Free Georgia G 7 Template in PDF

In the State of Georgia, businesses handling payroll must familiarize themselves with the G-7 Quarterly Return, an essential document for quarterly payers mandated by the Georgia Department of Revenue. This form serves as a comprehensive tool for reporting and paying withheld state income taxes. It requires detailed information, including the employer's Georgia Withholding ID and Federal Employer Identification Number (FEI), alongside other identifying data. The process entails downloading the latest version of Adobe Reader to complete the form, calculating tax withheld during the period, making the necessary adjustments, and determining the tax due. Payments, if needed, should accompany a printed, signed, and dated copy of the form, which must be submitted without staples or paper clips to the specified mailing address. Penalties apply for late submissions, ensuring timely compliance is critical. Importantly, this form is specific to quarterly payers, and businesses handling nonresident withholding must use a different document, Form G-7 NRW. The instructions clearly outline every step of the process, from document preparation to submission, aiming to streamline the tax payment process for businesses within Georgia.

Form Sample

State of Georgia

Department of Revenue

Instructions

1.Download (free) the latest version of Adobe Reader. adobe.com/products/acrobat/readstep2.html

2.Complete the worksheet below to automatically create your return.

3.Click the “Print” button to print a completed

4.Sign and date the return.

5.Cut the return along the dotted line. Mail only the return and payment (if required) to the address on the return.

DO NOT fold, staple or paper clip items being mailed.

DO NOT mail in the worksheet, keep this for your records.

1. |

GA Withholding ID: |

|

|

2. FEI Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

...........................Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Street Address Line 1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. |

Street Address Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. |

City: |

|

|

|

|

|

|

7. State: |

|

|

|

|

8. Zip: |

|

|

|

|

- |

|

0000 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Telephone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

10. |

|

|

Amended Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Please Select Tax Period: |

|

|

|

|

|

|

|

|

|

Select |

||||||||||||||

12. |

Tax Withheld This Period: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

13. |

Adjustment To Tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

14. |

.........................................................................Tax Due (Line 13 + or – Line 14): |

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

15. |

.................................................................................................................Tax Paid: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

16. |

Amount Enclosed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Explanation For Adjustment (99 Characters): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clear

Instructions for Completing the

Form

If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday.

Enter the “Tax Withheld”, “Tax Due”, and “Tax Paid” in the appropriate blocks.

Enter the payment amount in the “Amount Paid” section.

If applicable, enter any adjustment amount in the “Adjustment to Tax” block. This block should be used when using a credit from a prior period or paying additional tax due for a period. Explain adjustments in the indicated area of the form.

Submit Form

Do not use this form for nonresident withholding; use Form

Mail this completed form with your payment to:

Processing Center

Georgia Department of Revenue

PO Box 105544

Atlanta, Georgia

Contact the Withholding Tax Unit at

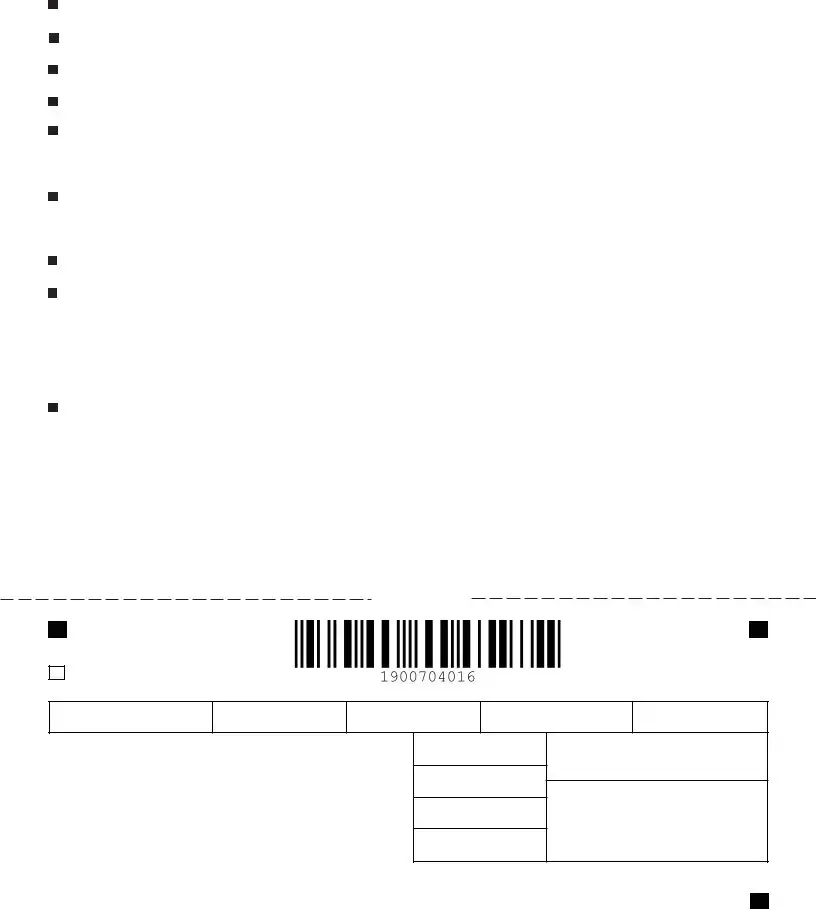

PLEASE DO NOT mail this entire page. Please cut along dotted line and mail only voucher and payment.

PLEASE DO NOT STAPLE OR PAPER CLIP. PLEASE REMOVE ALL CHECK STUBS.

Cut on dotted line

Name and Address: |

|

|

|

FOR QUARTERLY PAYER (Rev. 03/23/18) |

|

Amended Return |

|

GA Withholding ID

FEI Number

Period Ending

Due Date

Vendor Code

040

PLEASE DO NOT STAPLE OR PAPER CLIP. REMOVE ALL CHECK STUBS.

PROCESSING CENTER

GEORGIA DEPARTMENT OF REVENUE

PO BOX 105544

ATLANTA GA

Tax withheld this period

Adjustment to tax

Tax Due (Line 1 + or - Line 2)

Tax Paid

Explanation of adjustments

Under penalty of perjury, I declare that this return has been examined by me and to the best of my knowledge and belief it is true, correct and complete.

Signature |

Title |

|

|

Telephone |

Date |

Amount Paid $

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The G-7 Quarterly Return for Quarterly Payer is a mandatory filing for entities that have withheld taxes in the state of Georgia, ensuring compliance with state tax obligations. |

| Filing Deadline | The form must be submitted to the Georgia Department of Revenue by the last day of the month following the end of the quarter. If this day falls on a weekend or holiday, the deadline extends to the next business day. |

| Penalty for Late Filing | Late submissions are subject to a penalty of $25.00 plus 5% of the total tax withheld for each month the return is late, not to exceed $25.00 plus 25% of the total tax withheld. |

| Governing Law(s) | This form and its filing requirements are governed by the tax laws and regulations of the State of Georgia, as enforced by the Georgia Department of Revenue. |

Guide to Using Georgia G 7

Filing the Georgia G-7 quarterly return is a necessary step for quarterly payers to properly report and submit withheld taxes. It is crucial to meet the submission deadlines to avoid potential penalties. The form ensures that businesses are compliant with state tax obligations. Below are detailed instructions to help you complete the form accurately and efficiently.

- Download the latest version of Adobe Reader from adobe.com/products/acrobat/readstep2.html to ensure compatibility with the form.

- Fill in the G-7 Quarterly Return for Quarterly Payer Worksheet with the required information:

- GA Withholding ID

- FEI Number

- Name

- Street Address Line 1 and Line 2

- City, State, Zip

- Telephone Number

- If it's an amended return, mark the "Amended Return" box

- Select the Tax Period

- Enter the "Tax Withheld This Period"

- Adjustment To Tax, if applicable

- Calculate and enter the "Tax Due"

- Enter any "Tax Paid"

- Specify the "Amount Enclosed"

- Provide an "Explanation For Adjustment" if you made any adjustments

- Click the "Print" button to print the completed G-7 QUARTERLY RETURN form.

- Sign and date the form in the provided spaces.

- Before mailing, cut along the dotted line to separate the voucher from the rest of the worksheet.

- Mail the completed form and any payment to: Processing Center, Georgia Department of Revenue, PO Box 105544, Atlanta, Georgia 30348-5544. Remember, do not fold, staple, or paper clip items being mailed.

Ensure your return is postmarked by the due date which is the last day of the month following the quarter's end. If the due date falls on a weekend or holiday, submit your form by the next business day. Keeping a record of your submitted form and any correspondence with the Georgia Department of Revenue is important for future reference. If you encounter any difficulties or have questions, you can contact the Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711) for assistance.

Obtain Clarifications on Georgia G 7

What is the Georgia G-7 Quarterly Return for Quarterly Payer form, and who is required to file it?

The Georgia G-7 Quarterly Return for Quarterly Payer form is a document businesses use to report and pay withheld state income tax from employees' wages. If you are an employer who withholds Georgia state income tax from employees' paychecks, you are required to file this form. Filing must occur every quarter, even if no tax was withheld during that period. It's essential for businesses to comply to avoid penalties.

How do I complete the Georgia G-7 form?

To complete the Georgia G-7 form, you must first download the latest version of Adobe Reader, as the form needs to be filled out digitally for accuracy and compliance. The form will request your Georgia Withholding ID, Federal Employer Identification Number (FEI), business name, address, and other pertinent details such as the tax period, tax withheld, and any applicable adjustments. Make sure to enter the correct amounts for "Tax Withheld This Period," "Adjustment To Tax," and the resulting "Tax Due." If you've made payments, report these in "Tax Paid" and detail any adjustments in the provided field. After completion, print the form, sign and date it, and mail the specified section to the Georgia Department of Revenue without stapling or using a paper clip.

What are the deadlines for submitting the Georgia G-7 Quarterly Return?

The Georgia G-7 Quarterly Return must be submitted on or before the last day of the month following the quarter. Specifically, for Q1 (January to March), the deadline is April 30; for Q2 (April to June), July 31; for Q3 (July to September), October 31; and for Q4 (October to December), January 31 of the following year. If the due date falls on a weekend or holiday, the return is due the next business day. Filing after the deadline can result in penalties, so marking these dates in your calendar is advisable.

Where do I mail the completed Georgia G-7 form, and what if I need help?

After completing the G-7 form, mail it along with any payment to the Processing Center at the Georgia Department of Revenue, PO Box 105544, Atlanta, Georgia 30348-5544. Ensure you do not staple or paper clip the form or payment, and remove all check stubs. Should you require assistance during the process, contact the Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711). The staff can provide guidance and answer any questions you might have regarding the form or your obligations as a filer.

Common mistakes

Filling out tax forms can be a complex task, and mistakes can occur if you're not careful. When individuals and businesses fill out the Georgia G-7 form, there are common errors that can lead to complications. Understanding these mistakes can help ensure the process goes more smoothly and accurately. Here are nine mistakes often made on the Georgia G-7 form:

- Not using the latest version of Adobe Reader to download the form. Always make sure you are using the most up-to-date software to avoid compatibility issues.

- Failure to keep a copy of the worksheet for records. Although it's instructed to mail only the return, keeping a copy of the entire form, including the worksheet, is crucial for your records.

- Incorrectly filling out the Georgia Withholding ID or FEI Number. Double-check these numbers for accuracy as they are critical for identification.

- Filling in the wrong address or incomplete address details. Ensure that the street address, city, state, and zip code are correctly entered and match your official records.

- Choosing the wrong tax period or not correctly indicating the tax period for which the return is being filed. This could lead to misprocessed forms or penalties.

- Miscalculating the tax withheld, tax due, or tax paid amounts. It's important to carefully compute these figures to ensure the correct amounts are reported and paid.

- Omitting the explanation for adjustments. If there are adjustments made to the tax amount, a clear explanation is required in the indicated area of the form for proper processing.

- Forgetting to sign and date the return. An unsigned form is considered incomplete and will not be processed until corrected.

- Improper mailing practices, such as folding, stapling, or using paper clips on the mailed items, or mailing the entire worksheet instead of just the return portion. Following the specific mailing instructions is essential for your return to be properly received and processed.

By avoiding these common errors, you can streamline the submission of your Georgia G-7 form and help avoid unnecessary delays or complications with your quarterly tax filings.

Documents used along the form

When completing and submitting the Georgia G-7 Quarterly Return for Quarterly Payer, businesses and accountants often need to prepare and attach additional forms and documents to ensure compliance with state tax regulations. Understanding these supplementary documents can streamline the filing process and help avoid errors or delays. Below is a list of five forms and documents commonly used in conjunction with the Georgia G-7 form, along with brief descriptions of each.

- Form G-1003: This is the Income Statement Return, which companies use to report all Georgia source income payments and tax withholdings annually. It's essential for reconciling the amounts reported quarterly on the G-7 forms with the total annual amount reported to the state.

- Form G-7 NRW: Necessary for businesses that withhold Georgia income tax from nonresident individuals or entities. This form is relevant when the nonresident withholding is not covered under the regular G-7 Quarterly Return and ensures appropriate reporting and payment of nonresident withholdings.

- 940 Series Forms: These include any forms part of the Federal Employer's Annual Federal Unemployment (FUTA) Tax Return filings. While not directly related to the G-7, these forms prove compliance with federal employment tax obligations, which is information that state tax agencies may cross-reference.

- W-2 and W-3 Forms: At the end of the year, employers must send out W-2 forms to each employee and the W-3 to the Social Security Administration. These summarize the wages paid and taxes withheld for all employees. Ensuring accuracy between these forms and the G-7 filings is critical for compliance.

- 1099 Series Forms: Businesses use these to report various types of income other than wages, salaries, and tips to independent contractors and the IRS. The 1099 forms should align with the information reported on G-7 when it comes to payments made to non-employees and the corresponding withholdings.

Aligning the documentation and accurately completing each form are crucial steps in adhering to Georgia tax laws and maintaining good standing with tax authorities. Proper management of these forms not only supports compliance but helps in creating a transparent and orderly record of an entity's financial obligations and contributions throughout the fiscal year.

Similar forms

The Georgia G-7 form, a quarterly tax return for payers, bears similarity to several other documents commonly used in various business and taxation contexts. These documents, while distinct in their specific purposes and usage, share commonalities in terms of structure, function, and the type of information they require. Below is a list of nine documents and an explanation of how each one is similar to the Georgia G-7 form:

- IRS Form 941, Employer's Quarterly Federal Tax Return: Similar to the G-7 form, IRS Form 941 is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Both forms are filed quarterly and require detailed financial information.

- IRS Form 944, Employer's ANNUAL Federal Tax Return: This form serves a similar purpose to the G-7 form but is filed annually instead of quarterly. It is designed for smaller employers. Like the G-7, it includes withholding taxes and payments.

- IRS Form W-2, Wage and Tax Statement: The W-2 form is issued by employers to report an employee's annual earnings and taxes withheld. Although used annually, it complements the quarterly G-7 form by providing a summary of what has been reported incrementally throughout the year.

- IRS Form 1099-MISC, Miscellaneous Income: Used to report payments made in the course of a business to people who aren't employees, this form shares the G-7's focus on financial transactions and tax obligations, even though its application is different.

- IRS Form 1040, U.S. Individual Income Tax Return: Individuals use Form 1040 for their annual tax returns. While its focus is broader than the G-7, which is specifically for payers, both forms are integral to the reporting and payment of taxes.

- State-specific Sales Tax Returns: Similar to the G-7 form, sales tax returns are filed periodically (monthly, quarterly, or annually) with a state's revenue department, detailing taxable sales, tax collected, and remittance.

- Form W-4, Employee's Withholding Certificate: Even though the W-4 is not a tax return, it directly influences the information on the G-7 by determining how much tax employers withhold from employees' paychecks.

- Form W-9, Request for Taxpayer Identification Number and Certification: Like the G-7, the W-9 is used in the context of taxation to provide necessary tax IDs and certification for accurate reporting and withholding.

- State Unemployment Tax Filings: While specific forms vary by state, they serve a similar administrative function to the G-7 by requiring periodic reporting and payment based on wages and salaries paid to employees.

Each of these documents, though serving distinct roles within the broader financial and tax-reporting ecosystem, shares a fundamental link with the Georgia G-7 form through their collective aim of ensuring accurate tax reporting, withholding, and payment to governmental authorities.

Dos and Don'ts

When filling out the Georgia G-7 form, there are important dos and don'ts to keep in mind to ensure the process goes smoothly and accurately. Below are guidelines that will assist employers or payers in completing and submitting the G-7 Quarterly Return for Quarterly Payer form correctly.

Things You Should Do:

- Download the latest version of Adobe Reader to access and fill out the form correctly, ensuring compatibility and functionality.

- Use the worksheet provided to automatically calculate your return; this will help in minimizing errors.

- Sign and date the return to validate the information provided on the form.

- Ensure you mail only the return and payment (if applicable) using the provided address, and follow the specified mailing instructions to avoid processing delays.

- Keep the worksheet for your records, as it may be useful for future reference or in case of any queries from the Georgia Department of Revenue.

- Contact the Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711) if you need further assistance or have additional questions.

- Submit the Form G-7 by the due date to avoid any penalties or late fees that may accrue due to delayed filing.

Things You Shouldn't Do:

- Do not fold, staple, or use paper clips on the items you're mailing; this can cause problems during processing.

- Avoid mailing the entire worksheet or any unnecessary documents—only the specific parts of the form requested should be sent.

- Do not delay the filing beyond the specified due date; late submissions are subject to penalties.

- Refrain from using the G-7 form for nonresident withholding purposes; instead, use the appropriate Form G-7 NRW.

- Avoid guessing or estimating figures; ensure all financial information is accurate and verified.

- Do not ignore the instructions for explaining adjustments on the form; clear explanations will help in the processing of your return.

- Avoid sending incomplete forms; missing information can lead to processing delays or requests for additional information.

Adhering to these dos and don'ts can help streamline the process of filing the Georgia G-7 form, ensuring compliance with state tax regulations and contributing to a smoother tax processing experience.

Misconceptions

When it comes to completing and filing the Georgia G-7 form for quarterly tax returns, there are several misunderstandings that can lead to mistakes. Knowing the facts can help ensure compliance and accuracy when dealing with this essential task. Below are nine misconceptions regarding the Georgia G-7 form, explained for better clarity:

- It's only necessary to file if tax has been withheld for that quarter. This is incorrect. The form must be filed every quarter, even if no tax was withheld during that period. This ensures that records are consistently updated and accurate.

- Electronic submission isn't available; it must be mailed. While the instructions emphasize printing and mailing the completed form, taxpayers also have the option to file this electronically through the Georgia Tax Center, offering a more convenient and faster processing method.

- Weekends and holidays extend the due date indefinitely. If the due date falls on a weekend or a holiday, the due date is actually pushed to the next working day, not indefinitely extended. This helps in planning the exact date by which the return must be submitted.

- Adjustments can only be made for overpayments. Adjustments to the tax amount can be made for both overpayments and additional taxes due. This includes utilizing credits from previous periods or accounting for any underpayment.

- The form doesn't need a signature if filed electronically. Even when filing electronically, the taxpayer is required to verify the submission, which serves as their digital signature confirming the accuracy and completeness of the information provided.

- The entire completed form, along with worksheets, should be mailed. Only the return and payment, if applicable, should be mailed. The worksheet and any other documentation should be kept for your records. Mailing unnecessary documents can lead to processing delays.

- Staples or paper clips can be used for organizing materials when mailing. The instructions specifically request not to use staples or paper clips. This ensures that the processing of returns is not hindered by additional steps to remove these items.

- If a mistake is made, amending the return is complicated. The process for amending a return simply requires checking the "Amended Return" box and providing the corrected information. This is to ensure that errors can be rectified in a straightforward manner.

- Contacting the Withholding Tax Unit is unnecessary unless there are major issues. While it's true that many questions can be answered through the form's instructions or the Georgia Department of Revenue website, reaching out to the Withholding Tax Unit can provide clarification and assistance for any aspect of your G-7 filing, promoting accuracy and compliance.

Understanding these points about the Georgia G-7 can help taxpayers complete and submit their quarterly returns accurately and efficiently. Always refer to the most recent guidelines provided by the Georgia Department of Revenue to stay informed on any updates to the filing process.

Key takeaways

Filing the Georgia G-7 form correctly and on time is crucial for any business that withholds taxes from employees in Georgia. Here are four key takeaways to ensure compliance and avoid potential penalties:

- Before attempting to complete the G-7 form, ensure you have the latest version of Adobe Reader installed. This is essential for downloading, filling, and printing the form accurately.

- Always print and sign the completed G-7 QUARTERLY RETURN before mailing it. Remember, only the return and payment—if required—should be mailed. To avoid processing delays, do not fold, staple, or attach paper clips to the items being mailed.

- The form requires specific information such as GA Withholding ID, FEI Number, and details about the tax withheld during the quarter. All sections must be filled out correctly to avoid errors or potential fines for inaccuracies.

- Timeliness is key when submitting Form G-7. It must be filed by the last day of the month following the quarter’s end. Failing to do so can result in a penalty of $25.00 plus 5% of the total tax withheld for each month the return is late, up to a maximum of $25.00 plus 25% of the total tax withheld.

By following these guidelines, businesses can ensure they comply with Georgia's tax withholding requirements, contributing to a smoother operational process.

Popular PDF Forms

Vin Verification Form Ga - The inspection results documented on this form play a crucial role in the vehicle’s certification for roadworthiness.

Ga Tax Form - It highlights the legal implications of failing to comply with tax payments on tobacco stamp purchases.

Ga Ptet - This document outlines the necessary information for completing the Partnership Tax Return for the fiscal year 2014.