Free Georgia It 303 Template in PDF

Navigating the complexities of tax regulations and deadlines can be a challenging task for residents and businesses in Georgia. Fortunately, the Georgia IT 303 form serves as a critical tool for those seeking an extension of time for filing their state income tax returns. Designed to accommodate various circumstances such as sickness, absence, or other disabilities, this form offers a structured pathway to applying for additional time—thereby ensuring taxpayers can meet their obligations without undue stress. Required to be completed in triplicate and mailed to the Georgia Department of Revenue before the original return due date, it emphasizes the importance of thoroughness and timeliness in tax administration. The form also mandates separate applications for spouses filing individually and excludes acceptance through telephone or lists, showcasing a strict adherence to protocol. Particularly notable is the accommodation of requests for further extension within a six-month limit, subject to reapplication, and the specific provisions for fiduciaries and corporations, including the necessity of filing separate applications for each subsidiary in certain scenarios. Penalties and interest rates applicable for late filing and payments underline the consequences of non-compliance, emphasizing the necessity of adhering to stipulated deadlines. Nevertheless, the provision to use an approved federal extension as a basis for the state extension offers a convenient overlap for taxpayers. Essentially, the Georgia IT 303 form embodies the balance between enforcing tax laws and providing flexibility to taxpayers, encapsulating the state's approach to tax administration.

Form Sample

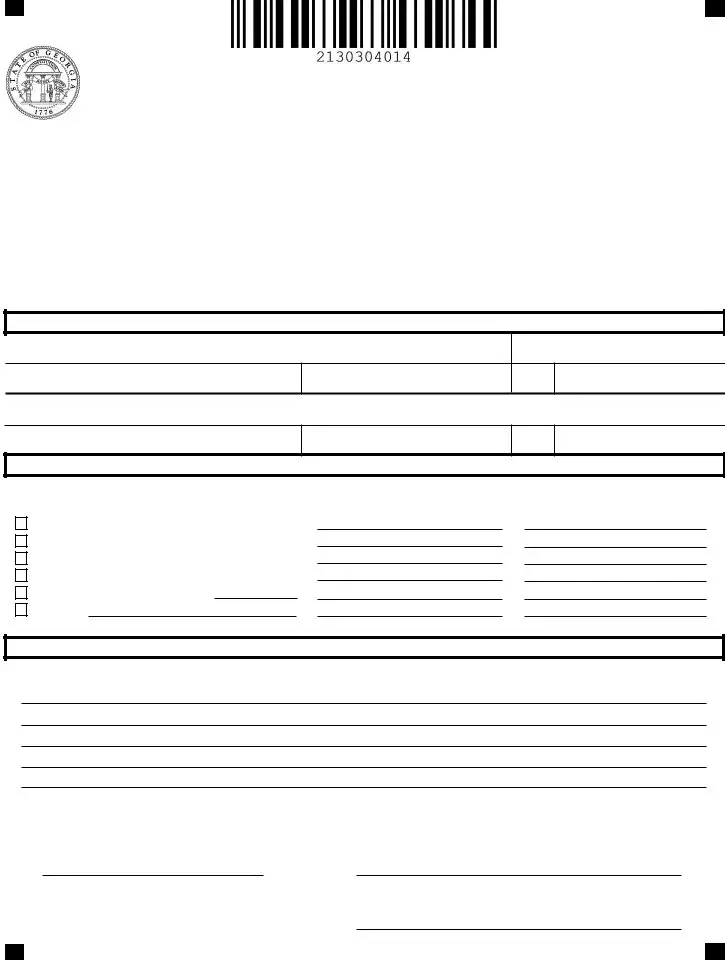

APPLICATION FOR EXTENSION OF TIME

FOR FILING STATE INCOME TAX RETURNS

INSTRUCTIONS

1)Extensions of time for filing returns may be granted n cases of sickness, absence, or other disability or whenever reasonable cause exists.

2)This form must be completed n triplicate. Mail the original form prior to the return due date to: Georgia Department of Revenue, Processing Center, P. O Box 740320,Atlanta GA

3)One copy of the extension must be attached to the completed return when filed. Retain the other copy for your records.

4)Separate applications for extension must be submitted for husband and wife if seperate returns are filed.

5)An extension request will not be accepted by telephone. Lists are not acceptable. Application must be made on this form, unless a copy of an approved federal extension is attached to your Georgia return when filed. If applicable, explain why t was not necessary to request a federal filing extension.

6)Additional time to file, within the six month imit, will require the submission of a new form along with a copy of the first extension request. For tax years beginning on or after January 1, 2016, a fiduciary will only be granted an exten- sion up to 5 and

7)Corporations filing consolidated returns must file a separate application for extension for filing Net Worth Tax for each subsidiary. Corporations not filing consolidated returns may request an extension for filing income tax and net worth tax returns on on eform.

8)Interest accruing for months beginning before July 1, 2016 accrues at the rate of 12 percent annually. Interest that ac- crues for months beginning on or after July 1, 2016 accrues as provided by Georgia Code Sections

9)Late iling penalty on returns iled after he due date prescribed by aw will be assessed at a rate of 5% per month computed on the tax not paid by the original due date. Late payment penalty will be assessed at a rate of 1/2 of

1% per month f ax due on he return s not paid by he date prescribed by law. Lat e payment penal ty accrues regardless of an approved extension request. Individuals and fiduciaries should remi t payment due on Form

NOTE: Remitting payment with Form

Form

MAIL TO:

Georgia Department of Revenue

Processing Center

PO Box 740320

Atlanta, GA

Georgia Department of Revenue

APPLICATION FOR EXTENSION OF TIME

FOR FILING STATE INCOME TAX RETURNS

IMPORTANT! ACCEPTANCE OF FEDERAL EXTENSIONS

AFEDERAL EXTENSION WILL BEACCEPTEDAS AGEORGIAEXTENSION IF: (1) THE RETURN IS RECEIVED WITHIN THE TIMEAS EXTENDED BY THE NTERNAL REVENUE SERVICE, AND (2) A COPY OF THE FEDERAL EXTENSION(S) S ATTACHED TO THE RETURN WHEN FILED. NOTE:

THERE S NO EXTENSION FOR PAYMENT OF TAX. INCOME TAX OR CORPORATE NET WORTH TAX MUST BE PAID BY THE PRESCRIBED DUE DATE TOAVOID THE ASSESSMENT OF LATE PAYMENT PENALTIES AND INTEREST.

THIS IS NOT A PAYMENT FORM! REMIT PAYMENT ON FORM

COMPLETE THIS FORM IN TRIPLICATE. MAIL THE ORIGINAL PRIOR TO THE RETURN DUE DATE AND KEEP 2 COPIES. ATTACH ONE COPY TO RETURN WHEN FILED AND RETAIN ONE COPY FOR YOUR RECORDS. WE WILL NOTIFY YOU ONLY IF YOUR EXTENSION REQUEST IS DENIED.

SECTION 1

NAME

SOCIAL SECURITY NUMBER OR FEIN

ADDRESS

CITY

STATE ZIP CODE

NAME OF TAXPAYER FOR WHOM EXTENSION IS FILED, IF DIFFERENT FROM ABOVE

ADDRESS

CITY

STATE ZIP CODE

SECTION 2

APPLICATION IS HEREBY MADE FOR AN EXTENSION OF TIME FOR THE FOLLOWING STATE TAX RETURN:

1. Type of return (check proper type):2. For Period Ending:3. Extension Requested To:

Corporate IncomeTax

Net Worth Tax (For Period Beginning)

Other

NOTE: Except as noted above, extensions are limited by law to six (6) months, please see line 6 of instructions.

SECTION 3

REASON FOR EXTENSION:

I AFFIRM THAT THE ABOVE INFORMATION IS, TO THE BEST OF MY KNOWLEDGE AND BELIEF, TRUE AND ACCURATE. THIS AFFIRMATION IS MADE UNDER THE PENALTIES PRESCRIBED BY LAW.

DATE |

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT |

IF SIGNED BYAGENT, AGENT’S FIRM OR TRADE NAME

File Overview

| Fact Number | Detail |

|---|---|

| 1 | The IT-303 form is an application for extending the time to file Georgia state income tax returns. |

| 2 | Extensions may be granted due to sickness, absence, other disabilities, or whenever there is a reasonable cause. |

| 3 | The form must be completed in triplicate, with the original mailed prior to the return due date. |

| 4 | Husband and wife filing separate returns must submit separate extension applications. |

| 5 | Extension requests cannot be made via telephone and must be made on the IT-303 form unless an approved federal extension is attached. |

| 6 | For tax years beginning on or after January 1, 2016, fiduciaries can only be granted an extension up to 5 and one-half months. |

| 7 | Corporations filing consolidated returns must file a separate application for each subsidiary when filing Net Worth Tax. |

| 8 | Interest rates for months before July 1, 2016, are 12% annually, and for months on or after are as provided by Georgia Code Sections 48-7-81 and 48-13-79. |

| 9 | Late filing and payment penalties are assessed with specific rates and limits, emphasizing the importance of timely tax payment to avoid such penalties. |

| 10 | A federal extension is accepted as a Georgia extension if the return is received within the time as extended by the IRS and a copy of the federal extension(s) is attached. |

Guide to Using Georgia It 303

When the time comes to file your Georgia state income tax return, you might find yourself needing a bit more time to get everything in order. Fortunately, the state allows for extensions, requiring you to fill out the IT-303 form. This process can seem daunting at first, but by breaking it down into manageable steps, you can ensure that you submit your request properly and avoid any potential penalties for late filing. Here's a guide to help you fill out the form accurately.

- Ensure you have all the necessary information handy, including your Social Security Number or FEIN (Federal Employer Identification Number), and your complete current address.

- Download the Georgia IT-303 form from the Georgia Department of Revenue website.

- Fill out Section 1 with your name, Social Security Number or FEIN, and address. If the extension is for a taxpayer different from yourself (e.g., if you're filing on behalf of someone else or a business), provide the taxpayer's name and address in the indicated fields.

- In Section 2, clearly mark the type of return you're requesting an extension for by checking the appropriate box. Specify the period ending date for which the request applies and indicate the new date to which you're requesting the extension.

- Provide a reason for the extension request in Section 3. Be concise but thorough in your explanation.

- Sign and date the form at the bottom. If you are an authorized agent filling out the form on behalf of someone else, ensure you provide your firm or trade name where indicated.

- Remember to make copies of the filled-out form. You will need to send the original to the Georgia Department of Revenue Processing Center at the address provided, keep one copy for your records, and attach the other copy to your completed tax return when you file it.

- Mail the original form to the Georgia Department of Revenue Processing Center, P.O. Box 740320, Atlanta, GA 30374-0320, ensuring it's sent before the original due date of the return to avoid any late filing penalties.

After you've mailed the form, it's a waiting game. The Department of Revenue will only get in touch if there's an issue with your extension request. Otherwise, you can proceed under the assumption that your extension has been granted. Just remember, an extension to file your return doesn't extend the due date for any tax owed, so if possible, estimate and pay any owed taxes by the original due date to avoid additional penalties and interest.

Obtain Clarifications on Georgia It 303

Understanding how to handle an extension for filing state income tax returns in Georgia can seem complex, but the following frequently asked questions (FAQ) regarding the Georgia IT-303 form aim to demystify the process. The IT-303 form is essential for those seeking an extension on their state income tax filings.

- What is the purpose of the Georgia IT-303 form?

The Georgia IT-303 form is designed for taxpayers who need additional time to file their state income tax returns. It can be used to request an extension due to reasons such as sickness, absence, other disability, or whenever there is a reasonable cause that prevents timely filing.

- How do I complete the form?

To properly complete the IT-303 form, it must be filled out in triplicate. The taxpayer should mail the original form to the Georgia Department of Revenue's Processing Center before the original due date of the tax return. One copy should be attached to the tax return when filed, and the taxpayer should keep the remaining copy for their records.

- Can a telephone request be made for an extension?

No, extension requests via telephone are not accepted. Taxpayers must submit their extension request using the IT-303 form unless a copy of an approved federal extension is included with the Georgia return when filed.

- Are separate extensions required for spouses filing separately?

Yes, when husband and wife file separate returns, each must submit a separate application for an extension.

- Is it possible to request more than a six-month extension?

Extensions beyond six months are generally not granted. The form allows for extensions within a six-month limit. However, fiduciaries are limited to a 5 and a half month extension for tax years beginning on or after January 1, 2016.

- What if I need an extension for filing a corporate net worth tax return?

Corporations filing consolidated returns must file a separate application for each subsidiary when requesting an extension for filing a Net Worth Tax. Those not filing consolidated returns can request an extension for both income tax and net worth tax returns on the same form.

- How are late filing and late payment penalties calculated?

Late filing penalties are assessed at a rate of 5% per month based on the tax not paid by the original due date, and late payment penalties are calculated at a rate of 0.5% per month if tax due on the return is not paid by the prescribed by law. The total of both penalties cannot exceed 25%.

- Does payment of tax extend the filing deadline?

Remitting payment with Form IT-560 or IT-560C does not extend the due date for filing your return. The payment of tax is required by the original due date to avoid late payment penalties and interest.

- How can I avoid penalties and interest charges?

To avoid penalties and interest, taxpayers should ensure that they pay any tax owed by the original due date and submit the IT-303 form before the return due date if they require an extension. Attaching a copy of an approved federal extension to the Georgia return, if applicable, can also suffice as a Georgia extension, allowing for more time to file without penalties for late filing.

Common mistakes

Filling out forms for tax purposes can often seem straightforward, yet it's surprisingly easy to make mistakes, especially when dealing with something as specific as the Georgia IT-303 form, the Application for Extension of Time for Filing State Income Tax Returns. Understanding where errors commonly occur can save taxpayers a lot of headaches. Here are six mistakes people often make:

-

Not completing the form in triplicate. The instructions clearly state that the form must be filled out in triplicate. Many individuals send just one copy, forgetting to mail the original to the Georgia Department of Revenue and keep two copies for their records—one to attach to the completed return and one for personal files.

-

Ignoring separate extension requirements for spouses filing separately. Couples who file separate returns must submit separate applications for an extension. This oversight can lead to one spouse inadvertently not receiving an extension.

-

Assuming extension requests can be made by telephone. The state does not accept extension requests over the phone. One must complete the IT-303 form or attach a copy of an approved federal extension to the Georgia return when filed.

-

Missing the submission for additional time within the six-month limit. If more time beyond the initial extension is needed, another form must be submitted with a copy of the first extension request. This step is often overlooked, leading to complications later on.

-

Omitting details for corporations filing consolidated returns. Corporations filing consolidated returns must file a separate application for an extension for each subsidiary. Some mistakenly file just one application for the entire group, which is not in compliance with the guidelines.

-

Forgetting to attach a copy of the federal extension. If taxpayers have received a federal extension, they are required to attach a copy to the Georgia return when filed. This is a crucial step for the state to recognize the federal extension, but it's frequently forgotten.

Beyond these specific mistakes, it's essential for all taxpayers to pay close attention to all instructions outlined in the form. Ensuring that every field is completed accurately can help avoid delays or denials of extension requests. And remember, an extension to file is not an extension to pay any taxes due.

Documents used along the form

When individuals or entities in Georgia seek an extension of time for filing their state income tax returns using the Georgia IT-303 form, they may need to gather several other forms and documents to ensure compliance and completeness of their tax responsibilities. The process can be complex, but understanding the required documentation can simplify it.

- Form 500: Individual Income Tax Return - This is the standard form used by individuals to file their annual State of Georgia income tax returns. It's required when detailing income, deductions, and credits for the tax year.

- Form IT-560: Individual/Fiduciary Income Tax Payment Voucher - Used by individuals and fiduciaries to remit payment of estimated taxes or taxes due with extensions. It's vital for submitting any payments due by the original filing deadline.

- Form IT-560C: Corporate Income Tax Payment Voucher - Corporations use this to make tax payments for estimated taxes or with extension requests, ensuring compliance with tax payment deadlines.

- Form 700: Partnership Tax Return - Required for partnerships to report their income, gains, losses, deductions, and credits to the State of Georgia.

- Form 501: Fiduciary Income Tax Return - This form is used by estates and trusts for reporting income and other financial activities to the Georgia Department of Revenue.

- Form CRF-002: State Business Tax Registration Application - Any business operating in Georgia must complete this form to register for tax purposes, including income and sales tax collection.

- Federal Extension Form 4868 or 7004: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return or Business Tax Returns - A copy of the approved federal extension must be attached to the Georgia return if seeking to use the federal extension for state filing purposes.

- Form 600: Corporation Tax Return - Georgia corporations must file this form to report their income, taxes due, and other pertinent financial information for the tax year.

Gathering these documents and forms in a timely manner is crucial for individuals and businesses looking to file an extension for their Georgia state income tax returns. Proper understanding and coordination of these forms ensure compliance with state tax laws, helping to avoid penalties and interest due to oversight or errors. While the IT-303 form is the primary document for extending the filing deadline, each of the accompanying documents serves a distinct yet complementary role in the overall tax filing process in Georgia.

Similar forms

The Georgia IT-303 form, designed for requesting an extension of time for filing state income tax returns, shares similarities with several other documents within the tax filing process. Each of these documents serves a unique purpose but aligns in their objective to aid in tax administration, compliance, or extension processes.

- Federal Tax Extension Form (IRS Form 4868): This form is used to request an automatic extension of time to file a U.S. individual income tax return. Similar to the Georgia IT-303, it provides additional time to file but does not extend the time for tax payment. The requirement to attach a copy of the federal extension if one is used further ties these two forms together.

- Form IT-560 (Individual/Fiduciary and Corporate Income Tax Extension Payment): While the IT-303 form applies for an extension of time to file, Form IT-560 is used to remit payment of estimated tax due by the original deadline, emphasizing that extension of filing does not apply to payment due dates. Both forms are integral to managing tax liabilities and ensuring compliance with state tax laws.

- Corporate Net Worth Tax Return and Extension Form: Similar to individual tax filing extensions, corporations can also request an extension for filing net worth tax returns. This parallels the option on the IT-303 for corporations to request extensions for income and net worth tax filings, highlighting the adaptability of extension requests across different tax types.

- Partnership Tax Return Extension Form (Form 700): This form is used by partnerships to request an extension of time to file their Georgia partnership tax return. The process mirrors that of the IT-303 form in its purpose to provide additional time for accurately completing and filing tax returns, underscoring the universal need for flexibility in tax filing deadlines across various taxpayer categories.

Dos and Don'ts

When filling out the Georgia IT-303 form, an application for an extension of time for filing state income tax returns, it is essential to navigate the process accurately. Here are five things you should do and five things you should avoid to ensure the process is smooth and error-free.

Do:

- Read the instructions carefully. Understanding each requirement can prevent mistakes and the need for corrections later.

- Complete the form in triplicate. Send the original to the Georgia Department of Revenue, attach one copy to your tax return upon filing, and keep the last copy for your records.

- If filing separate returns (e.g., for spouses), remember to submit separate applications for each.

- If applicable, attach a copy of the approved federal extension to your Georgia return. This can serve as your Georgia extension if it meets the criteria outlined.

- Ensure your extension request includes all necessary details such as the type of return, the period ending, and the extended due date requested, following the guidelines for specific entities like fiduciaries or corporations.

Don't:

- Wait until the last minute. Mail the original form before the return due date to avoid any possible mailing delays or other unforeseen issues.

- Forget to keep a copy for your records. Having your own copy can be crucial for future reference or in case of disputes.

- Request an extension by telephone or through lists. The application must be made using the IT-303 form or, if applicable, by attaching the approved federal extension.

- Assume an extension to file is an extension to pay. Tax payments are still due by the original prescribed due date to prevent late payment penalties and interest.

- Ignore the need to file a separate application for extension if filing consolidated returns for corporations or if different tax forms are required for different entities.

Misconceptions

Understanding the Georgia IT 303 form and its requirements can be challenging. Many taxpayers hold misconceptions about this document, necessary for applying for an extension of time for filing state income tax returns. Below are eight common misunderstandings, clarified to provide guidance and reassurance:

- Misconception 1: An extension of time to file also extends the time to pay taxes.

- Misconception 2: The extension provides an additional six months to file.

- Misconception 3: Separate extensions are not necessary for spouses filing separately.

- Misconception 4: Filing an extension request by phone is an option.

- Misconception 5: Only one copy of the form needs to be completed.

- Misconception 6: Approval of the extension request is communicated.

- Misconception 7: Interest and penalties are waived with an approved extension.

- Misconception 8: A federal extension automatically applies to Georgia state taxes.

This is a common misunderstanding. The extension only applies to the filing of the tax return, not the payment of taxes owed. Taxes are due by the original filing deadline, and failing to pay on time may result in interest and penalties.

The length of the extension can vary. While many taxpayers believe an extension always gives them an additional six months, this is not always the case. For example, corporate income tax and net worth tax returns may be subject to different extension lengths, and fiduciaries are only granted an extension up to 5 and one-half months.

This is incorrect. When spouses decide to file separate returns, they must file separate extension applications. This ensures that both parties receive the appropriate extension for their individual returns.

As clearly stated in the form's instructions, extension requests cannot be accepted over the telephone. All applications must be submitted in writing using the IT 303 form or by attaching a copy of the approved federal extension to the state return when filed.

This belief is incorrect. The form must be completed in triplicate, with the original mailed to the Department of Revenue and one copy attached to the tax return when filed. Retaining the last copy for personal records is crucial for tracking and verification purposes.

The Department of Revenue will not notify the taxpayer unless the extension request is denied. This often leads to confusion, with some taxpayers waiting for confirmation that is not forthcoming unless there is an issue with the extension request.

This is not true. Interest on unpaid taxes begins to accrue from the original due date of the return, and late penalties may also apply if the tax owed is not paid by this date. An extension to file does not affect the accrual of interest and penalties for late payment.

While a federal extension is accepted for Georgia tax purposes, you must still attach a copy of the federal extension to your state return. Additionally, taxes owed must be paid by the original due date to avoid late payment penalties and interest. This step is necessary to officially recognize the federal extension for state tax filing purposes.

Addressing these misconceptions can streamline the tax filing process, helping to avoid unnecessary stress and potential financial penalties. It's important for taxpayers to carefully review the IT 303 form instructions and comply with all outlined requirements to ensure a smooth extension request process.

Key takeaways

When preparing to submit a Georgia IT 303 form for an extension of time for filing state income tax returns, it is crucial to understand the rules and requirements set forth by the Georgia Department of Revenue. Here are key takeaways that taxpayers need to keep in mind:

- Extensions for filing can be granted in situations such as sickness, absence, or other disabilities, or whenever there is a reasonable cause for delay.

- The form must be filled out in triplicate. The taxpayer should mail the original to the Georgia Department of Revenue and keep one copy attached to the tax return when filed and another copy for personal records.

- Individual filings that are separate between spouses require individual extension requests.

- Telephone requests or lists for extension applications are not accepted; the form must be used, or a copy of an approved federal extension must be attached if applicable.

- If an initial extension was granted but additional time is needed, within the six-month limit, a new form must be submitted along with the initial extension request.

- For fiduciary tax returns, the extension period granted will only be up to five and a half months for tax years beginning on or after January 1, 2016.

- Corporations must file a separate extension application for each subsidiary when filing consolidated returns and specifically for filing Net Worth Tax.

- Interest and penalties accrue on late filings and late payments with specific percentages outlined by Georgia law. The acceptance of a federal extension as a Georgia extension is contingent on the return being received within the IRS extended time frame and the attachment of the federal extension copy to the filed return.

It is also important to remember that submitting an extension request does not extend the due date for tax payment to avoid late payment penalties and interest. Taxpayers are encouraged to estimate and pay any owed taxes by the original due date using the appropriate payment form. Compliance with these instructions ensures a smoother process in managing state tax obligations and avoiding unnecessary penalties.

Popular PDF Forms

How to Register a Business Name in Ga - With the Georgia Name Reservation form, propose up to three names for your business, securing your top choice for $25.

Can You Be Adopted at 18 - Take a decisive step towards a legally solidified family future with the Georgia Adult Adoption Petition form.

Georgia Medicaid Application - Applicants must acknowledge understanding of the obligation to assign rights to medical support payments to the state.