Free Georgia Mv 66 Template in PDF

In the dynamic landscape of Georgia's automotive industry, the MV-66 form emerges as a crucial document for dealers, ensuring compliance and facilitating smooth transactions devoid of state and local Title Ad Valorem Tax Fees. This meticulously designed affidavit enables Georgia dealers, who are registered and in good standing with no tax liabilities, to apply for relief under specified conditions. The form encompasses a spectrum of scenarios, including acquisition or foreclosure of security interests, support for title applications with surety bonds, mechanics liens, and instances requiring the acquisition of title for total loss claims, or to secure a marketable interest in vehicles sold or for sale without a marketable Certificate of Title. Each section demands strict adherence to the provided guidelines, such as attachments of corresponding legal documents—ranging from court orders to certified vehicle inspections and police or insurance reports. Furthermore, the MV-66 form mandates a solemn oath, underscoring the accuracy of the information provided with a stern reminder of the legal penalties for false statements, thereby exemplifying the seriousness with which the Georgian law treats the sale and transfer of vehicle ownership. Dealers navigating this process must ensure every detail is meticulously documented, aligning with the overarching legal framework and the specific requisites outlined in the form, to foster a transparent, efficient, and legally compliant transfer of vehicle titles.

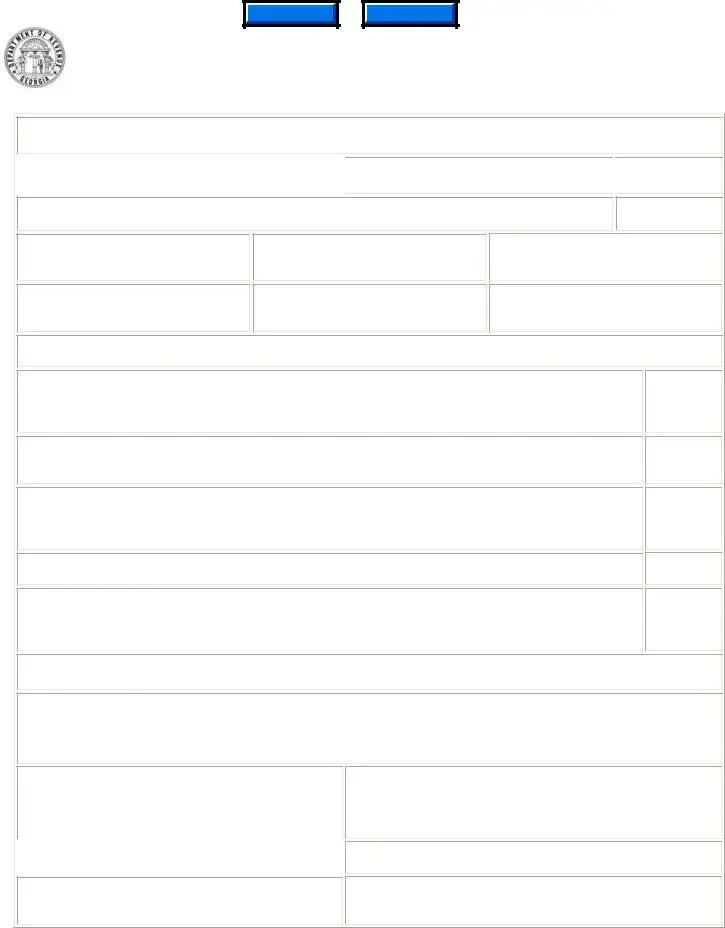

Form Sample

CLEAR

Georgia Dealer’s Affidavit for Relief of

State and Local Title Ad Valorem Tax Fees

Full Legal Name of Georgia Dealer

Street Address |

|

City |

|

|

|

Currently registered and in good standing with no tax liabilities?

Must answer yes and attach copy of Georgia Dealer, Distributor or Manufacturer Registration card.

Zip Code

Zip Code

□ Yes □ No

Vehicle Year & Make:

Vehicle Identification Number:

Model:

State of Title Records:

Title number:

MSO or MCO:

Check “Yes” for the appropriate statement which describes the relief for which you are applying and swear or affirm

such vehicle is or will be immediately placed in inventory and offered for sale.

O.C.G.A.

Attach copy of assignment of installment loan agreement, note guaranty, security, or affidavit of foreclosure of a security interest.

O.C.G.A.

Attach vehicle title history from state holding title records and affidavit of all efforts to acquire marketable Certificate of Title form

O.C.G.A.

Attach certified Copy of Court Order, certificate of vehicle inspection by law enforcement form

O.C.G.A.

□Yes

□Yes

□Yes

□Yes

O.C.G.A.

Attach an Affidavit of Correction of a Georgia Certificate of Title form

Oath and Affirmation

□ Yes

The undersigned hereby swears and affirms under oath that the information contained herein is true and correct.

Pursuant to O.C.G.A.

(b)A person convicted of the offense of false swearing shall be punished by a fine of not more than $1,000.00 or by imprisonment for not less than one nor more than five years, or both.

Sworn to and subscribed before me this __________ of

|

(Day) |

_____________________________, |

____________ |

(Month) |

(Year) |

|

|

Notary Public’s Printed Name: |

|

|

|

Notary Public’s Signature & Notary Seal or Stamp Date Notary Commission Expires:

Printed Name of Sole Proprietor/Partner or Executive Officer:

Signature

County Tag Agent Accepting Affidavit

This form must be legibly completed and attached to application for the Certificate of Title.

Any alteration or correction voids this form. County Tag Agent shall retain a copy for audit purposes.

File Overview

| Fact Number | Description |

|---|---|

| 1 | The Georgia MV-66 form is a Dealer's Affidavit for Relief of State and Local Title Ad Valorem Tax Fees. |

| 2 | This form is applicable in the State of Georgia. |

| 3 | It is used by dealers to apply for relief from certain title ad valorem tax fees. |

| 4 | Dealers must be currently registered and in good standing with no tax liabilities. |

| 5 | Required attachment includes a copy of Georgia Dealer, Distributor or Manufacturer Registration card. |

| 6 | The form outlines specific scenarios under which relief can be applied for, referencing Georgia Code O.C.G.A. 48-5C-1(d) (15) (A) to (G). |

| 7 | Supporting documents vary based on the type of relief being applied for, such as a copy of police reports or court orders. |

| 8 | False swearing on this form can result in a fine of not more than $1,000.00 or imprisonment for not less than one nor more than five years, or both, pursuant to O.C.G.A. 40-3-1, et. seq. & 16-10-7 (a). |

| 9 | The affidavit must be sworn to and subscribed before a notary public. |

| 10 | Alteration or correction of the form voids it, and a legibly completed form must be attached to the application for the Certificate of Title. |

Guide to Using Georgia Mv 66

Completing the Georgia MV-66 form is a critical step for dealers in Georgia seeking relief from certain state and local title ad valorem tax fees. This form must be filled out with precision and care to ensure all information is accurate and complies with the Georgia Code. It is designed for various situations, such as acquiring a vehicle through foreclosure, applying for a title with a surety bond, acquiring a vehicle through a mechanic's lien, or dealing with a total loss claim. Below are the detailed steps to properly fill out the Form MV-66.

- Start by entering the full legal name of the Georgia dealer at the top of the form, ensuring it matches with the name registered with the State of Georgia.

- Fill in the street address, city, and zip code of the dealership's primary location.

- Indicate whether the dealership is currently registered and in good standing, without any tax liabilities by checking the appropriate box. Attach a copy of the Georgia Dealer, Distributor, or Manufacturer Registration card.

- Provide the vehicle details, including the year and make, vehicle identification number (VIN), model, state of title records, title number, and if applicable, the MSO (Manufacturer's Statement of Origin) or MCO (Manufacturer's Certificate of Origin).

- Select the appropriate statement that describes the relief for which you are applying by checking the corresponding "Yes" box. This section may require attaching additional documentation such as a copy of the assignment of the installment loan agreement, vehicle title history, certified copy of court order, or copy of the police and insurance report, depending on the nature of the claim.

- Complete the Oath and Affirmation section by swearing and affirming under oath that the information provided on the form is true and correct. This includes acknowledging the consequences of false swearing as outlined by Georgia law.

- The form must be sworn to and subscribed before a Notary Public. Fill in the date, then have the Notary Public print their name, sign, and apply their seal or stamp. Also, ensure the Notary includes the expiration date of their commission.

- Enter the printed name of the Sole Proprietor/Partner or Executive Officer of the dealership and sign the form.

- Lastly, the form should be presented to the County Tag Agent for acceptance and attach it to the application for the Certificate of Title. Remember, any alteration or correction to the form once completed voids it.

After completing and submitting the MV-66 Form alongside the necessary additional documents, the submission will be reviewed by the local County Tag Office. Dealers should ensure they keep a copy of the form and all attachments for their records. Submission accuracy is crucial to avoid delays or rejections. The approval process time can vary, so it's advisable to check with the local County Tag Office for specific timelines. Successfully acquiring the relief sought will allow dealers to proceed with their transactions in compliance with Georgia laws, thus avoiding unnecessary legal or financial complications.

Obtain Clarifications on Georgia Mv 66

What is the Georgia MV-66 form used for?

The Georgia MV-66 form, known as the Dealer’s Affidavit for Relief of State and Local Title Ad Valorem Tax Fees, is used by Georgia dealers to apply for relief from state and local title ad valorem tax fees under certain conditions. It's applicable when a dealer acquires a vehicle through foreclosure, obtaining a surety bond for the title, acquiring a mechanics lien, acquiring a title to process a total loss claim, or selling a vehicle without a marketable Certificate of Title.

Who can use the Georgia MV-66 form?

This form is specifically designed for authorized Georgia dealers. These dealers must be currently registered, in good standing, and have no outstanding tax liabilities. A copy of the Georgia Dealer, Distributor, or Manufacturer Registration card must be attached to the form.

What documents are required along with the MV-66 form?

Depending on the type of relief being sought, different documents are required to be attached to the MV-66 form, such as:

- Assignment of installment loan agreement, note guaranty, security, or affidavit of foreclosure for security interest foreclosures.

- Vehicle title history and affidavit of efforts to acquire a marketable Certificate of Title, along with a release of any recorded security interests or liens for surety bond certificates.

- Certified copy of Court Order, certificate of vehicle inspection, newspaper advertisement tear sheet and statement of no higher bids for mechanics lien acquisitions.

- Copy of police report of stolen vehicle and insurance report for total loss claims.

- Affidavit of Correction of a Georgia Certificate of Title, Odometer Discrepancy Affidavit, or any supporting documentation if selling a vehicle without a marketable Certificate of Title.

Are there any conditions under which a dealer can seek tax relief according to the MV-66 form?

Yes, there are specific conditions outlined in the form under which a dealer can seek tax relief. These include:

- Acquiring or foreclosing a security interest or lien according to the Uniform Commercial Code.

- Applying for a Certificate of Title supported with a surety bond.

- Acquiring a mechanic's lien.

- Acquiring title to process a total loss claim.

- Holding a marketable interest in a motor vehicle that will be offered for sale or has been sold without a marketable Certificate of Title.

What are the penalties for providing false information on the MV-66 form?

Providing false information on the MV-66 form is considered an offense of false swearing, which can result in a fine of up to $1,000.00, imprisonment for not less than one nor more than five years, or both. This penalty underscores the importance of ensuring all provided information and attached documents are accurate and truthful.

How does a dealer affirm the information provided in the MV-66 form?

The dealer affirms the information by swearing and affirming under oath that all contained details are true and correct. This affirmation is made in front of a Notary Public, who then signs, dates, and seals or stamps the form. A false affirmation can lead to legal penalties, including fines and imprisonment.

What happens after the MV-66 form is completed?

Upon completing the MV-66 form and attaching all necessary documentation, the form must be submitted alongside the application for the Certificate of Title. The County Tag Agent then retains a copy for audit purposes, and the relief process moves forward according to Georgia law and regulations.

Can alterations be made to the MV-66 form after it's been completed?

No, any alterations or corrections void the MV-66 form. Accuracy while filling out the form is crucial, as any mistakes may require starting the process anew with a fresh form.

Is there a fee associated with submitting the MV-66 form?

The MV-66 form itself does not mention a specific fee for its submission or processing. However, dealers are encouraged to check with the relevant Georgia state departments or County Tag Agent for any fees that may be associated with the title or tax relief application process.

Where can dealers find more information about completing the MV-66 form?

For more detailed information and guidance, dealers should refer to the Georgia Department of Revenue website or contact their local County Tag Office. These resources can provide current information and answer specific questions related to the MV-66 form and its associated processes.

Common mistakes

Failing to print information clearly: If the details are not legible, it can lead to misunderstandings or processing delays. The form specifies that information should be clearly printed to ensure there are no errors in interpretation.

Not attaching necessary documentation: Documents such as the Georgia Dealer, Distributor, or Manufacturer Registration card, assignment of installment loan agreement, surety bonds, or certified court orders are crucial. The form requires these documents based on the type of relief being sought.

Checking the wrong box for state and local title ad valorem tax relief: This mistake can significantly delay the process, as it directly affects the type of relief the dealer is applying for. Misunderstanding this section can lead to incorrect processing of the application.

Omitting vehicle details: Including the correct vehicle year, make, VIN (Vehicle Identification Number), model, and state of title records is essential for proper processing. Incomplete or inaccurate vehicle information can hinder the application's progress.

Incorrect or incomplete title information: The form requires specific title information, including the title number and MSO (Manufacturer’s Statement of Origin) or MCO (Manufacturer's Certificate of Origin). Providing inaccurate or incomplete title information can cause delays.

Forgetting to swear or affirm the statement: The applicant must swear or affirm that the information provided is true and correct. Failure to do so may lead to the application being considered invalid.

Not using the form for the intended purpose: The MV-66 form is designed for dealers seeking relief from state and local title ad valorem tax fees. Using it for other purposes or failing to understand its specific intention can lead to its misuse.

Alterations or corrections: Any alterations or corrections to the form void it, so errors must be avoided. It’s important to review all entered information for accuracy before submission to prevent the need for changes that can invalidate the form.

When filling out the Georgia MV-66 form, attention to detail and a comprehensive understanding of the requirements are vital. Ensuring that all documentation is correctly attached and that the form is filled out meticulously can expedite the processing time and improve the likelihood of a favorable outcome.

Documents used along the form

When dealing with vehicle transactions in Georgia, particularly when filling out the MV-66 form for Dealers' Affidavit for Relief of State and Local Title Ad Valorem Tax Fees, it's essential to have the correct paperwork in order. This form is critical for dealers looking to acquire title under special circumstances such as foreclosures, mechanics liens, or to settle total loss claims. Alongside the MV-66, several other documents often play a vital role in ensuring the transaction aligns with Georgia law and regulation requirements.

- Georgia Dealer, Distributor, or Manufacturer Registration Card - Verifies the dealer is registered and in good standing, a prerequisite for the MV-66 form.

- Assignment of Installment Loan Agreement - Required when the dealer acquires or forecloses on a security interest or lien, demonstrating the transfer of interest.

- Vehicle Title History Report - Provides a comprehensive history of the vehicle's title, essential for those applying with a surety bond to support their Certificate of Title application.

- Affidavit of Foreclosure of a Security Interest - Necessary when the dealer is applying due to foreclosing on a security interest, detailing the foreclosure process.

- Certified Copy of Court Order for Mechanics Lien - When a dealer acquires a vehicle through a mechanics lien, this document proves the legal basis for the lien.

- Certificate of Vehicle Inspection (Form T-22B) - Required for vehicles acquired through a mechanics lien, verifying the vehicle's condition and legality.

- Original Tear Sheet of Newspaper Advertisement - Demonstrates the public auction of a vehicle due to a mechanics lien, required to show an attempt was made to sell the vehicle to satisfy the lien.

- Police Report of Stolen Vehicle - Required when a dealer must acquire title to obtain a total loss claim payment, proving the vehicle was stolen.

- Insurance Report - Accompanies the police report for total loss claims, detailing the insurance company's assessment and claim status.

- Affidavit of Correction (Form MV-18) and Odometer Discrepancy Affidavit (Form T-107) - Used to correct information on the title or to document odometer discrepancies, ensuring the title's accuracy.

Each of these documents serves a specific function in the titling process and helps ensure that dealers can navigate the complexities of vehicle transactions within Georgia's regulatory framework. Dealers must accurately and completely fill out the required paperwork, including the MV-66 form and any additional documents, to comply with state regulations and avoid legal issues. Understanding and gathering these documents is a critical step in the vehicle transaction process, ensuring a smoother, legally compliant path to transferring vehicle ownership.

Similar forms

MV-46A Certificate of Title Application: Like the Georgia MV-66 form, the MV-46A form is used when a dealer needs to obtain a marketable certificate of title. Both require providing detailed information about the vehicle, including its identification number and model. Additionally, they necessitate documentation proving attempts have been made to clear any liens or security interests against the vehicle.

T-22B Certificate of Inspection by Law Enforcement: This document, required when a dealer is acquiring a vehicle through a mechanics lien, has similarities with the MV-66 in its procedural nature. Both include steps that dealers must follow to legally obtain or sell a vehicle and necessitate validation from official entities – the T-22B from law enforcement and the MV-66 from a Notary Public.

MV-18 Affidavit of Correction: The MV-18 form and the MV-66 share the purpose of addressing issues related to vehicle titles. Both involve affidavits where dealers must swear to the accuracy of the information provided. Each form serves as a remedy to specific title-related problems and requires an oath or affirmation to be legally binding.

T-107 Odometer Discrepancy Affidavit: Similar to the MV-66 form, the T-107 form deals with discrepancies that need to be legally acknowledged and corrected. Both documents are crucial for ensuring the accurate representation of vehicles sold by dealers, emphasizing the importance of truthful disclosure about a vehicle’s condition and history.

MSO (Manufacturer’s Statement of Origin) or MCO (Manufacturer’s Certificate of Origin): These documents are foundational for a new vehicle’s initial registration and titling process, akin to the MV-66 form’s role in facilitating the dealers’ ability to claim relief or handle special title circumstances. All involve formal recognition of a vehicle’s status and rightful ownership or interest.

Assignment of Installment Loan Agreement: Similar to parts of the MV-66, which requires an attachment for acquiring or foreclosing a security interest or lien, this document is integral in transferring rights under a loan agreement. Both entail legal transfers of interest and the provision of supporting documentation to substantiate the change or claim.

Dos and Don'ts

When filling out the Georgia MV-66 form, a Dealer’s Affidavit for Relief of State and Local Title Ad Valorem Tax Fees, it is crucial to adhere to specific dos and don'ts to ensure accurate and successful submission. Below are guidelines to help navigate through the process:

Do:- Print clearly: Ensure all information is legible. This form requires clarity to avoid misinterpretation or delays.

- Include full legal name: The dealership's full legal name must be accurately provided to avoid any discrepancies with official records.

- Attach necessary documents: Depending on the relief being applied for, certain attachments are required (e.g., registration card, assignment of loan agreement, etc.). Ensure all relevant documents are attached before submission.

- Check the appropriate box for relief: Clearly indicate the specific relief you are applying for by checking the corresponding box. This helps in processing your application accurately.

- Provide vehicle information accurately: Vehicle year, make, model, and identification number must be filled out precisely as these details are critical for title verification.

- Sign and swear to the oath and affirmation: Signing acknowledges the information provided is true and correct, which is legally binding.

- Ensure the notary public section is completed: The form must be sworn to and subscribed before a notary public, including the notary's printed name, signature, seal or stamp, and expiration date.

- Leave sections blank: Incomplete forms may result in rejection or the need for resubmission, so ensure every relevant section is filled.

- Submit without verifying information: Double-check all entries for accuracy to avoid issues related to incorrect information.

- Forget to attach necessary documents: Failing to attach required documents can lead to processing delays or denial of the application.

- Alter or make corrections unwisely: Any alteration or correction must be made carefully, as it can void the form. If mistakes are made, it may be best to start with a new form.

- Use unofficial documentation: Ensure all attached documents are official and relevant to the criteria mentioned in the MV-66 instructions.

- Ignore state-specific requirements: The Georgia MV-66 form may have unique requirements compared to similar forms in other states. Pay attention to Georgia-specific instructions and requirements.

- Fail to update necessary documentation: If dealership information changes, such as address or dealer registration status, update these before submitting the MV-66 form to avoid incongruences.

Misconceptions

Understanding the Georgia MV-66 form, also known as the Georgia Dealer’s Affidavit for Relief of State and Local Title Ad Valorem Tax Fees, can be challenging due to various misconceptions. Clarifying these misunderstandings can help ensure the form is used correctly.

Misconception 1: The MV-66 form is only used for sales tax purposes.

Contrary to this belief, the MV-66 form is not strictly for sales tax purposes but is primarily utilized to apply for relief from certain state and local title ad valorem tax fees under specific conditions. These conditions include acquiring a vehicle through foreclosure, with a mechanics lien, or in situations involving a total loss claim.

Misconception 2: Any Georgia dealer can fill out the MV-66 form regardless of their tax status.

The form requires the dealer to be currently registered and in good standing, with no outstanding tax liabilities. This criterion must be met, and a copy of the Georgia Dealer, Distributor, or Manufacturer Registration card must be attached.

Misconception 3: The MV-66 form is complicated and requires legal assistance to complete.

While legal advice can be beneficial, especially in complex situations, the form itself guides the dealer through the process. Each section specifies what documentation is needed, such as a copy of the police report for stolen vehicles or a certified copy of the court order for mechanics liens. Proper attention to detail and adherence to the instructions can facilitate completion without necessarily requiring legal intervention.

Misconception 4: Once filled, the MV-66 form guarantees tax relief.

Filling out and submitting the MV-66 form does not automatically guarantee tax relief. The application is subject to review, and all attached documentation and claims are verified. Relief is granted only if the application meets all criteria set forth by the Georgia Department of Revenue.

Misconception 5: The MV-66 form can be submitted without supporting documents.

This is incorrect. The form explicitly requires the attachment of supporting documents relevant to the relief being sought. Whether it’s a certificate of title application supported with a surety bond, an assignment of an installment loan agreement, or any affidavits specified in the instructions, these documents are crucial for the processing and approval of the application.

In conclusion, understanding the purpose, requirements, and correct use of the Georgia MV-66 form is crucial for dealers seeking tax relief. By dispelling these misconceptions, dealers can approach the application process with clarity and confidence.

Key takeaways

Understanding how to correctly complete and utilize the Georgia MV-66 form is crucial for Georgia dealers seeking relief from State and Local Title Ad Valorem Tax Fees. Here are some key takeaways to ensure the process is handled smoothly:

- The Georgia MV-66 form is specifically designed for Georgia dealers requiring relief from certain title ad valorem tax fees. It's an affirmation of the dealer's situation and intentions regarding the vehicle in question.

- Dealers must provide their full legal name, street address, city, and zip code, along with confirmation that they are currently registered and in good standing, without any tax liabilities. A copy of the Georgia Dealer, Distributor, or Manufacturer Registration card must be attached if "Yes" is answered.

- Important vehicle information such as the year, make, vehicle identification number (VIN), model, state of title records, and title number need to be clearly provided on the form.

- The dealer must check "Yes" to the statement that best describes the relief for which they are applying. This includes scenarios like acquiring or foreclosing on a security interest or lien, supporting a certificate of title application with a surety bond, acquiring a mechanic's lien, or dealing with a total loss claim payment, among others.

- For each type of relief sought, specific attachments are required. These can include assignment of installment loan agreement, vehicle title history, certified copy of a court order, or a copy of a police report, depending on the situation.

- The form contains an oath and affirmation section where the dealer swears under oath that the information provided is true and correct. False swearing is punishable by law, with penalties including fines and imprisonment.

- The form must be sworn to and subscribed before a notary public, who will affix their signature, seal, or stamp, and provide the date their commission expires.

- Once completed, the form should be legible and free from alterations or corrections, as these void the form. It must be attached to the application for the Certificate of Title and a copy retained by the County Tag Agent for audit purposes.

Accurately filling out and submitting the Georgia MV-66 form is pivotal for dealers looking to streamline their business operations and comply with state requirements. By paying close attention to the specifics of the form and including all necessary documentation, dealers can efficiently move forward with their transactions.

Popular PDF Forms

What Is a Rule Nisi in Georgia - It's a procedural document used by the Fulton County Superior Court to ensure both sides are heard in a family law dispute.

Ga Form 501 Instructions - Pass-through and business credits adjustments are facilitated through Schedule 4, ensuring precise tax benefit calculations.