Free Georgia State Tax Instruction Template in PDF

Filing taxes can often seem like navigating a maze, especially when you're trying to understand the specifics of state requirements. In Georgia, residents and those doing business within the state are required to file their state taxes using specific guidelines detailed in the Georgia State Tax Instruction form. This crucial document not only breaks down the process into manageable steps but also sheds light on eligibility criteria, deadlines, necessary documentation, and potential deductions and credits. It serves as a comprehensive guide, designed to make the tax filing process as smooth as possible. Whether you're a first-time filer or a seasoned taxpayer, understanding the nuances of this form can significantly impact how effectively you manage your state tax obligations. From pinpointing which income is taxable to identifying what qualifies for a tax break, the Georgia State Tax Instruction form lays the foundation for a thorough and accurate tax return.

Form Sample

■ Form |

1303904012 |

Page 1 |

GEORGIA DEPARTMENT OF REVENUE REGISTRATION & LICENSING UNIT

P. O. BOX 49512

ATLANTA, GEORGIA

ОЛППЛЛЛ1 n

l3039040l2

Georgia Department of Revenue

State Tax Registration Application

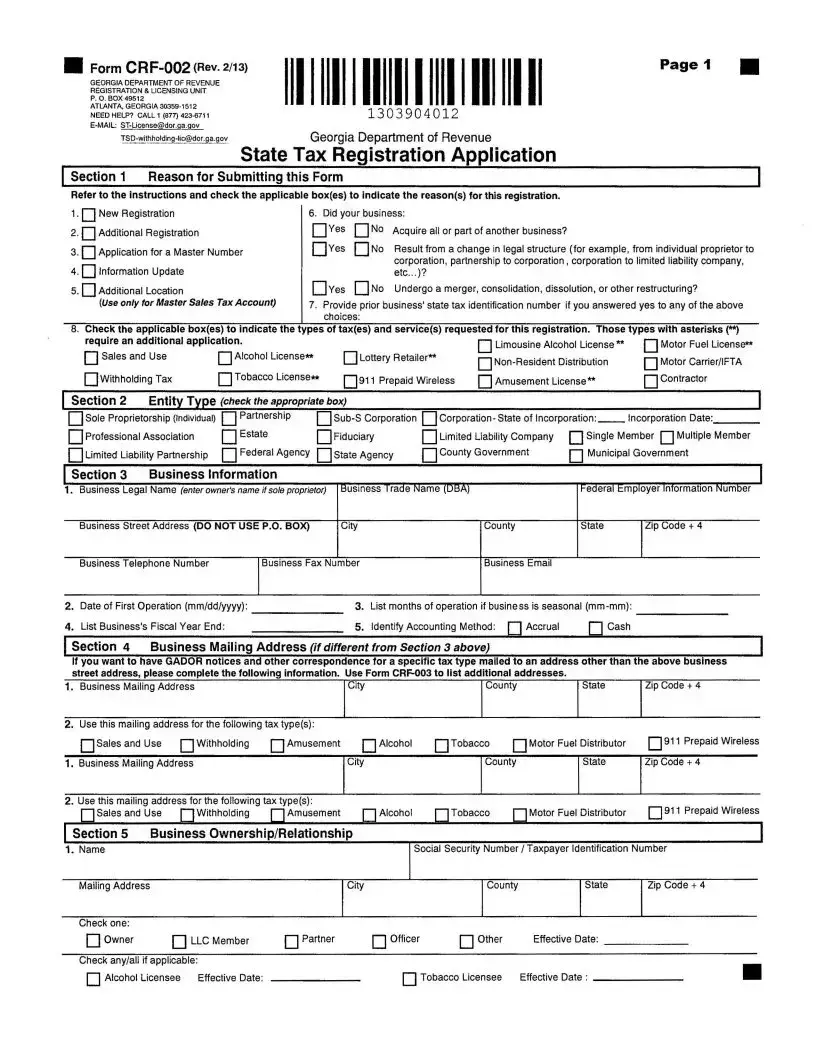

Section 1 Reason for Submitting this Form

Refer to the instructions and check the applicable box(es) to indicate the reason(s) for this registration.

1 • New Registration

2.Additional Registration

3.Application for a Master Number

4.Information Update

5.Additional Location

(Use only for Master Sales Tax Account)

6. Did your business:

Yes |

No |

Acquire all or part of another business? |

Yes |

No |

Result from a change in legal structure (for example, from individual proprietor to |

|

|

corporation, partnership to corporation, corporation to limited liability company, |

|

|

etc...)? |

Yes |

No |

Undergo a merger, consolidation, dissolution, or other restructuring? |

7.Provide prior business' state tax identification number if you answered yes to any of the above choices:

8. Check the applicable box(es) to indicate the types of tax(es) and service(s) requested for this registration. Those types with asterisks (**)

require an additional application. |

|

|

Limousine Alcohol License** |

Motor Fuel License** |

|||||

| | Sales and Use |

| |

| Alcohol License** |

Lottery Retailer** |

||||||

Motor Carrier/IFTA |

|||||||||

|

|

|

|

|

|

||||

Withholding Tax |

□Tobacco License** |

911 Prepaid Wireless |

Amusement License** |

| | Contractor |

|||||

| Section 2 |

Entity Type (check the appropriate box) |

|

|

|

] |

||||

Sole Proprietorship (Individual) |

| |

| Partnership |

| Corporation - State of Incorporation: |

Incorporation Date:. |

|||||

Professional Association |

| |

| Estate |

Fiduciary |

Limited Liability Company |

Single Member | | Multiple Member |

||||

Limited Liability Partnership |

|

Federal Agency |

State Agency |

County Government |

[ | Municipal Government |

||||

| Section 3 |

Business Information |

|

|

|

j |

||

1. |

Business Legal Name (enter owner's name if sole proprietor) |

Business Trade Name (DBA) |

Federal Employer Information Number |

||||

|

Business Street Address (DO NOT USE P.O. BOX) |

City |

County |

State |

Zip Code + 4 |

||

|

Business Telephone Number |

Business Fax Number |

Business Email |

|

|

||

2. |

Date of First Operation (mm/dd/yyyy): |

|

3. |

List months of operation if business is seasonal |

|

||

4. |

List Business's Fiscal Year End: |

|

5. |

Identify Accounting Method: □Accrual |

□Cash |

|

|

I Section 4 Business Mailing Address (if different from Section 3 above)

If you want to have GADOR notices and other correspondence for a specific tax type mailed to an address other than the above business street address, please complete the following information. Use Form

1. Business Mailing Address |

City |

County |

State |

Zip Code + 4 |

2. Use this mailing address for the following tax type(s):

Salesand Use | [Withholding □Amusement [ | Alcohol | |Tobacco | [Motor Fuel Distributor | |911 Prepaid Wireless

1. Business Mailing Address |

City |

County |

State |

Zip Code + 4 |

2. Use this mailing address for the following tax type(s):

[ [Sales and Use I [Withholding I [Amusement | | Alcohol | | Tobacco | | Motor Fuel Distributor 911 Prepaid Wireless

Section 5 |

Business Ownership/Relationship |

|

|

|

| |

||

1. Name |

|

|

|

Social Security Number/Taxpayer Identification Number |

|||

Mailing Address |

|

|

City |

|

County |

State |

Zip Code + 4 |

Check one: |

|

|

|

|

|

|

|

Owner |

|

LLC Member |

Partner |

Officer |

Other |

Effective Date: |

|

Check any/all if applicable: |

|

|

|

|

|

||

Alcohol Licensee |

Effective Date: |

|

|

Tobacco Licensee |

Effective Date : |

|

|

■ Form |

1303904022 |

Page 2 |

■ |

1303904022

| |

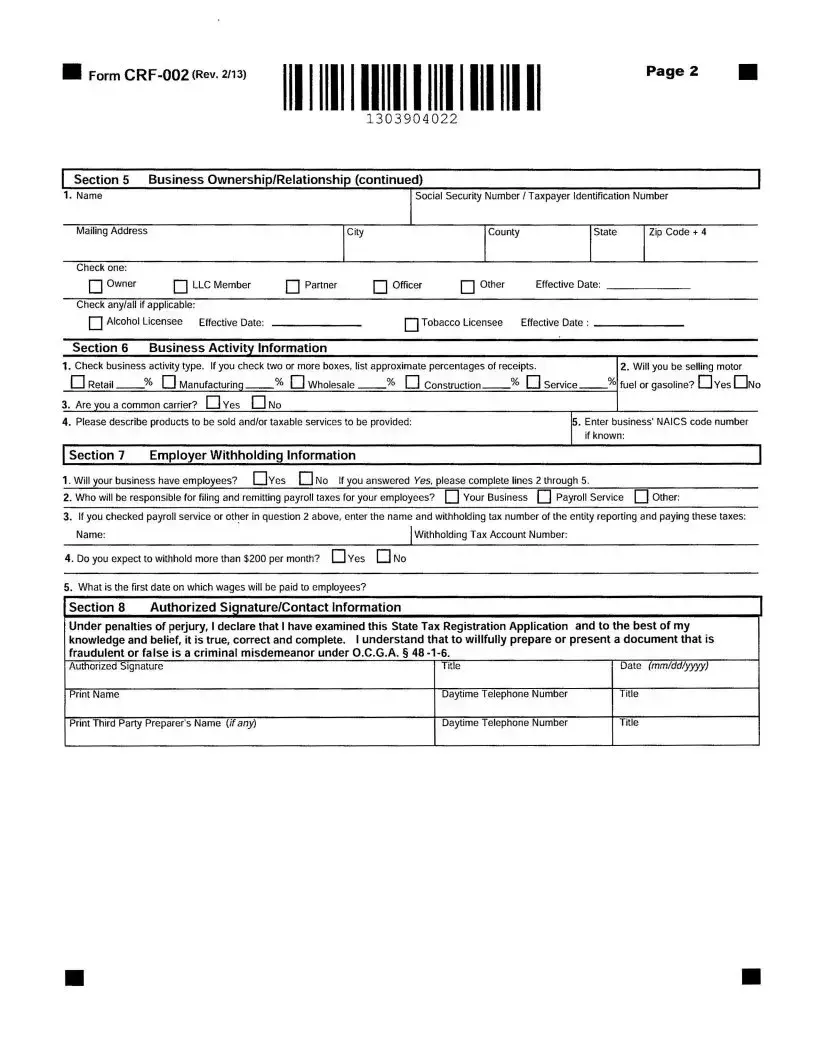

Section 5 |

|

Business Ownership/Relationship (continued) |

|

|

|

|

| |

|||||

1. |

Name |

|

|

|

|

|

|

Social Security Number/Taxpayer Identification Number |

|||||

|

Mailing Address |

|

|

|

City |

|

|

County |

|

State |

Zip Code + 4 |

||

|

Check one: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner |

|

I |

I LLC Member |

| |

| Partner |

| | Officer |

| | Other |

|

Effective Date: |

|

||

|

Check any/all if applicable: |

|

|

|

|

|

|

|

|

|

|||

|

I I Alcohol Licensee |

Effective Date: |

|

|

| |

| Tobacco Licensee |

|

Effective Date : |

|

||||

|

Section 6 |

|

Business Activity Information |

|

|

|

|

|

|

|

|||

1. Check business activity type. If you check two or more boxes, list approximate percentages of receipts. |

|

2. Will you be selling motor |

|||||||||||

1 |

1 Retail |

% П Manufacturing |

% 1 |

1 Wholesale |

% 1 |

1 |

Construction |

% П Service |

% fuel or gasoline? CH Yes CHNo |

||||

3. Are you a common carrier? П Yes П No |

|

|

|

|

|

|

|

|

|||||

4. |

Please describe products to be sold and/or taxable services to be provided: |

|

|

|

5. Enter business' NAICS code number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

if known: |

|

Section 7 |

|

Employer Withholding Information |

|

|

|

|

|

|

| |

||||

1. Will your business have employees? □Yes Д No If you answered Yes, please complete lines 2 through 5.

2. Who will be responsible for filing and remitting payroll taxes for your employees? |

Your Business | | Payroll Service | | Other: |

3.If you checked payroll service or other in question 2 above, enter the name and withholding tax number of the entity reporting and paying these taxes: Name:_______________________________________________________ [withholding Tax Account Number:

4. Do you expect to withhold more than $200 per month? |

Yes EH No |

5.What is the first date on which wages will be paid to employees?

Section 8 |

Authorized Signature/Contact Information |

| |

Under penalties of perjury, 1 declare that 1 have examined this State Tax Registration Application and to the best of my knowledge and belief, it is true, correct and complete. 1 understand that to willfully prepare or present a document that is fraudulent or false is a criminal misdemeanor under O.C.G.A. § 48

Authorized Signature |

Title |

Date (mm/dd/yyyy) |

Print Name |

Daytime Telephone Number |

Title |

Print Third Party Preparer's Name {if any) |

Daytime Telephone Number |

Title |

И Form |

1303904032 |

Page 3 |

1303 904032

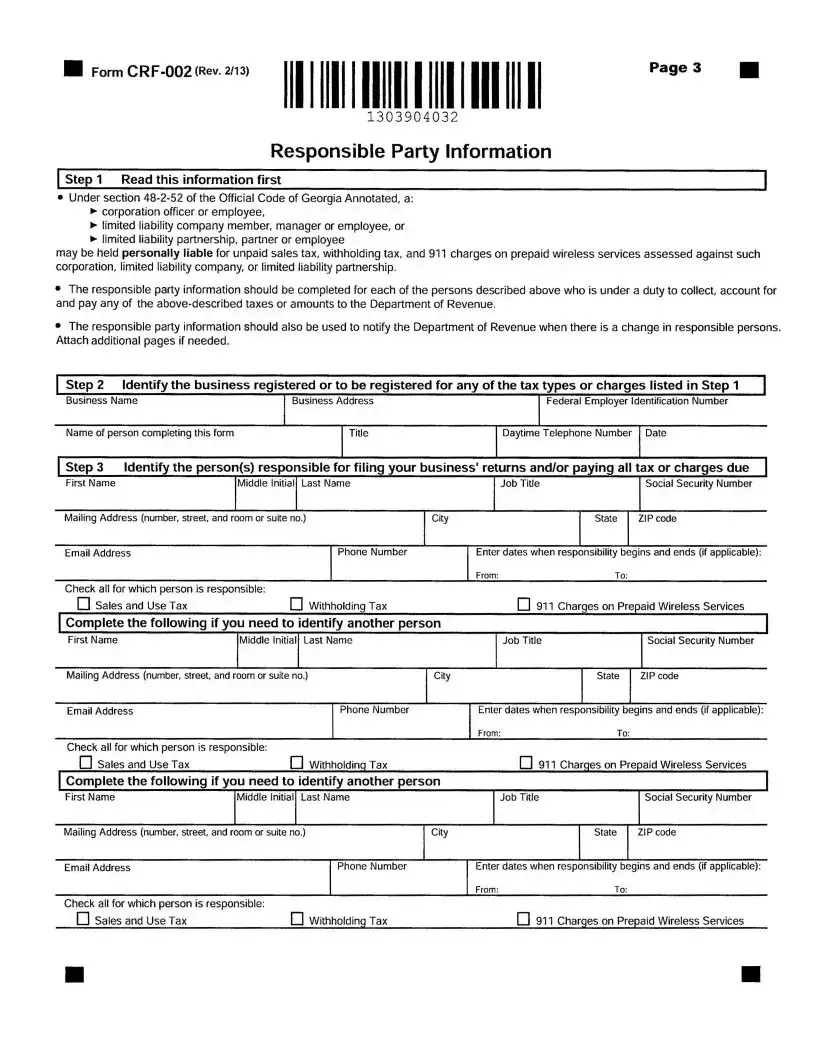

Responsible Party Information

Step 1 Read this information first |

| |

•Under section

►corporation officer or employee,

►limited liability company member, manager or employee, or

►limited liability partnership, partner or employee

may be held personally liable for unpaid sales tax, withholding tax, and 911 charges on prepaid wireless services assessed against such corporation, limited liability company, or limited liability partnership.

•The responsible party information should be completed for each of the persons described above who is under a duty to collect, account for and pay any of the

•The responsible party information should also be used to notify the Department of Revenue when there is a change in responsible persons. Attach additional pages if needed.

Check all for which person is responsible: |

|

|

□ Sales and Use Tax |

Д Withholding Tax |

□ 911 Charges on Prepaid Wireless Services |

File Overview

| Fact Name | Description |

|---|---|

| Form Identification | The Georgia State Tax Instruction form is a guide provided to taxpayers for filing state taxes in Georgia. |

| Usage Purpose | It is used to assist taxpayers in understanding how to correctly file their state taxes, including calculations of income, deductions, and tax credits. |

| Accessibility | The form is accessible online through the Georgia Department of Revenue website and can also be obtained in paper format at designated locations. |

| Governing law | The form and its instructions are governed by the Georgia Tax Code, which outlines the state's tax regulations and requirements. |

| Annual Update | It is updated annually to reflect any changes in the tax law, ensuring taxpayers have the most current information for their tax preparations. |

| Target Audience | Intended for Georgia residents and entities who are required to file state income tax returns. |

Guide to Using Georgia State Tax Instruction

Completing the Georgia State Tax Instruction form is a necessary step for residents to accurately report their income and calculate their state tax liability. This process involves gathering relevant financial documents, understanding the state's tax laws, and meticulously entering information to ensure accuracy and compliance. After filling out this form, individuals will submit it alongside any payment due or await any refund they might be owed. The following steps offer guidance through this crucial task.

- Gather all required documentation, including your W-2 forms, 1099 forms, and any other applicable income records.

- Read through the instructions provided by the Georgia Department of Revenue to familiarize yourself with the state-specific tax laws and requirements.

- Use your financial documents to fill in your gross income, adjusting for any Georgia-specific exclusions or deductions you may qualify for.

- Calculate your taxable income by deducting allowances and exemptions as outlined in the state's tax instruction guide.

- Determine the amount of state tax you owe by applying the tax rate to your taxable income, referring to the tax tables if necessary.

- If applicable, calculate and sum up your tax credits to reduce your total owed amount.

- Double-check all entered information for accuracy to prevent errors or potential delays in processing.

- Fill in your personal information, including your full name, address, social security number, and any other required identification details.

- Sign and date the form to attest to the accuracy of the information provided.

- Submit the completed form to the Georgia Department of Revenue by the specified deadline, using the appropriate submission method (mail or electronic filing).

Once the form is submitted, individuals should maintain a copy of their filed tax return and all relevant documents for their records. The Georgia Department of Revenue may be contacted for any questions or clarifications about the form or the filing process. By following these steps carefully, taxpayers can fulfill their state tax obligations efficiently and correctly.

Obtain Clarifications on Georgia State Tax Instruction

-

What is the purpose of the Georgia State Tax Instruction form?

The Georgia State Tax Instruction form is designed to guide taxpayers through the process of completing their state income tax returns. Its purpose is to provide clear instructions, explain various tax deductions and credits available, and outline the correct method for calculating tax liability. This form is an essential tool for ensuring that taxpayers comply with Georgia state tax laws and avoid common mistakes that could lead to penalties or audits.

-

Who needs to fill out the Georgia State Tax Instruction form?

Any individual or entity that earns income within the state of Georgia may need to refer to the Georgia State Tax Instruction form. This includes not only full-time residents but also part-time residents and individuals who earn income in Georgia but live elsewhere. Businesses operating within Georgia will also find relevant information in this form, especially for calculating and filing their state income taxes accurately.

-

How can I obtain the Georgia State Tax Instruction form?

There are several ways to obtain the Georgia State Tax Instruction form. The most convenient method is to visit the official website of the Georgia Department of Revenue, where the latest version of the form can be downloaded and printed. Additionally, paper copies can be requested by contacting the Department of Revenue directly, or they may be available at local libraries, post offices, and government offices throughout Georgia.

-

What should I do if I have questions while filling out my tax return using the Georgia State Tax Instruction form?

If you encounter difficulties or have questions while using the Georgia State Tax Instruction form, several resources are available to assist you. Firstly, the Georgia Department of Revenue provides comprehensive FAQs and resources online that address common concerns. For more personalized assistance, taxpayers can contact the Department of Revenue by phone or email to receive guidance from knowledgeable staff. Additionally, seeking the help of a professional tax advisor is always an option for those who prefer one-on-one assistance or have complex tax situations.

Common mistakes

Filling out tax forms can be a daunting task, and mistakes are not uncommon. The Georgia State Tax Instruction form, like any other tax form, has its share of common errors made by taxpayers. Recognizing and avoiding these mistakes can help ensure your tax process is smoother and error-free. Here are eight common mistakes:

-

Not checking the latest form version: Tax laws and forms can change. People often use an outdated version of the form, leading to incorrect or incomplete filing.

-

Skipping sections that apply to their situation: Taxpayers sometimes overlook entire sections that are relevant to them. Each section can impact the overall tax calculation and return.

-

Incorrect Social Security Numbers (SSNs): Entering SSNs inaccurately is a common error that can lead to processing delays or even affect tax return amounts.

-

Inaccurate financial information: Reporting incorrect income, deductions, or tax credits can result in an incorrect tax obligation. Always double-check these figures against your financial documents.

-

Choosing the wrong filing status: Your tax filing status affects your tax rates and allowable deductions. Choosing incorrectly can lead to overpayment or underpayment of taxes.

-

Ignoring tax deductions and credits: Many taxpayers miss out on deductions and credits they're entitled to, which can significantly lower their tax bill.

-

Failing to sign and date the form: An unsigned tax form is like an incomplete application; it will not be processed until it's properly signed.

-

Not attaching required documents: Forgetting to attach W-2s, 1099s, or other necessary documentation can delay processing and affect your tax outcome.

By paying careful attention to these areas, taxpayers can avoid common pitfalls and ensure their Georgia State Tax returns are accurately and efficiently filed.

Documents used along the form

When filing state taxes in Georgia, the Georgia State Tax Instruction form is a crucial document that guides taxpayers through the process of filing their state taxes accurately. However, it is often not the only document needed to complete this task. Several other forms and documents are commonly used in conjunction with the Georgia State Tax Instruction form to ensure a thorough and compliant tax filing. These include income statements, deduction documentation, and various other forms that play pivotal roles in the tax preparation process. Below is a list of additional forms and documents frequently used alongside the Georgia State Tax Instruction form, each described briefly to help taxpayers understand their importance.

- Form 500: The Individual Income Tax Return form for Georgia, where taxpayers declare their income, calculate their tax liability, and claim refunds if applicable.

- Form 500-EZ: A shorter version of the Form 500, suitable for taxpayers with simpler tax situations.

- W-2 Forms: Wage and tax statements from employers, showing the amount of taxes withheld from a taxpayer’s paycheck.

- 1099 Forms: Documents that report various types of income other than wages, such as freelance earnings, interest, and dividends.

- Schedule 1: Additional Income and Adjustments to Income, detailing sources of income or adjustments not listed on Form 500 or 500-EZ.

- Schedule 3: Nonrefundable Credits, outlining tax credits that reduce the amount of owed tax but not below zero.

- Form IT-303: Application for Extension of Time for Filing State Income Tax Returns, for those needing more time to file their tax return.

- Form IND-CR: Individual Income Tax Credit Form, used to claim various tax credits available in the state.

- Property Tax Return: A necessary form for individuals owning property in Georgia to declare the value of their property.

- Charitable Contributions Documentation: Receipts or records of donations made to charitable organizations, which may be deductible.

The preparation of a tax return in Georgia can be a complex process that requires several documents beyond the Georgia State Tax Instruction form. By gathering all relevant forms and documents, taxpayers can ensure they are accurately reporting their income and deductions, thereby fulfilling their tax obligations effectively. It is always advisable for individuals to consult with tax professionals or utilize reliable tax preparation software to ensure their tax filings are complete and correct.

Similar forms

Federal Tax Instruction Form: Just as the Georgia State Tax Instruction form provides guidance on state tax filings, the Federal Tax Instruction Form serves a similar purpose but on a national level. It outlines the procedures, documents needed, and guidelines for filing federal taxes, ensuring taxpayers comply with U.S. tax laws.

State Tax Forms from Other States: Each state has its own set of tax forms and instructions, tailored to its tax laws and regulations. Like the Georgia form, these documents provide state-specific instructions on filing taxes, deductions, exemptions, and tax rates applicable within the state.

Business Tax Filing Instructions: Aimed at business owners, these instructions offer guidance on how to file business taxes, including details on taxable income, deductions, and credits specific to businesses. They share the goal of clarifying tax filing processes, similar to the Georgia State Tax Instruction form but focus on the business tax aspect.

Property Tax Statements: Property tax statements outline the amount of property tax owed by property owners. While focusing on property taxes, these documents resemble the Georgia State Tax Instruction form by providing essential information taxpayers need to know, including deadlines and payment options.

Income Tax Booklets: Offered by both state and federal tax authorities, income tax booklets compile forms, instructions, and information relating to the filing of income taxes. They share the same purpose as the Georgia State Tax Instruction form: guiding taxpayers through the tax filing process.

W-4 Forms: Although the W-4 form is primarily used for determining the amount of federal income tax to withhold from an employee's paycheck, it shares similarities with the Georgia form in guiding taxpayers through a specific aspect of tax law— in this case, employment tax withholdings.

Voter Registration Instructions: Though not a tax document, voter registration instructions guide citizens through the process of registering to vote, including filling out forms and submitting them to the appropriate authorities. This is similar to the instructional nature of the Georgia State Tax Instruction form, albeit focused on the civic duty of voting.

Dos and Don'ts

Filing your Georgia State Tax Instruction form can be a breeze if you keep these pointers in mind. There are actions that will facilitate a smoother process, and there are those that could snag you up. Let's ensure you're prepared with a list of do's and don'ts.

- Do gather all necessary documents before you start. This includes W-2s, 1099s, and any relevant financial records.

- Do double-check your Social Security Number (SSN) on the form. It's a common mistake that can cause unnecessary delays.

- Do take advantage of tax software or professionals if you're unsure about the process. Accuracy is key, and getting help can prevent mistakes.

- Do use the instructions specified for the year you're filing. Tax laws change, so ensure the information you're using is current.

- Do file electronically if possible. It speeds up the processing time and typically allows for quicker refunds.

- Don't forget to sign and date your form. An unsigned tax form is like an unread book; it serves no purpose until it's properly endorsed.

- Don't neglect to report all income, including any from freelance or gig economy work. Omitting income can lead to penalties and interest.

- Don't rush through the deductions and credits sections. You might miss out on savings you're entitled to.

- Don't disregard the option to contribute to state funds or programs that might be beneficial to you or your community.

- Don't wait until the last minute to file. Procrastination can lead to errors or missed opportunities for tax-saving strategies.

By following these tips, you can navigate the Georgia State Tax Instruction form with confidence. Remember, it's not just about filling out a form—it's about securing your financial well-being while complying with state laws. Happy filing!

Misconceptions

Understanding the Georgia State Tax Instruction form is crucial for accurately filing state taxes. However, there are several misconceptions that often confuse individuals. By clarifying these misunderstandings, it becomes possible to approach tax filing with greater confidence and accuracy.

It's only for individuals. Many people believe that the Georgia State Tax Instruction form is exclusively for individual taxpayers. However, this document is also valuable for businesses and estates operating within Georgia. It contains pertinent information that can help these entities comply with state tax laws.

It's the same as the federal tax form. While it's true that state and federal tax systems in the United States have similarities, the Georgia State Tax Instruction form is specific to the state's tax regulations. It includes details and nuances that are not covered in federal tax forms, focusing on state-specific deductions, credits, and tax rates.

All residents must file it. Another common misconception is that every resident of Georgia must fill out and submit this form. In reality, filing requirements depend on multiple factors such as income level, filing status, and residency status. Not everyone may be obligated to file a state tax return.

Non-residents don't need to bother. Contrary to this belief, non-residents who earn income from Georgia sources may need to file a state tax return using the instructions on this form. This includes income from employment, property, or business operations within the state.

It doesn't change from year to year. Tax laws and regulations are subject to changes and updates. Consequently, the Georgia State Tax Instruction form is updated annually to reflect these changes. Always ensure to use the most current version of the form to avoid any errors in tax filing.

By dispelling these misconceptions, individuals and entities can navigate the complexities of state tax filing in Georgia with more clarity and precision. Seeking guidance from the updated instruction form or consulting with a tax professional is advisable for anyone unsure about their tax obligations.

Key takeaways

Filling out and using the Georgia State Tax Instruction form is an important task for individuals and businesses within the state. It's essential to understand the key takeaways to ensure accurate and timely filing. Below are eight key takeaways:

- Deadlines are crucial: The form must be filed by April 15th to avoid penalties and interest for late submissions. If April 15th falls on a weekend or a public holiday, the deadline extends to the next business day.

- Correct form version: Ensure you are using the most current version of the Georgia State Tax Instruction form. Tax laws and forms are updated regularly, and using an outdated form can lead to processing delays or errors.

- Accuracy is key: Double-check all entries for accuracy, including social security numbers, tax calculations, and personal information. Mistakes can result in processing delays or additional scrutiny from the tax authorities.

- Deductions and credits: Familiarize yourself with the deductions and credits available to Georgia residents. Properly claiming these can significantly reduce your tax liability.

- E-filing options: Consider e-filing your Georgia State Tax Return for faster processing and quicker refunds. E-filing is typically more accurate due to its built-in error checking.

- Payment methods: If you owe taxes, explore all available payment options such as online payments, checks, or money orders. Ensure payments are completed by the filing deadline to avoid penalties.

- Record keeping: Keep a copy of your filed tax return and all relevant documents for at least three years. These records are important in the event of an audit or to amend a previously filed return.

- Seeking help: If you encounter difficulties or have questions, consider seeking help from a professional tax preparer or the Georgia Department of Revenue. They can provide assistance and prevent costly mistakes.

Popular PDF Forms

Ga Workers Compensation - Important for workers to fill out in black ink or type, providing details of the injury, employer, and insurance information.

G-7 Return - The Georgia G-7 form is used by quarterly payers to report state withholding taxes and must be filed even if no taxes were withheld during the quarter.