor form asking if an employer is liable for federal unemployment tax.

The IRS Form W-4, Employee's Withholding Certificate, although primarily for income tax withholding purposes, shares a similarity in that it also centers around employment information critical for tax reporting, similar to the information collected regarding employment statuses in the Georgia form.

The IRS Form SS-4, Application for Employer Identification Number (EIN), shares a similarity as it involves the provision of an identification number (EIN) which is needed when filling out the Georgia Department of Labor form's requirement for a federal I.D. number.

The U.S. Department of Labor Form WH-530, for migrant and seasonal agricultural worker protection, is somewhat comparable as it involves employment specifics in agricultural sectors, similarly to how the Georgia form asks about agricultural employment specifics.

The U.S. Citizenship and Immigration Services Form I-9, Employment Eligibility Verification, while aimed at verifying the identity and employment authorization of individuals hired for employment in the United States, shares commonality in its focus on employment regulation, similar to the employment verification aspects of the Georgia Department of Labor form.

The U.S. Equal Employment Opportunity Commission's EEO-1 Form, Employer Information Report, has similarities regarding the gathering of employer information for compliance with regulations, much like the Georgia form’s collection of business employment data for labor compliance purposes.

The U.S. Department of Labor's Form LM-10, Employer Report, needed for reporting certain labor relations practices, also collects detailed information about employers and their practices, resembling the comprehensive detail required by the Georgia Department of Labor form.

The SBA Form 1919, Borrower Information Form, required by the Small Business Administration, shares aspects of detailed business operation information collection, akin to the detailed information about business operations and ownership changes that the Georgia Department of Labor form seeks.

Dos and Don'ts

When filling out the Georgia Department of Labor form, there are several key practices to follow, as well as certain practices to avoid to ensure the process is completed correctly and efficiently. Below is a list of do's and don'ts to consider:

- Do thoroughly read the instructions on the reverse side before beginning to fill out the form. This ensures you understand all requirements and provide accurate information.

- Do enter the correct and complete business name and address. It is crucial for correspondence and future contacts.

- Do include your Georgia Department of Labor Account Number if it has already been assigned to your business.

- Do accurately indicate the type of organization (e.g., Individual, Partnership, Corporation, Nonprofit organization) and attach a copy of the IRS letter if your organization is exempted under Section 501(c)(3).

- Do not leave any required fields blank. If a field does not apply, mark it as "N/A" (not applicable).

- Do use additional sheets if necessary to provide complete answers, ensuring they are signed, dated, and clearly labeled as a "Supplement to Form DOL-1."

- Do double-check all entered information for accuracy before submitting the form, including dates and numerical data.

- Do not use P.O. Box numbers for the principal business location in Georgia. An actual street address is required to ensure proper location identification.

By following these guidelines, you can help avoid common mistakes and ensure your Georgia Department of Labor form is submitted accurately and efficiently.

Misconceptions

Understanding the Georgia Department of Labor form is crucial for employers, but there are several misconceptions about its requirements and processes. Clearing up these misunderstandings is vital for compliance and avoiding potential penalties.

First Misconception: All Businesses are Required to File, Regardless of Size or Type of Employment

Many believe every new business in Georgia must file the Employer Status Report with the Georgia Department of Labor, no matter its size or the type of employees it has. In reality, the requirement to file depends on certain conditions, such as the number of employees, the type of employment, and the total payroll. For example, businesses with domestic employment need to file if they pay $1,000 or more in cash wages in a calendar quarter, while agricultural employers must meet different criteria.

Second Misconception: Nonprofit Organizations are Exempt from Filing

Another common misunderstanding revolves around nonprofit organizations. Some believe that if their organization is classified under IRS Code 501(c)(3), they are exempt from filing the Employer Status Report. However, nonprofit organizations are indeed required to file if they employ four or more workers in 20 different calendar weeks during a calendar year. They also need to attach a copy of their 501(c)(3) exemption letter when filing.

- Third Misconception: Only Permanent Employees Count Towards the Filing Requirement

- Fourth Misconception: The Form is Only Related to Unemployment Benefits

There's a misconception that businesses only need to count permanent or full-time employees when determining their requirement to file. The truth is, the type of employment—whether full-time, part-time, temporary, or seasonal—does not exempt an employer from filing. All individuals performing services in Georgia contribute to the requirement, underscoring the importance of tracking the employment status accurately.

Some employers mistakenly believe the Employer Status Report is solely for unemployment benefit purposes. While it is true that part of the information collected is used to determine an employer's liability for unemployment insurance, the form also aids in gathering employment statistics and helps in the administration of employment security and labor market information programs. Therefore, its significance extends beyond just unemployment insurance.

Dispelling these misconceptions about the Georgia Department of Labor form is crucial for ensuring that all employers understand their responsibilities and the importance of the information being requested. Awareness and compliance not only contribute to the smooth operation of a business but also to the broader economic health and labor market understanding in Georgia.

Key takeaways

Filling out the Georgia Department of Labor form is essential for employers to ensure compliance with state labor laws. Here are key takeaways to keep in mind:

- Accuracy is crucial: Ensure that all information provided on the form is correct and up-to-date, including the business name and address.

- Know your organization type: Clearly indicate whether your organization is an individual, partnership, corporation, nonprofit, etc., as each has different requirements and tax implications.

- Trade name inclusion: If your business operates under a trade name different from its legal name, make sure to include it.

- Physical location matters: The form requires the physical location of the business, not just a P.O. Box, to validate the presence of your business within Georgia.

- Employment details are key: Accurately report the date you first began employing workers in Georgia and if you’re liable for federal unemployment tax.

- History of business changes: If your business has undergone changes such as mergers, acquisitions, or changes in ownership, this information must be detailed.

- Employment classifications: Understand the distinctions between private business, domestic, and agricultural employment, as they each have different criteria for reporting.

- Nonprofit considerations: If your organization is a nonprofit exempt under IRS Code 501(c)(3), attach the exemption letter and follow the specific instructions for nonprofit organizations.

- Providing accurate employee numbers: Be precise about the current number of employees and those expected when in full operation.

- Compliance is not optional: Submission of this report is required by law for all employers operating within Georgia, emphasizing the importance of timely and accurate completion.

Remember, the information you provide on this form plays a critical role in your business’s compliance with Georgia labor laws. It's important to review all instructions provided and seek clarification if needed to ensure all sections are filled out correctly. Keeping a copy of the filled-out form for your records is also a best practice.

Popular PDF Forms

Georgia Form 600s - Navigate your S corporation's tax obligations in Georgia with the comprehensive 600S form for accurate reporting and compliance.

What Is a 3300 Form - It aids in creating a health profile for students that can be referenced by school staff, supporting individualized care and support as needed.

Georgia Separation Notice - A preventive measure against potential legal disputes related to the construction project's timeline and responsibilities.