Free Georgia S100 Template in PDF

In the state of Georgia, the registration and compliance requirements for paid solicitors conducting charitable solicitations are governed by the Georgia Charitable Solicitations Act of 1988. To navigate these regulations effectively, the Georgia S100 Form emerges as a crucial document for individuals and organizations in the field of charitable fundraising. This form, administered by the Professional Licensing Boards and Securities Division located at 237 Coliseum Drive in Macon, gauges compliance with the Act. It encompasses a range of information, including initial application fees, reinstatement protocols, and amendment procedures, with specific attention to the statutory nonrefundable fees. Key to the form is the detailed guidance it provides on maintaining current and accurate books and records, a vital component for ensuring transparency and integrity in charitable solicitation activities. Moreover, the form outlines the procedural steps for appointing the Secretary of State as an agent for service of process, which is integral for facilitating legal proceedings should violations of the Act occur. By highlighting important deadlines, such as the annual expiration of registration on December 31, and underscoring the legal implications of failing to adhere to the Act's provisions—including potential disciplinary and criminal actions—the Georgia S100 Form serves as a comprehensive resource for paid solicitors. Through its detailed requirements, including the submission of financial statements and surety bonds, as well as the declaration of compliance with various statutory requirements, the form ensures that charitable solicitation activities are conducted ethically and legally within the state.

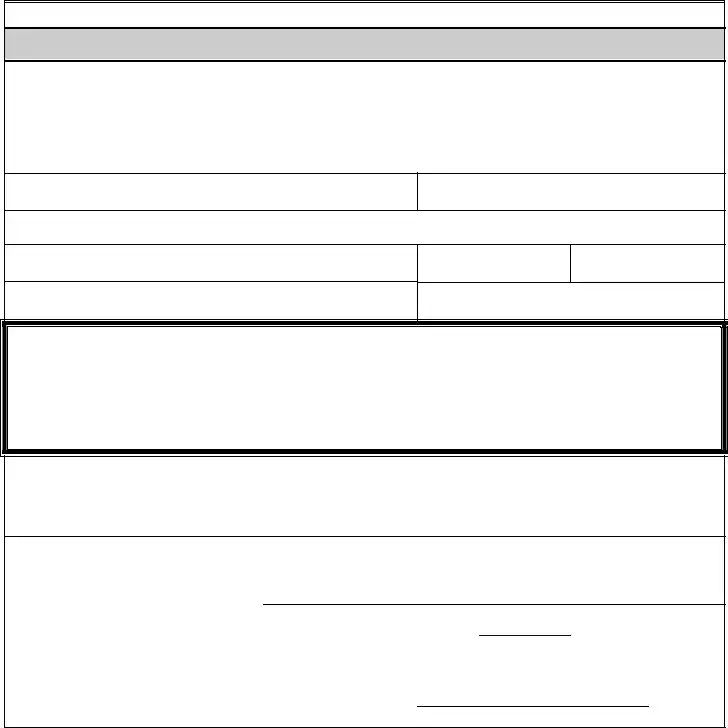

Form Sample

Professional Licensing Boards and Securities Division

237 Coliseum Drive

Macon, GA

(478)

http://www.sos.ga.gov

Brian P. Kemp

Secretary of State

Georgia Charitable Solicitations Act

Paid Solicitor Registration

Shawnzia Thomas Division Director

EXECUTION PAGE

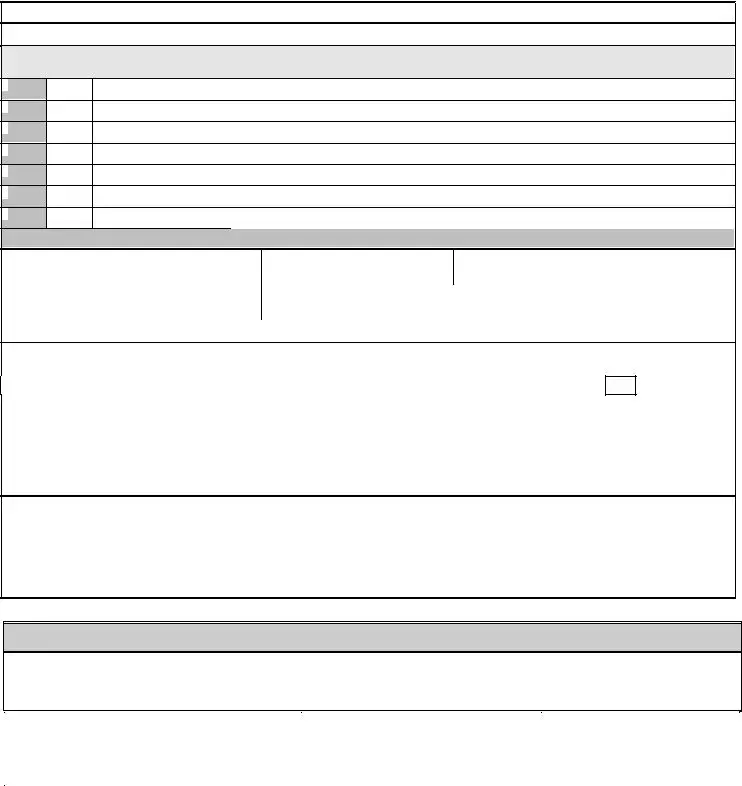

Statutory Fees

(Nonrefundable)

Make Check Payable to Georgia Secretary of State

INITIAL

APPLICATION

$250.00

REINSTATEMENT

Registration #: ___________________

$250.00

AMENDMENT

$15.00

WARNING: The registration of a paid solicitor expires on December 31 of each year. Failure to keep this form current and file accurate supplemental information on a timely basis, or failure to keep accurate books and records or otherwise comply with provisions of the Georgia Charitable Solicitations Act of 1988, will constitute a violation of said Act and may result in disciplinary, administrative, injunctive or criminal action. INTENTIONAL MISSTATEMENTS OR OMISSIONS OF FACT MAY CONSTITUTE CRIMINAL VIOLATIONS.

1. Official Name:

Address of Applicant (Paid Solicitor): |

Mailing Address (if different): |

2. Contact Person: |

Telephone: |

|

|

Email address for official correspondence: |

|

|

|

3. Location of Books and Records: |

|

EXECUTION: On behalf of the applicant identified above, for the purpose of complying with the Charitable Solicitations Act of 1988 (O. C. G. A. 43-

Georgia the agent for the applicant upon whom may be served any notice, process or pleading in any action or proceeding against the applicant arising out of, or founded upon, a violation or an alleged violation of said Act. The applicant hereby consents that any such action or proceeding against said applicant may be commenced in any court of competent jurisdiction and proper venue within the State of Georgia by service of process upon Secretary of State with the same effect as if the applicant was a resident of the State of Georgia and had been personally served with process. The undersigned hereby verifies that he had executed this form on behalf of, and with the authority of, said applicant. The undersigned and applicant represent that the information and statements contained herein, including the exhibits attached hereto, and other information filed herewith, are made a part hereof, are current, true and complete. The undersigned and applicant further represent that to the extent any information previously submitted is not amended, such information is currently accurate and complete.

Name of authorized Executive Officer (please type or print):

Signature of Executive Officer:

Date:

Title:

Official Witness (Notary)

THIS PAGE MUST ALWAYS BE COMPLETED IN FULL with original manual signature and notarization with seal. If filing an initial registration or reinstatement of registration, submit entire application. To amend, circle number(s) being amended. Registration does not become effective until all information on this application is received and approved. All paid solicitor registrations expire on December 31.

Form S100 Revised Dec 2013 |

Page 1 of 9 |

APPLICANT’S NAME:

To amend, circle numbers being amended and file with a completed execution page (S100 page 1)

4.Status of registration in other jurisdictions

Enter “1” for pending registrations, “2” if already registered, and leave blank if not registered.

AL

AL

DE

DE

KS

KS

MO

MO

NM

NM

RI

RI

WA

WA

|

AK |

|

|

|

AR |

|

|

|

AZ |

|

|

|

CA |

|

|

|

CO |

|

|

|

CT |

|

|

|

DC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FL |

|

|

|

GA |

|

|

|

HI |

|

|

|

IA |

|

|

|

ID |

|

|

|

IL |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

KY |

|

|

|

LA |

|

|

|

MA |

|

|

|

MD |

|

|

|

ME |

|

|

|

MI |

|

|

|

MN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

MS |

|

|

|

MT |

|

|

|

NC |

|

|

|

ND |

|

|

|

NE |

|

|

|

NH |

|

|

|

NJ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

NV |

|

|

|

NY |

|

|

|

OH |

|

|

|

OK |

|

|

|

OR |

|

|

|

PA |

|

|

|

PR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

SC |

|

|

|

SD |

|

|

|

TN |

|

|

|

TX |

|

|

|

UT |

|

|

|

VA |

|

|

|

VT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

WI |

|

|

|

WV |

|

|

|

WY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANIZATION

Date of Formation:

Place of Filing:

6. Applicant is a: |

Corporation |

|

Proprietorship |

|

|

Partnership |

Limited Liability Company |

|

Other: |

7.If FOREIGN Corporation, date qualified to transact business in Georgia:

8.Will applicant have physical possession or legal control over any contributions collected in or from the state of Georgia?

YES |

|

NO |

|

|

|

If yes, applicant must attach the following to this application:

(a)Fiscal

(b)Surety bond satisfactory to the Secretary of State in the sum of $10,000 payable to the State of Georgia OCGA

9.BRIEF DESCRIPTION OF BUSINESS. Provide a brief description of the general character of the business to be conducted or proposed to be conducted by the applicant:

CHAPTERS, BRANCHES, AND AFFILIATES

List the name and address of each affiliated branch or chapter

located in the State of Georgia and the directors of each such branch or chapter.

Attach additional sheets as needed.

|

Address |

Telephone |

Designated Supervisor |

|

|

|

|

|

Address |

Telephone |

Designated Supervisor |

|

|

|

|

|

Address |

Telephone |

Designated Supervisor |

|

|

|

|

|

Address |

Telephone |

Designated Supervisor |

|

|

|

|

Form S100 Revised Dec 2013 |

Page 2 of 9 |

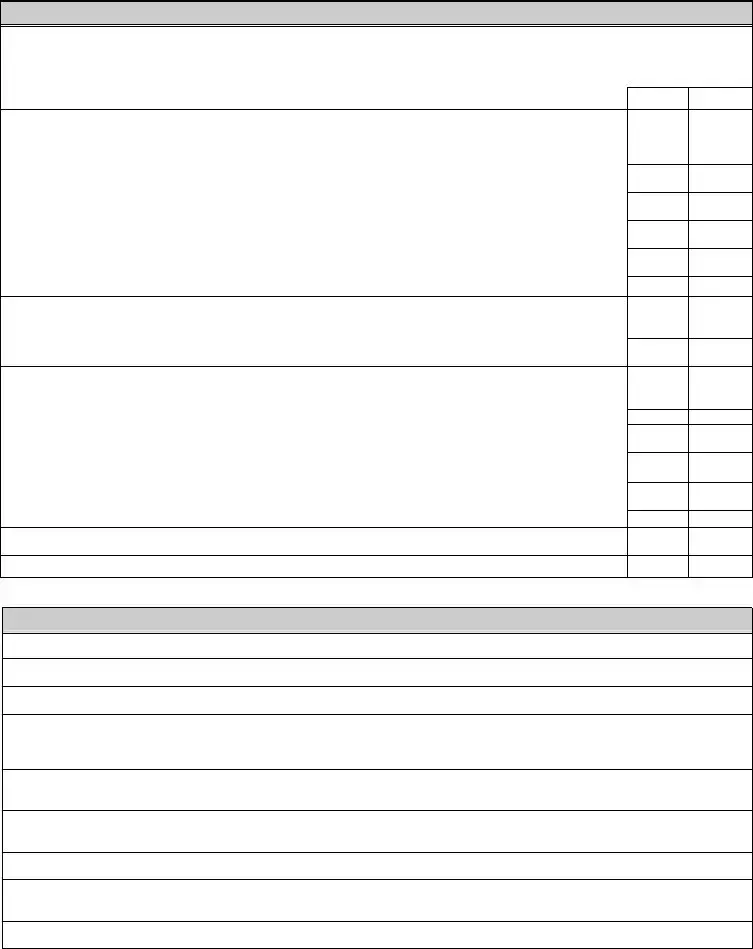

BACKGROUND INFORMATION

NOTE: (1) For the purpose of the following questions the term “executive officer” means the chief executive officer, the president, the principal financial officer, the principal operation officer, the treasurer or any other person performing similar functions.

(2)All YES answers to questions must be fully explained on page 4 of the application (attach additional sheets as needed) and you must complete Page 6 for a background investigation.

YES |

NO |

10.In the past ten years has the applicant, executive officer, or control person been convicted of or pled guilty or nolo contendere (no contest) to a felony or misdemeanor which:

(a) Involves the solicitation or acceptance of charitable contributions or the making of a false oath, the making of a false report, bribery, perjury, burglary, or conspiracy to commit any of the foregoing offenses?

(b) Arises out of the conduct of solicitation of contributions for a charitable organization?

(c)Involves the larceny, theft, robbery, extortion, forgery, counterfeiting, fraudulent concealment, embezzlement, fraudulent conversion, or misappropriation of funds?

(d)Involves murder or rape?

(e)Involves assault or battery if such person proposes to be engaged in counseling, advising, housing, or sheltering individuals? Or

(f)Pled guilty or nolo contendere (no contest) to any other felony offense?

11. Has any court:

(a)in the past ten years enjoined the applicant or a executive officer in connection with any aspect of the fundraising business?

(b)ever found that the applicant or executive officer was involved in a violation of any state or federal law regarding fundraising or any other deceptive practice?

12. Has any local, state or federal government agency:

(a)ever found the applicant or executive officer to have made a false statement or omission or been dishonest, unfair or unethical?

(b)ever found the applicant or executive officer to have been involved in a violation of a fundraising law?

(c)ever found the applicant or executive officer to have been a cause of any fundraising organization having its authorization to do business denied, suspended, revoked or restricted?

(d)in the past ten years entered an order against the applicant or a executive officer in connection with any fundraising statute or deceptive practices?

(e)ever denied, suspended, or revoked the applicant’s or a executive officer’s registration or license, prevented it from association with a fundraising organization, or otherwise disciplined it by restricting its activities?

(f)ever revoked or suspended the applicant’s or a executive officer’s license as an attorney or accountant?

13.Is the applicant or executive officer now the subject of any proceeding that could result in a yes answer to any question contained herein?

14.Does the applicant have any unsatisfied judgments or liens against it or has it filed for any type bankruptcy?

ACKNOWLEDGEMENTS

By submitting this application, the applicant acknowledges the following statutory requirements:

(a)SOLICITATION CONTRACT REQUIRED. [OCGA

(b)SOLICITATION NOTICE. [OCGA

(c)POINT OF SOLICITATION DISCLOSURE. [OCGA

(d)ACCOUNTING TO CHARITABLE ORGANIZATION. [OCGA

(e)COLLECTIONS AND DEPOSITS. [OCGA

(f)EXPIRATION. [OCGA

(g)COMMERCIAL COVENTURERS. [OCGA

(h)AMENDMENTS TO REGISTRATION. [OCGA

Form S100 Revised Dec 2013 |

Page 3 of 9 |

(i)RECORDS. [OCGA

(j)MISAPPROPRIATION OF FUNDS AND FRAUDULENT CONDUCT. [OCGA

EXPLANATION TO APPLICATION QUESTIONS

This section must be used to explain any YES answers on the previous pages.

It may also be used to explain the answers to any other questions on the application.

Attach additional sheets as needed.

Explanation:

Form S100 Revised Dec 2013 |

Page 4 of 9 |

APPLICANT’S NAME:

CONTROL PERSONS

The applicant must provide the following information for each person who directly or indirectly, has the power to direct or cause the direction of the management and policies of the applicant whether through the authority of voting securities, by contract or otherwise. The term control person includes, but is not limited to, each general partner, limited partner, director, affiliate or executive officer or person holding similar position.

Make additional copies of this form as needed.

(Please type or print)

Name:

Title:

Address:

City:

State:

Zip Code:

Date of Birth:

Social Security Number:

The person named above MUST provide a ten year employment history

beginning with the most recent employment.

Attach separate sheets if needed.

All persons who have custody of charitable donations must submit to a criminal background check.

By signing this form the person named above authorizes the Secretary of State to conduct a criminal history check pursuant to the paid solicitor’s registration in the State of Georgia.

Signature of Control Person

This |

|

Day of |

Official Witness (Notary) |

Signature |

Form S100 Revised Dec 2013 |

Page 5 of 9 |

Georgia Bureau of Investigation

Georgia Crime Information Center

Consent Form

I hereby authorize the Office of Secretary of State – Charities Division to receive any Georgia criminal history record information pertaining to me which may be in the files of any state or local criminal justice agency in Georgia.

_____________________________________________________________________________

Full Name (print)

_____________________________________________________________________________

Address

_____ |

_____ |

__________________ |

_________________________ |

Sex |

Race |

Date of Birth |

Social Security Number |

___________________________________________________

Signature

__________________

Date

Special employment provisions (check if applicable):

Employment with mentally disabled (Purpose code ‘M’)

Employment with mentally disabled (Purpose code ‘M’)

Employment with elder care (Purpose code ‘N’)

Employment with elder care (Purpose code ‘N’)

Employment with children (Purpose code ‘W’)

Employment with children (Purpose code ‘W’)

Employment with criminal justice agency – civilian (Purpose code ‘J’)

Employment with criminal justice agency – civilian (Purpose code ‘J’)

Employment with criminal justice agency – P.O.S.T. certified (Purpose code ‘Z’)

Employment with criminal justice agency – P.O.S.T. certified (Purpose code ‘Z’)

One of the following must be checked:

This authorization is valid for 90/180/_____ (circle one) days from date of signature.

I, _______________________________________________ give consent to the above named to

perform periodic criminal history background checks for the duration of my employment with this company.

Form S100 Revised Dec 2013 |

Page 6 of 9 |

AFFIDAVIT OF APPLICANT

I certify and declare that I am of good moral character and that all information contained in this application is true and correct, to the best of my knowledge. I understand that any willful omission or falsification of pertinent information required in the application is justification for the denial, suspension, or revocation of my registration by the Commission. I further swear and affirm that I have read and understand the current state laws and rules and regulations of the Georgia Paid Solicitor Regulatory Commission and I agree to abide by these laws and rules, as amended from time to time.

By signing this application, electronically or otherwise, I hereby swear and affirm one of the following to be true and accurate pursuant to O.C.G.A. §

1) _______ I am a United States citizen 18 years of age or older. Please submit a copy of your current Secure and

Verifiable Document(s) such as driver’s license, passport, or document as indicated on pages 7 & 8 of this application.

2) _______ I am not a United States citizen, but I am a legal permanent resident of the United States 18 years of

age or older, or I am a qualified alien or

I also understand that if I have made a false statement on the application, or if I am found to have been convicted of a felony and have not had all of my civil rights restored pursuant to the law, the Commission may suspend my registration without a prior hearing. I shall be entitled to a hearing after the suspension of my registration.

I understand that I must maintain the records required by the Commission, and I shall make the records available for inspection by the Georgia Paid Solicitor Regulatory Commission, or its authorized representative, at any time during normal business hours.

In making the above attestation, I understand that any failure to make full and accurate disclosures may result in disciplinary action by the Georgia Paid Solicitor Regulatory Commission and/or criminal prosecution.

_____________________________________________________

Signature of ApplicantDate

_____________________________________________________

Print Applicant’s Name

Personally appeared before me, the undersigned official authorized to administer oaths, comes

_______________________________who deposes and swears that he/she is the person who executed this

(Applicant’s Name)

application for a license by examination for Paid Solicitor in the State of Georgia; and that all of the statements

herein contained are true to the best of his/her knowledge and belief.

Sworn to and subscribed before me this ______ day of ___________________, 2________

Notary Public Signature ________________________________ |

________________________________ |

|

|

County |

State |

My Commission Expires ______________________

(seal)

Form S100 Revised Dec 2013 |

Page 7 of 9 |

APPLICANT: PLEASE CHECK THE FORM OF IDENTIFICATION BELOW THAT YOU POSSESS. RETURN THIS FORM ALONG WITH A COPY OF YOUR APPROPRIATE DOCUMENTATION.

________________________________________

Name

Secure and Verifiable Documents Under O.C.G.A. §

Issued August 1, 2011 by the Office of the Attorney General, Georgia

The Illegal Immigration Reform and Enforcement Act of 2011 (“IIREA”) provides that “[n]ot later than

August 1, 2011, the Attorney General shall provide and make public on the Department of Law’s website a

list of acceptable secure and verifiable documents. The list shall be reviewed and updated annually by the Attorney General.” O.C.G.A. §

basis, if necessary.

The following list of secure and verifiable documents, published under the authority of O.C.G.A. §

_____ A United States passport or passport card [O.C.G.A. §

_____A United States military identification card [O.C.G.A. §

_____A driver’s license issued by one of the United States, the District of Columbia, the

Commonwealth of Puerto Rico, Guam, the Commonwealth of the Northern Marianas Islands, the United States Virgin Island, American Samoa, or the Swain Islands, provided that it contains a photograph of the bearer or lists sufficient identifying information regarding the bearer, such as name, date of birth, gender, height, eye color, and address to enable the identification of the bearer [O.C.G.A. §

_____An identification card issued by one of the United States, the District of Columbia, the Commonwealth of Puerto

Rico, Guam, the Commonwealth of the Northern Marianas Islands, the United States Virgin Island, American Samoa, or the Swain Islands, provided that it contains a photograph of the bearer or lists sufficient identifying information regarding the bearer, such as name, date of birth, gender, height, eye color, and address to enable the identification of the bearer [O.C.G.A. §

_____A tribal identification card of a federally recognized Native American tribe, provided that it contains a

photograph of the bearer or lists sufficient identifying information regarding the bearer, such as name, date of birth, gender, height, eye color, and address to enable the identification of the bearer. A listing of federally recognized Native American tribes may be found at: http://www.bia.gov/WhoWeAre/BIA/OIS/TribalGovernmentServices/TribalDirectory/index.htm [O.C.G.A. §

_____A United States Permanent Resident Card or Alien Registration Receipt Card [O.C.G.A. §

CFR § 274a.2]

_____An Employment Authorization Document that contains a photograph of the bearer [O.C.G.A. §

CFR § 274a.2]

_____A passport issued by a foreign government [O.C.G.A. §

Form S100 Revised Dec 2013 |

Page 8 of 9 |

_____A Merchant Mariner Document or Merchant Mariner Credential issued by the United States Coast Guard

[O.C.G.A. §

_____A Free and Secure Trade (FAST) card [O.C.G.A. §

_____A NEXUS card [O.C.G.A. §

_____A Secure Electronic Network for Travelers Rapid Inspection (SENTRI) card [O.C.G.A.

§ 41.2] |

|

_____A driver’s license issued by a Canadian government authority [O.C.G.A. § |

274a.2] |

_____A Certificate of Citizenship issued by the United States Department of Citizenship and Immigration |

Services |

(USCIS) (Form |

|

_____A Certificate of Naturalization issued by the United States Department of Citizenship and Immigration

Services (USCIS) (Form

_____In addition to the documents listed herein, if, in administering a public benefit or program, an agency is required

by federal law to accept a document or other form of identification for proof of or documentation of identity, that document or other form of identification will be deemed a secure and verifiable document solely for that particular program or administration of that particular public benefit. [O.C.G.A. § secure and

Form S100 Revised Dec 2013 |

Page 9 of 9 |

File Overview

| Fact Number | Description |

|---|---|

| 1 | The Georgia S100 form is required for registration under the Georgia Charitable Solicitations Act. |

| 2 | Initial registration fee, reinstatement, and amendments cost $250, $250, and $15 respectively. |

| 3 | Registrations for paid solicitors expire on December 31 of each year. |

| 4 | Failure to comply with the Act can lead to disciplinary, administrative, injunctive, or criminal action. |

| 5 | Intentional misstatements or omissions of fact may constitute criminal violations. |

| 6 | Applicants must appoint the Secretary of State as their agent for service of any legal action arising from violations of the Act. |

| 7 | Financial statements and a $10,000 surety bond are required if applicants will have physical possession or legal control over contributions in Georgia. |

| 8 | The form mandates thorough background information for control persons, including a ten-year employment history and criminal background checks. |

| 9 | The form is governed by the Georgia Charitable Solicitations Act of 1988 (O.C.G.A. 43-17-1 et seq.). |

Guide to Using Georgia S100

Filling out the Georgia S100 form is an essential process for paid solicitors intending to comply with the Georgia Charitable Solicitations Act of 1988. This process requires attention to detail and accuracy to ensure full compliance and avoid potential violations or disciplinary actions. Below is a detailed guide to help you complete the form correctly.

- Start with the "Execution Page." Begin by entering the registration fee details at the top right corner of the form. Select the appropriate box for the type of application: Initial, Reinstatement, or Amendment.

- Provide the Official Name and Address of the paid solicitor in the respective fields. If the mailing address differs from the primary address, include that information as well.

- Enter the Contact Person's details, including their telephone number and email address, to ensure official correspondence can be conducted efficiently.

- Specify the Location of Books and Records where your financial documents and transaction records are kept.

- Under the EXECUTION section, have an authorized executive officer certify compliance with the act, appoint the Secretary of State as the agent for service of process, and verify the completeness and accuracy of the information provided.

- The Name of authorized Executive Officer should be printed, signed, and dated in the spaces provided. Ensure this section is also witnessed by a Notary, including the Notary’s original manual signature and seal.

- Proceed to page 2, where you'll provide specific details about the applicant's business, including the fiscal year end date, status of registration in other jurisdictions, and organization type (e.g., Corporation, Partnership, etc.).

- Answer questions about physical possession or legal control over contributions collected in Georgia. If "Yes," attach the required fiscal year-end financial statement and surety bond.

- Offer a Brief Description of Business activities, the general nature of the business conducted or proposed to be conducted.

- List Chapters, Branches, and Affiliates within Georgia, including the names and addresses of each, as well as the directors of these branches or chapters.

- Fill in the "Background Information" section by answering all questions regarding the applicant's and executive officers' past, ensuring full disclosure of any criminal or regulatory issues.

- If any question in the Background Information section was answered with "Yes," provide detailed explanations on Page 4 of the application, attaching additional sheets as necessary.

- Provide information about Control Persons on Page 5, including a 10-year employment history and consent to a criminal background check for each individual.

Once completed, review the entire form to ensure accuracy and completeness. Missing or inaccurate information may delay processing or result in disciplinary action. Submit the S100 form along with the appropriate fee and any required attachments to the provided address of the Georgia Secretary of State. This step is crucial for achieving compliance and legally conducting your solicitation activities within the state.

Obtain Clarifications on Georgia S100

-

What is the Georgia S100 form?

The Georgia S100 form is a registration application required for paid solicitors by the Professional Licensing Boards and Securities Division within the Georgia Secretary of State's office. It is designed for individuals or entities engaging in the solicitation of charitable contributions within the state of Georgia. This form helps ensure compliance with the Georgia Charitable Solicitations Act of 1988, aimed at regulating and monitoring fundraising activities to protect the public from fraudulent solicitation practices.

-

What are the fees associated with the Georgia S100 form?

- Initial Application: $250.00

- Reinstatement Registration: $250.00

- Amendment: $15.00

All fees are nonrefundable and payable to the Georgia Secretary of State.

-

When does the registration expire, and what are the consequences of not keeping it current?

All paid solicitor registrations expire on December 31 of each year. Failure to keep the registration current, file accurate supplemental information in a timely manner, or comply with the provisions of the Georgia Charitable Solicitations Act can result in disciplinary, administrative, injunctive, or criminal action. It is crucial to ensure that all information provided is accurate and complete to avoid potential violations.

-

What are the key requirements for a paid solicitor under the Georgia Charitable Solicitations Act?

- A written contract must be in place with each charitable organization for which solicitations are conducted.

- A solicitation notice and a copy of the solicitation contract must be filed with the Secretary of State before starting a solicitation campaign.

- Specific disclosure information must be provided at the point of solicitation.

- Accurate accounting to the charitable organization and the Secretary of State for all contributions and expenses is required within specified timeframes.

- All monetary contributions must be deposited in a designated account within three business days of receipt.

-

How does one amend the registration information on the Georgia S100 form?

To amend the registration, it's necessary to circle the number(s) being amended on the form and submit a completed execution page (S100 page 1) with the amended information. The registration must be kept current and up to date at all times, and amendments reflecting any material changes in the operation of the paid solicitor must be filed within 30 days. This ensures compliance with the Georgia Charitable Solicitations Act and helps maintain accurate and current records with the Secretary of State.

Common mistakes

-

Failing to provide current and complete contact information: Many applicants forget to update their contact details, especially if they have changed their address or email since the last filing. This oversight can result in missed communications from the Secretary of State, potentially affecting the validity of their registration.

-

Omitting criminal history or background information: The form requires disclosure of any past criminal convictions or ongoing proceedings that might affect the applicant's eligibility. Failure to provide this information truthfully can lead to severe penalties, including the rejection of the application.

-

Not attaching required financial statements and bond information: Applicants often overlook the necessity to attach a fiscal year-end financial statement and a $10,000 surety bond. These documents are crucial for the approval of the application, as they demonstrate financial stability and compliance with state regulations.

-

Incorrectly handling the solicitation of contributions section: Some applicants mistakenly believe they do not need to maintain control over contributions collected in Georgia or misinterpret the questions regarding possession or legal control of these funds. This misunderstanding can lead to non-compliance with the Georgia Charitable Solicitations Act.

-

Incomplete or incorrect amendment filings: When making amendments to their registration, applicants sometimes circle the wrong numbers for amendments or fail to provide a completed execution page. Accurate and complete amendments are crucial for keeping the registration current and reflective of the paid solicitor's operational status.

Common oversights and errors on the form S100 not only delay the processing of applications but also risk non-compliance with the Georgia Charitable Solicitations Act. It is imperative for applicants to review their submissions thoroughly, ensuring all information is accurate, complete, and up-to-date, to avoid potential legal complications.

Documents used along the form

Completing the Georgia S100 form is a critical step for paid solicitors planning to operate in the state, ensuring compliance with the Georgia Charitable Solicitations Act. However, the completion of the form often necessitates the submission of additional documents and forms to provide a comprehensive profile of the solicitor's activities and legal standing. Below is a list of documents that are commonly associated with the S100 form, each serving a specific purpose in the registration process.

- Fiscal Year-End Financial Statement: This document provides a snapshot of the financial health of the solicitor's organization by detailing its financial activities and status at the end of the fiscal year. It must be prepared in accordance with generally accepted accounting principles, offering transparency about the solicitor's financial management.

- Surety Bond: A surety bond in the sum of $10,000 payable to the State of Georgia is required to protect against potential financial loss resulting from the solicitor's actions. This document acts as a financial guarantee that the solicitor will comply with statutory obligations and regulations.

- Background Check Documentation: These are documents related to the completion of background checks for the applicant and any control persons. They must demonstrate that no party involved in solicitation has been involved in criminal activities that would disqualify them from acting as a paid solicitor.

- Solicitation Contract: This contract outlines the relationship between the paid solicitor and each charitable organization they represent, specifying the terms and conditions of their agreement. It ensures that both parties have clear expectations about the solicitation process, duties, and financial arrangements.

- Solicitation Notice: A solicitation notice, along with a copy of the solicitation contract, must be submitted before any campaign begins. This document outlines the specifics of the solicitation campaign, including dates, goals, and methods of solicitation, ensuring that activities are transparent and in compliance with legal requirements.

In addition to ensuring a thorough and compliant registration process, these documents provide a framework for responsible and lawful solicitation activities. They ensure that solicitors operate transparently, maintain financial integrity, and uphold their legal obligations, fostering trust between solicitors, charitable organizations, and the public. Familiarizing oneself with these documents and their requirements is essential for anyone involved in the solicitation process within the state of Georgia.

Similar forms

Business License Applications: Like the Georgia S100 form, business license applications are required for entities to legally operate in various jurisdictions. Both entail providing detailed information about the business or organization, the nature of its activities, and the identities of key personnel. In addition, they both require official authorization before the entity can commence its operations.

Charitable Organization Registrations: Similar to the S100 form, which solicitors use to register for engaging in charitable solicitations, charitable organization registration forms are submitted by nonprofits seeking legal recognition and permission to collect donations. Both documents necessitate disclosure of the organization’s purpose, financial information, and operational records to a regulating body.

Professional Licensing Forms: These forms, like the S100, are required for individuals or entities in certain professions to obtain the necessary authorization to offer their services legally. Both types of documents often require detailed personal and professional information, verification of qualifications, and agreement to abide by specific regulatory standards.

Securities Registration Statements: Similar to the S100 form’s role in regulating paid solicitors in charitable activities, securities registration statements are necessary for the issuance or trading of securities. Both involve stringent disclosure requirements designed to protect public interest by providing essential information about the entity’s financial health and operational intentions.

Corporate Annual Reports: Much like the requirement for S100 registrants to keep their information current and accurate, corporations are often required to file annual reports. These reports also compile comprehensive details about the company’s activities, financial status, and management, aiming to ensure transparency and regulatory compliance.

Bond Requirements Documents: The S100 form mandates a surety bond for paid solicitors, a commonality shared with various regulatory documents across different sectors. These documents ensure entities or individuals adhere to specific legal and financial obligations, offering a form of financial protection against malpractice or failure to comply with regulatory standards.

Dos and Don'ts

When completing the Georgia S100 form for paid solicitor registration, there are key do's and don'ts to ensure the process goes smoothly. Below are four crucial points to consider:

Do:- Ensure all information provided is current, true, and complete. Inaccuracies can lead to legal repercussions and delay the registration process.

- Include the original manual signature and notarization with seal on the execution page. This is a critical requirement for the form's validity.

- Attach all required documents, such as a fiscal year-end financial statement and a $10,000 surety bond if you will have control over contributions collected in Georgia. These documents are essential for compliance and verification purposes.

- Amend the registration timely, within 30 days, to reflect any material changes in operations. Keeping your registration current is mandatory for legal compliance.

- Leave sections incomplete. Failing to provide complete information can result in processing delays or denial of the application.

- Forget to provide an explanation for any "Yes" answers in the background information section. Detailed explanations are necessary for a thorough review of your application.

- Overlook the need for a criminal background check for all persons who have custody of charitable donations. This is a critical component of the application process.

- Miss the renewal deadline. Remember, registrations expire on December 31 of each year, and timely renewal is crucial to avoid interruption in your registration status.

Misconceptions

Understanding the Georgia S100 form, required for paid solicitors of charitable contributions, can be challenging due to various misconceptions. Here are six common misunderstandings explained in detail:

- Only Georgia-based organizations need to file the S100 form. Many assume that this form is exclusive to Georgia-based organizations. However, any paid solicitor collecting contributions in or from the state of Georgia, regardless of where they are based, is required to submit an S100 form. This ensures all organizations soliciting in Georgia comply with state laws governing charitable solicitations.

- Once filed, the registration is permanent. A significant misconception surrounding the S100 form is the belief that once a paid solicitor is registered, they do not need to renew their registration. However, the registration expires annually on December 31st, requiring renewal to ensure compliance and continued authorization to collect charitable contributions.

- The filing fee covers all registration-related expenses. While there is an initial application and reinstatement fee of $250, and an amendment fee of $15, understanding that these fees are non-refundable and separate from other potential costs such as the required surety bond or any fines for non-compliance is important.

- Any monetary contribution handling methods are acceptable. All monetary contributions received by a paid solicitor must be deposited in full within three (3) business days of receipt into an account at a federally insured financial institution, under the sole control of the charitable organization. This stringent requirement ensures transparency and trust in the handling of contributions.

- Registration information is confidential. Contrary to some beliefs, the information provided on the S100 form is a matter of public record. It helps maintain a level of transparency about organizations and individuals involved in charitable solicitations within the state and provides the public with important information about where their contributions are going.

- Background checks aren't mandatory for all involved. Anyone holding custody of charitable contributions, including control persons and executive officers, is required to undergo a criminal background check. This comprehensive approach helps prevent misconduct and ensures that those involved in charitable solicitations have not been convicted of relevant criminal offenses.

Understanding the specifics of the S100 form is essential for all paid solicitors operating in Georgia to ensure they comply with the Georgia Charitable Solicitations Act. Ensuring accuracy and timeliness in filing can protect organizations from potential penalties and maintain the integrity of their operations.

Key takeaways

Filling out and using the Georgia S100 form for paid solicitors intending to solicit donations on behalf of charitable organizations requires careful attention to detail and compliance with specific regulations. Here are key takeaways to help navigate this process effectively:

- The initial application fee and reinstatement registration fee are both set at $250, whereas amending an application costs $15, all of which are nonrefundable and should be made payable to the Georgia Secretary of State.

- Registration as a paid solicitor is mandatory under the Georgia Charitable Solicitations Act and must be renewed annually, as it expires on December 31 each year. Failing to renew can lead to disciplinary action.

- Providing accurate and complete information is crucial, as intentional misstatements or omissions may lead to criminal violations.

- The form requires the appointment of the Georgia Secretary of State as the agent for the applicant, allowing legal actions to be taken against the applicant within Georgia courts.

- Applicants must disclose whether they hold or will hold physical possession or legal control over any contributions collected within or from the state of Georgia. If so, additional documentation like a fiscal year-end financial statement and a surety bond of $10,000 payable to the State of Georgia are necessary.

- A detailed description of the business, information about chapters, branches, and affiliates within Georgia, as well as the names and addresses of directors, must be provided.

- Background checks are mandatory for control persons of the applicant, including a full disclosure of criminal history related to charitable solicitations or any financial misappropriations within the past ten years.

- Legal acknowledgments within the application outline the requirements for a solicitation contract with charitable organizations, filing of solicitation notices, disclosure at the point of solicitation, accounting to charitable organizations for collected contributions, and timely deposit of collected funds.

- Applicants must maintain solicitation campaign records for a minimum of three years, available for inspection by the Secretary of State, underlining the importance of systematic record-keeping.

- The Act imposes strict penalties for misappropriation of funds and fraudulent conduct, emphasizing the legal obligations of paid solicitors to act ethically and in accordance with the law.

Understanding these key aspects can guide applicants through the process of becoming registered paid solicitors in Georgia, ensuring compliance with state laws and regulations while helping maintain the integrity of charitable solicitations.

Popular PDF Forms

Georgia 5579 - Enhances the credibility and safety standards of child care institutions.

It-303 - Applicants must specify the tax return type they are seeking an extension for, such as individual, partnership, fiduciary, or corporate income tax.

Mv-16 - Details the legal definition of a fixture in the context of real estate transactions within the program, for clarity and compliance.