Free Georgia T4 Template in PDF

When a security interest or lien on a motor vehicle in Georgia is satisfied, it's important to officially notify the state to clear the title of any claims, and the Georgia T4 form serves this very purpose. This legal document, known as the Notice of Satisfaction of Security Interest or Lien Holder’s Affidavit, must be filled out by the individual or entity that held the lien. Detailed within are instructions for its completion, stipulating the use of black or blue ink for legibility or the option to complete it electronically, provided it is then printed. It's imperative to note that this form is not applicable to any lien that has been recorded electronically through the Electronic Lien on Title (ELT) system. The affidavit requires personal appearance before an authorized officer, who administers oaths, where the lienholder must provide comprehensive details including personal and business information, details about the motor vehicle, and the nature of the security interest or lien. Given the serious implications of such declarations, a notary public must acknowledge the affidavit, ensuring the document’s integrity and the accuracy of the information provided. The state's authority, under the Motor Vehicles Certificate of Title Act, to investigate titling and registration discrepancies or to refuse issuing a certificate of title if falsehoods or omissions are discovered, underlines the importance of this form in maintaining the accuracy and integrity of motor vehicle records in Georgia. Any alteration or correction to the form post-completion renders it invalid, emphasizing its critical role in the state's vehicle titling process.

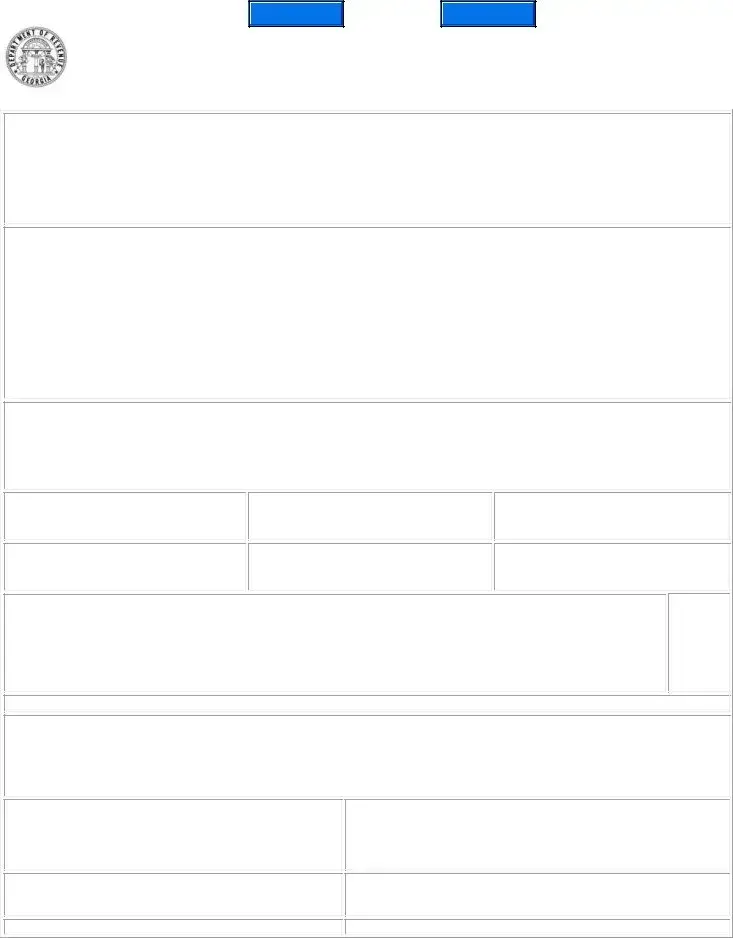

Form Sample

CLEAR

Form

NOTICE OF SATISFACTION OF SECURITY INTEREST OR LIEN HOLDER’S AFFIDAVIT

Instructions: This Affidavit should be executed by the person who holds a security interest or lien on the motor vehicle described below, pursuant to Article 3 of Chapter 3 in Title 40. Except for signatures, type or print legibly in black or blue ink or complete electronically and print.

Note: This form is not permitted for use by any participant in the Electronic Lien on Title (ELT) for any security interest or lien which has been recorded electronically.

Personally appearing before the undersigned officer, duly authorized by law to administer oaths, comes

_____________________________________________________________________________________, of

Print Full Legal Name of Executive Officer or Full Legal Name and Driver's License Number of Sole Proprietor or Partner

_____________________________________________________________________________________, located at

Legal Business Name of Security Interest or Lien Holder as listed on Certificate of Title (If Lien Holder is an individual, a copy of driver’s license must accompany this form.)

_____________________________________________________________________________________.

Business address, including city, state and zip code

__________________________________________________________________________________________________

Owner(s) names as it appears on Certificate of Title

__________________________________________________________________________________________________

__________________________________________________________________________________________________

Residence address, including city, state and zip code

Vehicle Year & Make:

Vehicle Identification Number:

Model & Body Style:

State of Title Records:

Title number:

Account number:

I understand that, pursuant to the Motor Vehicles Certificate of Title Act, the State Revenue Commissioner has the authority to investigate issues surrounding the titling and registration of motor vehicles and may refuse to issue a certificate of title if there are reasonable grounds to believe that the application contains a false statement or the applicant fails to furnish required information or documents or any additional information the commissioner reasonably requires. I understand that the Department may have information as to the vehicle’s title history, the security interest holder’s or the owner’s address, or some other information that is relevant to the Act’s requirements, which lien holder does not have. I understand that, based upon this information, the Department has the discretion to reject the application for title.

□ Yes

Notary Public Acknowledgement

I am over the age of majority and give this affidavit on the basis of my personal knowledge of facts and circumstances surrounding the security

interest or lien related to the motor vehicle listed:

__________________________________________________________________________________________________

Sole Proprietor/Partner or Executive Officer Signature |

Date |

Sworn to and subscribed before me this __________ of

(Day)

_____________________________, ____________

(Month)(Year)

Notary Public’s Signature & Notary Seal or Stamp

Notary Public residence address including City, State and Zip Code

Notary Public’s Printed Name

Date Notary Commission Expires:

Notary Public business phone number

This form must be legibly completed and attached to the application for Certificate of Title.

Any alteration or correction voids this form. All previous revisions of this form are obsolete.

File Overview

| Fact Number | Fact Detail |

|---|---|

| 1 | The form used is Form T-4, which is a Notice of Satisfaction of Security Interest or Lien Holder’s Affidavit. |

| 2 | It was revised in February 2015. |

| 3 | This affidavit is required to be executed by a person holding a security interest or lien on a motor vehicle. |

| 4 | The relevant governing law is Article 3 of Chapter 3 in Title 40. |

| 5 | Information must be typed or printed in black or blue ink, or completed electronically and printed. |

| 6 | This form is not permitted for use by participants in the Electronic Lien on Title (ELT) for any security interest or lien recorded electronically. |

| 7 | The State Revenue Commissioner has the authority to investigate titling and registration of motor vehicles, and may refuse to issue a certificate of title under certain circumstances. |

| 8 | Any alteration or correction to the form voids it, and all previous revisions of this form are considered obsolete. |

Guide to Using Georgia T4

Filling out the Georgia T4 form is a necessary step for individuals who have satisfied a security interest or lien on a motor vehicle and need to notify the appropriate authorities. The process is straightforward but requires attention to detail to ensure that all the required information is accurately and legibly provided. Follow these instructions carefully to complete the form.

- Start by printing your full legal name if you are an executive officer, or your full legal name along with your driver's license number if you are a sole proprietor or partner, at the space provided at the beginning of the form.

- Enter the legal business name of the security interest or lien holder as listed on the Certificate of Title in the space provided. If the lien holder is an individual, remember to attach a copy of the driver's license.

- Provide the business address, including the city, state, and zip code, in the designated space.

- Write the owner's name(s) exactly as it appears on the Certificate of Title.

- Include the residence address of the owner(s), ensuring the city, state, and zip code are clearly stated.

- For the vehicle information section, fill in the vehicle's year and make, vehicle identification number (VIN), model, body style, state of title records, and title number.

- Enter the account number associated with the security interest or lien.

- Mark the checkbox to affirm your understanding of the Motor Vehicles Certificate of Title Act and the accompanying statements regarding the application process and potential for refusal by the State Revenue Commissioner.

- Sign and date the affidavit in the presence of a Notary Public as a Sole Proprietor/Partner or as an Executive Officer. Ensure this section is completed with your signature and the date.

- Have the Notary Public complete their section, including their signature and seal or stamp, printed name, date, commission expiry date, business phone number, and residence address. Ensure this is done on the date you sign the affidavit.

Once the form is fully completed and signed in front of a Notary Public, it should be attached to the application for Certificate of Title. Ensure that all information is correct and legible to avoid any delays in the processing of your application. Any alterations or corrections to the form after completion may void it, so carefully review before submission.

Obtain Clarifications on Georgia T4

- What is the Georgia T4 form used for?

- Who is required to complete the Georgia T4 form?

- What information is necessary to fill out the form?

- The full legal name and business address of the security interest or lien holder, as listed on the certificate of title.

- If the lien holder is an individual, a copy of the driver’s license must accompany the form.

- The owner(s) name as it appears on the certificate of title, along with their residence address.

- Detailed vehicle information, including the year, make, vehicle identification number (VIN), model, body style, and the state of title records.

- Title number and account number, if applicable.

- Can this form be used by participants in the Electronic Lien on Title (ELT) program?

- Why must a notary public acknowledge this form?

- What happens if there are alterations or corrections to the form?

- Is there a deadline for filing the Georgia T4 form after a lien is satisfied?

- What are the consequences of not filing the Georgia T4 form?

- Where can one obtain the Georgia T4 form?

- Can an individual file the Georgia T4 form on behalf of a corporation or business entity?

The Georgia T4 form is a crucial document designed to notify the state of the satisfaction of a security interest or lien against a motor vehicle. When a loan or other financial obligation secured by the vehicle is fully paid off, the holder of that security interest or lien uses this form to affirm that the debt has been satisfied, clearing the way for the vehicle's title to be updated accordingly. It acts as a lien holder’s affidavit, confirming that there is no longer any claim on the vehicle due to the settled debt.

This form should be executed by the individual or entity that held the security interest or lien on the motor vehicle, as described under Article 3 of Chapter 3 in Title 40. It's typically the responsibility of financial institutions, lenders, or private lienholders that initially placed the lien on the vehicle's title due to financing or other secured obligations. The form requires detailed information, including the legal name of the executive officer or the full legal name and driver's license number if a sole proprietor or partner.

To accurately fill out the Georgia T4 form, several pieces of information are required:

No, the Georgia T4 form is not permitted for use by participants in the Electronic Lien on Title (ELT) program for any security interest or lien that has been recorded electronically. Those within the ELT program have a different process for notifying the state of lien satisfactions, which aligns with the program's digital processes and requirements.

The notary public's acknowledgment serves as a formal witness to the signature of the person executing the form, verifying the signatory's identity, and ensuring that the signature was provided freely and with awareness of the form's contents. This step adds a layer of legal verification and protection, underscoring the form's authenticity and the accuracy of the information provided.

Any alterations or corrections made to the Georgia T4 form void it, requiring the submission of a new, unaltered document. This policy helps maintain the integrity of the information and ensures clear, unequivocal communication regarding the lien's satisfaction.

While specific deadlines may vary and should be verified with the Georgia Department of Revenue, it's generally advisable to file the T4 form as soon as possible after the lien's satisfaction. Prompt filing ensures the vehicle's title can be updated expediently, removing the lienholder's claim and reflecting the current ownership status accurately.

Failing to file the Georgia T4 form after a lien is satisfied can lead to several complications. Most significantly, the vehicle's title will continue to show the lien, potentially hindering the sale or transfer of the vehicle. Moreover, it could create legal and financial disputes regarding the vehicle's ownership and status of the debt.

The Georgia T4 form is available through the official website of the Georgia Department of Revenue or at local tax commissioner's offices across the state. It can be downloaded, filled out electronically, and then printed, or printed first and filled out in black or blue ink.

Yes, an individual, such as an executive officer, can file the T4 form on behalf of a corporation or other business entity. The form requires the print full legal name of the executive officer, further supported by the business’s legal name as listed on the certificate of title. This ensures that the entity's legal representative is the one making the affidavit, providing a legal declaration that the lien has been satisfied.

Common mistakes

When filling out the Georgia T4 form, which is crucial for noting the satisfaction of a security interest or for lienholders affirming their position, various mistakes can be made by individuals. These mistakes can lead to delays in processing or even the rejection of the form. It is vital to understand and avoid these common errors to ensure a smooth and efficient transaction.

- Not using black or blue ink or failing to complete the form electronically before printing. The instructions specify that, except for signatures, the form should be filled out legibly in black or blue ink or completed electronically and then printed. Using other ink colors or pencil can cause the form to be rejected.

- Leaving fields blank. Every field on the T4 form should be completed unless explicitly indicated as optional. Incomplete forms can result in processing delays or outright rejection.

- Entering incorrect vehicle information. The vehicle's year, make, model, body style, vehicle identification number (VIN), and title number must be accurately recorded. Mistakes here can lead to significant issues in the titling process.

- Failing to provide the legal business name or full legal name and driver's license number of the lienholder. If this critical information is missing or inaccurate, it can cause delays or rejection of the form.

- Forgetting to include the business address, including city, state, and zip code. Omitting this information can result in the form being considered incomplete.

- Incorrect or omitted owner information. The owner's name(s) as it appears on the Certificate of Title and the residence address, including city, state, and zip code, must be correctly provided.

- Not providing a copy of the driver's license if the lien holder is an individual. This is a specific requirement when an individual, rather than a business, is the lienholder.

- Not acknowledging the affidavit in front of a Notary Public. The form requires notarization; failing to properly have the form sworn to and subscribed before a Notary Public invalidates it.

- Altering or correcting the form after it has been filled out. Any alterations or corrections void the form, necessitating a new form to be completed.

- Using outdated versions of the form. The instructions note that all previous revisions of the form are obsolete. Using an old form can lead to rejection, so it is crucial to ensure the latest version is used.

To prevent errors and ensure the timely processing of the Georgia T4 form, individuals should thoroughly review their form for accuracy and completeness before submission. Careful attention to detail and adherence to the specified requirements will facilitate a smoother interaction with the Department of Revenue.

Documents used along the form

When handling the Georgia T4 form, also known as the Notice of Satisfaction of Security Interest or Lien Holder's Affidavit, several other documents often accompany it to ensure a smooth and legally compliant process. These documents play critical roles in verifying the details about the vehicle, the lien status, and the identities of the parties involved. Having a comprehensive understanding of these documents can significantly streamline the process of satisfying a security interest on a motor vehicle.

- Application for Georgia Certificate of Title (Form MV-1): This form is used to apply for a new or replacement title. It is crucial when a lien has been satisfied, and the vehicle owner needs to obtain a title that reflects there is no longer a lien on the vehicle.

- Bill of Sale (Form T-7): This document acts as proof of the transaction between the seller and the buyer. While it's not always directly linked to the T4 form, it provides essential information regarding the sale that may be relevant when transferring or releasing a lien.

- Odometer Disclosure Statement (Form T-107): Federal and state laws require that the seller disclose the vehicle's mileage upon transfer of ownership. This form is necessary for the accurate recording of the vehicle’s mileage at the time the lien is satisfied or released.

- Lien Release (Separate document): In some cases, a separate lien release document is required in addition to the T4 form. This document provides a formal declaration that the lien holder has released the interest in the vehicle.

- Power of Attorney (Form T-8): If someone is acting on behalf of the vehicle owner or lienholder, a power of attorney may be necessary. This form authorizes an individual to sign documents and make decisions relating to the satisfaction of the lien on behalf of another.

- Vehicle Registration Application (Form MV-1): While similar to the title application, this form is specifically for registering the vehicle with the state of Georgia. It may need to be updated or completed once the lien is satisfied and the title is being updated.

- Insurance Information: Proof of current insurance may be required as part of the process for satisfying a lien and updating the vehicle’s title and registration status.

- Personal Identification: Valid personal identification, such as a driver's license or state ID, is typically needed to verify the identities of the parties involved in the satisfaction of the lien.

Understanding the purpose and requirements of each document can help individuals and businesses navigate the complexities of satisfying a lien on a vehicle with greater ease. The Georgia T4 form and its accompanying documents ensure that all legal aspects are addressed thoroughly, safeguarding the interests of all parties involved and facilitating a clear transfer of ownership or lien release.

Similar forms

Vehicle Release of Lien Certificate: Similar to the Georgia T4 form, the Vehicle Release of Lien Certificate is used to notify a state's Department of Motor Vehicles (DMV) that a lien on a vehicle has been paid off and the lienholder no longer holds an interest in the vehicle. Both documents serve the purpose of updating vehicle title records to reflect that the vehicle is free of encumbrances from the lienholder.

Mortgage Satisfaction Certificate: This document is akin to the Georgia T4 form in the real estate sector. When a mortgage on property is fully paid, this document is used to indicate that the borrower has fulfilled their repayment obligation, allowing for the removal of the lien from public records. Both documents are formal affidavits acknowledging the satisfaction of a secured loan, though one pertains to personal property (vehicles) and the other to real property (real estate).

UCC Financing Statement Amendment (UCC-3): This document is used to amend a previously filed UCC Financing Statement (UCC-1), including actions such as termination, assignment, or continuation of a security interest in collateral. The UCC-3 form parallels the Georgia T4 form in that both may serve to officially release a security interest from the public record, albeit in different contexts; the Georgia T4 targets motor vehicle liens specifically while UCC-3 can cover a broader range of personal property security interests.

Construction Lien Release Form: In the construction industry, this document is used when a contractor, subcontractor, or supplier releases their lien rights against a property, typically after being paid. The function of this form correlates with the Georgia T4 form because both signify that a claim on property (real for construction liens, personal for vehicle liens) due to owed debts has been satisfied and can be removed from public records.

Personal Property Security Agreement Release Form: This form is used when a security interest held against movable personal property (not real estate or vehicles) is released by the lienholder, signifying that the obligation securing the lien has been met. Similar to the Georgia T4 form, it's a crucial document for proving that the previous debtor-creditor relationship has been resolved with respect to the secured property, allowing the owner to regain full control and ownership rights unencumbered by the previous lien.

Dos and Don'ts

When filling out the Georgia T4 form, a Notice of Satisfaction of Security Interest or Lien Holder’s Affidavit, it's important to follow specific guidelines to ensure the process is handled correctly and efficiently. Here are some tips on what you should and shouldn't do:

What You Should Do:- Use black or blue ink or complete the form electronically: This ensures that the information is legible and can be processed without issues.

- Provide all requested information accurately: Double-check the vehicle details, such as the make, model, vehicle identification number (VIN), and the owner’s information, ensuring they match the records.

- Include the legal business name if the lien holder is a business: For individual lien holders, a copy of the driver’s license must accompany the form.

- Understand the implications: Acknowledge that the State Revenue Commissioner has the authority to investigate and possibly reject the application if there is any reason to believe it contains falsehoods or lacks required information.

- Sign and date the form in front of a notary public: This verifies the legitimacy of the affidavit and the identity of the signer.

- Attach the form to the application for Certificate of Title: The completed form is a crucial part of the documentation needed to update the vehicle’s title records.

- Verify the Notary Public’s information: Make sure the Notary Public’s signature, seal or stamp, and commission expiration date are present and clearly visible.

- Use any other ink colors: Only black or blue ink is accepted to maintain uniformity and legibility.

- Leave sections incomplete: Failing to fill out parts of the form can lead to delays or rejection of the application.

- Make alterations or corrections on the form: Any changes could void the affidavit, requiring you to start over with a new form.

- Forget to attach the lien holder’s driver’s license (if an individual): Not including proper identification could lead to processing delays.

- Sign the form without a notary present: The affidavit must be sworn to and subscribed before a notary to be valid.

- Overlook the checklist of needed information: Before submitting, review all the requirements to ensure nothing is missing.

- Ignore the instructions provided: Understanding and following the guidelines carefully helps in avoiding common mistakes during the submission.

Misconceptions

When dealing with the Georgia T4 Form, also known as the "Notice of Satisfaction of Security Interest or Lien Holder’s Affidavit," several misconceptions often arise. This form plays a crucial role in the process of recording that a lien on a vehicle has been satisfied. Clarifying these misunderstandings can help individuals navigate their responsibilities more effectively.

Only for electronic liens: A common misconception is that the T4 form can only be used for liens that are held electronically. In reality, the form explicitly states that it is not permitted for use by any participant in the Electronic Lien on Title (ELT) system for any security interest or lien recorded electronically. It is instead intended for those liens not processed through the ELT system.

Exclusive to commercial vehicles: Some people mistakenly believe the T4 form is only applicable to commercial vehicles. However, the form is used for the satisfaction of security interests or liens on all types of motor vehicles, not just those used for commercial purposes.

Lien holder's presence not required: Another misunderstanding is that the lien holder does not need to be present to submit the form. The form requires the personal appearance of the lien holder or their authorized representative before a notary public to validate the affidavit, highlighting the necessity of their physical presence or direct representation.

Any ink color is acceptable: People often think any ink color is acceptable when filling out the form. However, the form specifies that all entries, except for signatures, should be typed or written legibly in black or blue ink or completed electronically and then printed.

Notary acknowledgment is optional: There's a common belief that the notary acknowledgment section is optional. Nonetheless, this section is mandatory as it confirms the identity of the person executing the affidavit and ensures the authenticity of the signature, thereby preventing fraud.

Alterations are allowed: Some individuals are under the impression that alterations to the form, after completion, are permitted. The form clearly states that any alteration or correction voids it, stressing the importance of accuracy when completing it initially.

Driver’s license copy not always needed: It's often misunderstood that a copy of the driver’s license is not required when the lien holder is an individual. On the contrary, the form requires a copy of the driver's license if the lien holder is listed as an individual, ensuring proper identification and verification.

Form can be submitted electronically: There's a misconception that the T4 form can be submitted electronically. The current process necessitates that the completed and notarized form be attached to the Certificate of Title application, then submitted through the appropriate channels, which does not include electronic submission as an option.

Any notary can notarize the form: The belief that any notary can notarize the form, irrespective of their jurisdiction, is incorrect. The notary public must be duly authorized by law in the jurisdiction where the affidavit is executed, ensuring the notarization is legally valid.

Immediate processing of applications: Lastly, there is a mistaken belief that the submission of a T4 form guarantees immediate processing of the title application. The State Revenue Commissioner has the authority to investigate the titling and registration of motor vehicles, which can delay processing if there are concerns about the accuracy of the application or the need for further information.

Understanding these misconceptions can significantly smooth the process of satisfying a security interest or lien on a motor vehicle in Georgia. It's always best to review the form carefully and follow the specified requirements to ensure compliance and avoid unnecessary delays or complications.

Key takeaways

Filling out the Georgia T4 form is an essential process for those who hold a security interest or lien on a motor vehicle, as it signifies the satisfaction of that interest. Here are key takeaways to consider:

- The Georgia T4 form, also known as the Notice of Satisfaction of Security Interest or Lien Holder’s Affidavit, must be executed by the lienholder to release the lien from the vehicle’s title.

- This document requires detailed information, including the full legal name and business address of the lienholder, as well as the name(s) of the owner(s) as it appears on the Certificate of Title.

- Vital vehicle details such as the year, make, model, body style, Vehicle Identification Number (VIN), state of title records, title number, and account number must be accurately provided.

- Completion of the form must be done with either black or blue ink, or it can be filled out electronically then printed, ensuring all information is legible and clear.

- The T4 form specifically states it cannot be used by participants in the Electronic Lien on Title (ELT) program for liens recorded electronically.

- By signing the form, the lienholder affirms personal knowledge of the facts surrounding the security interest or lien on the identified motor vehicle.

- A Notary Public must acknowledge the completion and signing of the form, ensuring that the lienholder’s signature is sworn and subscribed in front of them.

- Any alteration or correction made on the form after it has been completed voids its veracity, emphasizing the importance of accuracy when filling it out.

- The form plays a critical role in the vehicle titling process, where the Georgia State Revenue Commissioner reserves the right to refuse issuing a title if the application is believed to contain false statements, lacks required information, or if additional needed information is not provided.

Understanding these elements and the procedure outlined in the T4 form ensures that lien release is conducted properly, safeguarding the interests of all parties involved and facilitating the smooth transition of vehicle ownership.

Popular PDF Forms

How Do I Get My College Transcripts - Process outline for Georgia Highlands College scholars to request transmission of their transcripts to desired entities.

Georgia Hotel Tax - Clarifies the amendment to the Official Code of Georgia regarding exemptions from local hotel/motel excise taxes.

What Is a Rule Nisi in Georgia - Acts as a beacon for due process, ensuring that every voice is heard in a court of law regarding contentious family issues.