Free Georgia Mv 6 Template in PDF

In the evolving landscape of Georgia's motor vehicle registration and management, the Georgia Department of Revenue – Motor Vehicle Division's Form MV-6, and its supplementary forms MV-6A and MV-6B, stand as pivotal documents for dealers, distributors, manufacturers, and transporters in the automotive industry. These forms encompass the application and management processes for obtaining dealer, distributor, and transporter tags, which are essential for the legal operation and facilitation of vehicle sales, distribution, and transportation within the state. Key elements include the need for businesses to provide comprehensive details such as the Permanent Twelve-Digit Customer ID Number, State of Georgia Tax ID Number, and specific categorization of the types of vehicles dealt with—ranging from motorcycles to trailers and manufactured homes. Moreover, these forms uphold stringent compliance with Georgia law §40-2-38, asserting the necessity for truthful and accurate submissions under penalty of significant fines or imprisonment for fraudulent declarations. The addition of Form MV-6A and MV-6B further elaborates on the need for accurate representation of agents acting on behalf of these entities and the application for additional tags based on the volume of vehicles sold or anticipated to be sold, thus ensuring a structured and accountable framework for vehicle sales and distribution operations in Georgia.

Form Sample

Form

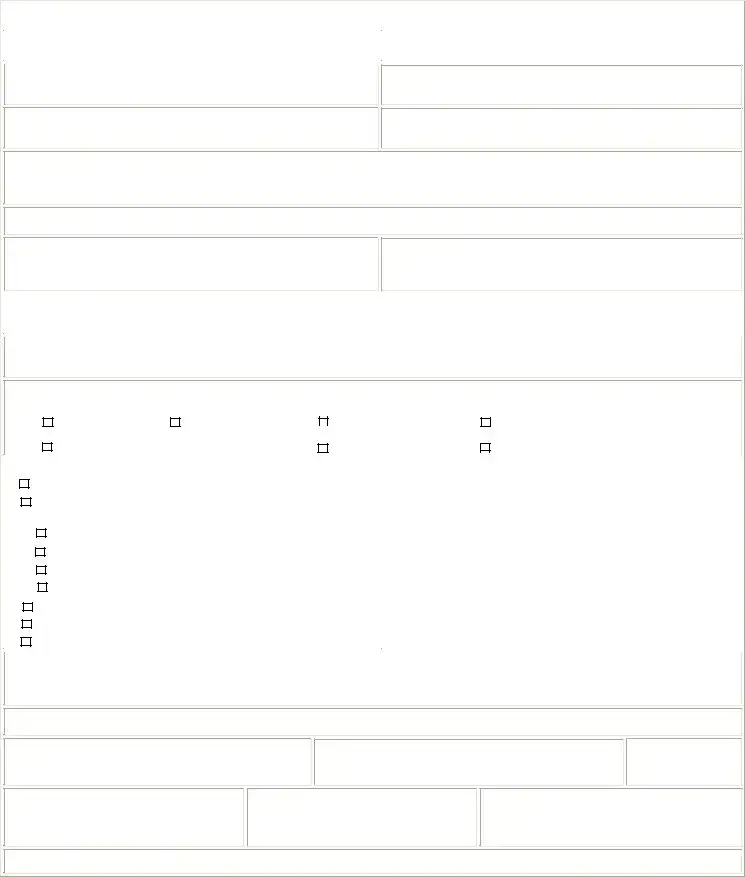

Georgia Department of Revenue – Motor Vehicle Division

Dealer, Distributor, Manufacturer & Transporter Tag Application

Please read the instructions that apply to requested tag category before completing and submitting documents and fees.

Permanent |

|

Current Master Tag Number |

|

|

|

|

|

|

Company’s Publicly Listed Phone Number (No cell phone numbers) |

|

State of Georgia Tax ID Number (Attach copy) |

|

|

|

|

|

|

State of Georgia Business or Occupational License Number (Attach copy)

Makes of Motor Vehicles, Tractors, Trailers or Motorcycles Sold, Manufactured, Leased or Transported

State of Georgia Used Motor Vehicle Dealer Number, Used Motor Vehicle Parts Dealer Number (Attach copy)

Manufactured Home Dealers Only State of Georgia Fire Marshal Number (Attach copy)

|

TRANSPORTERS ( WHEN APPLI CABLE) |

|

Federal Employer Identification Number (FEIN) |

U.S. D.O.T. Number |

I.F.T.A. Decal Number |

In accordance with Georgia Law

Full, Legal Name of Company, Business, Firm, Corporation, LLC

D/B/A Company, Business, Firm, Corporation, LLC Name Under Which You Do Business, if not the same as the full, legal name

Established Place of Business Street Address |

City |

Zip Code |

County |

|

|

Georgia |

|

|

|

|

|

Mailing Address (if different from street address) |

City |

Zip Code |

County |

Georgia

TAG CATEGORY

Check box to indicate the tag category you are requesting. Submit a separate MV- 6 application for each category or business location.

̊ Dealer |

̊ Distributor |

̊ Manufacturer |

̊ Motorcycle Dealer |

|

|

|||

̊ Motorcycle Distributor |

|

̊ Motorcycle Manufacturer |

̊ Transporter |

|

|

|||

|

|

|

|

|

|

|||

When applying for dealer tags, check applicable box(es) below: |

|

|

|

|

|

|||

□ Franchise Dealer (new motor vehicles) |

|

|

Master Tag* |

1@ |

$ |

62.00 |

||

|

|

|

|

|

|

|||

□ Independent Dealer (used motor vehicles) – An Independent Dealer |

|

Number of additional tags* ________@ $12.00 |

$ |

_______ |

||||

must also check the applicable box(es) below: |

|

|

|

|

|

|

||

□ |

Auction Company |

|

|

|

Franchise Fee/Franchise dealers only (new motor vehicles) |

$ |

25.00 |

|

□ |

Broker |

|

|

|

Mailing Fee* |

________# of tags |

$ |

_______ |

□ |

|

|

|

|

||||

Retail Dealer |

|

|

|

|

|

|

|

|

□ |

Wholesaler |

|

|

|

|

Total Due: |

$_______ |

|

|

|

|

|

|

|

|

||

□ Motorcycle Dealer |

|

|

|

* See instructions for requirements. Pay all fees with a check or money |

||||

□ Manufactured Home Dealer |

|

|

|

order payable to the Department of Revenue. Please do not remit cash |

||||

□ Trailer Dealer |

|

|

|

by mail. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

By placement of my signature hereon, I do solemnly swear, affirm or certify under criminal penalty of a felony for fraudulent use of a false or fictitious name or address or making a material false statement punishable by a fine of up to $5,000 or by imprisonment of up to five (5) years, or both, that statements contained on documents submitted by me are true and accurate. I also swear, affirm or certify that I am the authorized agent to sign for the company listed above, and shall comply with all state laws, rules and regulations pertaining to these tags.

The person authorized to complete this application must print their name, sign their name and enter their position or job title with the company and the date signed. Attach a copy of the authorized person’s valid Georgia driver’s license or Georgia ID card.

Printed Name of Person Authorized to Complete MV- 6, MV- 6A & MV- 6B Forms

Signature & Position or Job Title of Person Authorized to Complete MV- 6, MV- 6A & MV- 6B Forms

Date

Mailing Address

ATTN: Special Tags

DOR/Motor Vehicle Division

PO Box 740381

Atlanta, Georgia

Drop- off Box ( Business Hours) White Mailbox

Inside Lobby

1200 Tradeport Boulevard

Hapeville, Georgia 30354

Drop- off Box ( After Hours) Metal Box

To the right of the main entrance 1200 Tradeport Boulevard Hapeville, Georgia 30354

If you need additional information, please call (404)

Form

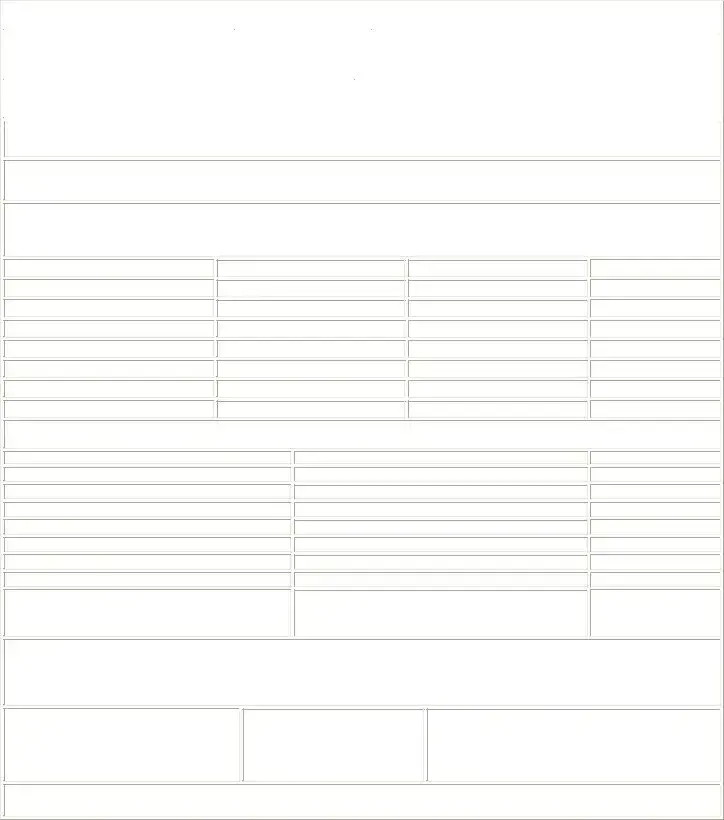

Georgia Department of Revenue – Motor Vehicle Division

Authorize/Add/Delete Agents

Dealer, Distributor, Manufacturer & Transporter Tags

Please read the instructions that apply to requested tag category before completing and submitting documents and fees.

Permanent |

|

Current Master Tag Number |

|

|

Company’s Publicly Listed Phone Number (No cell phone numbers) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Full, Legal Name of Company, Business, Firm, Corporation, LLC |

|

|

D/B/A Company, Business, Firm, Corporation, LLC Name under which you do |

|||||

|

|

|

|

|

business if not the same as the full, legal name |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Established Place of Business Street Address |

|

City |

|

|

Zip Code |

County |

||

|

|

|

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

||

Mailing Address (if different from street address) |

|

City |

|

|

Zip Code |

County |

||

Georgia

In accordance with Georgia law

AUTHORI ZE/ ADD Agents (Complete additional

Record authorized agents’ full, legal names as shown on their valid Georgia driver’s licenses or Georgia ID cards & their positions or job titles with the company, business, firm, corporation or LLC.

At tach a copy of each agent’s Georgia driver’s license or Georgia I D card. Each authorized agent must sign & date this form.

Authorized Agent’s Printed Name

Authorized Agent’s Signature

Authorized Agent’s Position or Job Title

Date

DELETE Agents (Complete additional

Record the name of agents/representatives no longer authorized to act as agents or representatives of the company, business, firm or LLC.

Agent’s Printed Name

Agent’s Position or Job Title

Date Deleted

Printed Name of Person Authorized to Complete MV- 6, MV- 6A & MV- 6B Forms

Signature & Position or Job Title of Person Authorized to Complete MV- 6, MV- 6A & MV- 6B Forms

Date Signed

By signing this form to authorize, add or delete agents of the company, business, firm or LLC recorded above, I swear, affirm or certify under criminal penalty of a felony for fraudulent use of a false or fictitious name or address or for making a material false statement punishable by a fine of up to $5,000 or by imprisonment of up to five (5) years, or both, that statements contained on documents submitted by me or authorized agents/representatives are true and accurate. I also swear, affirm or certify that I am the authorized agent of the business listed above and shall comply with all state laws, rules and regulations pertaining to these tags.

Mailing Address

ATTN: Special Tags

DOR/Motor Vehicle Division

PO Box 740381

Atlanta, Georgia

Drop- off Box ( Business Hours) White Mailbox

Inside Lobby

1200 Tradeport Boulevard

Hapeville, Georgia 30354

Drop- off Box ( After Hours) Metal Box

Right of the Main Entrance

1200 Tradeport Boulevard

Hapeville, Georgia 30354

If you need additional information, please call (404)

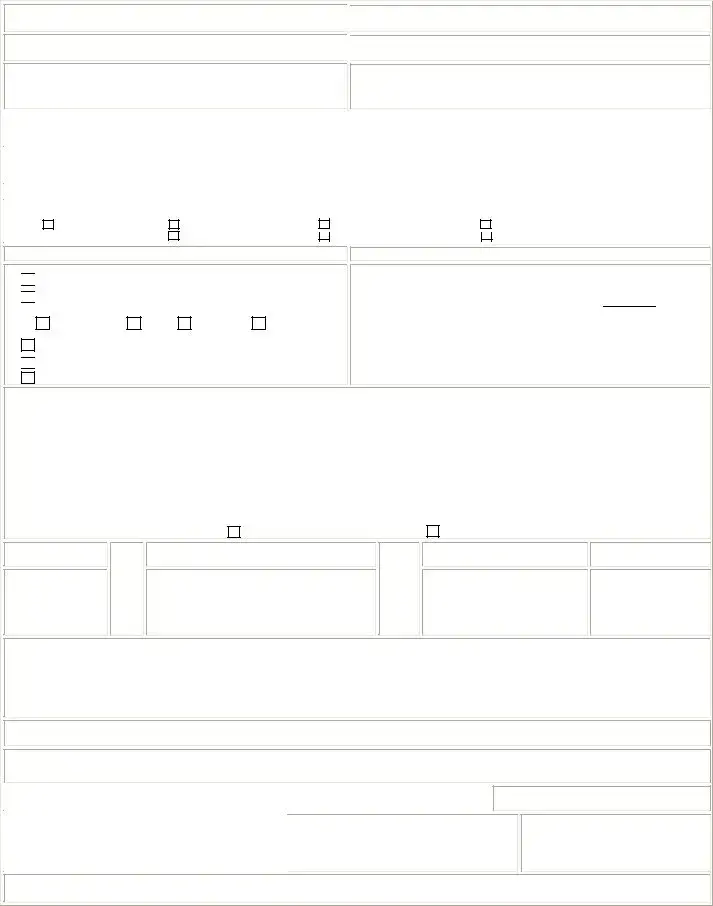

Form

Georgia Department of Revenue – Motor Vehicle Division

Dealer, Distributor, Manufacturer or Transporter Application for Additional Tags

Please read the instructions that apply to requested tag category before completing and submitting documents and fees.

Permanent

Company’s Publicly Listed Phone (No cell phone numbers)

Full, Legal Name of Company, Business, Firm, Corporation, LLC

Current Master Tag Number

Current Master Tag Number

State of Georgia Tax ID Number

State of Georgia Tax ID Number

D/B/A Company, Business, Firm, Corporation, LLC Name under which you do business if not the same as the full, legal name

Established Place of Business Street Address |

City |

|

Zip Code |

County |

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

Mailing Address (if different from street address) |

City |

|

Zip Code |

County |

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

|

|

|

Tag Category |

|

|

|

|

|

|||

|

Check box to indicate the tag category for which you are requesting additional tags. |

|

|||

̊ Dealer |

̊ Distributor |

|

̊ Manufacturer |

̊ Motorcycle Dealer |

|

|

̊ Motorcycle Distributor |

̊ Motorcycle Manufacturer |

̊ Transporter |

|

|

|

|

|

|

✔ |

|

When applying for dealer tags, check applicable box below:

□

Franchise Dealer (new motor vehicles)

Franchise Dealer (new motor vehicles)

□

Independent Dealer (used motor vehicles)

Independent Dealer (used motor vehicles)

An Independent Dealer must also check the applicable box(s) below:

|

✔ |

✔ |

✔ |

✔ |

□ |

□ Auction Company |

̊ Broker |

̊ Retail Dealer |

̊ Wholesaler |

Motorcycle Dealer |

|

|

|

□

Manufactured Home Dealer

Manufactured Home Dealer

□✔ Trailer Dealer

Fees

Number of additional tags* |

25 |

$ |

300.00 |

|

________@$12.00 |

|

|

Mailing Fee* |

_________25 # of tags |

$ |

15.00 |

|

TOTAL DUE |

$ |

315.00 |

*See instructions for requirements. Pay all fees with one check or money order payable to the Department of Revenue. Please do not remit cash through the mail!

Affidavit

I, ___________________________________________________________________, am applying for __________________________________

(Authorized Agent’s Printed Name & Position or Job Title) |

(Number of Additional Tags) |

additional tags. To be eligible to receive more than two (2) additional tags, I am completing the following affidavit certifying the number of vehicles the business named in this application sold (retail or wholesale), distributed, manufactured or transported during the previous calendar year based on its business records. If the business named in this application is a new business or has been in business less than a year, I am certifying the number of vehicles the business is projected to sell (retail or wholesale), distribute, manufacture or transport during the coming calendar year. I understand that the Department has the right to limit the number of additional tags issued when the numbers certified in this affidavit differs from the department’s records, business records or investigative findings. I also understand that the Department may request additional documents to validate the need for additional tags.

Check the applicable box: |

̊ Actual Number |

̊Projected Number

Retail Vehicle Sales

Number Sold Retail:

OR

Vehicles Distributed, Manufactured or Transported

No. Distributed, Manufactured or Transported:

OR

Broker/Wholesaler/Auction Sales

No. Brokered, Wholesaled or Sold at Auction:

=

No. of Additional Tags

Requested

I hereby swear, affirm or certify under criminal penalty of a felony for fraudulent use of a false or fictitious name or address or making a material false statement punishable by a fine of up to $5,000 or by imprisonment of up to five (5) years, or both, that statements contained on documents submitted by me are true and accurate and I understand the authorized uses of these tags as required by this state’s laws, rules and regulations. I understand that I must promptly file a police report when a tag is lost or stolen and submit a copy of such police report to the Motor Vehicle Division. I further swear, affirm or certify that in accordance with

Signature & Position/Job Title of Person Authorized to Complete

Sworn to and subscribed before me this _________ of ____________________, 2________.

(day) |

|

(Month) |

(Year) |

|

|

|

|

Notary Public’s Printed Name, Signature & Notary Seal or Stamp: |

|

|

|

|

|

|

|

|

|

Drop- off Box ( Business Hours) |

|

Mailing Address |

|

||

ATTN: Special Tags |

|

White Mailbox |

|

DOR/Motor Vehicle Division |

|

Inside Lobby |

|

PO Box 740381 |

|

1200 Tradeport Boulevard |

|

Atlanta, Georgia |

|

Hapeville, Georgia 30354 |

|

Date Notary Public’s Commission Expires:

Drop- off Box ( After Hours)

Metal Box

To the right of the main entrance 1200 Tradeport Boulevard Hapeville, Georgia 30354

If you need additional information, please call (404)

File Overview

| Fact | Description |

|---|---|

| Form Number and Revision | Form MV-6 (Rev 05-2006) |

| Administering Body | Georgia Department of Revenue – Motor Vehicle Division |

| Purpose | Application for Dealer, Distributor, Manufacturer, and Transporter Tags |

| Governing Law | Georgia Law §40-2-38 |

| Key Requirements | Permanent Twelve-Digit Customer ID Number, State of Georgia Tax ID Number, Business or Occupational License Number, among others |

| Tag Categories | Includes categories such as Dealer, Distributor, Manufacturer, and Transporter, with specific subcategories for motorcycle dealers, manufacturers, etc. |

| Fees and Payment | Fees vary by tag category and type; payment is made to the Department of Revenue, excluding cash through mail |

| Submission Requirements | Submission of completed form along with attached required documentation and fees; separate applications for each category or business location |

Guide to Using Georgia Mv 6

Filling out the Georgia MV-6 form is a critical step for dealers, distributors, manufacturers, and transporters in securing the necessary tags for their motor vehicles. This document requires attention to detail and accurate information about your business and the vehicles you deal with. Here’s a clear roadmap to help navigate through this form.

- Start by providing the Permanent Twelve-Digit (12) Customer ID Number at the top of the form, ensuring accuracy for identification purposes.

- Enter the Current Master Tag Number associated with your business, allowing the Department of Revenue to track your existing tags.

- Fill in the Company’s Publicly Listed Phone Number, making sure to use a landline number rather than a mobile phone number.

- Indicate your State of Georgia Tax ID Number and attach a copy of this document to validate your business’s legal standing.

- List your State of Georgia Business or Occupational License Number, attaching a copy of the license for verification.

- Specify the Makes of Motor Vehicles, Tractors, Trailers or Motorcycles your business deals with, giving a clear picture of your operations.

- If applicable, provide the State of Georgia Used Motor Vehicle Dealer Number or Used Motor Vehicle Parts Dealer Number, along with a copy for documentation.

- For manufactured home dealers, include the State of Georgia Fire Marshal Number with an attached copy.

- Transporters must input their Federal Employer Identification Number (FEIN), U.S. D.O.T. Number, and I.F.T.A. Decal Number if applicable.

- Enter the Full, Legal Name of Company, D/B/A (Doing Business As) if different, and the Established Place of Business Street Address, ensuring all information reflects your current business operations.

- Check the appropriate Tag Category box(es) for the tags you’re requesting, accurately reflecting the nature of your business.

- For dealer tags, select the applicable type(s) of dealer and fill out fee details including Number of Additional Tags, their cost, and any applicable Mailing Fee.

- The authorized agent must print their name, sign, date, and state their position or job title at the bottom of the form. Attach a copy of the authorized agent’s valid Georgia driver’s license or Georgia ID card as required.

- Review the form thoroughly to ensure all filled sections are correct and complete. Mistakes could delay the processing of your application.

- Send the completed form and any accompanying documents to the mailing address provided or use the drop-off box for physical submissions.

After submitting the MV-6 form, it will be reviewed by the Motor Vehicle Division. If all information is in order and fees paid, your business will be issued the requested tags. This enables your operations to continue smoothly, in compliance with Georgia laws. Always keep copies of your submission and note your tracking number (if mailed), allowing you to follow up if necessary.

Obtain Clarifications on Georgia Mv 6

Understanding state-specific forms can be quite the task, especially when you are trying to navigate the requirements for vehicle-related businesses in Georgia. To help clarify the process, here is a detailed FAQ section concerning the Georgia MV-6 form, a crucial document for dealers, distributors, manufacturers, and transporters in the automotive industry within the state.

- What is the purpose of the Georgia MV-6 form?

- Who needs to complete the Georgia MV-6 form?

- Vehicle dealers (both franchise and independent)

- Distributors of vehicles

- Manufacturers of vehicles

- Transporters of vehicles

- Motorcycle dealers, distributors, and manufacturers

- Trailer dealers

- Manufactured home dealers, but only in specific cases

- What documents must accompany the Georgia MV-6 form?

- A copy of the State of Georgia Tax ID Number

- The State of Georgia Business or Occupational License Number

- If applicable, the State of Georgia Used Motor Vehicle Dealer Number or Used Motor Vehicle Parts Dealer Number

- For manufactured home dealers, the State of Georgia Fire Marshal Number is required

- A valid Georgia driver’s license or Georgia ID card of the person authorized to complete and sign the form

- How can one submit the Georgia MV-6 form and what are the associated fees?

The Georgia MV-6 form serves as an application for obtaining dealer, distributor, manufacturer, and transporter tags within the state. It's designed for businesses involved in the manufacture, distribution, sale, lease, or transportation of motor vehicles, including motorcycles and trailers. This form is a formal request to the Georgia Department of Revenue – Motor Vehicle Division, declaring the applicant's intent to comply with state laws in the operation of their vehicle-related business.

This form must be filled out by businesses requiring distinguishing tags for their operations related to motor vehicles. This includes:

Alongside the completed MV-6 form, applicants are required to attach:

Submission of the MV-6 form, along with the necessary documents and fees, can be done via mail or drop-off at specified locations provided by the Georgia Department of Revenue. The cost varies depending on the type and number of tags being requested. For instance, dealer tags have a specific fee, with additional costs for each extra tag. Fees for other categories like distributors, manufacturers, and transporters can differ and must be paid with a check or money order payable to the Department of Revenue. Importantly, cash should not be sent through mail for these transactions.

Always refer to the most current version of the form and check the Georgia Department of Revenue’s official website for up-to-date information on fees, requirements, and submission processes. Each business’s situation might have unique considerations, so it might be beneficial to seek advice if there are any uncertainties.

Common mistakes

When completing the Georgia MV-6 form, attention to detail is key. However, individuals often make mistakes that can delay the application process. Here are six common errors to avoid:

Not reading the instructions carefully: Each tag category has specific instructions which are crucial for completing the form correctly.

Entering incorrect information for the company: The full, legal name of the company, as well as its doing business as (DBA) name if applicable, must match official documents.

Omitting the Permanent Twelve-Digit Customer ID Number or Current Master Tag Number: These are essential identifiers that facilitate the processing of your application.

Using a cell phone number as the company's publicly listed phone number: The form explicitly requires a landline phone number.

Forgetting to attach required documents: Copies of the State of Georgia Tax ID Number, Business or Occupational License Number, and, if applicable, the Used Motor Vehicle Dealer Number or Fire Marshal Number, are necessary for the application.

Incorrect fee calculation or payment method: Each tag and additional tag has a specified fee. The total due must be accurately calculated and paid with a check or money order, as cash is not accepted by mail.

Avoiding these mistakes not only speeds up the process but also ensures that your application is not returned for corrections. It's always a good practice to double-check your entries and ensure that all required documentation is attached before submission.

Documents used along the form

When completing the Georgia MV-6 form for Dealer, Distributor, Manufacturer & Transporter Tag Application, several other forms and documents are often used in conjunction to ensure compliance and accuracy in the application process. These documents play a vital role in validating the information provided and meeting the state requirements for motor vehicle operations involving dealerships, manufacturing, and transportation.

- Form MV-6A – This form serves as a method for businesses to authorize, add, or delete agents responsible for the vehicles that the company manufactures, distributes, exchanges, sells, transports, or leases. It requires the full, legal names of agents as shown on their valid Georgia driver's licenses or ID cards, along with their job titles.

- Form MV-6B – Tailored for dealers, distributors, manufacturers, or transporters looking to request additional tags beyond what was initially allocated. Applicants must provide details on the number of vehicles sold, distributed, manufactured, or transported in the previous calendar year or projected sales for new businesses.

- State of Georgia Business or Occupational License Number – A copy of this license must be attached to the MV-6 form. This document verifies that the business is legally authorized to operate within the state in its respective field, ensuring compliance with state regulations.

- Copy of Authorized Person’s Georgia Driver’s License or ID Card – To confirm the identity of the individual completing and signing the MV-6, MV-6A, & MV-6B forms. This ensures accountability and the integrity of the information provided on the application.

These documents complement the MV-6 form by providing comprehensive information required by the Georgia Department of Revenue – Motor Vehicle Division. Together, they help facilitate the application process for obtaining dealer, distributor, manufacturer, and transporter tags while ensuring that all legal and state-mandated criteria are met.

Similar forms

The Vehicle Registration Application in other states is similar to the Georgia MV-6 form as it gathers information about the vehicle, the owner, and the type of registration requested. These documents are essential for any motor vehicle transactions and require details about the vehicle's make, model, and identification number, paralleling the MV-6's requirement for information on the types of vehicles sold, manufactured, leased, or transported.

The Business License Application shares similarities with the MV-6 form in that it requires the business's legal name, type of business, and tax identification numbers. Both documents are crucial for legal operation within their respective frameworks: the MV-6 for motor vehicle dealerships and transports, and the business license for any commercial operation.

State Tax Registration Forms, akin to the MV-6 form, necessitate the business's state tax ID number, ensuring compliance with tax obligations. These forms serve as a bridge between a company's financial activities and state tax regulations, ensuring that businesses properly report and pay taxes.

The EIN Application (SS-4 form used by the IRS) is analogous to the MV-6 in its requirement for a Federal Employer Identification Number (FEIN) for transporters. This detail underscores the importance of tax identification at both state and federal levels for businesses operating within regulated industries.

Dealer Tag Application Forms in other jurisdictions resemble the Georgia MV-6 form, as they are designed specifically for businesses involved in the sale and distribution of motor vehicles. They compile information to track and validate the legal sale and transport of vehicles, ensuring dealers have the necessary permissions for dealership tags.

The Commercial Driver's License (CDL) Application intersects with the MV-6 when transporters are involved, requiring specific information about the driver's eligibility and the transport vehicle. Both forms are instrumental in regulating who is authorized to operate commercial vehicles, focusing on safety and compliance.

Used Motor Vehicle Dealer License Application corresponds closely with sections of the MV-6 form which ask for the State of Georgia Used Motor Vehicle Dealer Number. This licensing is pivotal for ensuring that dealerships selling used vehicles meet specific criteria set by the state to protect buyers.

Lastly, the Manufactured Home Dealer Application shares similarities with the MV-6 regarding the inclusion of a specialized dealer number, in this case, the State of Georgia Fire Marshal Number for manufactured home dealers. This specification ensures that dealers meet safety and regulatory standards pertinent to their industry.

Dos and Don'ts

When dealing with the Georgia MV-6 form, a meticulous approach is essential to ensure accuracy and compliance. Here is a list of dos and don'ts to consider:

Dos:

- Read all instructions carefully before you begin to fill out the form. This form comes with specific instructions for different tag categories that need to be understood thoroughly.

- Ensure you have the correct Permanent Twelve-Digit Customer ID Number and Current Master Tag Number handy before filling in your application.

- Make sure the company’s publicly listed phone number provided is accurate and is not a cell phone number, as per requirement.

- Attach copies of your State of Georgia Tax ID Number, Business or Occupational License Number, and other required documents, as specified in the form.

- Accurately list all motor vehicles, tractors, trailers, or motorcycles sold, manufactured, leased, or transported by your company.

- When providing your address, ensure that the established place of business street address and the mailing address (if different) are current and correct.

- Choose the correct tag category you are applying for and check the appropriate boxes that apply to your dealership type or business.

- Complete the affidavit section truthfully if applying for additional tags, including accurate sales, distribution, or transportation numbers as required.

- Make all fee payments with a check or money order payable to the Department of Revenue. Cash is not accepted through mail.

- Print and sign the form, ensuring the person authorized to complete the form also provides their position or job title and signs the form.

Don'ts:

- Do not leave any required fields blank. If a section does not apply, indicate with "N/A" (not applicable).

- Avoid using cell phone numbers as your business contact; only publicly listed phone numbers are acceptable.

- Do not forget to attach a copy of the authorized person’s valid Georgia driver’s license or Georgia ID card if required for verification.

- Do not mistake the tag category; submitting the wrong category can delay processing.

- Avoid guessing or estimating figures in the affidavit section when applying for additional tags. Use actual numbers from previous years or well-estimated projections for new businesses.

- Do not ignore the payment of fees. Incomplete payment can lead to application rejection.

- Make sure not to submit incorrect or outdated documents.

- Do not use a false or fictitious name or address; this is punishable by law.

- Avoid making any material false statements on the form; all information provided must be true and accurate.

- Do not fail to comply with state laws, rules, and regulations pertaining to these tags; compliance is crucial for the validity of your application.

Misconceptions

Understanding the Georgia MV-6 form can sometimes be confusing. Here are seven common misconceptions about this form and the truths behind them:

- All businesses can use Form MV-6 for any type of vehicle registration. The truth is, Form MV-6 is specifically designed for dealers, distributors, manufacturers, and transporters to apply for tags for motor vehicles they manufacture, distribute, exchange, sell, transport, or lease. It is not intended for individual vehicle owners.

- One MV-6 form can cover all tag categories needed by a business. Actually, businesses must submit a separate MV-6 application for each tag category or business location they are requesting tags for, ensuring each type of operation is correctly documented.

- Cell phone numbers are acceptable for the company’s publicly listed phone number. The form explicitly requires a company's publicly listed phone number and indicates that cell phone numbers are not acceptable, likely to ensure a stable and permanent contact number is provided.

- The State of Georgia Tax ID Number is optional if you have a Federal EIN. The form requires a State of Georgia Tax ID Number in addition to the FEIN for TRANSPORTERS, highlighting the need for businesses to be registered and recognized by both the federal and state tax systems.

- Any type of dealer can use the same sections of the form without distinction. There are specific boxes to check that differentiate between Franchise Dealers (dealing new motor vehicles) and Independent Dealers (dealing used motor vehicles), among other specific dealer types. This differentiation ensures that fees and regulations are correctly applied based on the type of dealership.

- Submission of copies of licenses and IDs is optional. The form requires attachments of copies of specific documents such as the State of Georgia Business or Occupational License Number and the State of Georgia Used Motor Vehicle Dealer Number. These documents are crucial for verifying the legal status and legitimacy of the applicant business.

- Payment can be made in any form, including cash. Payments for the fees associated with the MV-6 form must be made with a check or money order payable to the Department of Revenue. The form clearly instructs not to remit cash, especially when submitting by mail, to avoid loss or theft.

Correct understanding and completion of the Georgia MV-6 form ensure that dealers, distributors, manufacturers, and transporters comply with state regulations and receive the necessary tags for their vehicles without unnecessary delays or legal issues.

Key takeaways

When filling out the Georgia MV-6 form for Dealer, Distributor, Manufacturer, and Transporter Tag Applications, it is important to follow the provided instructions closely to ensure accurate and timely processing. Here are key takeaways to consider:

- Ensure that all required sections of the form are completed, including the permanent twelve-digit Customer ID Number, current Master Tag Number, and the full legal name of the company, to avoid any processing delays.

- Attach the necessary documents for verification, such as the State of Georgia Tax ID Number, Business or Occupational License Number, and, if applicable, the State of Georgia Used Motor Vehicle Dealer Number or Fire Marshal Number for manufactured home dealers.

- Clearly indicate the tag category you are requesting by checking the appropriate box. Submit a separate application for each category or business location to streamline the request process.

- For dealer tags, remember to specify the type (e.g., Franchise Dealer, Independent Dealer) and include the required fees with the application. The fees must be paid with a check or money order payable to the Department of Revenue; cash is not accepted through mail.

- If additional tags are needed, complete and submit the MV-6B form. This requires certifying the number of vehicles sold, distributed, manufactured, or transported in the previous calendar year or a projection for new businesses.

- Authorized agents must swear or affirm the accuracy of the information provided under the penalty of felony charges for fraudulent claims. This includes the truthfulness of names, addresses, and statements made in the document.

- Contact information for further assistance is provided, including phone numbers and addresses for mailing or dropping off applications. Additionally, the forms can be electronically completed and printed for signing and submission via the Georgia Department of Revenue website.

By paying careful attention to these details and requirements, businesses can navigate the process of obtaining the necessary tags for vehicles they manufacture, distribute, sell, transport, or lease in Georgia.

Popular PDF Forms

Georgia Separation Notice - Strategically crafted to meet the regulatory needs of the Georgia construction landscape, supporting effective project management.

Georgia Dispossessory Process - Includes a notary section to ensure the claim's authenticity and veracity, asserting the plaintiff's demand for judgment.