Free St 12B Georgia Template in PDF

Understanding the nuances of the ST-12B form can be a pivotal aspect for both individuals and businesses within Georgia when it comes to managing sales tax refunds. Facilitated by the Georgia Department of Revenue, Taxpayer Services Division, this form serves as a structured way for purchasers to lodge a claim for a sales tax refund. It's imperative that the form is filled out with careful attention to detail, including the purchaser's information and the specifics of the sales tax paid. Essential elements such as the name of the purchaser, sales tax number, and the details of the dealer from whom the purchase was made are required. Moreover, the form asks for the date of purchase, the invoice number, and the gross amount of the sale excluding the tax-exempt portion. Importantly, it queries whether a refund request has previously been made to the dealer, the outcome of such a request, and necessitates an affidavit swearing the truthfulness of the provided information under penalty of perjury, along with the requisite signatures. Designed for clarity and legal compliance, the ST-12B emphasizes the importance of retaining copies for audit purposes and clearly outlines the steps needed for individuals to assert their rights to a sales tax refund effectively. This detailed approach not only aids in ensuring accuracy and legality but also simplifies the process for the taxpayer.

Form Sample

Georgia Department of Revenue Taxpayer Services Division 1800 Century Blvd. NE Atlanta, GA

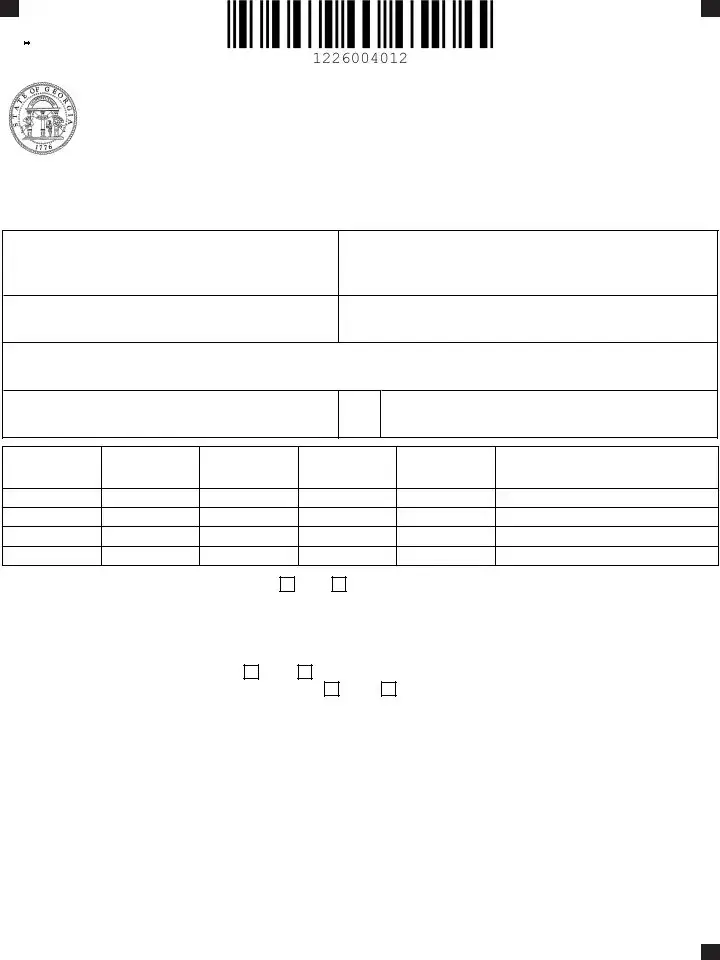

PURCHASER’S CLAIM FOR SALES TAX REFUND AFFIDAVIT

PLEASE RETAIN A COPY FOR FUTURE AUDIT

Name of Purchaser

Purchaser’s Sales Tax Number (if Purchaser does not have a Sales Tax Number, provide Federal Employer Identification Number or Social Security Number)

Name of Dealer

Dealer’s Sales Tax Number (if known)

Dealer’s Street Address

City

State

Zip Code

Date of

Purchase

Invoice No.

Gross Amount

of Sale

Excluding Tax

Exempt Portion

of Sale

Tax Paid by Purchaser to Dealer

Item Purchased

1.Did you request a sales tax refund from the Dealer?

Yes

No. If yes, on what date? ____________________. If no, whynot?________

2.

3.

____________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________

a.Enclose a copy of your request; and

b.Enclose a copy of proof of mailing or proof of delivery.

Did the Dealer refund any sales tax to you? |

Yes |

No. If yes, how much? $_______________________ |

|

Did the Dealer act upon your request for refund in any way? |

Yes |

No. If yes, what did the Dealer do? _________________________ |

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I swear or affirm that I have personal knowledge and understanding of the statements made in this sales tax claim for refund. The facts given in the claim and affidavit are true, correct and complete to the best of my knowledge and belief. I further understand that false statements could result in criminal prosecution as well as the repayment of any refunded tax, plus interest and penalties.

__________________________________________ |

_____________________________________________________ |

|

Purchaser’s Signature |

|

Purchaser’s Name and Title (if applicable) |

Subscribed and sworn to me, this _______ day of ____________________, __________. |

||

Notary Signature: ______________________________________________________ |

[Notary seal] |

|

Typed or Printed Name of Notary: _________________________________________ |

|

|

NOTARY PUBLIC

NOTARY PUBLIC

THIS AFFIDAVIT SHALL BE ATTACHED TO FORM

File Overview

| Fact Number | Description |

|---|---|

| 1 | This form is titled PURCHASER’S CLAIM FOR SALES TAX REFUND AFFIDAVIT and is intended for use in Georgia. |

| 2 | It's administered by the Georgia Department of Revenue Taxpayer Services Division, located at 1800 Century Blvd. NE, Atlanta, GA 30345-3205. |

| 3 | The designated telephone number for contact is 1(877) 423-6711. |

| 4 | To complete the form, information required includes the purchaser’s name, sales tax number (or federal employer identification number or social security number), and details about the dealer and the transaction. |

| 5 | The form serves as a formal request for a sales tax refund from the purchaser to the Department of Revenue, requiring details about the purchase and whether a refund request was previously made to the dealer. |

| 6 | Purchasers must affirm under penalty of perjury that the information provided is true, understanding that false statements could lead to criminal prosecution as well as the repayment of any refunded tax with interest and penalties. |

| 7 | The submission of the form must be accompanied by supporting documentation, such as a copy of the refund request and proof of mailing or delivery to the dealer. |

Guide to Using St 12B Georgia

Filling out the ST-12B form for a sales tax refund in Georgia requires careful attention to ensure accuracy and completeness. This document is a crucial step in the process of requesting a refund on sales taxes that you may believe were incorrectly charged or you were not required to pay. Following the correct procedure not only helps in making a compelling case for a refund but also ensures that your application is processed efficiently by the Georgia Department of Revenue. Let's walk through the steps needed to fill this form accurately.

- Start by writing the Name of Purchaser at the top of the form. This should be your name or the name of the entity requesting the refund.

- Enter the Purchaser’s Sales Tax Number immediately below your name. If you do not have a Sales Tax Number, provide your Federal Employer Identification Number or Social Security Number instead.

- Proceed to fill in the dealer’s information, starting with the Name of Dealer, followed by the Dealer’s Sales Tax Number if you know it. If this information is not available, leave it blank.

- Provide the Dealer’s Street Address, including the city, state, and zip code to ensure the dealer can be clearly identified by the Department of Revenue.

- Write down the Date of Purchase and the Invoice No. to help locate the transaction in question.

- Enter the Gross Amount of Sale Excluding Tax, as well as the Exempt Portion of Sale, if applicable. This detail is crucial for calculating the correct refund amount.

- Document the Tax Paid by Purchaser to Dealer, which is the amount you're requesting a refund for.

- Describe the Item Purchased. This information could help clarify why a refund is being sought, especially if the item qualifies for a tax exemption.

- Answer the questionnaire segment by marking Yes or No to the questions about requesting a refund from the dealer, receiving any refund, and whether the dealer acted upon your refund request. Provide dates and details as required.

- If you have made a request to the dealer, enclose a copy of your request and a copy of proof of mailing or proof of delivery. This documentation is crucial for verifying your efforts to resolve the issue directly with the dealer.

- Complete the form by signing at the bottom. Your signature and the date you sign, alongside your name and title if applicable, certify that the information provided is true and accurate to the best of your knowledge.

- Have the document notarized. The notary’s signature, seal, and their typed or printed name are mandatory to validate the affidavit.

- Remember, this affidavit must be attached to the Form ST-12 and submitted together as part of your sales tax claim for refund.

By meticulously following these steps, you ensure that your ST-12B form is thoroughly and correctly filled out, thereby facilitating a smoother process for your sales tax refund claim with the Georgia Department of Revenue. Ensure all the documentation and information provided is precise and verifiable, as accuracy significantly impacts the outcome of your application.

Obtain Clarifications on St 12B Georgia

What is the purpose of the ST-12B form in Georgia?

The ST-12B form is designed for purchasers to claim a sales tax refund from the Georgia Department of Revenue. It serves as an affidavit where the purchaser can outline the grounds for requesting a refund of sales tax previously paid to a dealer.

What information is required to fill out the ST-12B form?

Information needed includes the purchaser's name, Sales Tax Number or alternative identification (Federal Employer Identification Number or Social Security Number), the dealer's name and Sales Tax Number (if known), the dealer's address, the date of purchase, invoice number, gross amount of sale excluding the tax-exempt portion, amount of tax paid, and a description of the item purchased.

Is it necessary to contact the dealer before filing a ST-12B form?

Yes, the form requires that you indicate whether you requested a sales tax refund from the dealer and provide details of any response or refund received. Documentation of the request and the dealer's response should be enclosed with the form.

What proof is needed to submit along with the ST-12B form?

Alongside the ST-12B form, you must enclose a copy of your request for a refund from the dealer and proof of mailing or delivery of this request. This serves as evidence that you have attempted to resolve the refund request directly with the dealer prior to contacting the Department of Revenue.

Can the ST-12B form be submitted on behalf of a business?

Yes, individuals acting in a business capacity can file the ST-12B form. The purchaser’s name and title, if applicable, should be clearly indicated in the appropriate sections of the affidavit, demonstrating representation of the business in the refund claim.

What happens if the information provided on the ST-12B form is found to be false?

Providing false information on the ST-12B form can lead to severe consequences, including criminal prosecution. Moreover, any sales tax refunded based on inaccurate or misleading claims must be repaid, along with applicable interest and penalties.

Where is the ST-12B form submitted?

The completed ST-12B, along with all required documentation, should be submitted to the Georgia Department of Revenue at the address provided on the form: Taxpayer Services Division, 1800 Century Blvd. NE, Atlanta, GA 30345-3205. You may also call 1(877) 423-6711 for additional guidance or assistance.

Is there a deadline to submit the ST-12B form for a sales tax refund?

The ST-12B form does not specify a submission deadline within its content. However, it is generally advisable to file a sales tax refund claim as soon as possible to ensure it is considered in a timely manner. Specific deadlines may apply depending on the circumstances of the sale and the nature of the claim.

Do I need to notarize the ST-12B form?

Yes, part of the process for completing the ST-12B form involves having the affidavit notarized. A purchaser must sign the affidavit in the presence of a Notary Public to attest to the truthfulness and accuracy of the statements made within the form.

Can I keep a copy of the completed ST-12B form?

It is highly recommended that you retain a copy of the completed ST-12B form and all accompanying documentation for your records. Keeping a copy will assist in any future audits or inquiries regarding the sales tax refund claim.

Common mistakes

When filling out the ST-12B Georgia form, which is essential for claiming a sales tax refund, people often stumble over several common mistakes. Understanding these mistakes can not only simplify the process but also enhance the chances of getting your refund without unnecessary delay. Here is a closer look at eight common errors:

Failing to retain a copy for future audit purposes: Many individuals overlook the advice to keep a copy of their form and documentation for their records. This oversight can become problematic if questions arise later or if they need to reference the submission for future claims.

Incorrect or incomplete Purchaser’s Sales Tax Number, Federal Employer Identification Number (FEIN), or Social Security Number (SSN): Providing accurate identification numbers is crucial for processing your claim. Errors or omissions in these fields can lead to delays or rejection.

Not providing complete dealer information: The form requires details about the dealer, including the sales tax number if known, street address, and contact information. Partial or incorrect dealer information can impede the processing of your claim.

Omitting the date of purchase and invoice number: These details verify the transaction in question and are essential for a refund claim. Forgetting to include this information can result in an incomplete submission.

Inaccurately reporting the gross amount of sale, exempt portion of the sale, and tax paid: It's important to break down the transaction accurately to ensure the refund calculation is correct. Mistakes here can either delay your refund or affect the amount refunded.

Neglecting to enclose a copy of the refund request and proof of mailing or delivery to the dealer: Proper documentation supports your claim and is often a required part of the process. Failing to include this could nullify your claim.

Incorrectly answering questions regarding interaction with the dealer post-refund request: Your responses provide context and evidence regarding your attempt to resolve the issue directly with the dealer, which is a critical aspect of your claim.

Leaving the affidavit unsigned or failing to have it notarized: The affirmation that the information provided is accurate and true under penalty of perjury is a legal requirement. An unsigned or unnotarized form is typically considered invalid.

In summary, when claiming a sales tax refund with the ST-12B form in Georgia, ensuring attention to detail can significantly impact the success and efficiency of your refund process. Being diligent, thorough, and careful with your submission helps avoid common pitfalls and paves the way for a smoother transaction.

Documents used along the form

Filing a Purchaser’s Claim for Sales Tax Refund using the ST-12B form is a significant step that can be both necessary and beneficial for individuals and businesses in Georgia. However, to complete this process successfully, this form is often accompanied by additional documents to support the claim. Understanding these other forms and how they complement your filing can ensure a smoother transaction with the Georgia Department of Revenue.

- Original Sales Receipt or Invoice: Provides documented proof of the transaction, showing the amount of sales tax paid. Essential for substantiating the claim made on the ST-12B form.

- Form ST-5 Sales Tax Certificate of Exemption: If the purchase was for resale or for an exempt purpose, this certificate proves the buyer's right to exemption from sales tax, which supports the refund claim.

- Form ST-12: The primary form for filing a Purchaser’s Sales Tax Claim for Refund, of which the ST-12B is a supportive affidavit. This form outlines the details of the sales tax refund request.

- Proof of Mail or Delivery: Documentation such as certified mail receipts or delivery confirmation to prove that the refund request was submitted to the dealer.

- Form G-1003, Income Statement Return: Although indirectly related, providing annual sales and use tax information could be relevant if your refund claim has implications for your reported taxable income.

- Copy of Check or Payment to Dealer: Offers evidence of the payment made, including the sales tax, crucial when discrepancy or proof of tax payment is needed.

- Legal Identification Documents: A valid ID, such as a driver’s license or passport, may be required when notarization of the ST-12B form is necessary. It helps in verifying the identity of the claimant.

While the ST-12B form serves as a critical component of the sales tax refund claim, these additional documents collectively strengthen the case for a refund. They provide a comprehensive narrative and evidence trail that back the assertions made in the claim, facilitating the review process by the Georgia Department of Revenue. It is therefore advisable for claimants to gather and prepare these documents as part of their refund application to ensure that the process proceeds as expediently and smoothly as possible.

Similar forms

Form 843 (Claim for Refund and Request for Abatement): Much like the ST-12B Georgia form, Form 843 is used by taxpayers seeking a refund for certain taxes, penalties, fees, or interest. Both forms require detailed information about the transaction and proof that the requester paid more than was due. While Form 843 is used for a variety of taxes at the federal level, ST-12B focuses on sales tax refunds in Georgia.

State Tax Refund Forms from Other States: Similar to the ST-12B, many states have their own version of tax refund request forms tailored to their state-specific sales tax laws. These forms, while differing in name and possibly in some nuances related to state tax codes, share the common purpose of providing a documented process for taxpayers to claim refunds on sales tax overpayments.

Form 1040X (Amended U.S. Individual Income Tax Return): Although the ST-12B is for sales tax refunds and Form 1040X is for correcting previously filed individual income tax returns, both forms involve requesting adjustments to previously submitted information that may result in a refund. Each requires thorough documentation and an explanation of why the amendment or refund is justified.

VAT Refund Forms (for businesses or individuals in various countries): In countries that use Value-Added Tax (VAT), taxpayers must often submit specific forms to claim refunds for VAT paid in error or in excess. Much like with the ST-12B, these forms require detailed transaction information and documentation to support the claim. While the taxes differ, the process of claiming back overpaid amounts shares similar procedural steps.

Business Tax Refund Request Forms: These forms are used by businesses to request refunds for overpaid taxes other than sales tax, such as payroll taxes or corporate income taxes. Similar to the ST-12B Georgia form, businesses must provide detailed information about the payments and why they believe a refund is warranted. Both require stringent documentation and are subject to verification processes.

Dos and Don'ts

When you're filling out the ST-12B Georgia form, which is specifically designed for a purchaser's claim for sales tax refund, it's essential to approach it with accuracy and attention to detail. Here's a comprehensive guide that outlines what you should and shouldn't do to ensure your submission is both correct and effective.

Things You Should Do:- Double-check the dealer’s details: Make sure the dealer’s name, sales tax number (if known), address, and other relevant information are accurate. Incorrect information could delay processing your claim.

- Include all necessary documentation: Attach a copy of your request for a sales tax refund to the dealer and any proof of mailing or delivery. This supports your claim and validates the steps you’ve taken.

- Answer all questions truthfully: Be honest when responding to questions about whether you requested a refund from the dealer and the outcome of that request. Your integrity is crucial.

- Sign and date the affidavit: Your signature and the date affirm that the information provided is accurate and complete to the best of your knowledge. It's an affirmation under oath.

- Keep a copy for your records: It's important to retain a copy of the form and all supporting documents for your records. They might be needed for future reference or audits.

- Verify your tax identification information: Whether you're providing a Sales Tax Number, Federal Employer Identification Number, or Social Security Number, ensure it's correct.

- Review the entire form before submission: A thorough review ensures all sections are complete and correct, reducing the likelihood of errors that could delay your refund.

- Leave sections incomplete: Do not skip any parts of the form. Incomplete information can cause delays or result in denial of your claim.

- Guess on dates or amounts: Avoid estimating dates of purchase, amounts of tax paid, and other financial details. Use exact figures and dates wherever possible.

- Use unclear handwriting: If you’re filling out the form by hand, make sure it’s legible. Unclear writing can lead to misinterpretation of your information.

- Forget the notary section: The form needs to be notarized to be valid. Skipping this crucial step can invalidate your claim.

- Submit without proof of purchase: Failing to attach a copy of the invoice showing the purchase and the tax paid can weaken your claim. Always include supporting documents.

- Ignore instructions for attachments: Pay attention to the requirements for attaching documents. Incorrectly attached or missing attachments can lead to processing delays.

- Provide false information: Never intentionally submit false information. This can lead to criminal prosecution, as well as the obligation to repay the refunded tax with interest and penalties.

Misconceptions

Understanding the Georgia ST-12B form, specifically aimed at claiming a sales tax refund, can seem daunting at first glance. However, misconceptions can complicate the process further for many. Here’s a clear look at some common misunderstandings:

- The form is only for businesses. It’s a common belief that only businesses can file for a sales tax refund using this form. However, any purchaser, whether an individual or a business entity, can utilize the form provided they have made a taxable purchase that qualifies for a refund.

- You need a sales tax number to apply. While having a sales tax number is typical for businesses, the form also accommodates those who don’t possess one. In such instances, a Federal Employer Identification Number or Social Security Number can be used instead.

- It’s too complicated to complete. The form requires detailed information, but it is structured to guide you through providing the necessary documentation for your refund claim, including purchase details and any prior communications with the dealer.

- Direct dealer refund requests are not necessary. A key step in the process—often misunderstood—is the initial attempt to obtain a refund directly from the dealer. Documentation of this request is crucial for the form’s submission.

- Any item purchased can be claimed for a refund. Not all purchases qualify for a sales tax refund. The eligibility for a refund depends on specific criteria set by the Georgia Department of Revenue, focusing on the nature of the item purchased and the reason for the refund claim.

- Refund claims are processed immediately. The expectation that refund claims are processed right away leads to frustration. In reality, the review process takes time as it involves verifying the provided information against tax laws and regulations.

- No proof of purchase is required. Each claim must be accompanied by sufficient proof of purchase, including the invoice or receipt, clearly showing the tax amount paid. This documentation is vital for the refund claim to be considered.

- Filing the form guarantees a refund. Filing the ST-12B form does not ensure a refund. The claim undergoes a thorough review, and refunds are issued based on compliance with the tax refund criteria. Misstatements or inaccuracies can lead to the denial of the claim or even legal repercussions.

Clearly understanding these points can simplify the process of claiming a sales tax refund in Georgia and help set realistic expectations for those looking to file. Remember, accurate and complete submissions are key to a successful claim.

Key takeaways

When dealing with the ST-12B Georgia form, understanding its purpose and the correct way to fill it out is crucial. This form is specifically designed for purchasers seeking a sales tax refund from a transaction. Here are key takeaways for successfully managing this process:

- Form Identification: The ST-12B form, issued by the Georgia Department of Revenue, is an affidavit for purchasers claiming a sales tax refund.

- Contact Information: It's essential to have both the purchaser's and the dealer's detailed contact information, including sales tax numbers when available. If the purchaser does not have a sales tax number, a Federal Employer Identification Number or Social Security Number must be provided.

- Purchase Details: Accurate recording of the purchase details, such as date of purchase, invoice number, gross amount, and the tax paid, is crucial for processing the refund.

- Requirement for Documentation: Supporting documents, including a copy of the request for a refund and proof of mailing or delivery to the dealer, are required to be enclosed with the form.

- Dealer's Response: Information concerning whether the dealer has refunded any sales tax and how they have responded to the refund request must be declared.

- Oath of Truth: By signing the affidavit, the purchaser attests under the penalties of perjury that all provided information is true and complete to the best of their knowledge.

- Legal Implications: Falsifying information on this form can lead to criminal prosecution, in addition to the repayment of the refunded tax with interest and penalties.

- Notarization: The form requires notarization; thus, it must be signed in the presence of a notary public, who will also sign and affix their seal to the affidavit.

- Attachment to Form ST-12: It is important to note that the ST-12B affidavit should be attached to form ST-12, making it part of the overall claim for a sales tax refund.

Correctly filling out and submitting the ST-12B form, along with the necessary documentation and adherence to the legal declarations, are vital steps in the process of requesting a sales tax refund in Georgia. This procedure underscores the importance of record-keeping and accuracy in financial transactions.

Popular PDF Forms

Georgia Notification - Ensure your asbestos project aligns with Georgia's environmental standards by submitting a detailed notification form.

Housse Rubric Georgia - An evaluative process in Georgia designed to boost the quality and legal robustness of documents.