Free Georgia Hire Reporting Template in PDF

Ensuring compliance with federal and state legislation, all employers in Georgia, spanning across both the public and private sectors, are mandated to submit a Georgia New Hire Reporting form for each employee that is newly hired, rehired, or returns to work after a period of separation. This requirement, grounded in Georgia statute 19‐11‐9.2, is critical for the maintenance of accurate employment records, aiding in the enforcement of child support orders among other legal and administrative purposes. Employers are directed to the official website, www.GA‐newhire.com, for comprehensive information on how to fulfill this reporting obligation effectively, including details for online submission. The reports, required to be submitted within a span of 10 days from the employee’s start date, play a pivotal role in streamlining the reporting process. It is emphasized that failure to provide the necessary information on the form could result in the report not being processed. For any queries or further assistance, the program offers dedicated contact numbers, ensuring employers have the support needed to comply with these requirements. This meticulous approach underscores the importance of the Georgia New Hire Reporting Program in fostering compliance and facilitating essential state functions.

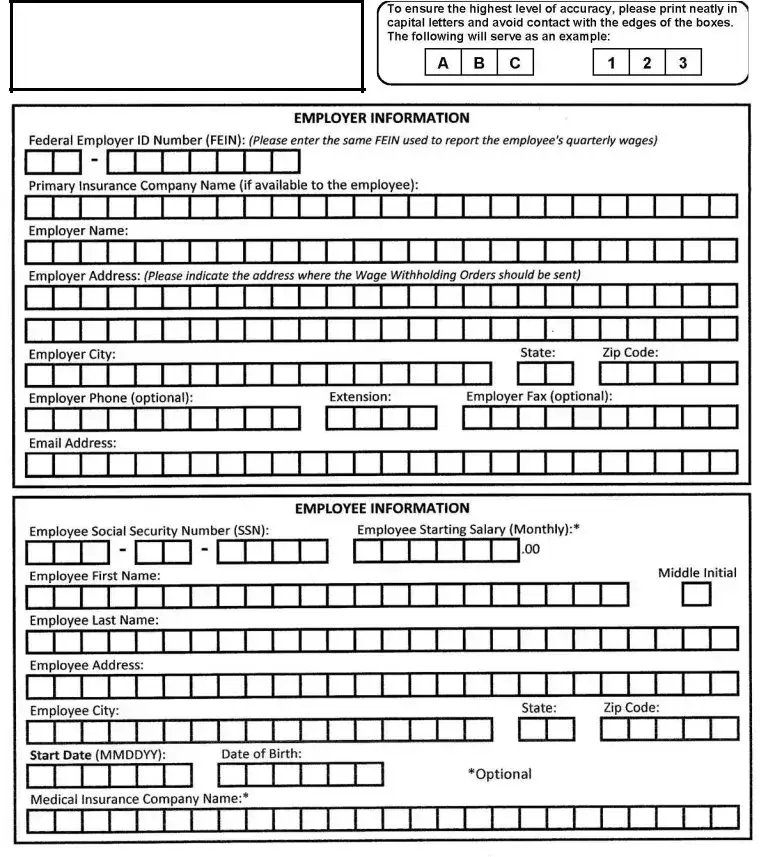

Form Sample

Georgia New Hire Reporting Form

Federal and state legislation (Georgia statute 19‐11‐9.2), requires all Georgia employers, both public and private, to report to the New Hire Reporting Program all newly hired, rehired, or returning to work employees. Information about new hire reporting and online reporting is available on our website: www.GA‐newhire.com

Send completed forms to:

Georgia New Hire Reporting Program

PO Box 90728 East Point, GA 30364‐0728

Fax: (404) 525‐2983 or toll‐free: (888) 541‐0521

Reports must be submitted within 10 days of hire or rehire date.

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING

Questions? Call us at (404) 525‐2985 or toll‐free at (888) 541‐0469

File Overview

| Fact Name | Description |

|---|---|

| Governing Legislation | Georgia statute 19‐11‐9.2 mandates that all Georgia employers report newly hired, rehired, or returning employees. |

| Who Must Report | All public and private employers in Georgia are required to comply with the New Hire Reporting Program. |

| Reporting Website | Comprehensive information about new hire reporting can be found and submissions can be made online at www.GA‐newhire.com. |

| Submission Methods | Forms can be sent to the Georgia New Hire Reporting Program via mail, fax, or toll-free fax number. |

| Submission Deadline | Reports must be submitted within 10 days of the employee's hire or rehire date. |

| Accuracy Requirement | Reports will not be processed if any required information is missing from the submission. |

| Contact Information | Employers with questions can reach out via a local or toll-free number provided. |

Guide to Using Georgia Hire Reporting

Filling out the Georgia New Hire Reporting Form is a straightforward task that's essential for compliance with both federal and state regulations. As mandated by Georgia statute 19‐11‐9.2, all employers in Georgia are required to report any new hires, rehires, or employees returning to work to the New Hire Reporting Program. This not only aids in the enforcement of child support orders but also helps in detecting unemployment benefits fraud and workers' compensation abuse. The form can be submitted either through mail or fax, and it's essential to report within 10 days of the employee's start date to ensure compliance. Below are the steps to properly fill out and submit the form.

- First, gather the necessary employment information, including the employee’s start date, personal details, and your employer details.

- Visit the website www.GA-newhire.com to access the form and any additional guidance you may need.

- Enter the employee's full name, address, and Social Security Number in the designated sections of the form.

- Fill in the employee's date of hire, rehire, or return to work, as applicable.

- Provide your business name, address, Federal Employer Identification Number (FEIN), and the State Employer Identification Number (if applicable).

- Double-check the form to ensure all provided information is accurate and complete. Incomplete forms will not be processed.

- Submit the completed form to the Georgia New Hire Reporting Program via fax at (404) 525-2983 or toll-free at (888) 541-0521. Alternatively, you can mail it to:

Georgia New Hire Reporting Program

PO Box 90728

East Point, GA 30364-0728 - If you have any questions or require assistance, contact the program by calling (404) 525-2985 or toll-free at (888) 541-0469.

By following these steps, you ensure that your business remains in compliance with Georgia's employment reporting laws, contributing to the integrity of statewide employment data and support systems. Remember, prompt and accurate reporting benefits not only your business by simplifying record-keeping but also supports the broader social and economic welfare of Georgia communities.

Obtain Clarifications on Georgia Hire Reporting

-

What is the Georgia Hire Reporting Form and why is it important?

The Georgia Hire Reporting Form is a mandatory document that all Georgia employers, regardless of their size, must complete and submit to the New Hire Reporting Program. This form is used to report any newly hired, rehired, or returning to work employees. Following federal and Georgia state law (Georgia statute 19‐11‐9.2), this requirement aims to ensure that child support enforcement agencies can quickly locate parents who owe child support, thereby helping to secure timely child support payments.

-

How and where do I submit the Georgia Hire Reporting Form?

Employers can submit the Georgia Hire Reporting Form in several ways. Completed forms can be sent via mail to the Georgia New Hire Reporting Program, PO Box 90728, East Point, GA 30364‐0728. Alternatively, submissions can be made by fax at (404) 525‐2983 or the toll‐free number (888) 541‐0521. For convenience, online reporting options are also available at the program’s website, www.GA-newhire.com.

-

What is the deadline for submitting the Georgia Hire Reporting Form?

The deadline for submitting the Georgia Hire Reporting Form is within 10 days of the employee's hire or rehire date. It is crucial for employers to adhere to this deadline to remain compliant with state and federal laws, and to avoid potential penalties. This timely submission is essential for the effectiveness of child support enforcement efforts.

-

What information is required on the Georgia Hire Reporting Form?

The Georgia Hire Reporting Form requires specific information to be filled out accurately for it to be processed. While the form details are not provided here, employers are typically required to include information about the employee, such as their name, address, Social Security number, date of hire or rehire, and possibly their salary information. Employers' information, including their federal Employer Identification Number (EIN) and state Employer Identification Number, if applicable, are also required. It's important to double-check the form for completeness to ensure it gets processed without delays.

Keep in mind that reports will not be processed if required information is missing.

-

Who can I contact if I have questions about the Georgia Hire Reporting Form or its submission process?

If you have questions regarding the Georgia Hire Reporting Form or the submission process, assistance is available. You can contact the Georgia New Hire Reporting Program directly by calling (404) 525‐2985 or the toll-free number (888) 541‐0469 for support. These lines provide access to information and help with any inquiries related to new hire reporting in Georgia.

Common mistakes

In compliance with both federal and state legislation, especially the Georgia statute 19‐11‐9.2, employers in Georgia are mandated to report new, rehired, or returning employees to the Georgia New Hire Reporting Program. Despite the clear directive to complete and send the Georgia New Hire Reporting Form within ten days of the employee's start date, a number of common errors can render these submissions incomplete or incorrectly processed. Understanding and avoiding these mistakes is crucial for both the effectiveness of this process and compliance with legal requirements.

Delay in Submission: One prevalent mistake is not adhering to the mandated timeframe for submission, which is within ten days of the employee's hire or rehire date. Timely submission is critical to remaining compliant with Georgia's employment laws.

Incomplete Forms: Reports will not be processed if required information is missing. It’s essential to review the form thoroughly and ensure that no section is left blank.

Incorrect Information: Mistakes in entering accurate details, such as misspelling a name or inputting the wrong social security number, can lead to the rejection of the form. Accuracy is key.

Failing to Report Rehires: Some employers mistakenly believe that only new hires need to be reported. However, rehired or returning employees must also be included in the report.

Overlooking Online Reporting Options: While mail and fax are accepted, utilizing the online platform at www.GA-newhire.com can streamline the process, reduce errors, and ensure timely submission.

Improperly Filled Sections: Certain sections may require specific formats or information that is not properly adhered to by the person filling out the form. Paying close attention to detail and instructions for each section can mitigate this issue.

Not Using Updated Forms: Employers might unknowingly use outdated forms for their reporting. Ensuring that the most recent version of the form is being used is necessary for accurate processing.

In conclusion, the submission of the Georgia New Hire Reporting form is a straightforward yet crucial procedure that requires attention to detail and awareness of deadlines. By avoiding these common pitfalls, employers can contribute to the efficiency and accuracy of the New Hire Reporting Program, subsequently aiding in the enhancement of child support enforcement efforts and ensuring compliance with Georgia employment reporting standards.

Documents used along the form

In the complex landscape of employment law, the Georgia New Hire Reporting Form is a critical piece of documentation. However, to ensure full regulatory compliance and a smooth onboarding process, several other forms and documents frequently accompany it. These serve various purposes, from verifying an employee's eligibility to work in the United States to setting up essential employment details. Understanding each document's role can safeguard employers against potential legal complications and streamline administrative processes.

- Form I-9, Employment Eligibility Verification: Required by federal law, this form verifies an employee's identity and establishes that they are legally permitted to work in the U.S. It must be completed within three days of the start of employment.

- W-4 Form, Employee's Withholding Certificate: This IRS document is used by employers to determine the correct federal income tax to withhold from employees' paychecks. Employees fill out the W-4 form to indicate their tax situation to their employer.

- State Tax Withholding Form: Similar to the federal W-4, this form determines the appropriate state income tax withholding amount. The specific form varies by state, matching the state's tax laws and requirements.

- Direct Deposit Authorization Form: This form allows employees to set up direct deposit for their paychecks. It requires the employee's bank account information and usually a voided check.

- Emergency Contact Form: Collects information about whom to contact in case of an emergency involving an employee. This is vital for workplace safety and emergency response planning.

- Employee Handbook Acknowledgement Form: Indicates that the employee has received, read, and understood the company's handbook. This document is crucial for HR records and helps in defending against certain legal claims.

- Job Description and Acknowledgement Form: Outlines the specific duties, responsibilities, and expectations associated with a position. The employee signs it to acknowledge their understanding of their role, which can be useful for performance reviews and if any disputes arise about job duties.

Together with the Georgia New Hire Reporting Form, these documents form a comprehensive framework that supports legal compliance, efficient administration, and clear communication between employers and employees. Each document plays a unique role in ensuring that both parties are well-informed and protected, laying the groundwork for a productive and compliant working relationship.

Similar forms

W-4 Form - Similar to the Georgia New Hire Reporting Form, the W-4 Form is another critical document that employers must collect from employees at the start of employment. The primary purpose is to determine the correct amount of federal income tax to withhold from employees' paychecks. Like the New Hire Reporting Form, it is a mandatory requirement, aimed at ensuring tax compliance.

I-9 Employment Eligibility Verification - This document parallels the Georgia New Hire Reporting Form in its requirement for employers to verify an employee's eligibility to work in the United States. Both forms must be completed for every new employee. However, the focus of the I-9 form is on verifying the legal status and identity of employees, reflecting compliance with federal regulations.

State Tax Withholding Forms - Similar to the Georgia example, many states have their own tax withholding forms that need to be filled out by new hires to determine state income tax deductions. These forms, like the Georgia New Hire Reporting Form, ensure compliance with state tax laws and are mandatory for all employees to complete, ensuring the correct state tax is withheld from their earnings.

Direct Deposit Authorization Forms - While not a government-mandated requirement like the Georgia New Hire Reporting Form, Direct Deposit Authorization Forms are commonly used by employers to set up payment for new hires. Both documents are collected at the beginning of employment and are crucial for administrative processing. The direct deposit form ensures that an employee's salary is correctly deposited into their bank account, mirroring the New Hire form's role in maintaining employment compliance and record-keeping.

Dos and Don'ts

When filling out the Georgia Hire Reporting Form, it's crucial to follow specific guidelines to ensure the process is smooth and complies with the stated requirements. Below are things you should and shouldn't do to make the submission successful.

Things You Should Do:- Visit the official website: Prior to completing the form, explore www.GA-newhire.com for any updates or additional guidance on new hire reporting.

- Gather necessary information: Make sure you have all the required details of the newly hired, rehired, or returning employees ready.

- Complete all required fields: Fill out every section of the form without leaving any mandatory information empty to avoid processing delays.

- Submit within the deadline: Ensure the form is sent within 10 days of the employee's hire or rehire date to comply with state regulations.

- Use the provided addresses: Send the completed forms either to the specific PO Box in East Point, GA, or via fax using the numbers provided.

- Submit incomplete forms: Avoid sending the form if it lacks required information, as this will result in non-processing.

- Miss the reporting window: Do not delay beyond the 10-day reporting period after the hire date, which could lead to non-compliance with state law.

- Overlook the submission methods: Don’t attempt to submit the form through unverified methods. Stick to the mailing address or fax numbers provided.

Following these guidelines will facilitate a smoother process for both the employer and the newly hired employees. Should there be any questions or uncertainties, the contact numbers provided should be used to seek clarification.

Misconceptions

Understanding the Georgia New Hire Reporting Form is vital for all employers, but there are several common misconceptions that can lead to confusion. Clarifying these misunderstandings is essential to ensure compliance with state requirements and to facilitate a smoother hiring process.

Misconception #1: The reporting requirement only applies to large businesses.

Contrary to this belief, Georgia statute 19-11-9.2 mandates that all employers, regardless of their size, must report newly hired, rehired, or returning employees. This encompasses both public and private sectors, making it a universal requirement for businesses operating within the state.

Misconception #2: Employers can delay submitting the form beyond the 10-day window.

Some employers might think that the 10-day deadline for submitting reports is flexible. However, reports must be submitted within 10 days of the employee's hire or rehire date, as stipulated by the legislation. Failing to do so could result in non-compliance with state laws.

Misconception #3: Only online reporting is available.

While online reporting is available and encouraged for its convenience and efficiency, it is not the only method for submitting the Georgia New Hire Reporting Form. Employers can also send completed forms via mail or fax, offering multiple channels to comply with reporting requirements.

Misconception #4: The reporting process is complicated.

The thought of dealing with legal forms and compliance can be daunting for many. However, the process has been simplified to ensure ease of use. Resources and assistance are available through the provided contact information, and the online portal streamlines the process further.

Misconception #5: Partially completed forms are acceptable.

There might be a belief that submitting a form with some information is better than not submitting at all. This is not the case; reports will not be processed if required information is missing. Ensuring that all sections of the form are accurately filled out is crucial for a valid submission.

Misconception #6: Assistance is hard to come by.

Employers may hesitate to reach out for help due to the assumption that support is limited. However, assistance is readily available for anyone needing clarification or facing issues with the reporting process. This is evidenced by the dedicated call lines, both local and toll-free, intended to assist employers with their questions.

Dispelling these misconceptions ensures that employers can fulfill their reporting obligations with confidence, understanding the importance of timely and accurate submissions to comply with Georgia's employment regulations.

Key takeaways

Understanding the requirements and process of the Georgia Hire Reporting form is crucial for all employers in the state to ensure compliance with federal and state legislation. Below are key takeaways for filling out and using this form effectively:

- All Employers Must Report: Both public and private employers are required to report all newly hired, rehired, or employees returning to work to the Georgia New Hire Reporting Program. This directive is mandated by Georgia statute 19-11-9.2, underlining the importance of compliance to avoid legal pitfalls.

- Timely Submission is Critical: Reports must be submitted within 10 days of the employee's hire or rehire date. This tight timeline emphasizes the importance of having an efficient process in place for reporting to avoid penalties and stay compliant with state requirements.

- Complete Information is Essential: Reports that are missing required information will not be processed. It’s important to ensure that every field on the Georgia New Hire Reporting form is filled accurately to ensure the report is accepted and processed by the state. Incomplete submissions can lead to compliance issues and further complications for employers.

- Multiple Submission Methods Available: Employers can send completed forms via mail to the Georgia New Hire Reporting Program, or fax them. Additionally, online reporting is available and can be a faster and more convenient option. Understanding the various submission methods allows employers to choose the most efficient process for their operations.

For additional assistance or inquiries, employers can reach out directly to the Georgia New Hire Reporting Program. Various contact options, including phone and fax numbers, are readily available, providing support to ensure understanding and compliance with these reporting requirements.

Popular PDF Forms

Georgia Dispossessory Process - Specifies the court's instructions for defendants to either file a written or oral answer to the claim against them.

Georgia Separation Notice - Includes provision for the identification of the surety for performance and payment bonds, enhancing financial security for the project.