Free Georgia G 1003 Template in PDF

In the landscape of tax documentation and compliance within the state of Georgia, the G-1003 form emerges as a pivotal tool for employers and entities overseeing payroll. This form, endorsed by the Georgia Department of Revenue, serves as a comprehensive avenue for reporting income statements, including but not limited to W-2s, W2-Cs, and various 1099 forms, specifically catering to non-employee compensation and other income categories. It mandates a detailed enumeration of Georgia taxable wages and the corresponding tax withheld, ensuring accuracy and transparency in financial disclosures. The design of the G-1003 form accommodates diverse filing needs — from domestic employers to amendments and nonresident income reports — reflecting its versatile utility in tax administration. Notably, the form stresses the importance of electronic filing, a move aimed at enhancing efficiency and security, whilst stipulating formidable penalties for late submissions, thereby underscoring the state's commitment to timely tax reporting and compliance. Additionally, the provision for amended returns accompanied by corrected income statements exhibits a nuanced approach towards rectifying discrepancies, ensuring that entities have the leeway to amend errors and uphold integrity in financial reporting. With deadlines set decisively for the submission of different income statements, the G-1003 form epitomizes the intricate balance between regulatory requirements and the facilitation of taxpayer responsibilities in Georgia, delineating a clear pathway for compliance while simultaneously safeguarding against the pitfalls of oversight or delinquency.

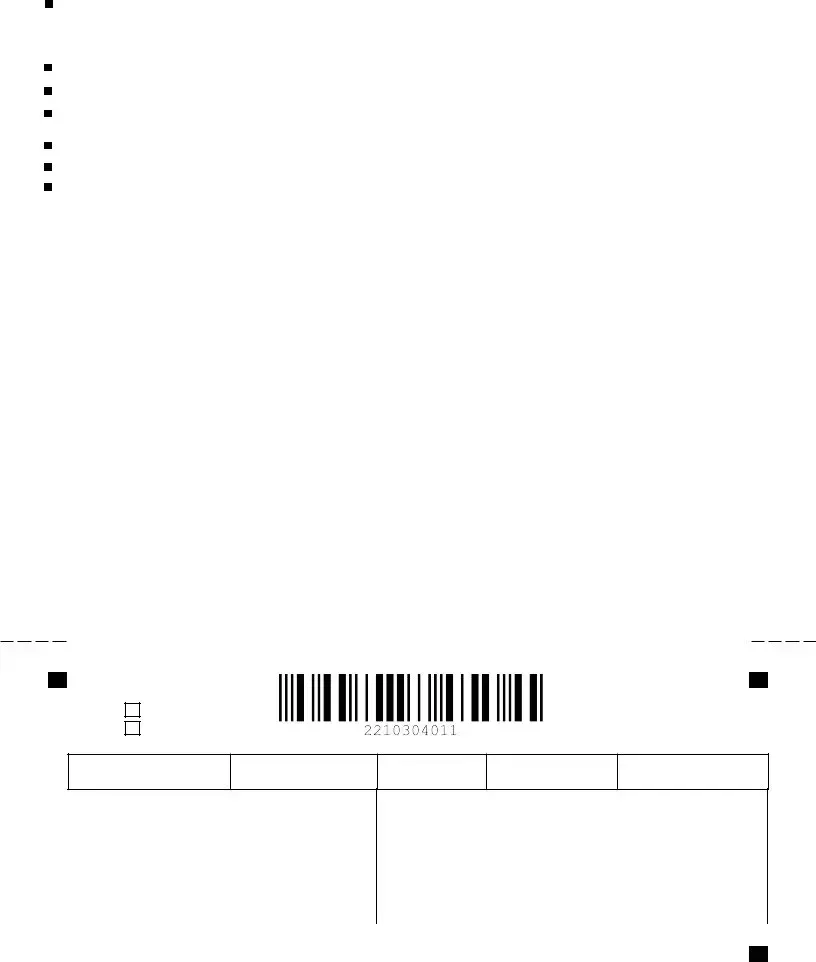

Form Sample

A |

S |

|

|

E |

|

L |

|

P |

|

E

DO

N

OT

M

A

I !L

State of Georgia Department of Revenue

KEEP THESE INSTRUCTIONS AND WORKSHEET WITH YOUR RECORDS

Instructions

1.Download (free) the latest version of Adobe Reader. adobe.com/products/acrobat/readstep2.html

2.Complete the worksheet below to automatically create your return.

3.Click the “Print” button to print a completed

4.Sign and date the return.

5.Cut the return along the dotted line. Mail only the return to the address on the return. Do not send a payment with this return, submit an amended

DO NOT fold, staple or paper clip items being mailed.

DO NOT mail in the worksheet, keep this for your records.

|

|

|

|

|

|

|||||

|

1. |

GA Withholding ID: |

|

|

2. FEI Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Amended Return: |

|

|

4. Domestic |

Employers with no GA Tax withheld: |

|

|

|

|

|

5. |

Name: |

|

|

|

|

|

|

|

|

|

6. |

Street Address Line 1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Street Address Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

City: |

|

9. State: |

10. Zip: |

- |

0000 |

11. |

Telephone: |

|

Check here if correction to SSN only |

|

||

|

1099 - NEC |

|

||||

12. |

Form Type: |

1099 Other Income: |

|

|

||

|

|

|

|

|||

13. |

Tax Year/Fiscal Year Ending: |

SELECT |

|

|

||

14. |

Number Of Forms: |

|

|

|

15. |

..........................................................Georgia Taxable Wages: |

|

|

|

16. |

Georgia Tax Withheld : |

|

|

|

|

|

|

|

|

Instructions for Preparing the

If you file and pay electronically or are filing Form

All other 1099 income statements are due on or before February 28th of the following calendar year.

For a

If a due date falls on a weekend or holiday, the income statement is due the next business day.

If a business closes during the taxable year, income statements are due within 30 days after payment of final wages.

If submitting

Submit

Submit

Submission requirements:

Submission requirements:

a.

b.The

c.The

The “Number of Forms,” “Form Type,” “Georgia Taxable Wages,” and “Georgia Tax Withheld” blocks must be completed where applicable.

The “Number of Forms,” “Form Type,” “Georgia Taxable Wages,” and “Georgia Tax Withheld” blocks must be completed where applicable.

Copies of the corrected

Copies of the corrected

Beginning on and after 2019, if

Beginning on and after 2019, if

(1)Ten dollars per statement filed up to 30 calendar days after the date such statement is due, provided that the total amount imposed on a person pursuant to this paragraph shall not exceed $50,000.00;

(2)Twenty dollars per statement filed at least 31 calendar days, but not more than 210 calendar days after the date such statement is due, provided that the total amount imposed on a person pursuant to this paragraph shall not exceed $100,000.00; or

(3)Fifty dollars per statement filed 211 calendar days or more after such statement is due, provided that the total amount imposed on a person pursuant to this paragraph shall not exceed $200,000.00.

Submit Form

Submit Form

Processing Center

Georgia Department of Revenue

PO Box 105685

Atlanta, GA

PLEASE DO NOT mail this entire page. Please cut along dotted line and mail coupon only.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE DO NOT STAPLE OR PAPER CLIP. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cut on dotted line |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

EMPLOYER NAME AND ADDRESS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Income Statement Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Amended Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Domestic employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

with no GA Tax Withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

DO NOT SUBMIT PAYMENT WITH THIS FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

GA Withholding ID

FEI Number

Tax Year

000000

Number of Forms

Vendor Code

040

PROCESSING CENTER

GEORGIA DEPARTMENT OF REVENUE PO BOX 105685

ATLANTA GA

|

|

|

|

|

Form Type |

|

|

|

|

|

Check here if correction to |

|||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Social Security Numbers only. |

||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Income |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia Taxable Wages |

|

|

Georgia Tax Withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalty of perjury, I declare that this return has been examined by me and to the best of my knowledge and belief it is true, correct and complete.

Signature |

Title |

|

|

Telephone |

Date |

|

|

10300000000000000000004000000000000

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The G-1003 form is used for reporting income statements including W-2s, W2-Cs, and 1099s to the Georgia Department of Revenue. |

| Electronic Filing Requirement | Entities federally required to file income statements electronically must also file them electronically for Georgia purposes, as per Reg. 560-7-8-.33. |

| Submission Deadline | W-2 and 1099-NEC forms are due by January 31st of the following year, while other 1099 forms are due by February 28th of the following calendar year. |

| Special Instructions for Amended Returns | Copies of corrected W2s, 1099s, or G2-As must accompany all amended returns. |

| Penalty for Late Submission | Penalties for filings not made by the due date can range from $10 per form (up to $50,000 total) to $50 per form (up to $200,000 total), depending on the delay length. |

| Mailing Instructions | Submit Form G-1003 and paper copies of income statements to the Processing Center at the Georgia Department of Revenue, and do not staple or use paper clips. |

Guide to Using Georgia G 1003

Completing the Georgia G 1003 form is a crucial task for businesses to fulfill their tax obligations accurately. This form is designed for reporting income statements such as W-2, W2-C, 1099-NEC, and others to the Georgia Department of Revenue. It's essential not just for compliance but also for maintaining orderly records. The steps below guide you through the process, ensuring that each part of the form is filled out correctly to avoid common mistakes. Remember, deadlines are strict, and adhering to them can help avoid penalties. Keep the instructions and the worksheet with your records, but only the return itself should be mailed.

- Download the latest version of Adobe Reader from adobe.com/products/acrobat/readstep2.html to ensure compatibility.

- Complete the G-1003 worksheet below, which will help auto-generate your return.

- Click the “Print” button to print your completed G-1003 return.

- Sign and date the printed return to certify its accuracy.

- Cut the return along the dotted line as indicated on the form. Remember, this part is crucial for proper processing.

- Mail only the return portion to the Processing Center, Georgia Department of Revenue, PO Box 105685, Atlanta, GA 30348-5685. Do not include any payment with this return. If additional tax is due, submit an amended G-7 form.

- DO NOT fold, staple, or use a paper clip on the items being mailed to ensure they’re processed efficiently.

- Keep the worksheet for your records; do not mail it with the return.

- If you have corrections to Social Security Numbers only, indicate by checking the appropriate box on the form.

- Fill in all relevant details such as GA Withholding ID, FEI Number, if it's an Amended Return, your details (Name, Address, Telephone), and the specifics of the Income Statement including Form Type, Tax Year, Number of Forms, Georgia Taxable Wages, and Georgia Tax Withheld.

By following these steps carefully, you’ll ensure that your Georgia G 1003 form is filled out correctly and mailed properly. This process contributes to the accurate reporting of income statements, crucial for both businesses and the Department of Revenue to manage tax obligations efficiently. Keep in mind that timely submission is key to avoiding any potential penalties. If you have questions or need further assistance, consider contacting the Georgia Department of Revenue directly or consulting with a tax professional.

Obtain Clarifications on Georgia G 1003

Frequently Asked Questions about the Georgia G-1003 Form

What is the Georgia G-1003 form used for?

The Georgia G-1003 form is utilized for submitting an income statement return which encompasses reporting Georgia taxable wages and the associated Georgia tax withheld. It's mainly used by employers to submit annual summaries of wages and taxes withheld for their employees.

Who needs to file the G-1003 form?

Any employer that withholds Georgia state income tax from employee wages must file the G-1003 form. This also applies to those who are required to report income paid to non-employees, such as contractors receiving 1099-NEC forms, and entities reporting withholdings on nonresident members' share of taxable income sourced to Georgia.

When is the G-1003 form due?

For W-2 and 1099-NEC forms, the deadline is January 31st of the following year. All other 1099 forms must be submitted by February 28th of the subsequent year. In the case of flow-through entities, the G-1003 and related G2-As are due by the earlier date of the entity's income tax return filing or its no-extension due date. If the due date falls on a weekend or holiday, the next business day becomes the deadline.

Are electronic filings required for the G-1003 form?

Yes, electronic filings are mandatory for those who file and pay electronically or who are mandated to file income statements electronically at the federal level. However, those not obligated to file electronically may opt to do so voluntarily.

Can the G-1003 form and its attachments be mailed?

Absolutely, but only after ensuring all required sections are completed accurately. The physical copies should be sent to the Processing Center at the Georgia Department of Revenue. Remember not to fold, staple, or paper clip the documents.

What happens if the G-1003 form is filed late?

There are penalties for late filings, starting at ten dollars per statement up to thirty days late, with a maximum penalty of $50,000. Penalties increase the longer the form and relevant documents are past due, potentially reaching up to $200,000.

Can amendments be made to a previously filed G-1003?

Yes, amended returns are permissible. It's crucial to submit all corrected W-2s, 1099s, or G2-As along with the amended G-1003 form to ensure accurate processing.

What documentation should be kept for records?

It is strongly advised to keep a copy of the completed G-1003 form and any corresponding worksheets, along with copies of all the W-2, 1099, or G2-A forms submitted. These documents should be retained as part of your tax records.

Common mistakes

Filling out government forms can be daunting, and the Georgia G 1003 form is no exception. People often make errors when completing this document, which can lead to delays or issues with the state's Department of Revenue. Understanding these common mistakes can help filers avoid them in the future.

Not updating to the latest version of Adobe Reader: To accurately complete and print the Georgia G 1003 form, having the latest version of Adobe Reader is crucial. Failure to do so may result in formatting issues that can affect the readability of the return.

Ignoring the electronic filing requirement: Many filers are not aware that if they are required to file their income statements electronically at the federal level, they must do so similarly for Georgia. This includes the G-1003 along with W2 and 1099-NEC income statements, which must be filed electronically, a step that is often overlooked.

Mailing the entire page instead of just the return: A common mistake is mailing the entire worksheet page instead of only the return portion. It's important to note that only the cut portion along the dotted line should be mailed to the provided address.

Stapling or paper clipping mailed items: The instructions specifically advise against stapling or paper clipping any items being mailed. Such actions can damage the documents or interfere with processing, yet it's a frequently ignored directive.

Incorrectly submitting payment information with the form: The G-1003 form clearly states not to submit payment with the form. If additional tax is due, an amended G-7 form should be submitted instead. This mistake can lead to processing delays and confusion.

Failing to send corrected W2s/1099s/G2-As with amended returns: When filing an amended return, it's mandatory to include copies of the corrected W2s, 1099s, or G2-As. This requirement is often missed, leading to incomplete submissions and potential penalties.

In conclusion, careful attention to the specific requirements and instructions of the Georgia G 1003 form is essential. By avoiding these common mistakes, individuals and businesses can ensure smoother interactions with the Georgia Department of Revenue.

Documents used along the form

Completing and submitting the Georgia G-1003 form, otherwise known as the Income Statement Return, is a crucial step for businesses operating within the state, particularly when it comes to reporting and reconciling state tax withholdings from employees and non-employees. While the G-1003 form is a key document in its own right, it often works in conjunction with several other forms and documents that facilitate accurate reporting and compliance with the Georgia Department of Revenue's regulations. Understanding each of these additional forms can greatly assist businesses and tax preparers in ensuring all necessary information is reported correctly.

- Form W-2: This wage and tax statement is used by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. It's crucial for both federal and state tax filing.

- Form W-2C: Known as the Corrected Wage and Tax Statement, this document is used to correct errors on a previously filed W-2 form, such as an incorrect Social Security number, wage, tax information, or employee's name.

- Form 1099-NEC: This form reports non-employee compensation. It's typically used for freelancers, independent contractors, and other non-employees who have been paid $600 or more over the course of the fiscal year.

- Form 1099-MISC: Used for various types of income aside from non-employee compensation, such as rents, prizes, awards, healthcare payments, and other forms of miscellaneous income.

- Form G-7: A Monthly, Quarterly, and Annual Withholding Tax Return form for reporting and paying withheld Georgia income tax from employees' wages and non-resident members.

- Form G-2A: A report of tax withheld on behalf of nonresident members by flow-through entities, which must be filed alongside a separate G-1003 form for nonresident member withholdings only.

- Form G2-FL: The Foreign Licensee Withholding Tax Statement, used for reporting withholding on payments to foreign licensees and copyright holders.

- Form G-1003A: An accompanying schedule for the G-1003, used to list each individual W-2 or 1099 form being reported on the G-1003 when the number of such documents exceeds the space available on the G-1003 itself.

- Form W3: Though a federal form, it summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the year. It's sent to the Social Security Administration along with Copy A of the W-2 forms.

Together, these documents ensure thorough and accurate compliance with both federal and Georgia state tax laws, providing a clear record of all taxable wages and withholdings. It's essential for businesses to familiarize themselves with these forms to maintain proper financial and tax records, thus avoiding potential penalties for incorrect or incomplete tax filings. While the G-1003 form is pivotal, it functions as part of a larger ecosystem of tax documentation that supports the comprehensive reporting of income and taxes withheld throughout the fiscal year.

Similar forms

The Georgia G-1003 form, while specific in its application and use within the state of Georgia, shares similarities with other forms used across the United States for income reporting and tax withholding purposes. These forms serve a critical role in the tax filing process, ensuring that income is reported accurately and taxes withheld are properly documented. Here are nine documents that are similar to the Georgia G-1003 form:

- IRS Form W-2 (Wage and Tax Statement): Like the G-1003, the IRS Form W-2 is used to report wages paid to employees and the taxes withheld from them. Employers must send this form to employees and the IRS at the end of each year.

- IRS Form 1099-NEC (Nonemployee Compensation): Similar to the G-1003's section for reporting non-employee compensation, the 1099-NEC form reports payments made to independent contractors and is a key document for freelancers and independent consultants.

- IRS Form 1099-MISC (Miscellaneous Income): This form, akin to the G-1003, is used for reporting various types of income, such as rents, royalties, and other miscellaneous payments, where Georgia tax is withheld.

- Form W-2C (Corrected Wage and Tax Statement): Similar to the G-1003's provisions for corrected statements, the W-2C is used to correct errors on previously filed W-2 forms, addressing issues such as incorrect salary, tax withholdings, or name and social security numbers.

- Form 941 (Employer’s Quarterly Federal Tax Return): While the G-1003 deals specifically with income statements, Form 941 is filed quarterly by employers to report federal withholdings from employees' paychecks, including income tax and FICA taxes.

- Form W-3 (Transmittal of Wage and Tax Statements): The W-3 form is used to transmit Form W-2s to the Social Security Administration, similar to how the G-1003 aggregates reporting for state tax purposes in Georgia.

- State-specific withholding tax forms: Many states have their own versions of the G-1003 form for reporting state tax withholdings and income, such as California's Form DE9C or New York's NYS-45 form.

- Form 1096 (Annual Summary and Transmittal of U.S. Information Returns): Similar to the G-1003's function of summarizing income statements for state tax purposes, Form 1096 is used to compile and transmit 1099s and other information returns to the IRS.

- Form G-7 (Quarterly Return for Quarterly Payer): This is a specific form for Georgia, much like the G-1003, but it focuses on the quarterly reporting of state income tax withheld, demonstrating the periodic requirements for reporting and remitting withholding taxes in the state.

Each of these documents plays a crucial role in tax administration, ensuring that individuals and businesses report and remit the correct amounts to tax authorities. Despite their differences, the core aim of facilitating accurate tax reporting and payment unites them with the Georgia G-1003 form.

Dos and Don'ts

When dealing with the Georgia G-1003 form, which is essential in reporting income taxes withheld, there are specific dos and don'ts that can help ensure the process is completed smoothly and accurately. Here is a comprehensive list to guide you through the procedure.

Dos:

- Download the latest version of Adobe Reader to ensure compatibility when accessing the form.

- Complete the G-1003 worksheet accurately, utilizing the provided fields to automatically prepare your return.

- Use the "Print" option to generate a hard copy of your completed G-1003 return for mailing.

- Ensure to sign and date the return before mailing it to the Georgia Department of Revenue.

- Cut along the dotted line as instructed, and mail only the return part of the form to the address indicated.

- Keep the worksheet part of the form for your records, as it will not be mailed.

- File and submit your G-1003 form and any required income statements by the specified deadlines to avoid penalties.

- Submit W-2s, W-2Cs, and 1099-NEC forms together, if applicable, in line with the submission requirements.

- For amended returns, ensure to include copies of the corrected W-2s, 1099s, or G2-As as necessary.

- Follow electronic filing requirements if you file and pay taxes electronically or if mandated by regulation.

Don'ts:

- Do not fold, staple, or use a paper clip on items being mailed to the Department of Revenue.

- Do not include a payment with your G-1003 return; if additional tax is due, submit an amended G-7 form instead.

- Do not send the worksheet—only the return portion should be mailed to the processing center.

- Do not overlook the importance of cutting the return along the dotted line, as failing to do so might result in processing delays.

- Do not wait until the last minute to obtain or update your Adobe Reader, as this could delay your ability to fill out the form properly.

- Do not ignore the checkboxes for form types and corrections to social security numbers, which help specify the purpose of your submission.

- Do not mail your entire packet without ensuring you've met all submission requirements, including separate filings for different form types.

- Do not miss the deadlines for filing W-2 and 1099 statements to avoid late penalties.

- Do not fail to sign or date your return, as this could render your submission invalid.

- Do not underestimate the importance of retaining a copy of your worksheet and any related documents for your records.

Misconceptions

Understanding the Georgia G-1003 form and its filing requirements can be complex, and there are several misconceptions that individuals and employers may have. Below are nine common misconceptions about the G-1003 form, each explained to provide clarity:

Electronic filing is optional: While it might seem like filing electronically is a matter of preference, certain taxpayers are required to submit their G-1003 and related statements electronically. This includes those who file and pay electronically or are filing Form G2-FL, as well as persons federally required to file income statements electronically for Georgia purposes.

Only W-2s Need to Be Filed: It's a common mistake to think that the G-1003 form is solely for reporting W-2s. In reality, this form is used to report various types of income, including W-2, W2-C, and different 1099 forms, depending on whether Georgia tax was withheld.

All 1099 Forms Are Due at the Same Time: The due dates for submitting 1099 forms with the G-1003 vary. While W-2 and 1099-NEC forms are due by January 31st of the following year, other 1099 forms are due by February 28th, which is an important distinction for timely filing.

Payments Should Be Sent with the G-1003 Form: A notable misunderstanding is the belief that payment should accompany the G-1003 form. The instructions specifically state not to send payments with the return and to file an amended G-7 if additional tax is due.

Amending Is Only for Number Corrections: Some may believe that amendments to the G-1003 are only for correcting the number of forms filed. However, amendments should also include any corrected W2s, 1099s, or G2-As to accurately reflect changes in either the number of forms or the information reported therein.

Penalties Are Only for Incorrect Filings: It's often misunderstood that penalties are solely for inaccuracies. In reality, penalties can also be assessed for late filings, escalating based on how tardy the submission is beyond the due date, with specific thresholds outlined for the amount imposed.

Mailing the Entire Page Is Necessary: There's a misconception that the entire instruction and worksheet page must be mailed. Instructions specify to cut along the dotted line and mail only the return, without any staples or paper clips, to ensure proper processing.

All Forms Can Be Filed Together: Some employers might think they can file different types of forms together with one G-1003. However, W2s, W2-Cs, and 1099-NECs can be filed together, but other types, like 1099-Other and G2-As, require separate submissions.

Worksheet Must Be Mailed In: Another common error is believing that the worksheet used to prepare the G-1003 must be mailed to the Department of Revenue. The instructions explicitly state to keep the worksheet for your records and not to mail it in with your return.

Understanding these misconceptions about the G-1003 form can help ensure that it is completed and submitted accurately and in compliance with Georgia Department of Revenue requirements, thereby avoiding penalties and processing delays.

Key takeaways

Filling out the Georgia G-1003 form is a critical step for employers in reporting state income taxes withheld from employees and other payments. To ensure clarity and compliance, here are key takeaways to keep in mind:

- Use the Latest Technology: Download the latest version of Adobe Reader to complete the G-1003 worksheet. This step is crucial to ensure compatibility and to utilize the automated features provided by the form.

- Save Records: After filling out the form, click the “Print” button, sign and date the printout, and cut along the dotted line. However, only mail the return portion to the Georgia Department of Revenue and retain the worksheet for your records. This approach aids in maintaining thorough documentation.

- Avoid Common Mistakes: Do not fold, staple, or use paper clips on the items being mailed. Such practices can delay processing or damage the document.

- Submission Deadlines and Types: Remember, W-2 and 1099-NEC forms must be submitted on or before January 31st of the following year. All other 1099 forms have a deadline of February 28th. Additionally, different types of income statements, such as those for nonresident members, require separate G-1003 forms.

- Amending Returns: If corrections are necessary, ensure that amended returns are accompanied by the corrected income statements. This requirement helps in verifying the changes made and expedites the amendment process.

- Penalties for Late Filing: Failure to file the required forms by the due date can result in penalties ranging from $10 to $50 per statement, depending on the delay's extent. The maximum penalties can reach up to $200,000.00, showcasing the importance of timely submissions.

By adhering to these guidelines, entities can effectively manage their obligations related to the Georgia G-1003, facilitating a smoother interaction with the Georgia Department of Revenue.

Popular PDF Forms

Georgia State Tax Refund Status - A taxpayer’s formal request to the Georgia Department of Revenue for a sales tax refund.

Total Loss Threshold Georgia - For vehicles planning to be rebuilt, the T-56 form mandates the retention and submission of photographic evidence of the vehicle in its damaged condition and parts bills of sale.